India Post offers diverse investment schemes with guaranteed returns and attractive interest rates for investors.

India Post offers safe and guaranteed investment plans with varying interest rates. The Government of India sets these rates for post office deposit schemes periodically, ensuring consistent growth for investors. Administered by the National Savings Institute under the Department of Economic Affairs, these schemes come with no risk and provide attractive returns.

Let's take a closer look at the different investment options available:

1) Post Office Savings Account: Earn a 4% interest rate per annum, with fully taxable interest and no TDS deduction.

2) 5-Year Post Office Recurring Deposit Account (RD): Start with monthly deposits as low as Rs 100, earning an interest rate of 6.5% p.a., compounded quarterly.

3) Post Office Time Deposit Account (TD): Similar to a bank fixed deposit, with tenors ranging from 1 to 5 years. Interest is calculated quarterly but paid out annually. Q2 FY 2023-24 rates are 6.9% for a one-year account, 7% for two- and three-year accounts, and 7.5% for a five-year account.

4) Post Office Monthly Income Scheme Account (MIS): A low-risk investment with regular monthly income through 7.40% p.a. interest. The scheme has a lock-in period of five years.

5) Senior Citizen Savings Scheme (SCSS): This government-backed retirement scheme allows lump sum deposits, with an 8.2% interest rate for Q2 FY 2023-24, paid out quarterly.

6) 15-Year Public Provident Fund Account (PPF): A popular investment and retirement tool with income tax deductions up to Rs 1.5 lakh per financial year under Section 80C. PPF offers a tax-free 7.1% p.a. interest, compounded annually.

7) National Savings Certificates (NSC): With a five-year tenure, NSC offers a 7.7% p.a. interest, compounded annually, and paid out at maturity.

8) Kisan Vikas Patra (KVP): Your investment in KVP will double in 123 months, with the current interest rate at 7% per annum.

9) Sukanya Samriddhi Accounts (SSA): Specifically designed for girl children under 10 years of age, SSA offers an attractive 8% p.a. interest, calculated yearly and compounded annually.

These post office deposit schemes provide diverse and secure options for investors, catering to various financial goals and risk appetites. Investors can choose the scheme that best suits their needs and enjoy the benefits of guaranteed returns and steady growth.

Read more: Now non-SBI account holders can also make UPI payments from YONO app, here's how

![submenu-img]() House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins

House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins![submenu-img]() Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle

Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle![submenu-img]() Apple partners up with Google against unwanted tracker, users will be alerted if…

Apple partners up with Google against unwanted tracker, users will be alerted if…![submenu-img]() Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..

Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..![submenu-img]() Who is the real owner of Delhi's Connaught Place and who collects rent from here?

Who is the real owner of Delhi's Connaught Place and who collects rent from here?![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() Goa Board SSC Result 2024: GBSHSE Class 10 results to be out today; check time, direct link here

Goa Board SSC Result 2024: GBSHSE Class 10 results to be out today; check time, direct link here![submenu-img]() CUET-UG 2024 scheduled for tomorrow postponed for Delhi centres; check new exam date here

CUET-UG 2024 scheduled for tomorrow postponed for Delhi centres; check new exam date here![submenu-img]() Meet man who lost eyesight at 8, bagged record-breaking job package at Microsoft, not from IIT, NIT, VIT, his salary is…

Meet man who lost eyesight at 8, bagged record-breaking job package at Microsoft, not from IIT, NIT, VIT, his salary is…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins

House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins![submenu-img]() Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle

Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle![submenu-img]() Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..

Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..![submenu-img]() 'Ek actress 9 log saath leke...': Farah Khan criticises entourage culture in Bollywood

'Ek actress 9 log saath leke...': Farah Khan criticises entourage culture in Bollywood![submenu-img]() Bollywood’s 1st multi-starrer had 8 stars, makers were told not to cast Kapoors; not Sholay, Nagin, Shaan, Jaani Dushman

Bollywood’s 1st multi-starrer had 8 stars, makers were told not to cast Kapoors; not Sholay, Nagin, Shaan, Jaani Dushman![submenu-img]() Who is the real owner of Delhi's Connaught Place and who collects rent from here?

