As you prepare to dip your toes into the enticing world of trading, finding the perfect trading platform, specifically a well-regarded trading app in India, might seem like a tall order.

Fear not, these six guiding principles will assist you in unearthing the optimal platform that caters to your novice trader status.

As the lure of potentially high returns draws an increasing number of individuals to the stock market within our rebounding economy, understanding associated risks and identifying a suitable trading platform becomes essential.

How To Select Your Ideal Trading Platform

Choosing the right trading platform as a trader is much like selecting the ideal toolkit - it can considerably bolster your profit potential.

Here's how you can navigate towards your perfect trading platform:

1. Understand Your Trading Style

Embark on your journey by determining your trading style and strategy. Do you see yourself as a marathoner in the long-term investment game or a sprinter with a penchant for day trading?

Some platforms cater specifically to active trading, while others support more passive trading. Ensure the platform you select resonates with your trading style and offers the requisite tools and features.

2. Seek User-Friendly Interface

When evaluating a platform for online share trading, gauge the initial appeal. If the interface fails to grab your interest or lacks user-friendliness, consider investigating other possibilities.

While grasping the complexities of a platform is vital for proficient operation, fundamental icons, and settings should present an intuitive, easy-to-understand face when you first venture into the website.

3. Assess Basic and Additional Features

It's essential that your chosen trading platform seamlessly aligns with your present trading scenario. Prioritize the features that will directly enhance your trading efforts over being inundated with superfluous functions.

Remember, there's always room to upgrade as your prowess and requirements evolve. An advanced platform proves advantageous when a majority of its features (at least 80%) are used practically.

4. Prioritize Security and Reliability

When choosing a trading app in India, make security and reliability your primary considerations. Opt for apps that provide robust encryption and two-factor authentication to safeguard your personal and financial data.

Moreover, ensure that the chosen app is reliable and stable to avoid any downtime or potential financial losses.

5. Consider Customer Support

Assess the customer support offerings of your prospective trading platform. Responsive and supportive customer service can prove invaluable during your trading journey.

Look for platforms that offer multiple support channels, including phone, email, and live chat, ensuring assistance is readily available when required.

Why Consider Dhan?

Dhan, a swiftly growing stock trading platform in India, offers zero brokerage on equity delivery, a boon for traders in terms of cost-effectiveness.

The platform impresses with a user-friendly interface and features such as 1-Tap Reverse Position, Live Market Scanners, Real-Time Data, and Analytics, along with the option to trade directly from TradingView charts.

Moreover, Dhan equips traders with practical tools such as the ability to pledge shares, daily and weekly CPR indicators for determining support and resistance levels, and a Transaction Estimator for calculating brokerage fees upfront.

Conclusion

As a beginner trader in India, the selection of the right trading platform is a pivotal determinant in your stock market success journey. Prioritize user-friendly interfaces, robust security measures, comprehensive research tools, and reliable customer support in your decision-making process.

Dhan, with its burgeoning reputation and impressive features such as zero brokerage on equity delivery, a user-friendly interface, TradingView charts, and additional tools for traders, emerges as a strong contender.

Choosing Dhan can pave the way for a seamless trading experience, access to valuable resources, and informed trading decisions, setting you on a path to reach your financial goals.

(Above mentioned article is consumer connect initiative. This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever)

