Equity markets in India rose to their previous peak of over 21,000 after Diwali, and then corrected sharply to about 17,500 by mid-February.

Equity markets in India rose to their previous peak of over 21,000 after Diwali, and then corrected sharply to about 17,500 by mid-February.

After a couple of sharp upward movements and downward movements of close to 1,000 points, the Sensex has been moving up since late March to reach about 19500 points currently.

The question that is uppermost in the minds of most market participants is - where is the market headed from here?

Which begs another one: if the market is expected to rise, then what is the time horizon over which it will play out? It’s important because it is difficult to predict the short term; unlike long-term trends, the short-term is not always driven by fundamentals.

This study is an attempt to answer that through a logical analysis of the historical correlations in the behaviour of India’s gross domestic product (GDP), the Bombay Stock Exchange Sensex and corporate earnings.

GDP in India is projected to grow by 3.4 times to about $4.6 trillion by 2020. There may be many factors — oil prices, interest rates, foreign exchange rates, inflation, the global macroeconomic situation and event risks such as wars and so on — that could spoil the party.

These are outside the scope of this analysis.

This article simply tries to answer a straightforward question: where could the Sensex be, if GDP reached $4.6 trillion by 2020?

The answer is 70000. It may sound out of whack today, but an extrapolation of past market behaviour shows this is very much a possibility. Of course, there will be several crises and hiccups — both domestic and international — along the way, that will take the index down. But once the events are absorbed, fundamentals will stand up.

70000 translates into a compounded annual growth rate of 14% for the Sensex over the next 10 years, and makes the Indian equity market a compelling asset class.

Methodology

The accompanying chart juxtaposes trends in India’s GDP, corporate earnings, the Sensex and the price earnings ratio (PE) between 1995 and 2010.

During this period, the GDP has grown 5.2 times; corporate earnings 8.8 times (ignoring 1995, which saw very low earnings); and the Sensex 6.5 times.

It is clear that markets have been buoyed by healthy corporate earnings and GDP growth. In fact, they have grown at a slower rate than earnings.

The PE multiple during much of this period has hovered in the 15-20 range. It does not show any marked change between the period immediately preceding 2003 (when the Sensex started rising sharply) and the post-2003 era, which goes to show again that the rise in the Sensex was largely driven by earnings, and not by increasing multiples.

Interestingly, the index as well as corporate earnings moved in tandem till 2007-08, at which point they moved in opposite directions. The Sensex plunged immediately after the credit crisis struck, a year ahead of the earnings decline.

The previous peaks for the PE multiple were in 1995 (23.6), 2000 (24.5) and 2007 (22.3). The multiple for Sensex is currently about 20. But the economy has grown during this time. Therefore, the current high multiple is backed by a five times larger economy compared with the one in 1995, three times compared with 2000 and nearly a third larger compared with 2007. Meaning, the current high multiples are rooted much stronger compared with the past.

Now, point to point comparisons could be tricky. For example, if one took 2008 as the end point, the multiples would be very different. However, 2008 appears be more of an outlier to the trend.

The US experience

It is always helpful to study the experience of other countries that have been in similar situations in the past. Between 1980 and 2010, American GDP grew around five times — from roughly $3 trillion to about $14 trillion.

During the same period, the Dow Jones stock index grew 10 times, from about 1,000 to over 11,000 (ignoring 14,000 in early 2007 and 6547 in March 2009) implying that the stock index multiplied twice as fast as GDP.

Crystal ball-gazing

A recently published research paper by Crisil, the rating agency says India’s GDP is expected to grow to about $4.6 trillion by 2020.

What does this mean for the Sensex? As we saw, the US stock index multiplied twice as fast as GDP over the last 30 years. In India, over the last 15 years, the Sensex multiplied at 1.3 times the GDP multiplier rate.

Two sets of arguments can be made here. One, earnings and the Sensex’s growth vis-à-vis the GDP will be slower than in the past because of:

1. the base effect - the base is higher now than in the past;

2. and, more severe domestic and international competition in future.

