Infosys has announced four buybacks since its initial public offering in 1993.

Infosys, India’s second largest IT service company on October 13 reported 11% rise in consolidated net profit at Rs 6,021 crore for the September quarter and a Rs 9,300 crore share repurchase programme.

Since its initial public offering in 1993, the company has announced four buybacks.

The Bengaluru-based company increased its FY23 revenue growth guidance to 15–16%, pushing the forecast towards the higher end of the previously-projected 14–16% band. This was accomplished despite global macroeconomic concerns thanks to a "strong large deals pipeline" and good demand momentum.

An interim dividend of Rs 16.50 per share has also been declared by the Infosys board. The company announced in a statement that the estimated payout for the interim dividend will be Rs 6,940 crore.

The company has set October 28 as the interim dividend record date and November 10 as the interim dividend payout date.

For the second quarter ended September 2022, Infosys, which competes with Tata Consultancy Services, Wipro, and HCL Technologies for outsourcing contracts, reported an increase in consolidated net profit of 11% year over year to Rs 6,021 crore.

In the second quarter that ended in September, revenue increased 23.4% from the previous year to Rs 36,538 crore.

The Q2 showing was "broad-based with all industries and geographies growing in double digits in constant currency," Salil Parekh, CEO and MD of Infosys said at a briefing.

With "operational rigour," margins increased by 150 basis points sequentially, and supply-side pressures subsided a little bit as attrition dropped to 27.1% from 28.4% in the June quarter.

Parekh said, "While concerns around the economic outlook persist, our demand pipeline is strong as clients remain confident in our ability to deliver the value they seek, both on the growth and efficiency of their businesses. This is reflected in our revised revenue guidance of 15-16 per cent for FY23".

For a price of up to Rs 1,850 per equity share, the company has announced an open market share buyback worth Rs 9,300 crore. The buyback price is 30% more expensive than the Thursday closing scrip price of Rs. 1,419.7 per share.

Share buyback is seen as an alternative, tax-efficient way to return money to shareholders.

Among the headline metrics, the large deal total contract value for the quarter was robust at USD 2.7 billion, in fact, the highest in the last seven quarters.

Revenues from the digital sector, which accounted for 61.8% of total revenues, increased by 31.2% in constant currency. Operating margin rose sequentially by 140 basis points to 21.5 percent for the quarter.

As opposed to the earlier stated range of 21–23%, the company has now lowered the upper end of operating margin guidance and now anticipates an operating margin for FY23 in the range of 21–22%.

"While supply side challenges are gradually abating as reflected in the reducing attrition rates, they continue to exert pressure on our cost structure," Nilanjan Roy, Chief Financial Officer of the company, said.

While the company has a healthy pipeline of significant deals, according to Parekh, it is keeping an eye on the macroenvironment.

"We indicated that we had started seeing concerns on mortgage side, financial services and retail industry... we are seeing, this time, some concerns in high tech and telecom space in addition, more on discretionary part," Parekh said but assured that overall "the pipeline for large deals remain quite strong today".

On October 13 at Rs. 1420, Infosys closed with a loss of Rs 8.8 on the National Stock Exchange. The stock has generated negative returns of 17% over the last year and is down 8% over the last month amid the current uncertain environment engulfing the IT sector.

![submenu-img]() Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat

Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat![submenu-img]() Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic

Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic![submenu-img]() Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi