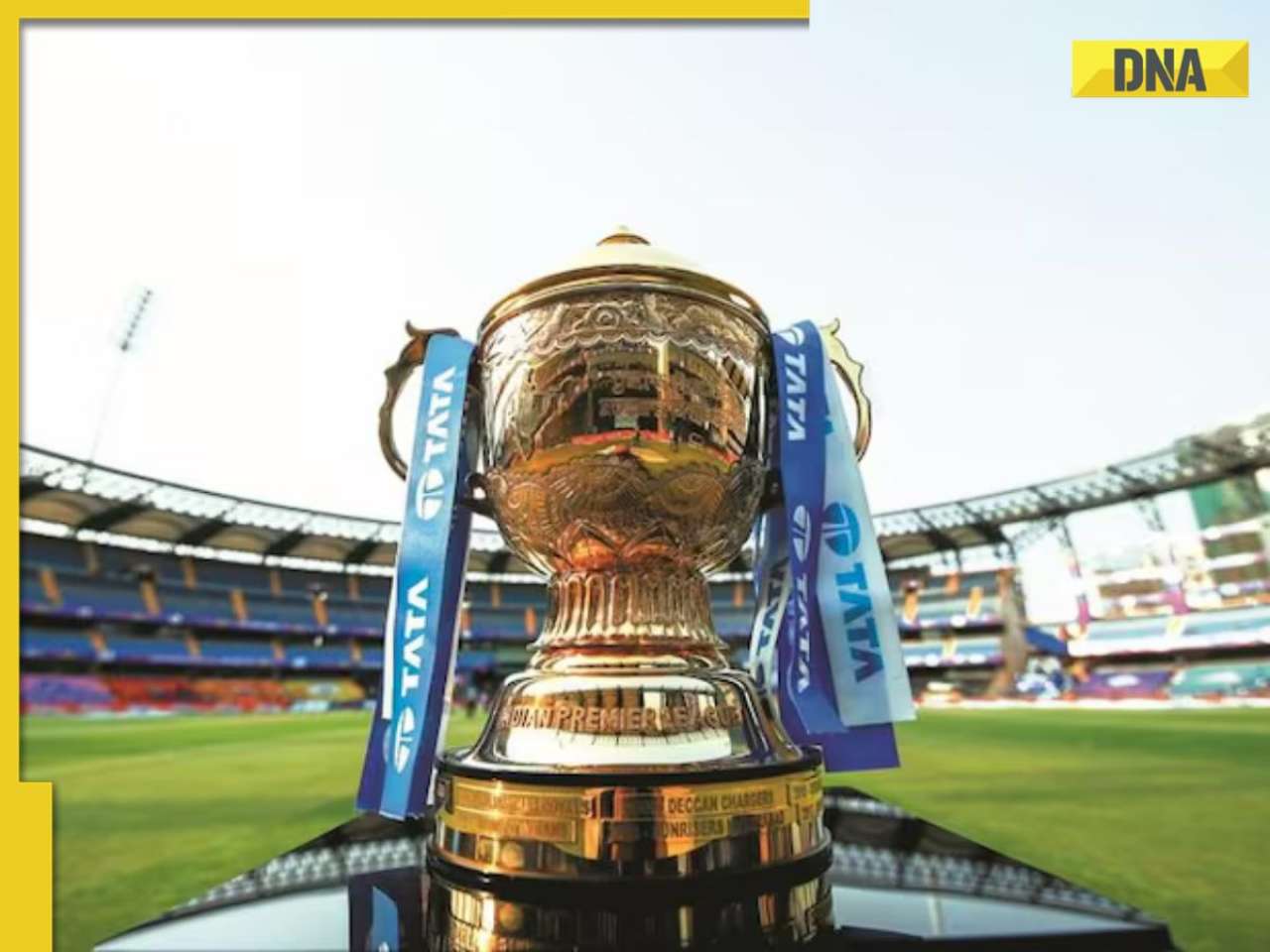

![submenu-img]() IPL 2024 Final KKR vs SRH: How much prize money winner and runners-up will get?

IPL 2024 Final KKR vs SRH: How much prize money winner and runners-up will get?![submenu-img]() CHSE Odisha board Result 2024: Class 12 results DECLARED; check direct link, steps to download

CHSE Odisha board Result 2024: Class 12 results DECLARED; check direct link, steps to download![submenu-img]() Made in Rs 1 crore, this classic was shot in 40 days, director made film to battle depression, movie inspired 6 remakes

Made in Rs 1 crore, this classic was shot in 40 days, director made film to battle depression, movie inspired 6 remakes![submenu-img]() Meet Amitabh, Rajinikanth, Mithun's heroine, who started working at 14, quit acting at peak of her career, is now...

Meet Amitabh, Rajinikanth, Mithun's heroine, who started working at 14, quit acting at peak of her career, is now...![submenu-img]() Faridabad Jewar Expressway: Ballabgarh to Jewar Airport in 15 minutes, check distance, route, completion date

Faridabad Jewar Expressway: Ballabgarh to Jewar Airport in 15 minutes, check distance, route, completion date![submenu-img]() CHSE Odisha board Result 2024: Class 12 results DECLARED; check direct link, steps to download

CHSE Odisha board Result 2024: Class 12 results DECLARED; check direct link, steps to download![submenu-img]() IIT-JEE topper who joined IIT Bombay with AIR 1, son of income tax officer, now working as a...

IIT-JEE topper who joined IIT Bombay with AIR 1, son of income tax officer, now working as a...![submenu-img]() Odisha 10th Result 2024 Declared: Odisha Matric results announced, direct link here

Odisha 10th Result 2024 Declared: Odisha Matric results announced, direct link here![submenu-img]() Odisha Board 10th Result 2024 today: BSE Odisha Matric result 2024 to be declared shortly at bseodisha.ac.in

Odisha Board 10th Result 2024 today: BSE Odisha Matric result 2024 to be declared shortly at bseodisha.ac.in![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Made in Rs 1 crore, this classic was shot in 40 days, director made film to battle depression, movie inspired 6 remakes

Made in Rs 1 crore, this classic was shot in 40 days, director made film to battle depression, movie inspired 6 remakes![submenu-img]() Meet Amitabh, Rajinikanth, Mithun's heroine, who started working at 14, quit acting at peak of her career, is now...

Meet Amitabh, Rajinikanth, Mithun's heroine, who started working at 14, quit acting at peak of her career, is now...![submenu-img]() Who is Payal Kapadia? Indian filmmaker who won Grand Prix at Cannes, once faced disciplinary action, FIR at FTII, now...

