- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Equity derivative margins hiked ahead of Budget

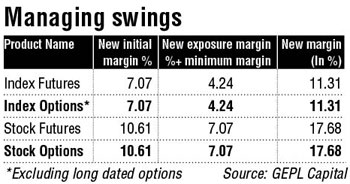

UNDER CONTROL: Higher initial, exposure margin in equity derivatives come to effect from today, to lid volatility

TRENDING NOW

Increased initial margin and exposure margin norms for the equity derivatives segment come into effect from Monday after the Securities and Exchange Board of India (Sebi) expanded the increased the margin period of risk (MPOR) for all products in the equity derivative segment to two days compared to current MPOR of one day. Brokers have asked equity derivative players to prepare for the new margin regime, or risk open positions being squared off.

This means traders will have to keep more money aside as margin requirements for index futures, index options (excluding long-dated options), stock futures and stock options are rising. For instance, existing initial and exposure margin (combined) for index futures, as well as index options, will go up from 10% to 11.31%. Similarly, existing initial and exposure margin (combined) for stock futures and stock options will inch up from 17.5% to 17.68%, as per GEPL Capital. Equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives.

Due to new norms, SPAN plus exposure margin will go up by a maximum of 41% of the current margins to accommodate for two-day volatility, some brokers like Zerodha say. SPAN margins are charged to cover for the worst possible movement in the contract one is trading for a single day. Now, this has been revised to cover for possible volatility over two days.

There is a significant rise in margin requirement when translated into rupees. At a price of Rs 10,930 for Nifty index futures (lot size of 75), the earlier margin at 10% was Rs 81,975 for the total contract value of Rs 819,750. But with effect from Monday, the margin would be 11.31%, or Rs 92,713.73. This is actually a 13% rise in terms of earlier margin money. Broking house officials said the margins for Nifty and Banknifty futures will go up by roughly Rs 10,000 and Rs 7,000, respectively.

There is a significant rise in margin requirement when translated into rupees. At a price of Rs 10,930 for Nifty index futures (lot size of 75), the earlier margin at 10% was Rs 81,975 for the total contract value of Rs 819,750. But with effect from Monday, the margin would be 11.31%, or Rs 92,713.73. This is actually a 13% rise in terms of earlier margin money. Broking house officials said the margins for Nifty and Banknifty futures will go up by roughly Rs 10,000 and Rs 7,000, respectively.

"The higher margins may be a necessary evil. It is widely expected that volatility would increase ahead of the Budget session. The incremental margins, while may lead to some short-term volatility, could ensure that post-Budget volatility is lower," said the chief of derivatives desk of a large bank.

Some brokerages, including Sharekhan and Zerodha, as a precautionary measure, from January 17/18, had applied revised margin at the order level.

In absence of sufficient higher margin in broking accounts, this will lead to rejection of orders. From January 21, 2019, any shortfall in margins as per the revised structure will attract exchange penalty on the shortfall, or lead to open positions being squared off by risk management system (RMS) team of the brokers.

The Sebi had laid down the enhanced risk management framework for equity derivatives through its circular dated December 17, 2018. This was followed up by an NSE circular dated December 26, 2018, asking members to take note.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)