On the other hand, this growth will be faster because:

1. infrastructure will be better in future compared with the past;

2. demographics will increasingly become better;

3. more foreign funds will flow into India;

4. and, because of increased productivity brought about by technology.

So, even if the Sensex moves just at the rate of GDP growth - and not faster- it will touch 70,000 by 2020.

— Thyagarajan is CEO of Carnation Consulting and a former director of ratings at Crisil

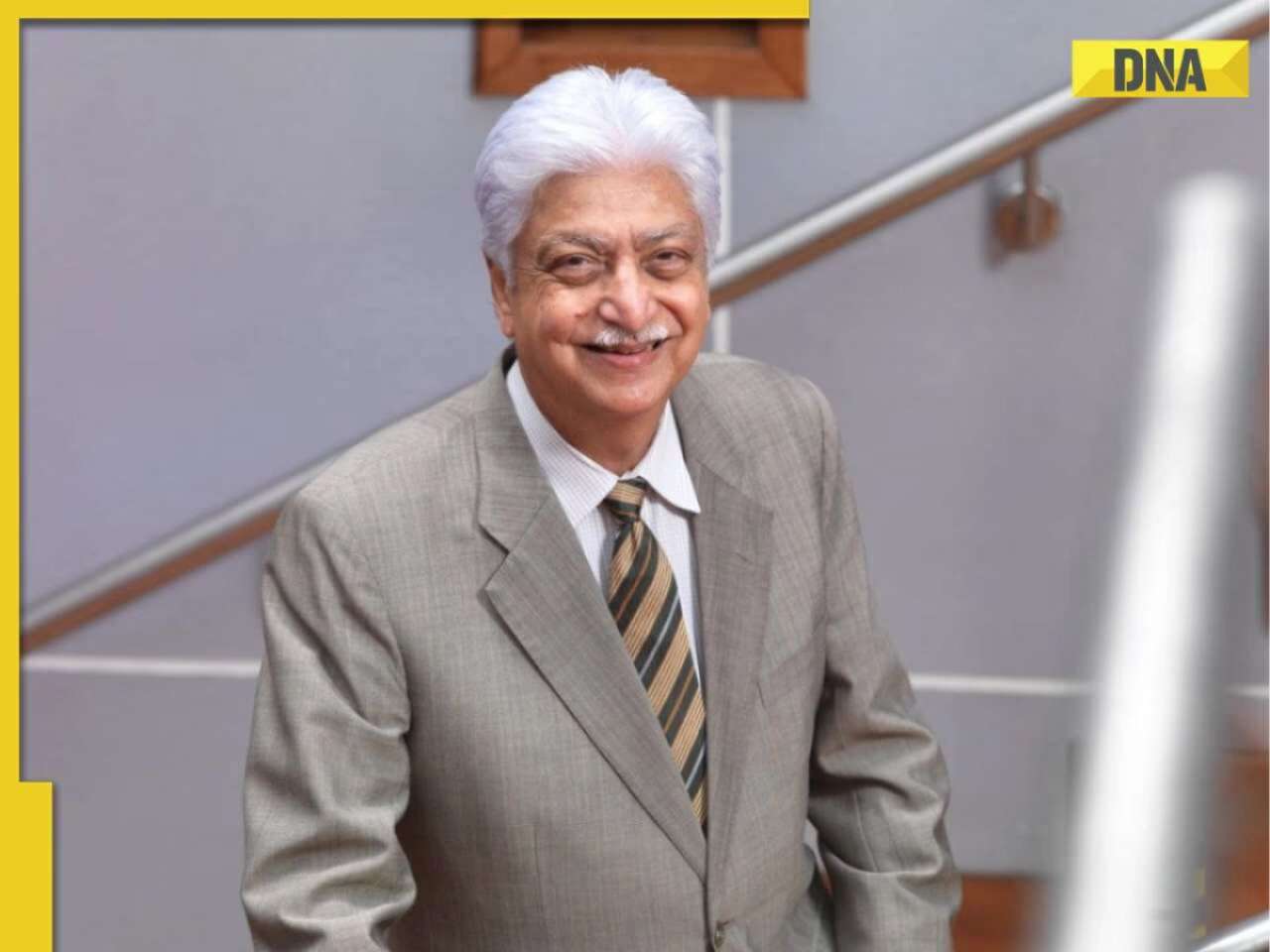

![submenu-img]() Azim Premji may acquire majority stake in this bank from…

Azim Premji may acquire majority stake in this bank from…![submenu-img]() Meet schoolmates who quit high-paying jobs to start their own business, invested Rs 1 lakh, now worth Rs…

