When it comes to filing your income tax return, there are several potential pitfalls that you should be aware of. One of the most common mistakes people make is not disclosing all of their income, and they may also forget to claim certain deductions they are eligible for. But don't worry, the Income Tax Department has a solution for this – you can file a revised return to correct any errors you've made.

The process is straightforward. If you realize you made a mistake in your original tax return, the Income Tax Department will notify you and give you a fixed time window within which you can submit a revised return. The best part is that you won't be charged any additional fees for this correction.

So, when do you need to file a revised return? Here are some situations where it's necessary:

1. Correcting mistakes: If you spot any errors in your original income tax return, a revised return can help you set things right.

2. Additional income: If you forgot to include some of your income in the original return, you can report it in the revised one.

3. Missed deductions: If you initially missed claiming certain deductions or exemptions you're eligible for, the revised return allows you to include them.

4. Updated information: If you have a revised Form 16 or TDS certificate that shows changes in your income or deductions, you can use it to update your return.

5. Changes in tax deposits: In case you made changes to your tax deposits, a revised return is required to reflect these updates.

6. Responding to notice: If the Income Tax Department sends you a notice regarding discrepancies in your original return, filing a revised return is necessary.

Now, let's take a look at the deadlines. The regular due date for filing your original income tax return is July 31st, 2023. However, if you need to file a revised return, you have some leeway. Taxpayers covered under section 139(5) can file a revised return anytime before three months from the end of the relevant assessment year or before the completion of the assessment, whichever comes earlier. This means you have until December 31st, 2023, to submit your revised return for the financial year 2022-23.

Remember, it's essential to correct any mistakes in your income tax return promptly. If you miss the deadline, you might face penalties. So, if you haven't filed your return yet and need to make corrections, make sure to do it before the deadline to stay on the right side of the tax laws.

Read more: From SCSS, PPF, NSC, KVP to Post Office Scheme: 9 India Post investment schemes with tax benefits, guaranteed returns

