- Home

- Latest News

![submenu-img]() Meet man who once suffered loss of Rs 15 crore, then built Rs 2000 crore turnover company at 60, he is…

Meet man who once suffered loss of Rs 15 crore, then built Rs 2000 crore turnover company at 60, he is…![submenu-img]() 'They did her dirty': Aishwarya Rai fans criticise stylist for her 'failed art project' outfit on Cannes red carpet

'They did her dirty': Aishwarya Rai fans criticise stylist for her 'failed art project' outfit on Cannes red carpet![submenu-img]() Woman walks on the streets of Tokyo in saree, viral video shows people’s reaction

Woman walks on the streets of Tokyo in saree, viral video shows people’s reaction![submenu-img]() Blinkit offering ‘free dhaniya’ with vegetable orders, people now asking for free…

Blinkit offering ‘free dhaniya’ with vegetable orders, people now asking for free…![submenu-img]() Kartam Bhugtam: Shreyas Talpade-starrer is a riveting dive into the unknown

Kartam Bhugtam: Shreyas Talpade-starrer is a riveting dive into the unknown

- Election 2024

- Webstory

- IPL 2024

- Education

![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() Maharashtra Board Results 2024: MSBSHSE class 10th, 12th results soon, know how to check results via SMS

Maharashtra Board Results 2024: MSBSHSE class 10th, 12th results soon, know how to check results via SMS![submenu-img]() Meet Indian genius who became world’s 'youngest' surgeon at 7, worked in IIT for...

Meet Indian genius who became world’s 'youngest' surgeon at 7, worked in IIT for...![submenu-img]() Meet Kashmir boy, who is JEE topper, wants to pursue Computer Science, he aims to clear...

Meet Kashmir boy, who is JEE topper, wants to pursue Computer Science, he aims to clear...

- DNA Verified

![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

- Her DNA

- Photos

![submenu-img]() Aishwarya Rai Bachchan turns heads in intricate black gown at Cannes, walks the red carpet with injured arm in cast

Aishwarya Rai Bachchan turns heads in intricate black gown at Cannes, walks the red carpet with injured arm in cast![submenu-img]() Laapataa Ladies' Poonam aka Rachna Gupta looks unrecognisable in viral photos, amazes with jaw-dropping transformation

Laapataa Ladies' Poonam aka Rachna Gupta looks unrecognisable in viral photos, amazes with jaw-dropping transformation![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

- DNA Explainers

![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

- Entertainment

![submenu-img]() 'They did her dirty': Aishwarya Rai fans criticise stylist for her 'failed art project' outfit on Cannes red carpet

'They did her dirty': Aishwarya Rai fans criticise stylist for her 'failed art project' outfit on Cannes red carpet![submenu-img]() Kartam Bhugtam: Shreyas Talpade-starrer is a riveting dive into the unknown