Meet schoolmates who quit high-paying jobs to start their own business, invested Rs 1 lakh, now worth Rs…![submenu-img]() Meet daughter of cleaning contractor who cleared UPSC exam in first attempt, secured AIR...

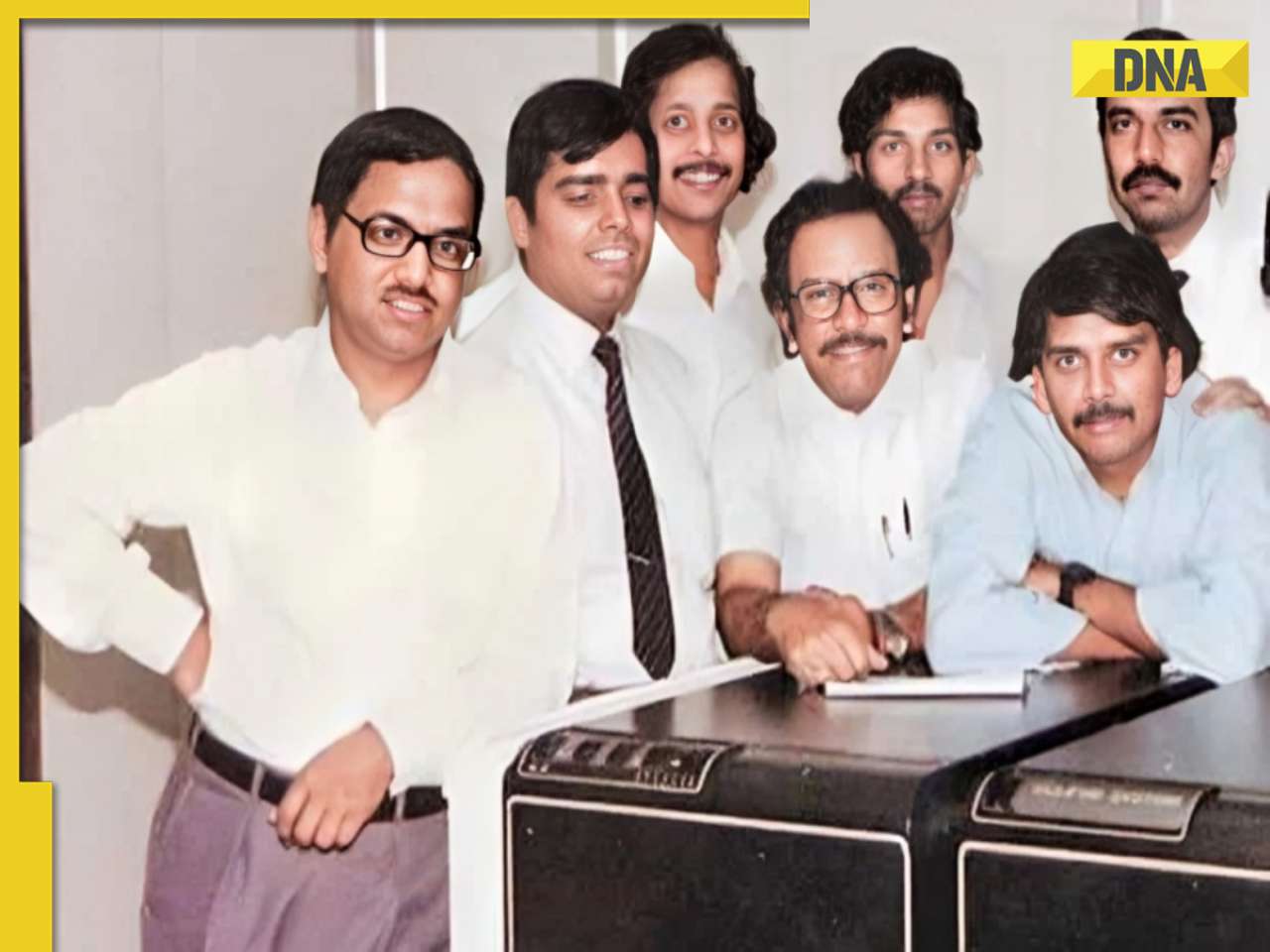

Meet daughter of cleaning contractor who cleared UPSC exam in first attempt, secured AIR...![submenu-img]() Meet man who was first employee of Infosys, it's not Narayana Murthy, Nandan Nilekani, SD Shibulal

Meet man who was first employee of Infosys, it's not Narayana Murthy, Nandan Nilekani, SD Shibulal![submenu-img]() Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’

Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’

Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’![submenu-img]() Meet actress, who debuted with Aamir Khan's film, now winning hearts in Heeramandi; know her connection to Preity Zinta

Meet actress, who debuted with Aamir Khan's film, now winning hearts in Heeramandi; know her connection to Preity Zinta![submenu-img]() Meet engineer-turned-actor, who quit high-paying job for acting, struggled to get Rs 200; became superstar, now earns…

Meet engineer-turned-actor, who quit high-paying job for acting, struggled to get Rs 200; became superstar, now earns… ![submenu-img]() This film bombed at box office, earned less than Rs 2 crore, Shraddha Kapoor was first choice, director quit filmmaking

This film bombed at box office, earned less than Rs 2 crore, Shraddha Kapoor was first choice, director quit filmmaking![submenu-img]() India's biggest flop lost Rs 250 crore, derailed 2 stars; worse than Adipurush, Shamshera, Ganapath, Laal Singh Chaddha

India's biggest flop lost Rs 250 crore, derailed 2 stars; worse than Adipurush, Shamshera, Ganapath, Laal Singh Chaddha![submenu-img]() IPL 2024: Venkatesh Iyer, Mitchell Starc power Kolkata Knight Riders to 24-run win over Mumbai Indians

