A pension may be received annually, quarterly, or monthly under the PM Vaya Vandana Yojana social security programme.

The Pradhan Mantri Vaya Vandana Yojana is administered by the central government. PMVVY is an insurance policy-cum-pension scheme that provides security to senior citizens. The beneficiary is guaranteed a pension under this plan. The Central Government launched this programme on May 26, 2020. By 31 March 2023, you can apply for this programme if you'd want to participate as well. After turning 60, both a husband and a woman may get a pension under this programme.

Pradhan Mantri Vaya Vandana Yojana: About

PM Vaya Vandana Yojana is a social security scheme in accordance with which the applicant may get an annual, quarterly, or monthly pension. Let us tell you that the Indian Government has introduced this plan which is run by the Life Insurance Corporation of India (LIC).

Pradhan Mantri Vaya Vandana Yojana: Eligibility

Pradhan Mantri Vaya Vandana Yojana: Interest rate

PMVVY offers a 10-year, fixed-rate pension payout that is guaranteed. For the whole ten-year period, this plan will guarantee a return of 7.4% per year, which will be paid out monthly.

Pradhan Mantri Vaya Vandana Yojana: Benefits and Features

1. Obtaining pension payments for retirement security-

Individuals who have enrolled in the Pradhan Mantri Vaya Vandana Yojana are eligible to receive a fixed sum at the conclusion of a time period of their choosing for a maximum length of 10 years.

2. Guaranteed returns-

Annual reset of the assured rate of interest takes effect from April 1 of each fiscal year, in accordance with the Senior Citizens Savings Scheme's (SCSS) revised rate of returns, up to a maximum of 7.75%, with a fresh evaluation of the programme upon breach of this cap at any time.

3. Options for periodic payout-

According to their needs and convenience, people can choose a monthly, quarterly, half-yearly, or annual payout option with the plan. Depending on the payment method selected, the first payment needs to be made right away after purchasing the plan. For instance, if a pensioner has chosen a quarterly payment schedule, the first instalment should arrive within three months of the policy's purchase date.

4. Maturity benefit-

In addition to the last instalment payout and a lump sum payment for the plan's purchase price, the Pradhan Mantri Vy Vandna Yojna offers a maturity benefit. Up until the conclusion of the policy's tenure, a pensioner may use this facility.

5. Death benefit-

Upon providing the necessary paperwork, the beneficiary of a pensioner who passes away during the policy's term is entitled to receive the whole purchase price as compensation.

6. Loan service-

People may obtain a loan against a Pradhan Mantri Vaya Vandana Yojana investment after three successful policy years. Pensioners are only permitted to borrow up to 75% of the cost of the purchase. According to the frequency of loan repayment set, interest computed on the loan is recovered from the pension payout. The date of the pension payment is when the interest is due.

Additionally, the outstanding loan balance will be recovered from its claim amount during maturity or surrender.

For instance, If you invest a lump sum from your savings to ensure a fixed regular income for the next 10 years with the following details below:

Age: 60 years

Purchase Price: Rs. 7,50,000

Policy Term: 10 years

Purchase Year: 2017

Pension Mode: Monthly

You will receive a pension benefit of Rs. 4,625 as pension amount at the end of every month for 10 years. The rate of interest is 7.4% so, 7.4% of Rs. 7,50,000 divided by 12 is what you will get every month and on maturity, you will receive the purchase price i.e Rs. 7,50,000 which you had paid to purchase the plan.

And in case the holder dies at age of 65- The purchase amount, or Rs. 7,50,000, will be paid to the nominee upon the death. You will receive a monthly pension of Rs. 4,625 until you become 65. This is valid for any moment throughout the ten-year policy term when he passes away.