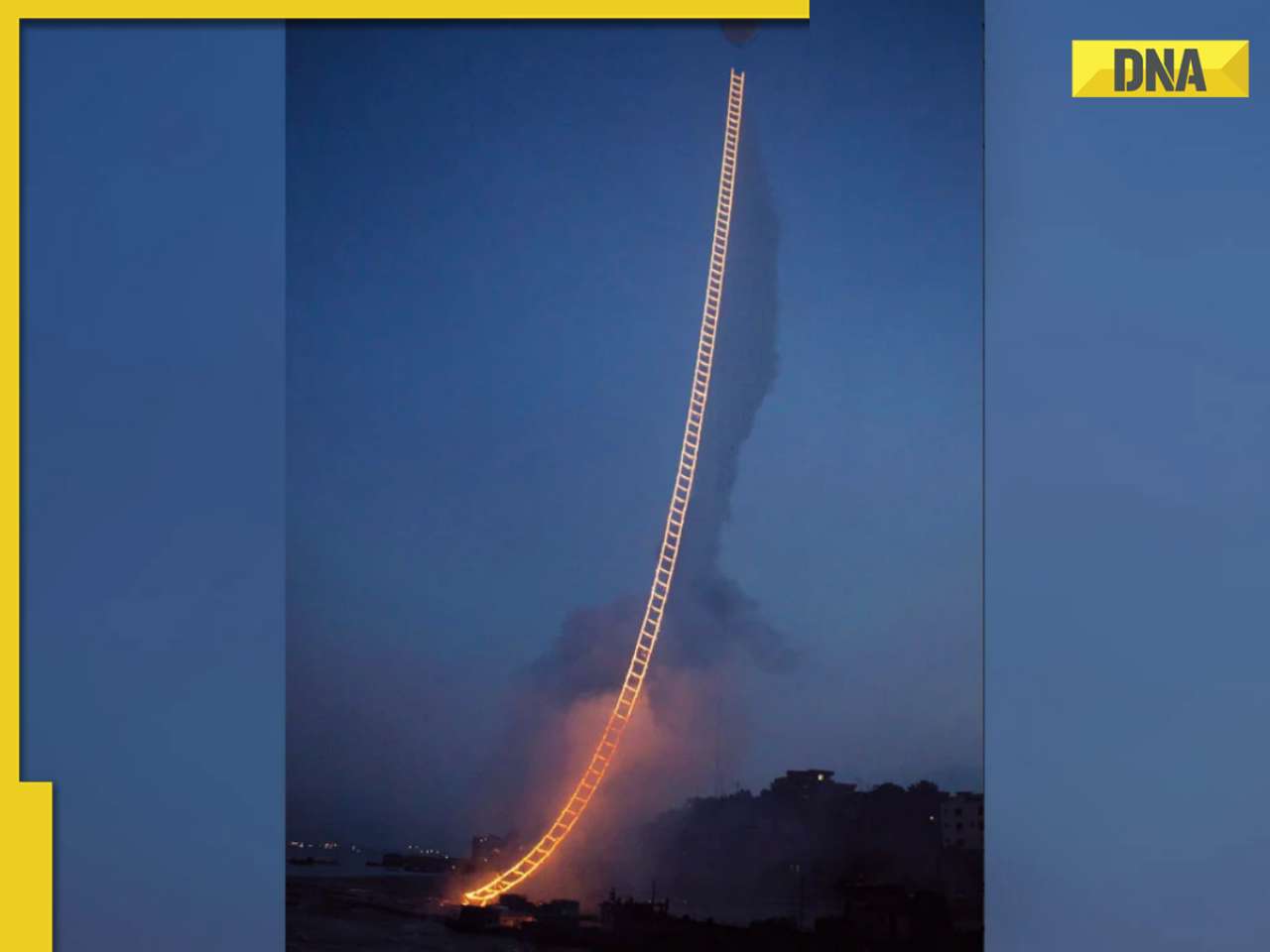

Who is the real owner of Delhi's Connaught Place and who collects rent from here?![submenu-img]() Viral video: Chinese artist's flaming 'stairway to heaven' stuns internet, watch

Viral video: Chinese artist's flaming 'stairway to heaven' stuns internet, watch![submenu-img]() Video: White House plays 'Sare Jahan Se Achha Hindustan Hamara" at AANHPI heritage month celebration

Video: White House plays 'Sare Jahan Se Achha Hindustan Hamara" at AANHPI heritage month celebration![submenu-img]() Viral video: Bear rides motorcycle sidecar in Russia, internet is stunned

Viral video: Bear rides motorcycle sidecar in Russia, internet is stunned![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

)

)

)

)

)

)

)