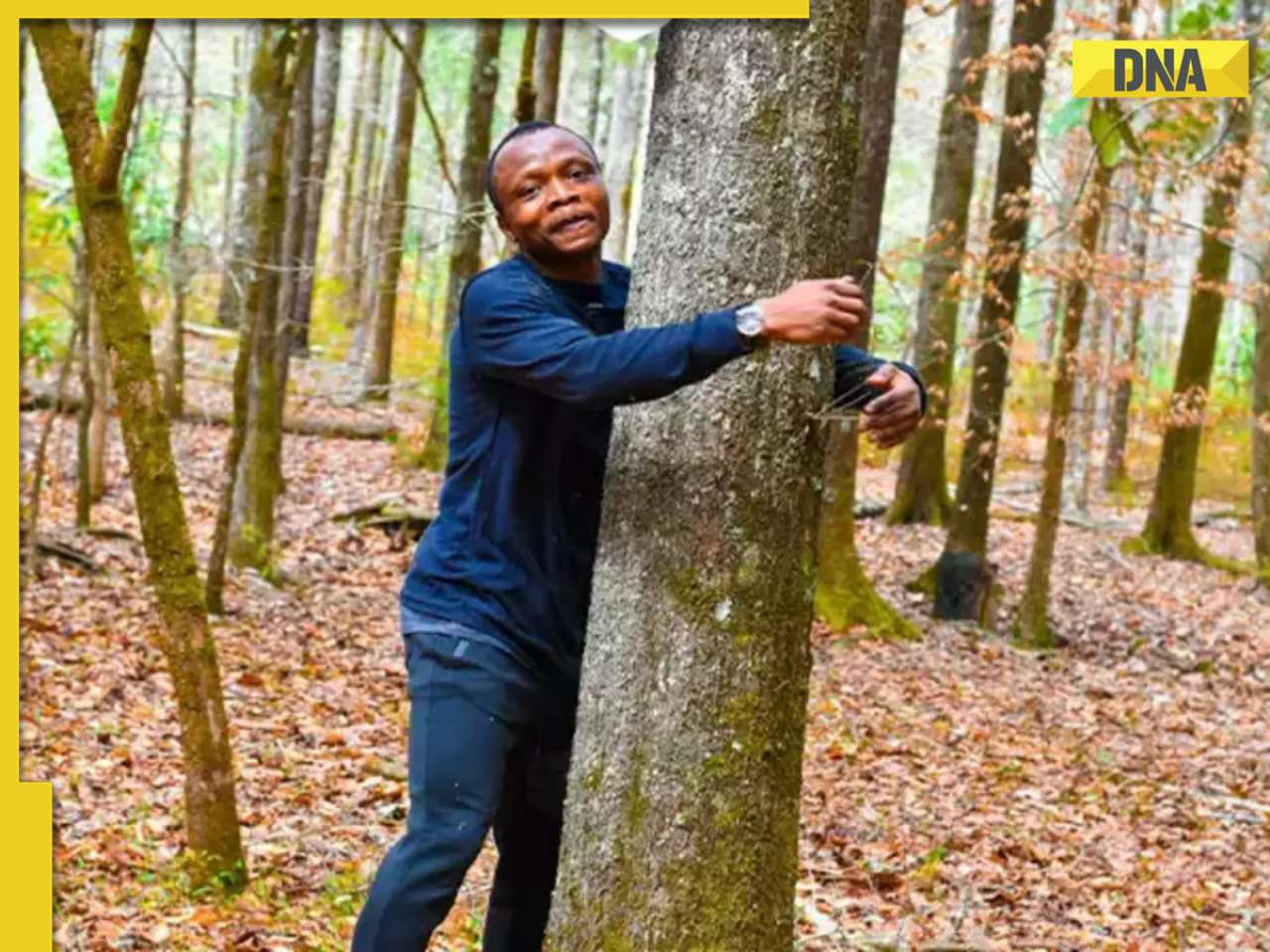

![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax

Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

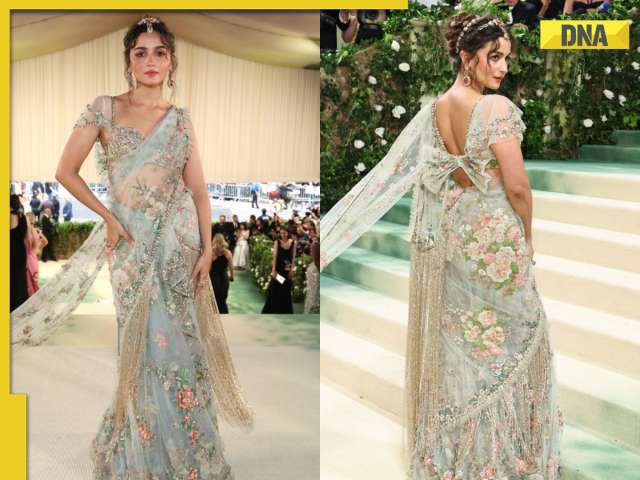

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy

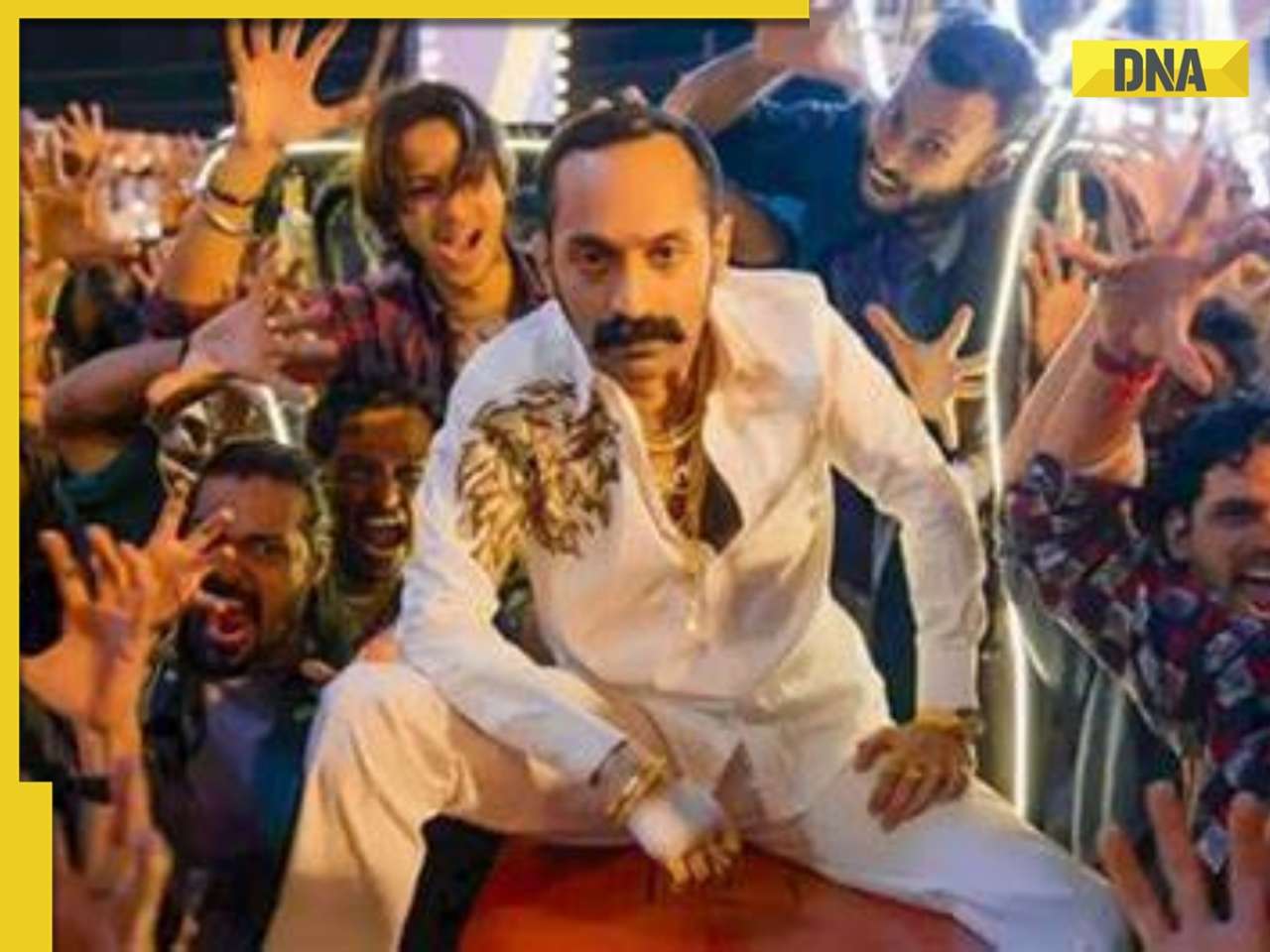

Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy![submenu-img]() Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’

