One of the first things Andrea Ricci did when he was promoted to head the new problem loan division at Italy's Banca Nazionale del Lavoro this year was to launch a recruitment campaign.

One of the first things Andrea Ricci did when he was promoted to head the new problem loan division at Italy's Banca Nazionale del Lavoro this year was to launch a recruitment campaign.

The shake up in an area sometimes viewed as a backwater by ambitious employees reflects a push by Italian banks to claw back bad debts that make up some 15 percent of total loans -- three times the European average.

Instead of the lawyers that have traditionally dominated loan recovery, Ricci hired as his No.2 a former senior executive at Goldman Sachs' Realty Management Division. Italian banks have largely held onto loans backed by property and are now seeking to manage these assets more actively, as repossessions take years and judicial sales curtail their value.

"We brought in some big guns ... but also several mid-level people from loan recovery specialists. And we moved staff with a more business-like approach from other areas of the bank to complement customary legal and technical skills," Ricci said.

"The challenge is to make everyone sing from the same hymn sheet."

Even after crises at Monte dei Paschi di Siena and Popolare di Vicenza and Veneto Banca are resolved, Italy's banks will be sitting on 300 billion euros ($335 billion) of loans that soured during a harsh recession.

The fragility of Italian banks, compounding chronic low growth and a huge public debt, make the country a dormant risk to euro zone stability.

As the economy recovers, inflows of new problem loans have slowed to pre-crisis levels. But banks are struggling to shift impaired debts off their balance sheets, hurting their already weak profitability.

Accounting rule changes and a European Central Bank review next year of assets held by small cooperative lenders could fuel fresh loan losses, warned Katia Mariotti of consultancy EY.

Gross bad loan sales in Italy totalled just 15 billion euros in 2015-2016, according to the Bank of Italy.

SALES

Up to 70 billion euros in sales are now in the pipeline, driven by ECB-enforced clean-ups at Monte dei Paschi, Italy's fourth-largest bank, and the two Veneto lenders. Together the three are set to offload 45 billion euros in bad loans, using taxpayers' money to cover the bulk of ensuing losses.

Italy's top bank UniCredit is meanwhile preparing to sell 18 billion euros of its bad loans, having already raised fresh capital to cover the hit to its balance sheet.

Bank of Italy officials have publicly advised healthy lenders against selling their problem loans, however, warning that fire sales enrich only a handful of specialised buyers and risk blowing a hole in banks' capital.

The ECB, which is yet to respond to bad loan reduction plans banks submitted in the spring, may see matters differently.

"We don't know yet if our goals will be seen as sufficiently ambitious. It'll be a moment of reckoning when we hear back from the ECB," one source at an Italian bank said.

"If the ECB takes a hard stance it'll be hard to avoid the significant sales that the Bank of Italy is warning against."

A person familiar with the matter said the ECB, which directly supervises Italy's 13 largest banks, was analysing the heaps of data banks provided and assessing how realistic each lender's projections were.

The euro zone's central bank can take measures to ensure compliance with its bad loan guidelines, which the Bank of Italy is set to adapt for the smaller banks still under its supervision.

Senior supervisor Ignazio Angeloni said in May the ECB expected the guidelines to significantly speed up disposals.

CULTURAL SHIFT

Battling with a sluggish judicial system and patchy loan records, Italian banks on average recover in a year a sum equivalent to around 4 percent of their impaired loan stock.

To boost that, some banks have struck joint ventures with collection specialists while others are bringing in fresh skills to explore ways of recouping debts while steering clear of Italian courts.

But insiders say a cultural shift is required as well as an overhaul of processes that, partly because banks have not invested in technology, still rely largely on paper documents.

"Italian banks will be given some time, even a year maybe, but, without selling, it will be hard for them to meet their non-performing loan reduction targets and the ECB will then be in a position to step up pressure," said Andrea Resti, an academic who advises the European parliament on banking supervision.

After writing down about 174 billion euros of debt and raising 63 billion euros via share issues since 2008, according to consultancy Prometeia, Italian banks have roughly halved the book value of their impaired loans. They value insolvent loans at less than 40 percent of their nominal value.

The Bank of Italy calculates this is line with the recovery rate of 43 percent recorded by Italian banks in 2006-2015. But the average market price is around 20 percent of a loan's nominal value, meaning banks can only sell at a loss.

Reuters calculations based on central bank data show that cutting Italy's gross impaired loan ratio to match UniCredit's 2019 target of 8.4 percent would require banks to raise some 19 billion euros in capital.