Who is Payal Kapadia? Indian filmmaker who won Grand Prix at Cannes, once faced disciplinary action, FIR at FTII, now...![submenu-img]() Watch: Anasuya Sengupta says 'I just want to go back to family and rest' as she returns after historic Cannes win

Watch: Anasuya Sengupta says 'I just want to go back to family and rest' as she returns after historic Cannes win![submenu-img]() Bhuvan Bam trademarks his character Titu Mama for BB Ki Vines universe: 'This property belongs to me'

Bhuvan Bam trademarks his character Titu Mama for BB Ki Vines universe: 'This property belongs to me'![submenu-img]() This is world's first airline for dogs, here's how much it will cost

This is world's first airline for dogs, here's how much it will cost![submenu-img]() Woman says poha is 'worst breakfast' in now-viral post, divides internet

Woman says poha is 'worst breakfast' in now-viral post, divides internet![submenu-img]() Meet Carlo Acutis, tech-savvy teen to become first millennial saint of Catholic Church, he is from.....

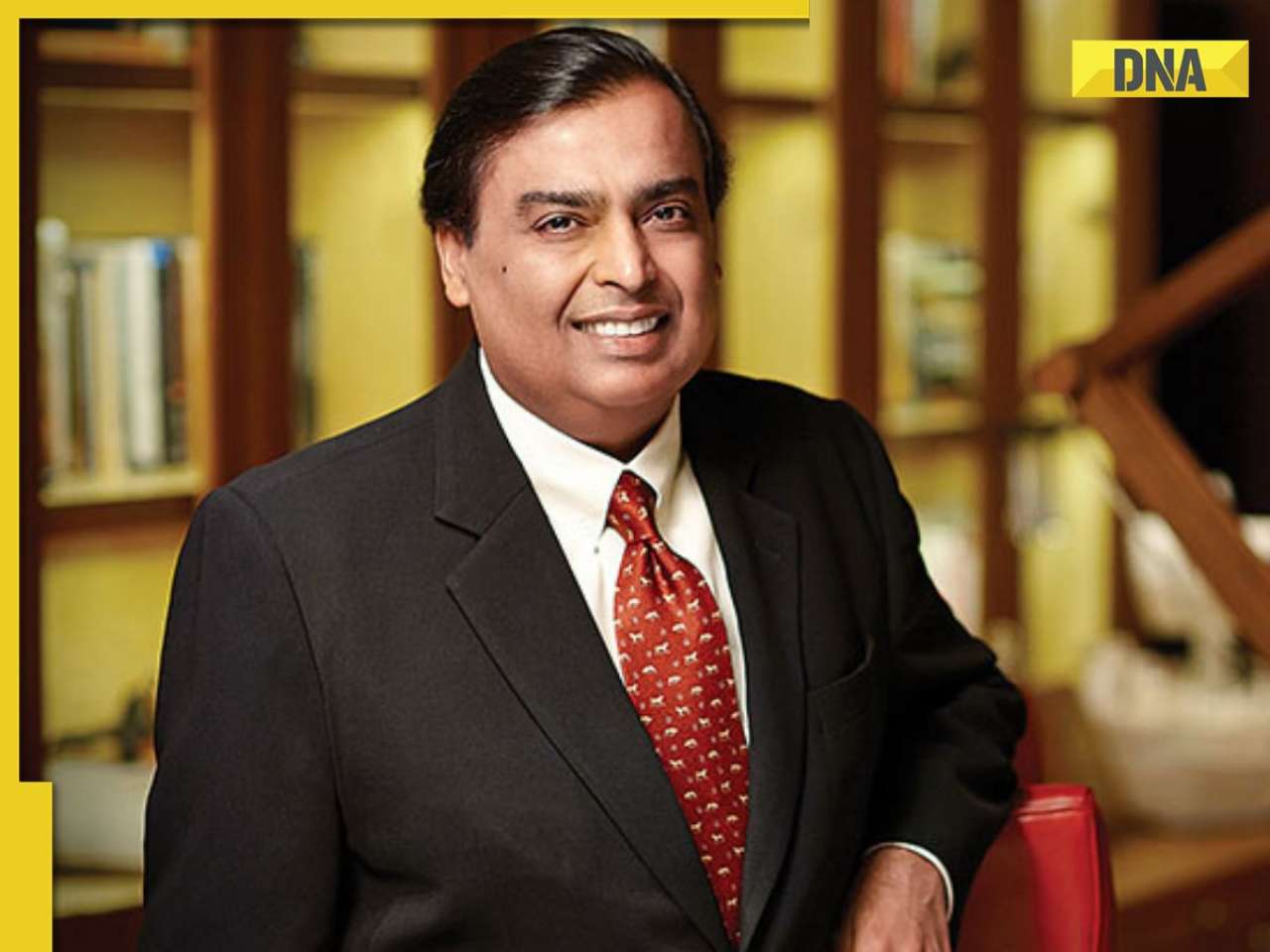

Meet Carlo Acutis, tech-savvy teen to become first millennial saint of Catholic Church, he is from.....![submenu-img]() Mukesh Ambani's son Anant is younger than Radhika Merchant, Akash younger than Shloka, check age difference

Mukesh Ambani's son Anant is younger than Radhika Merchant, Akash younger than Shloka, check age difference![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

)

)

)

)

)

)

)