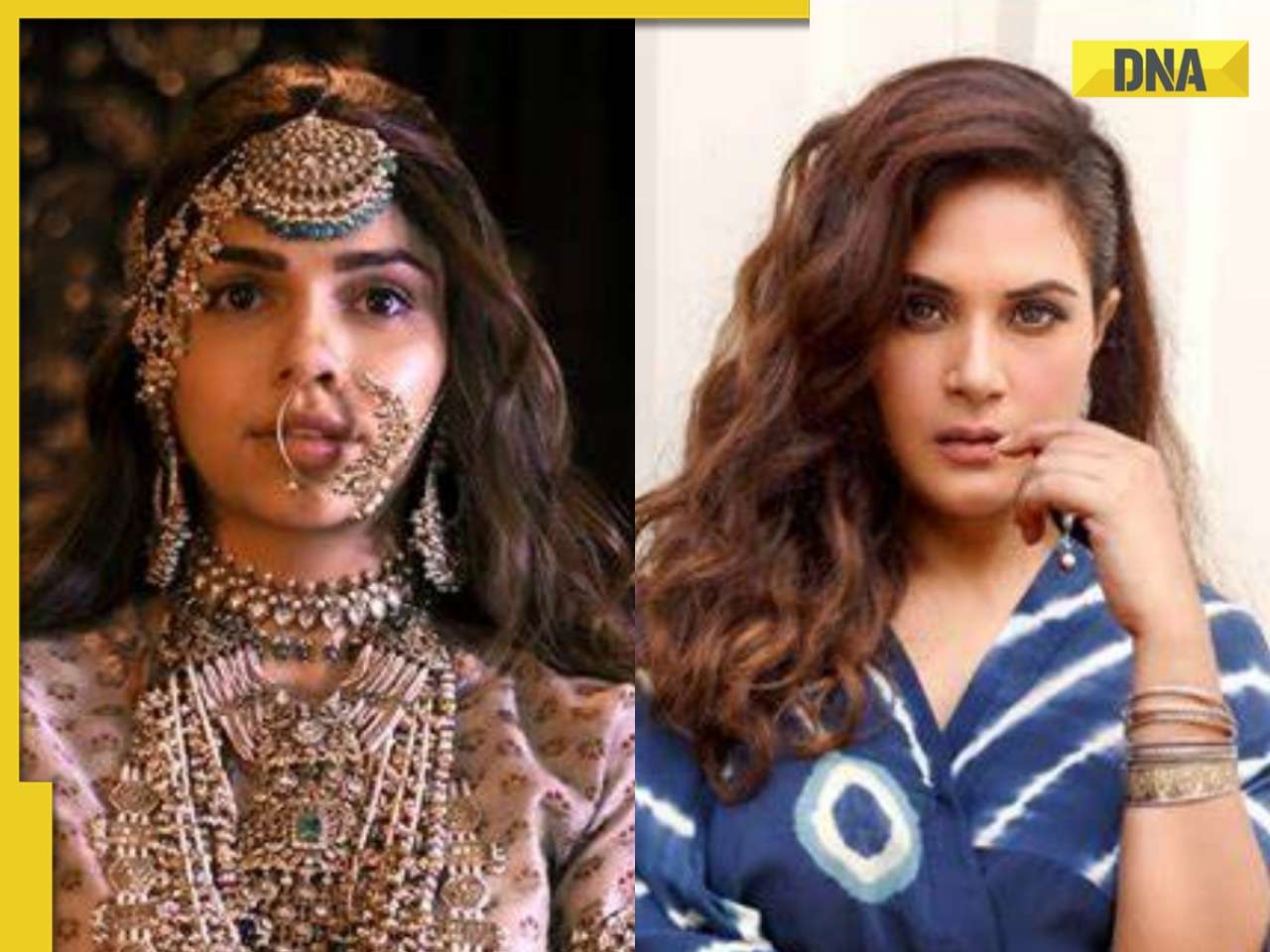

Kartam Bhugtam: Shreyas Talpade-starrer is a riveting dive into the unknown![submenu-img]() Richa Chadha says Heeramandi co-star Sharmin Segal being trolled for her performance is 'audience’s right'

Richa Chadha says Heeramandi co-star Sharmin Segal being trolled for her performance is 'audience’s right'![submenu-img]() Meet only Indian actress whose film is competing for top prize at Cannes; not Aishwarya, Deepika, Kiara, Priyanka, Alia

Meet only Indian actress whose film is competing for top prize at Cannes; not Aishwarya, Deepika, Kiara, Priyanka, Alia![submenu-img]() How two heroines beat Rajinikanth, Vijay, Dhanush to give Tamil cinema's biggest hit of 2024; low-budget film earned...

How two heroines beat Rajinikanth, Vijay, Dhanush to give Tamil cinema's biggest hit of 2024; low-budget film earned...

- Viral News

![submenu-img]() Woman walks on the streets of Tokyo in saree, viral video shows people’s reaction

Woman walks on the streets of Tokyo in saree, viral video shows people’s reaction![submenu-img]() Why Australians walk barefoot in public: Here’s the reason

Why Australians walk barefoot in public: Here’s the reason![submenu-img]() People in this country compete to see who’s best at doing nothing, here's why

People in this country compete to see who’s best at doing nothing, here's why![submenu-img]() Viral video: Influencer dressed as 'Manjulika' dances on crowded road, internet reacts

Viral video: Influencer dressed as 'Manjulika' dances on crowded road, internet reacts![submenu-img]() Viral video: Baby elephant receives 'Z-category security' during family nap in Tamil Nadu reserve

Viral video: Baby elephant receives 'Z-category security' during family nap in Tamil Nadu reserve

)

)

)

)

)

)

)