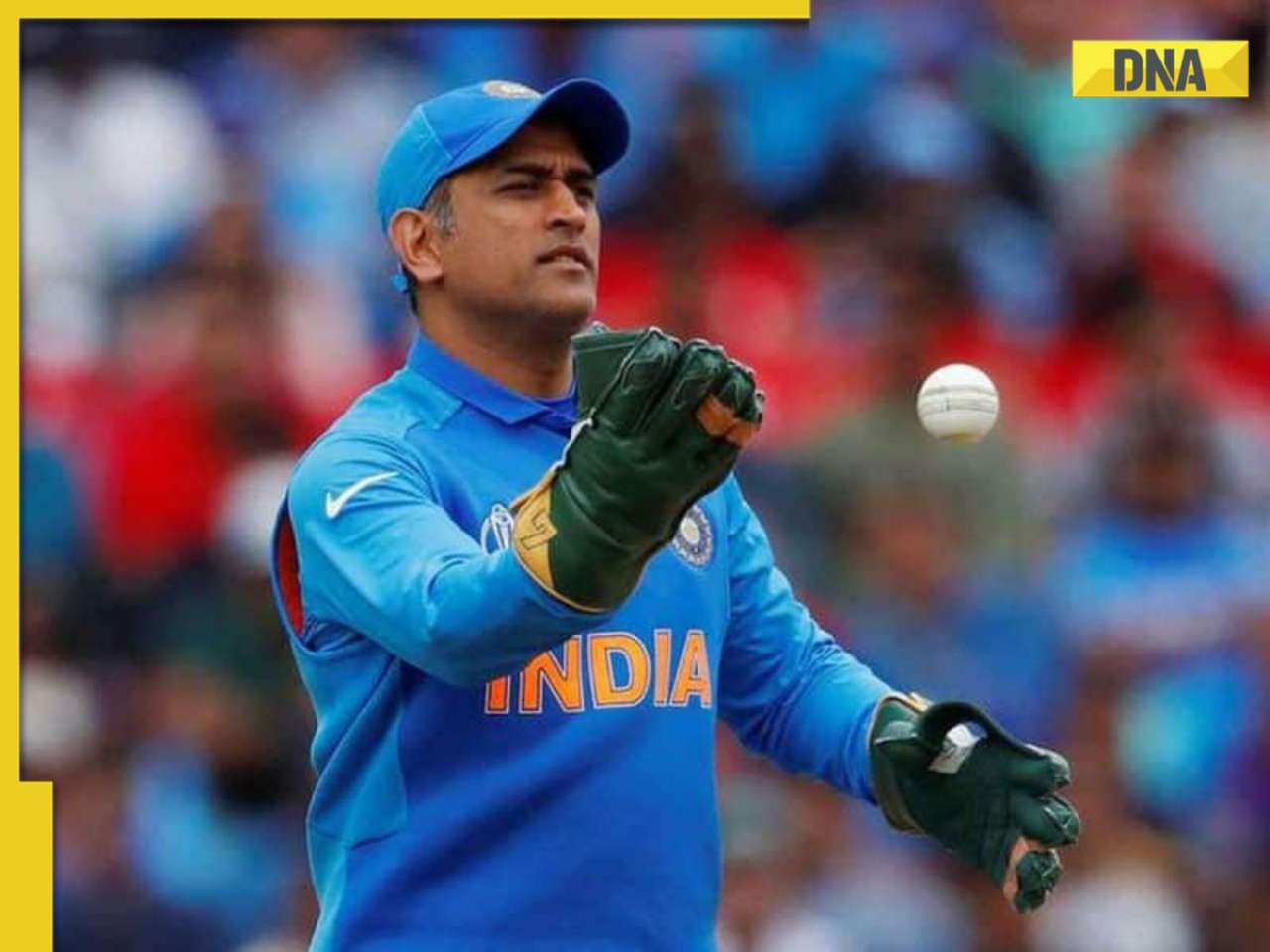

Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi![submenu-img]() Explained: Why MS Dhoni cannot apply for India head coach job

Explained: Why MS Dhoni cannot apply for India head coach job![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...

Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...![submenu-img]() Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..

Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…

Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…![submenu-img]() Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...

Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...![submenu-img]() Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive

Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive![submenu-img]() Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell

Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell![submenu-img]() Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...