"The market is thawing after years of paralysis but I believe that, at least over the medium term, some cash calls will be necessary if banks want to get rid of bad loans," said Claudio Scardovi, Managing Director at AlixPartners.

($1 = 0.8955 euros)

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() 'He used to call women to...': Woman shares ordeal in Prajwal Revanna alleged 'sex scandal' case

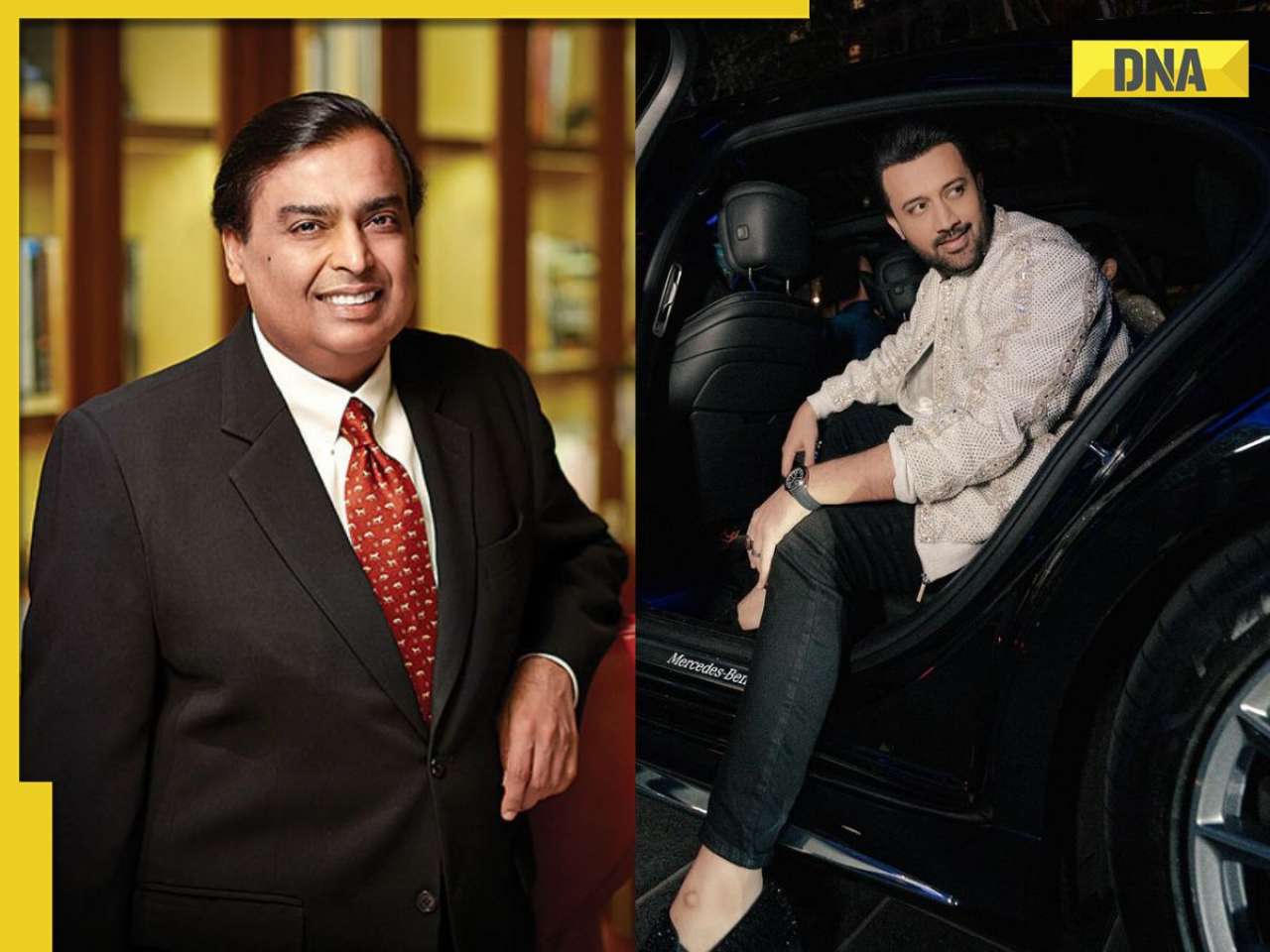

'He used to call women to...': Woman shares ordeal in Prajwal Revanna alleged 'sex scandal' case![submenu-img]() Mukesh Ambani, India’s richest man with over Rs 9603670000000 net worth, invites Pakistanis for…

Mukesh Ambani, India’s richest man with over Rs 9603670000000 net worth, invites Pakistanis for…![submenu-img]() You won't be able to board these trains from New Delhi Railway station, here's why

You won't be able to board these trains from New Delhi Railway station, here's why![submenu-img]() Meet IAS officer who is IIM grad, left bank job to crack UPSC exam, secured AIR...

