The prospect of Pakistan being placed back on a global terrorist financing watchlist could endanger its handful of remaining banking links to the outside world, causing real financial pain to the economy just as a general election looms.

The prospect of Pakistan being placed back on a global terrorist financing watchlist could endanger its handful of remaining banking links to the outside world, causing real financial pain to the economy just as a general election looms.

Washington and its European allies have co-sponsored a motion calling for the nuclear-armed nation to be placed on a "grey list" of countries deemed to be doing too little to comply with anti-terrorist financing and anti-money laundering regulations, with a decision expected next week when member states of the Financial Action Task Force (FATF) meet in Paris.

The move is part of a broader U.S. strategy to pressure Pakistan to cut its alleged links to Islamist militants waging chaos in Afghanistan.

Pakistan, which denies such links, last month shrugged off a U.S. aid suspension worth $2 billion. But inclusion on the FATF watchlist could inflict real damage, bankers and government officials say.

Islamabad has sought to head off the motion by amending its anti-terrorism laws and by taking over organisations controlled by Hafiz Saeed, a Pakistan-based Islamist whom Washington blames for the 2008 Mumbai attacks that killed 166 people.

But there are concerns Pakistan's nearly $300 billion economy, expanding at its fastest rate in a decade at above 5 percent, could lose steam if it ends up on the FATF watchlist, from which it was removed in 2015 after three years.

"We don't think the consequences are going to be drastic but it's definitely not good," said one senior finance ministry official.

Military successes against militants and massive Chinese infrastructure investments have restored some vim to an economy hobbled by a long-running Islamist insurgency and wrecked by the 2008/09 global financial crisis.

Officials are aiming for economic expansion to hit 6 percent this fiscal year (July-June) and Prime Minister Shahid Khaqan Abbasi's ruling party will want to avert a slowdown in the lead up to a general election due in about six months.

Being placed on the FATF watchlist carries no direct legal implications, but brings extra scrutiny from regulators and financial institutions that can chill trade and investment and increase transaction costs, according to experts.

Mike Casey, a partner at law firm Kirkland & Ellis in London, said being put back on the grey list would heighten Pakistan's risk profile and some financial institutions would be wary of transacting with Pakistani banks and counterparties.

"Others might elect to avoid Pakistan altogether, viewing the legal risks associated with doing business there to outweigh any economic benefits," he said.

CURRENT ACCOUNT DEFICIT

A decline in foreign transactions and a drop in foreign currency inflows could further widen Pakistan's large current account deficit, the Achilles heel of an economy that required an IMF bailout in 2013 following a balance of payments crisis.

Another major worry is that the likes of Standard Chartered, the largest international bank in Pakistan with 116 branches, or Citibank and Deutsche Bank, who mostly deal with corporate clients, would pull out.

Banks have been retreating from high-risk countries in recent years amid intense pressure from global regulators to guard against money laundering and terrorist financing.

"The level of due diligence is already high in countries like Pakistan, but if this goes ahead then the banks will really have to reassess the risk-reward scenario," said a senior executive with a large foreign bank, which has business interests in Pakistan.

In September, Pakistan's biggest lender, Habib Bank, was fined $225 million and effectively forced to shut its U.S. operations by the New York regulator due to compliance failures over money laundering and terrorist financing.

U.S. watchdogs have dished out more than $16 billion in fines for anti-money laundering (AML) compliance failings since the end of 2009, according to data compiled by Hong Kong consultancy Quinlan & Associates.

"No one wants to be get caught in a situation where for a few million dollars of business the bank will have to pay billions in fines," added the foreign bank executive.

There is no immediate indication the handful of international banks that remain are considering leaving Pakistan, and banking sources point out that these banks are well-versed with the risks of operating in the country.

Citibank, in a statement, said: "Citi complies with all applicable U.S. and international anti-money laundering requirements and economic sanctions."

Standard Chartered said it was "closely monitoring the situation and as a matter of policy, we do not comment on market speculation". Deutsche declined to comment.

RAISING MONEY

The FATF threat has begun to weigh on Pakistan's stock market, although local businessmen say the country's companies are accustomed to operating in tough conditions.

Yet some are unnerved.

One Pakistani money manager launching an alternative investment fund said he fears his new venture could now struggle to attract U.S and European investment.