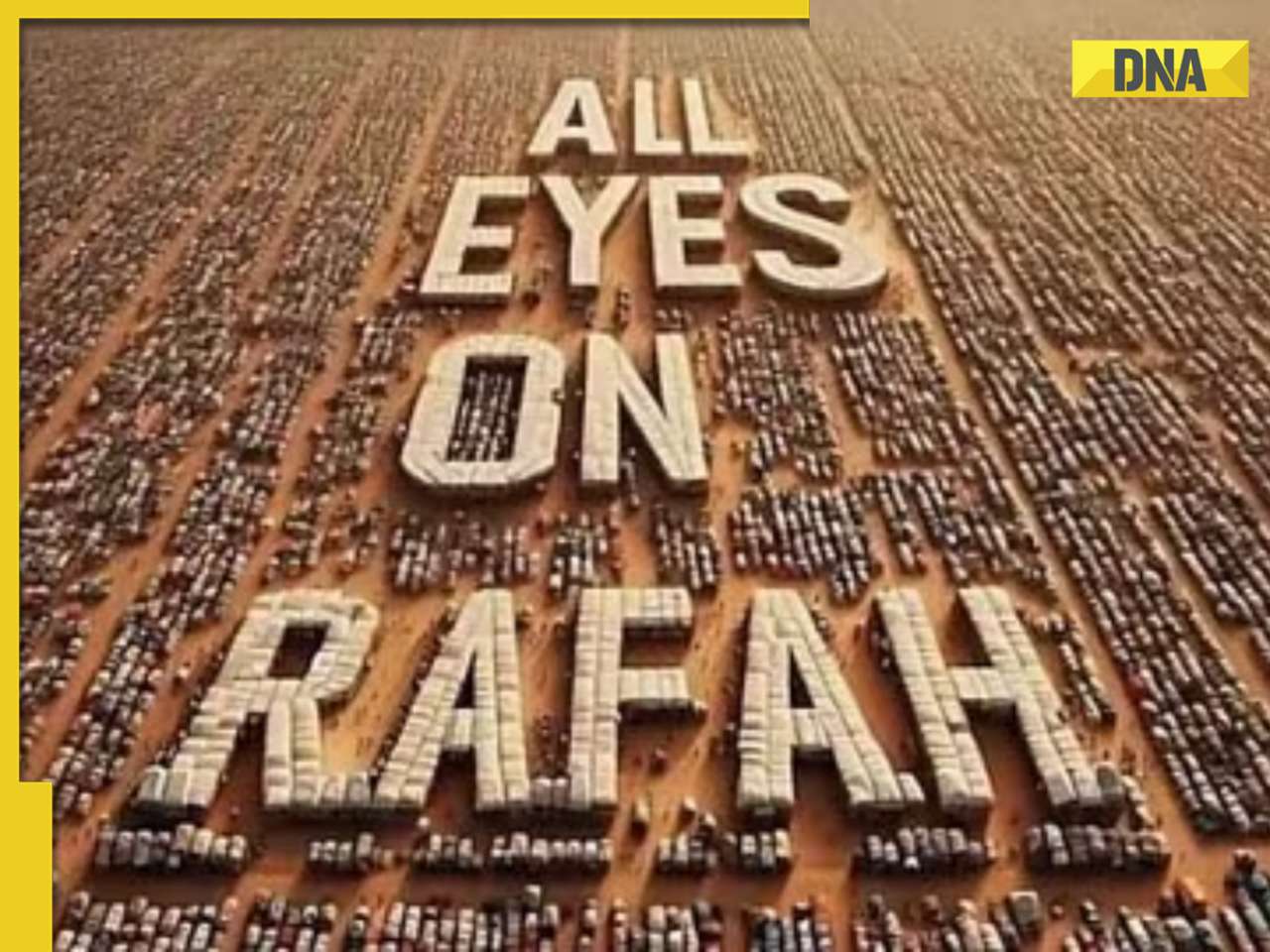

Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...![submenu-img]() 'All Eyes On Rafah' campaign goes viral on social media, here's what the image means

'All Eyes On Rafah' campaign goes viral on social media, here's what the image means![submenu-img]() Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here

Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here![submenu-img]() Viral video: Woman takes over streets of London in lungi, here’s how locals reacted

Viral video: Woman takes over streets of London in lungi, here’s how locals reacted![submenu-img]() Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

)

)

)

)

)

)

)