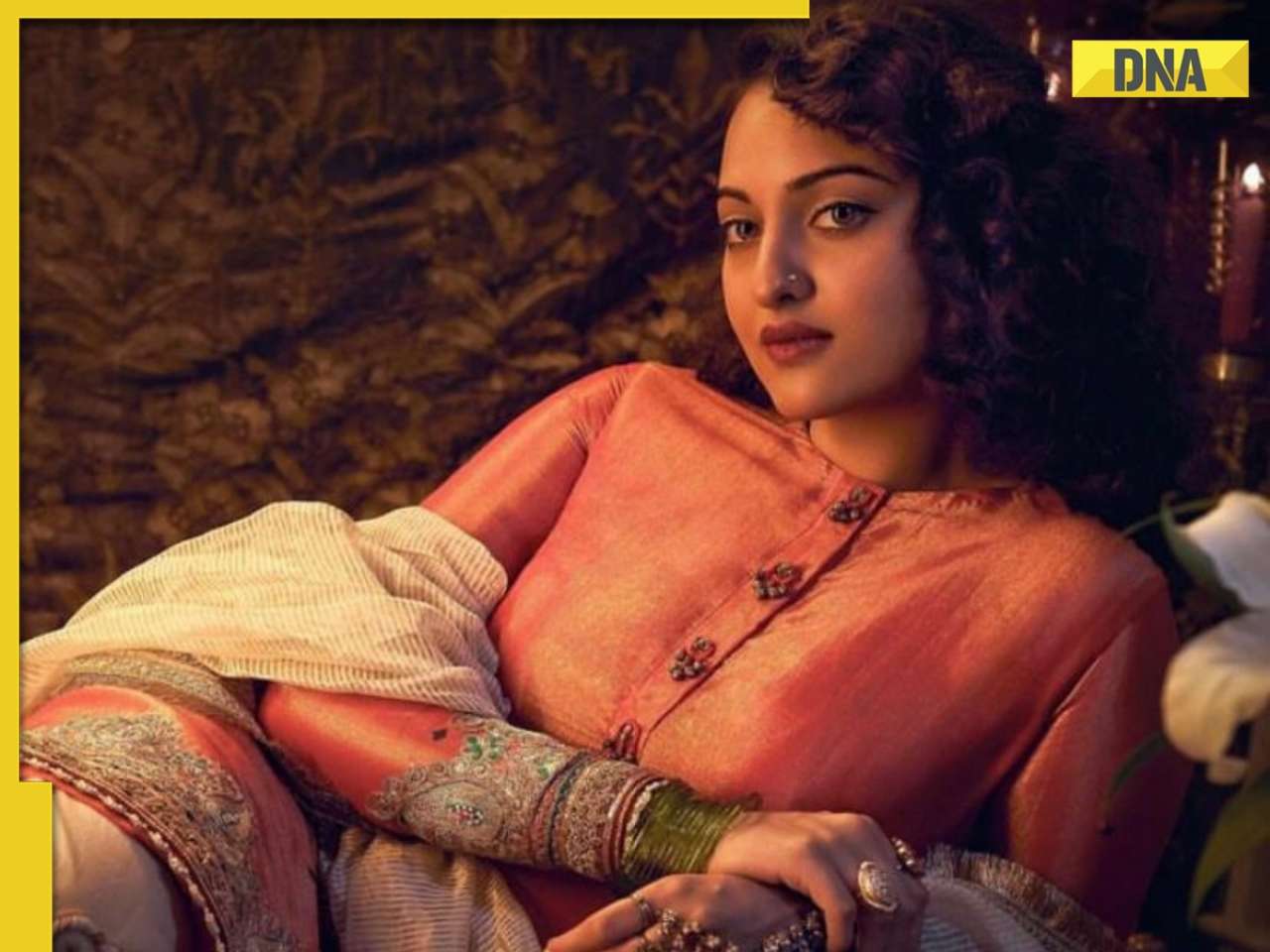

Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’![submenu-img]() Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive

Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive![submenu-img]() IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets

IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets![submenu-img]() PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru

PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru![submenu-img]() Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral

Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() Tiger cub mimics its mother in viral video, internet can't help but go aww

Tiger cub mimics its mother in viral video, internet can't help but go aww![submenu-img]() Octopus crawls across dining table in viral video, internet is shocked

Octopus crawls across dining table in viral video, internet is shocked![submenu-img]() This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

)

)

)

)

)

)

)