- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Early results perk up banking sector in Q3

Profits of the banks were riding on an over 20% growth in advances and a healthy growth in interest income

TRENDING NOW

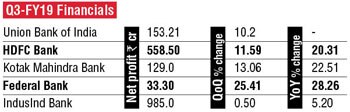

Early bird results for the third quarter in the banking sector suggest that the lenders' profitability is improving with a robust growth in advances and interest income. With demand for credit rising, the banks were also able to price the loans higher, which improved their net interest margins (NIMs).

All the five banks – HDFC Bank, Kotak Mahindra Bank, Union Bank of India, Federal Bank and IndusInd Bank – that have announced their results have reported profits on the back of growth in advances and growth in interest income. Some of the banks have also reported lower non-performing assets (NPAs).

Profits of the banks were riding on an over 20% growth in advances and a healthy growth in interest income.

Union Bank of India, the first public sector bank to announce its results, reported a net profit of Rs 153.2 crore for the third quarter ended December 31, 2018, reversing the loss of Rs 1,249.8 crore it had reported in the same period last year, helped in part by an improvement in the asset quality and sharp fall in provisions. The gross NPA of the bank fell to Rs 49,713 crore from Rs 50,157 crore the bank reported in the trailing quarter. The gross additions to the NPAs was Rs 2,983 crore during the quarter, which was higher than the Rs 2,667 crore in the trailing quarter, but the recoveries and upgrades in its stressed accounts improved.

Union Bank of India, the first public sector bank to announce its results, reported a net profit of Rs 153.2 crore for the third quarter ended December 31, 2018, reversing the loss of Rs 1,249.8 crore it had reported in the same period last year, helped in part by an improvement in the asset quality and sharp fall in provisions. The gross NPA of the bank fell to Rs 49,713 crore from Rs 50,157 crore the bank reported in the trailing quarter. The gross additions to the NPAs was Rs 2,983 crore during the quarter, which was higher than the Rs 2,667 crore in the trailing quarter, but the recoveries and upgrades in its stressed accounts improved.

Union Bank chairman Rajkiran Rai said in a press conference, "The bank is expecting to make about Rs 4,000 crore of recoveries in the fourth quarter a major portion coming from the NCLT account."

HDFC Bank, the largest private sector lender, posted a 20% rise in net profit to Rs 5,586 crore backed by a robust growth in loan book and higher net interest income. However, the slippages have been on a little higher side, but the asset quality continued to be stable. The fresh additions during the quarter was Rs 4,000 crore. However, the gross NPAs continue to be the best in the industry at 1.38% of total advances.

Kotak Mahindra Bank reported a 23% rise in profits to Rs 1,291 crore in the quarter ended December 2018 also helped by interest income and the write-back of provisions made for mark-to-market losses. The bank's advances were up 23% to Rs 1,96,432 crore at the end of the quarter, pushing up its profits.

Net interest income, or core income, of the bank rose 27% to Rs 2,939 crore, also higher than the Rs 2,633 crore estimate. Net interest margin expanded to 4.33% from 4.2 % in the previous quarter.

Kerala-based Federal Bank reported a 28.31% rise in net profit in the third quarter of this fiscal to Rs 333.63 crore, against Rs 260 crore in the year-ago period. The Kochi-based lender's net interest income grew 13.4% to Rs 1,077.29 crore for the July to December 2018 quarter, as against Rs 950 crore a year ago. Robust growth in the interest income helped offset the impact of higher provisions.

IndusInd Bank saw a lower 5.21% rise in profit at Rs 985.03 crore for December quarter over the previous year after the lender made provisions on its exposure to road projects of IL&FS. The lender made a provision of Rs 606.70 crore for bad loans during the quarter as against Rs 590 crore it made in the September quarter. Gross NPA for the quarter came in at 1.13% against 1.09% in the year-ago period. This included Rs 255 crore of contingent provisions for IL&FS (standard assets), in addition to an amount of Rs 275 crore made in the September quarter.

Over 20% – growth in advances and a healthy growth in interest income reported by banks

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)