But debt inflows may take time to resume.

The Securities and Exchange Board of India (SEBI), the capital markets regulator, on Friday further relaxed the process for foreign investors to access Indian debt markets by doing away with debt auction mechanism for investing in government debt.

This means, foreign institutional investors (FIIs) and qualified foreign investors (QFIs) can now invest in government debt without purchasing debt limits through the existing auction mechanism till the overall investment reaches 90%.

“Once this 90% limit is reached, auction mechanism shall be initiated for allocation of the remaining limits that are currently in place for FII investments in corporate debt,” Sebi said in a statement.

Friday’s decision is likely to help attract inflows once FIIs’ interest in Indian government debt returns, experts said.

Suyash Choudhary, head of fixed income at IDFC Mutual Fund, believes that the move is a logical progression of the regulator’s efforts to make operational access for FIIs more painless.

“This would greatly simplify the access mechanism for FIIs and would help in attracting investors once their interest revives in the bond segment. Currently, the FII participation is not there; so, this step in itself wouldn’t help bring inflows,” Choudhary said.

Foreign investors have been consistent sellers in the Indian debt market for the last three straight months, and have net-sold debt securities worth Rs 882 crore so far this month.

The narrowing spread between the US treasury yield and the benchmark Indian 10-year government bond, along with volatility in the rupee, has been responsible for outflows from the Indian debt market.

Currently, though 88.28% of the limit has been exhausted, only 50.7% of the $25 billion upper limit to invest in government debt is being utilised by FIIs. Also, the $5 billion additional limit for Sebi-registered FIIs under the categories of sovereign wealth funds, endowment funds, insurance funds, pension funds, so on, has seen only 10.38% utilisation.

Nirakar Pradhan, chief investment officer at Future Generali India Life Insurance Company, believes that though Friday’s Sebi step is in the right direction, it may not help much in attracting foreign fund inflows, if FIIs go by other considerations such as the level of risk, rate of return and outlook for interest rates in India.

Earlier, FIIs/QFIs, in order to invest in government debt, were required to purchase the debt limits through the auction mechanism which was administered by the Sebi on a monthly basis.

![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say

Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say![submenu-img]() Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..

Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..![submenu-img]() TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here

TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here![submenu-img]() Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here

Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here![submenu-img]() Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in

Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in![submenu-img]() Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check

Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

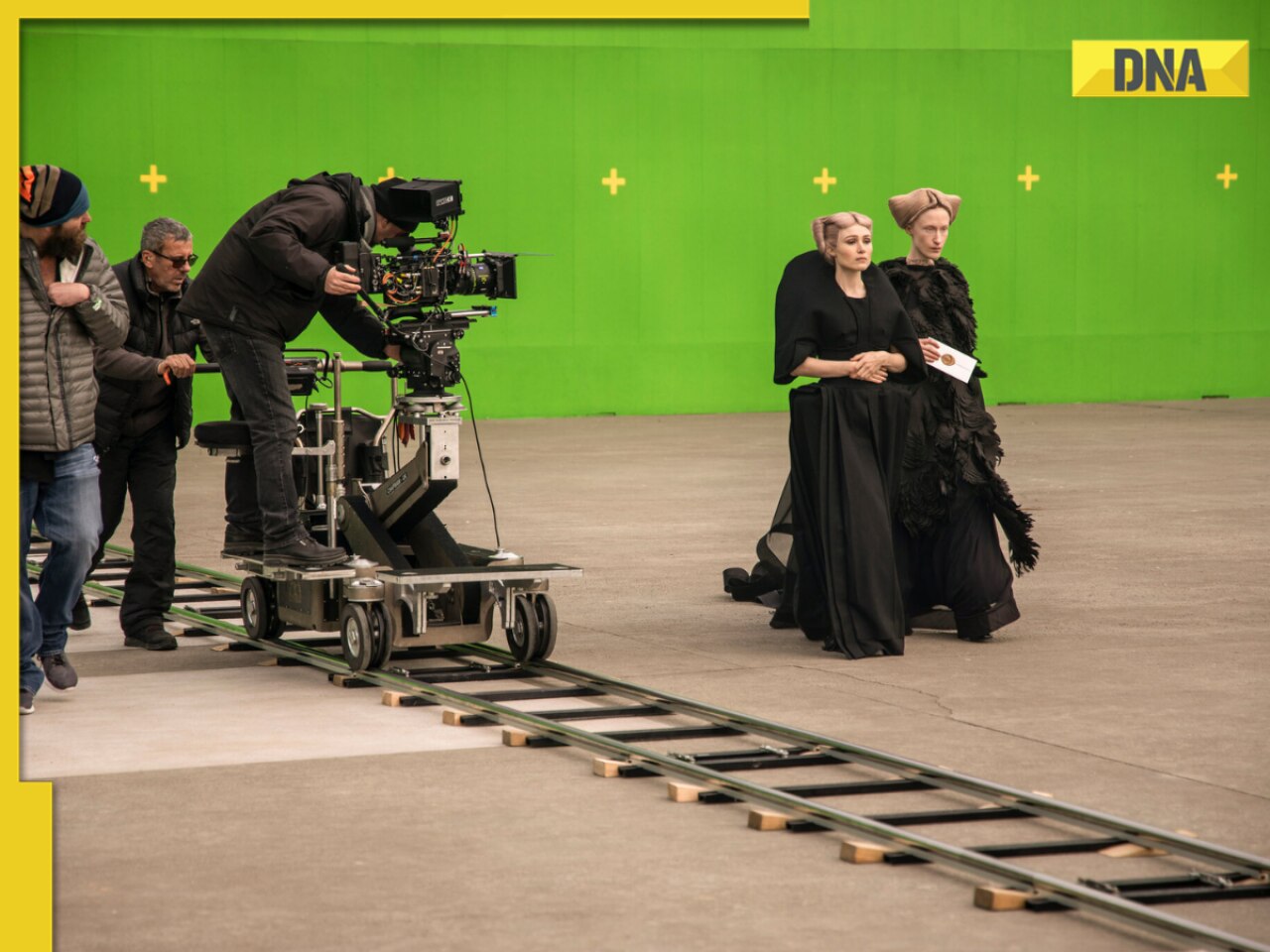

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive

Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive![submenu-img]() This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..

This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it

Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it![submenu-img]() Shocking! Woman discovers intruder living in her bedroom for four months, details inside

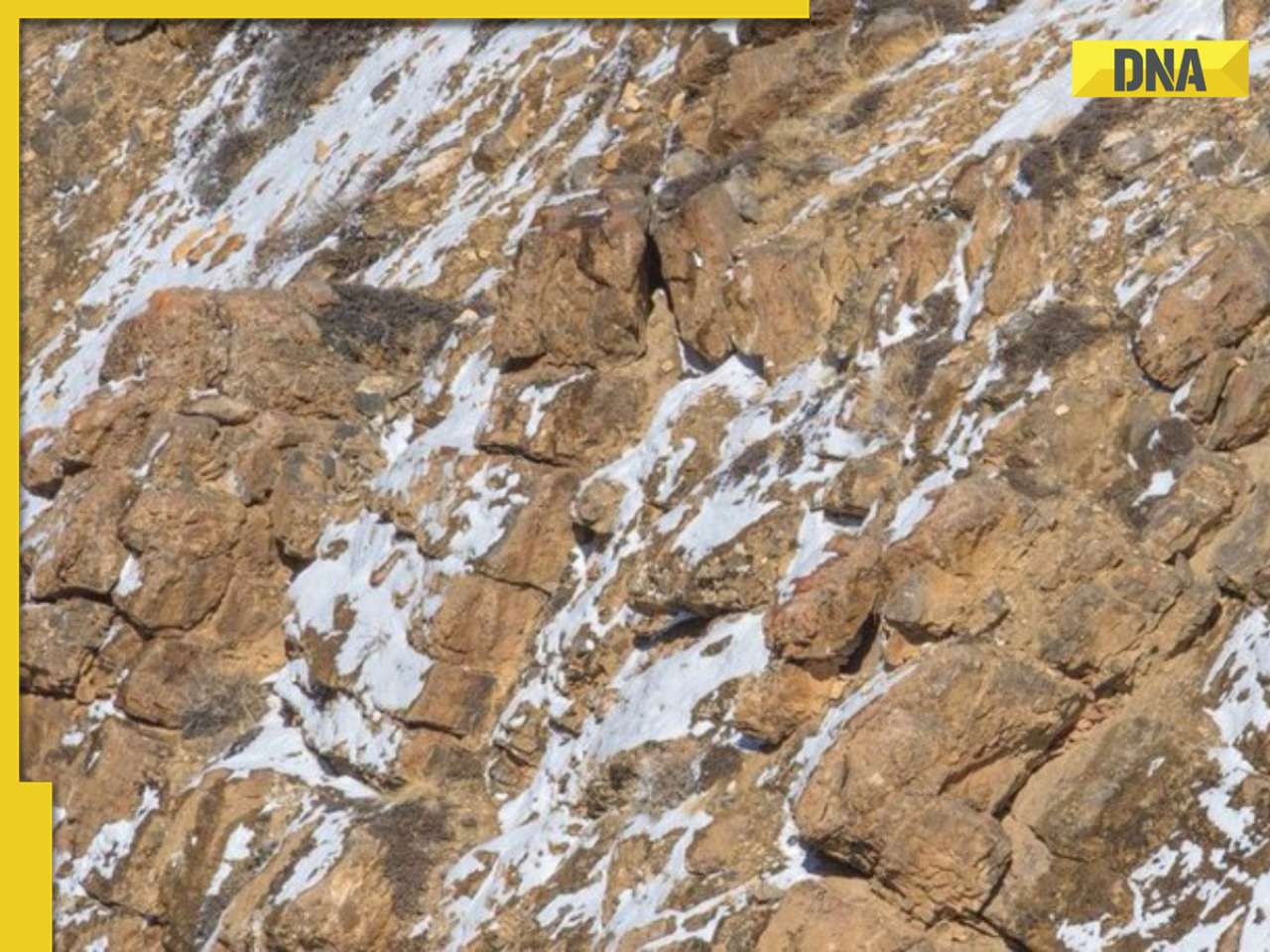

Shocking! Woman discovers intruder living in her bedroom for four months, details inside![submenu-img]() Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard

Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard![submenu-img]() Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

)

)

)

)

)

)