Suppose at the age of 68 you need the money for treatment of some critical illness of yourself or your spouse. In such a scenario, till the age of 68, you will receive a monthly pension of Rs. 4,625 and at the age of 68 when you surrender the policy, you will be refunded 98% of the purchase price i.e. 98% of 7,50,000 = Rs. 7,35,000.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

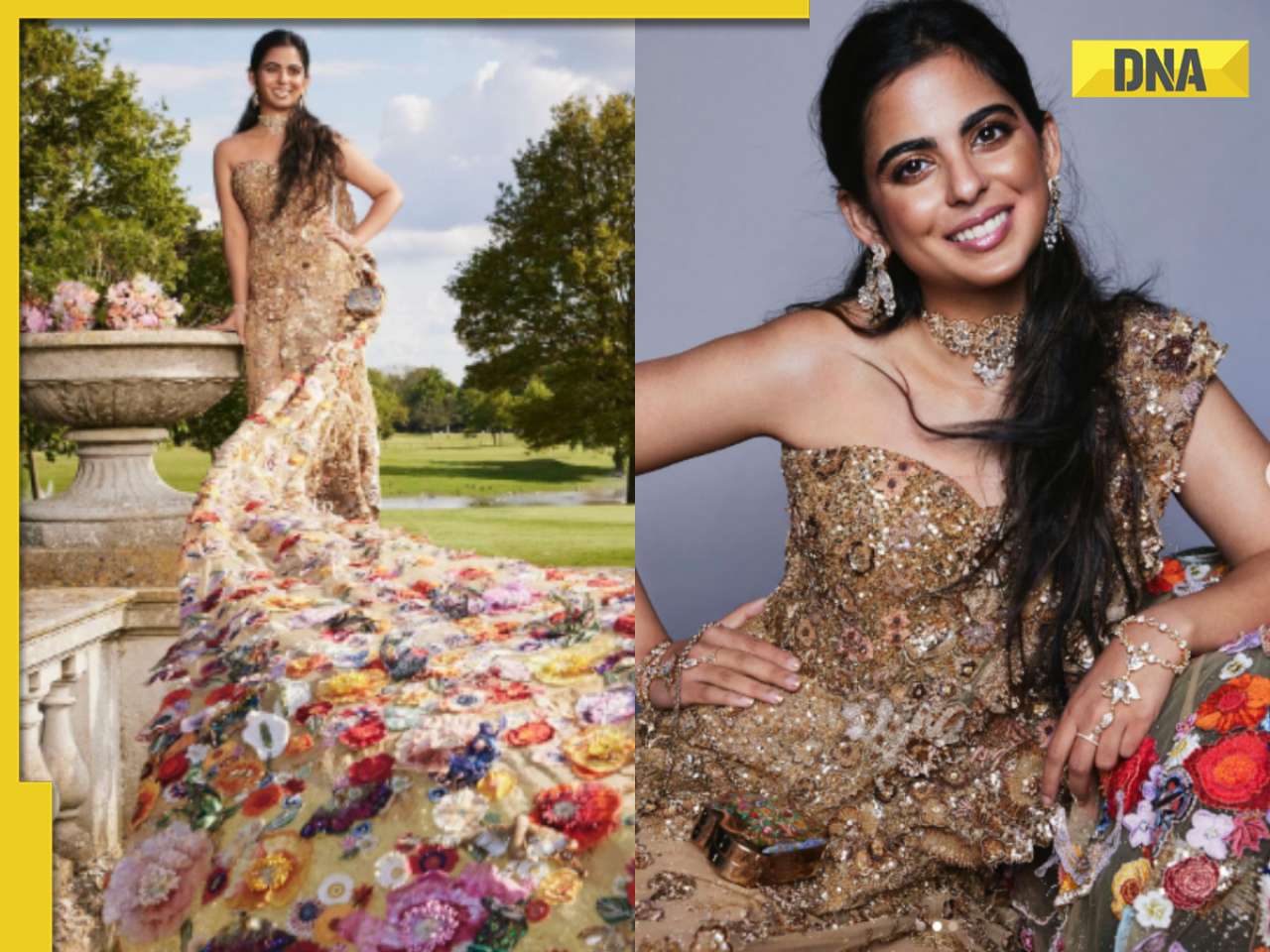

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)

)