Explore India's attractive fixed-income investments amid rising interest rates and expectations for stable small savings schemes.

As interest rates in India surge, fixed-income investments like bank FDs and Senior Citizens Savings Scheme gain appeal. Despite the current high rates, they offer attractive returns. For example, Senior Citizens Savings Scheme yields 8.2%, bank FDs offer up to 7.75%, and post office deposits provide up to 7.5% annually. Even the Public Provident Fund (PPF) offers a 7.1% interest rate. Large banks like HDFC, SBI, and PNB offer competitive rates on FDs as well. The government is set to revise interest rates on these schemes at the end of September. According to experts, based on G-Sec yields and inflation projections, the rates on small savings schemes are likely to remain stable.

Small Savings Schemes are government-managed instruments encouraging regular savings. They include savings deposits, social security schemes, and monthly income plans. Savings deposits comprise various time deposits and saving certificates like NSC and KVP. Social security schemes encompass PPF, Sukanya Samriddhi Account, and Senior Citizens Savings Scheme, while the monthly income plan consists of the Monthly Income Account.

Current interest rates for July-September 2023 are as follows:

• Savings Deposit: 4%

• 1-Year Post Office Time Deposits: 6.9%

• 2-Year Post Office Time Deposits: 7.0%

• 3-Year Post Office Time Deposits: 7%

• 5-Year Post Office Time Deposits: 7.5%

• 5-Year Recurring Deposits: 6.5%

• National Saving Certificates (NSC): 7.7%

• Kisan Vikas Patra: 7.5% (matures in 115 months)

• Public Provident Fund: 7.1%

• Sukanya Samriddhi Account: 8.0%

• Senior Citizens Savings Scheme: 8.2%

• Monthly Income Account: 7.4%

In a recent review on June 30, 2023, the government increased interest rates on various small savings schemes. It marked the fourth rate hike since September 2022, breaking a pattern of unchanged rates spanning nine quarters from Q2 2020-21 to Q2 2022-23.

Read more: How to make UPI payments without active internet with just a call? Know here

![submenu-img]() This singer left Air Force, sang at churches, became superstar; later his father killed him after...

This singer left Air Force, sang at churches, became superstar; later his father killed him after...![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...![submenu-img]() Anil Ambani’s Rs 96500000000 Reliance deal still waiting for green signal? IRDAI nod awaited as deadline nears

Anil Ambani’s Rs 96500000000 Reliance deal still waiting for green signal? IRDAI nod awaited as deadline nears![submenu-img]() Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina

Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina![submenu-img]() Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’

Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’ ![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

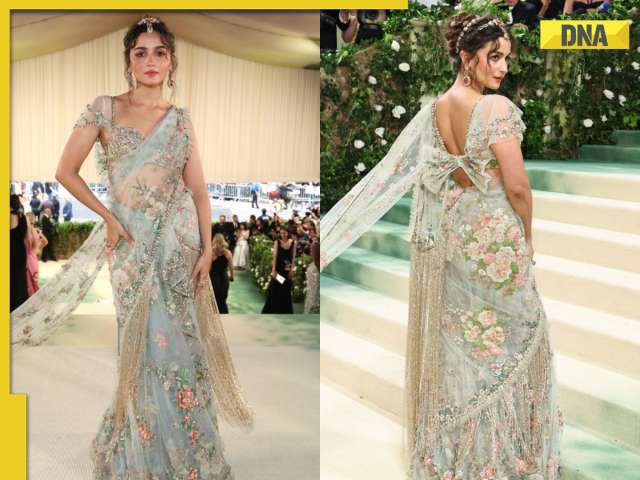

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() This singer left Air Force, sang at churches, became superstar; later his father killed him after...

This singer left Air Force, sang at churches, became superstar; later his father killed him after...![submenu-img]() Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina

Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina![submenu-img]() Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’

Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’ ![submenu-img]() Watch: Arti Singh gets grand welcome at husband Dipak's house with fairy lights and fireworks, video goes viral

Watch: Arti Singh gets grand welcome at husband Dipak's house with fairy lights and fireworks, video goes viral![submenu-img]() Meet actress, who belongs to family of superstars, quit films after 19 flops, no single hit in 9 years; is still worth…

Meet actress, who belongs to family of superstars, quit films after 19 flops, no single hit in 9 years; is still worth…![submenu-img]() IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH

IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH![submenu-img]() DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Watch: Team India’s new jersey for T20 World Cup 2024 unveiled

Watch: Team India’s new jersey for T20 World Cup 2024 unveiled![submenu-img]() DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals

DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...![submenu-img]() Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...

Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer

)

)

)

)

)

)

)