- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Trade war may snip 5% off China GDP

Economists say China's economy is already cooling down, but the US may also not come out unscathed

TRENDING NOW

China may be engaged in furious negotiations with the US over the skewed trade balance between them, but if it decides to take a tough stand and the tariff war escalates, there is a risk of its economy getting "shaved off" by five percentage points by 2030.

This is what Hugo Erken, senior economist at RaboResearch Global Economics & Markets, says his research firm's study has found.

"In case of further escalations, the Chinese economy would take a beating of five percentage points, which will be shaved off up to 2030. That is quite severe given the fact that the Chinese economy is also slowing down," he said.

The Rabobank economist, who had accurately predicted slump in India's gross domestic product (GDP) growth in quarters after demonetisation, however, does not see the recent dismal fourth quarter and annual economic data on China as an aftermath of tariff war.

"I don't think the weak December numbers are directly related to the trade war because the Chinese economy was already cooling down before as well. They are facing problems of inefficient state enterprises, debts, etc. The government is imposing all kinds of stimulus measures but their effect is also waning. You stimulate to put another subway in place but what is the added value of another subway if you already have 30 in place," he said.

Recent Chinese economic numbers put out by various agencies show their growth is slowing even as trade balance figures slip into the negative zone.

Recent Chinese economic numbers put out by various agencies show their growth is slowing even as trade balance figures slip into the negative zone.

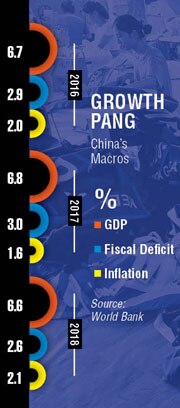

The world's second-largest economy saw its GDP growth slow by 20 basis points to 6.6% in 2018 from 6.8% in 2017. For the fourth quarter, it fell to 6.4% sequentially.

With China's confidence running low, there are reports that Beijing will cut its official GDP growth outlook for 2019 to 6% from the earlier 6.5%. This is in line with Moody's forecast. World Bank has projected China's economic growth in 2019 at 6.2%.

But it's the trade balance numbers that have alarmed many. For the first time, China's nominal exports have shown negative growth in December. It declined by 4.4% last month from a growth of 5.4% in November. Imports shrunk by 7.6% in the same month from a 3% rise in the previous month.

China's purchasing manager's index (PMI) December has also shown a contraction, reporting a figure of 49.4 compared to 50.2 in November.

Amit Sarkar, partner, BDO India, told DNA Money that it is not that the US is unscathed in the tariff war.

According to him, despite attractive tax-breaks, US has failed to attract the kind of investment it was hoping to.

"Despite the tax-breaks announced by Trump, where he was hoping to have extra capital which was being parked in other jurisdictions to come back to the US. There was still a drop in investment in the US," he said.

In the second quarter of last year, foreign direct investment (FDI) flows into the US were in the negative region, leading to the divestment of $8.2 billion after a comparatively strong first quarter. The quarter had seen unusually high selloff and purchase activity, reportedly suggesting that close to $100 billion invested in the US had transferred ownership abroad.

In 2017, the US FDI had slumped by 32%. Thus, the US-China tariff standoff is emitting confused signals.

There is no clarity on which way the long-running and bruising trade war between the two largest economies is headed.

Erken said his reading of the current situation showed both sides still have the existing package in place. He did not expect the trade tiff to escalate but he also does not see a deal being cut any time soon.

"The base case shows both sides will continue to have the current package in place. Even a slight rise in tariff or further escalation of the trade war will damage both economies. With the 2020 elections in the US and China undertaking structural reform, we see that going forward Trump will try to put pressure on China in rounds of 90 days," he said.

On December 1 last year, China and the US agreed to a 90-day trade war truce till March at G20 in Argentina.

An economic report by Björn Giesbergen titled China: Cooling economy induces policymakers to fire up the stimulus engine (again) said the nature of the Chinese stimulus was changing with the altering economic realities. He said it was moving from driving investment in infrastructure to consumption.

"Due to the rapidly cooling economy and the escalating trade war, stimulus measures were introduced again. It should, however, be noted that this set of stimulus measures is more limited compared to the large-scale packages that have been implemented regularly since 2008. Regardless of the size, the focus has also changed. Previous rounds were mainly focused on investments in the construction of factories, housing and infrastructure. This time there is more room for consumption," wrote Giesbergen in his

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)