IPL 2024: Venkatesh Iyer, Mitchell Starc power Kolkata Knight Riders to 24-run win over Mumbai Indians![submenu-img]() RCB vs GT IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs GT IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs GT IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Gujarat Titans

RCB vs GT IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Gujarat Titans![submenu-img]() Australia dethrone India to become No. 1 ranked test team after annual rankings update

Australia dethrone India to become No. 1 ranked test team after annual rankings update![submenu-img]() Watch: MS Dhoni's heartfelt gesture for CSK's 103-yr-old superfan wins internet, video goes viral

Watch: MS Dhoni's heartfelt gesture for CSK's 103-yr-old superfan wins internet, video goes viral![submenu-img]() Viral video: Man transports huge wardrobe on bike, internet is stunned

Viral video: Man transports huge wardrobe on bike, internet is stunned![submenu-img]() Mother polar bear cuddles with her cub, viral video will melt your heart

Mother polar bear cuddles with her cub, viral video will melt your heart![submenu-img]() Viral video: Girl's 'Choli Ke Piche' dance performance at college fest divides internet, watch

Viral video: Girl's 'Choli Ke Piche' dance performance at college fest divides internet, watch![submenu-img]() Video: Cobra mother's protective instincts go viral as she guards nest of eggs, watch

Video: Cobra mother's protective instincts go viral as she guards nest of eggs, watch![submenu-img]() Die-hard Virat Kohli fan displays love for 'Namma RCB' at graduation ceremony in US, video goes viral

Die-hard Virat Kohli fan displays love for 'Namma RCB' at graduation ceremony in US, video goes viral

)

)

)

)

)

)

)