"It's already tough to raise money in Pakistan and anything to do with a 'terror financing' watchlist will just scare people," said the fund manager. "There will be more scrutiny and some foreign funds will back away."

A Pakistani finance ministry source said the government also fears a downgrade by the credit ratings agencies, making it harder or more expensive for Pakistan to raise debt on the international markets.

"It reduces our credibility in the world, which is unfair," added Pakistan's State Minister for Finance, Rana Afzal.

Some Pakistani officials say there is growing confidence in the country that recent efforts against Saeed, who was the focus of the FATF motion, will be enough to stave off further action.

"We've taken the wind out of their sails," said one senior Pakistani government official. "If we now get punished, it would be a political move and vengeful."

![submenu-img]() Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis

Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis![submenu-img]() Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900

Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900![submenu-img]() DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi

DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

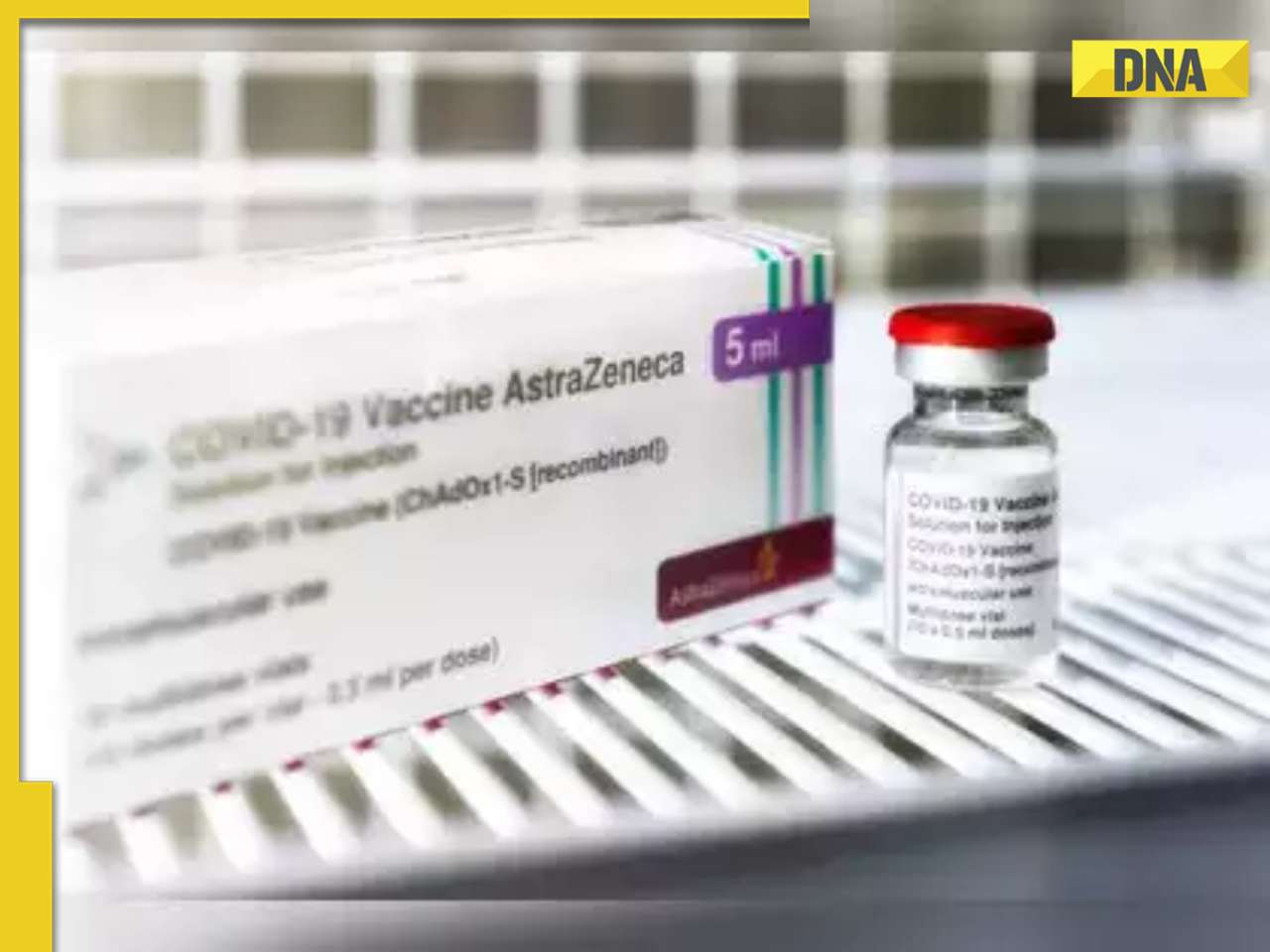

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...

Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'

Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'![submenu-img]() Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film

Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

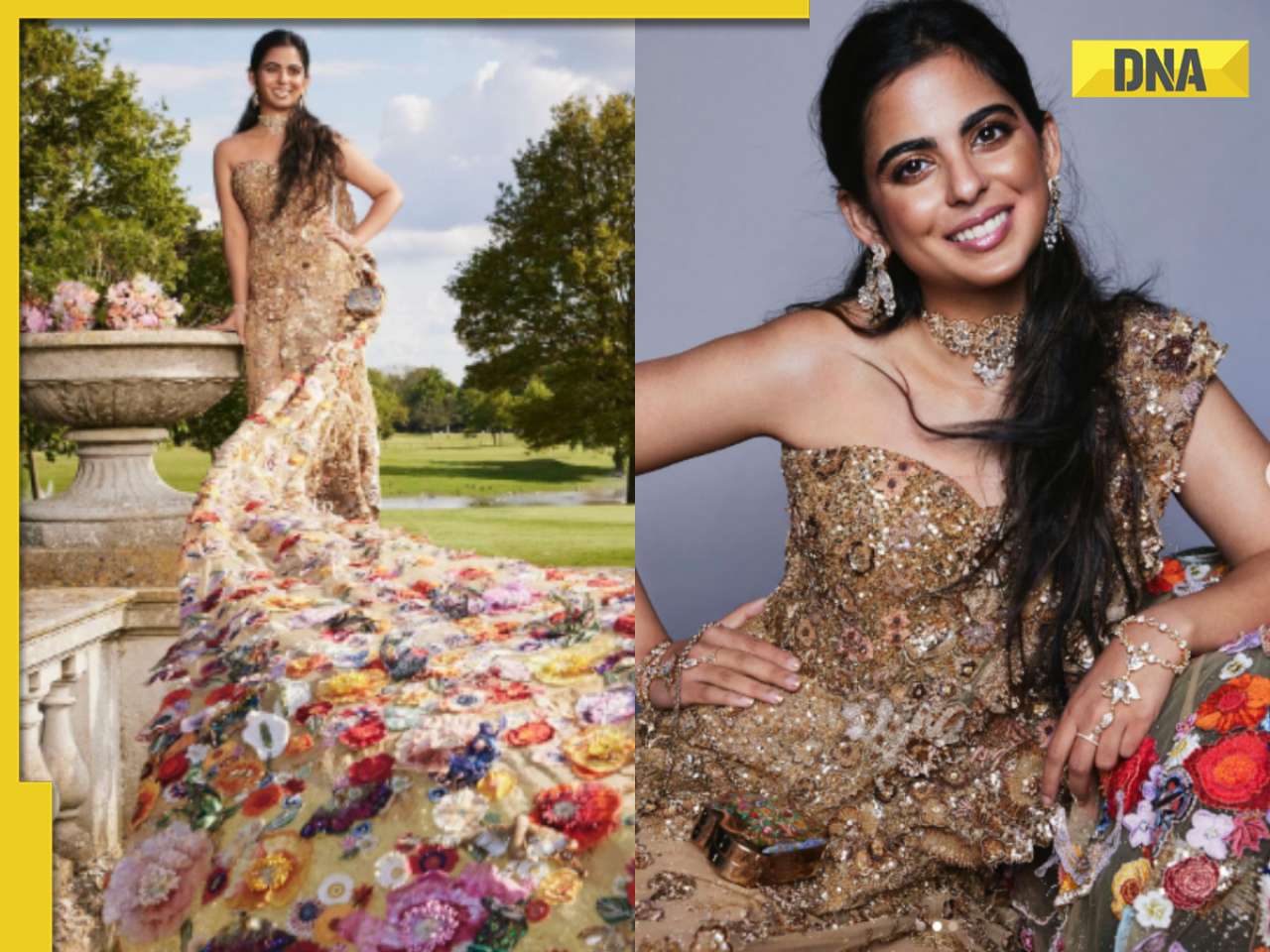

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)

)