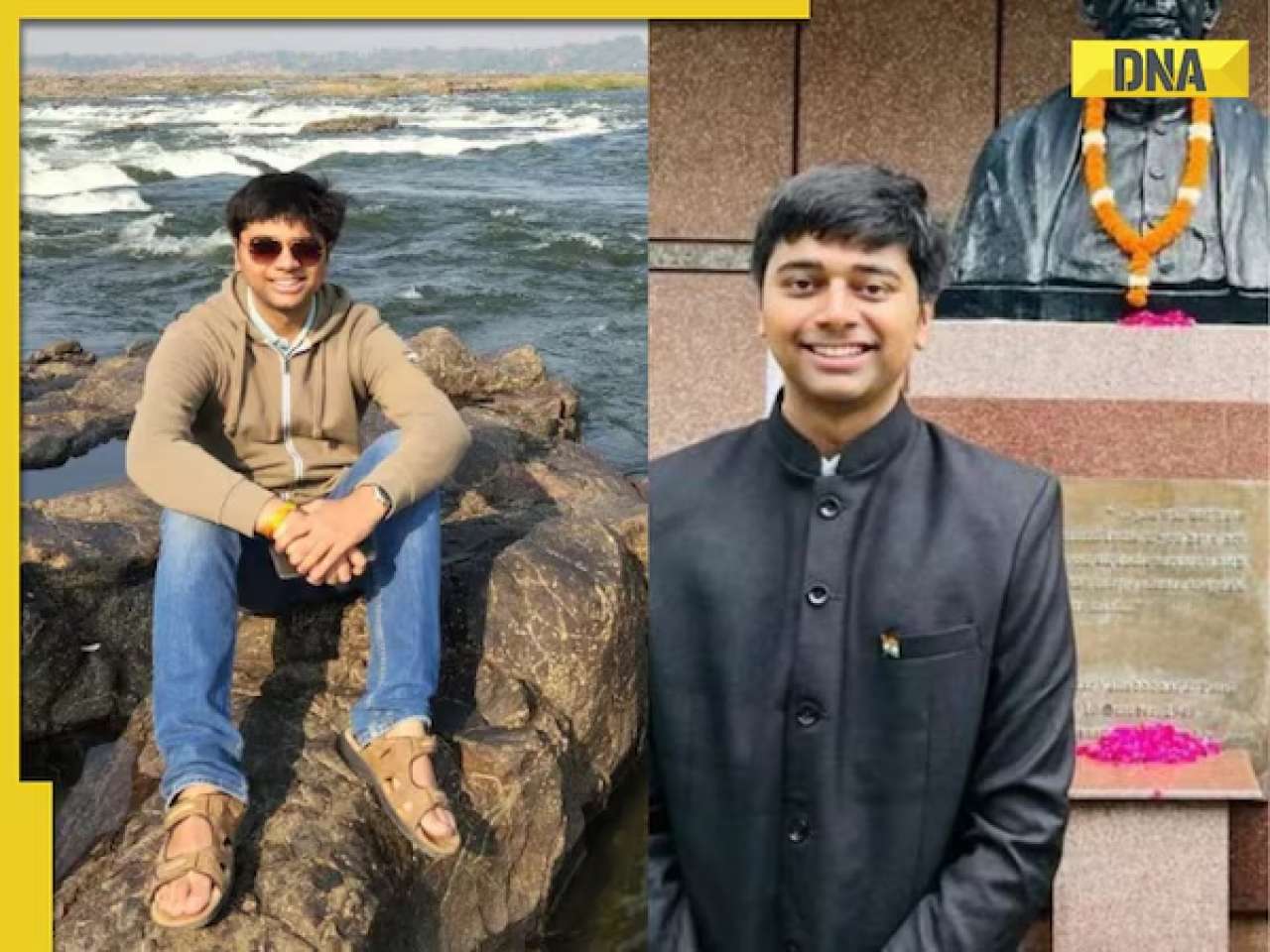

Meet IAS officer who is IIM grad, left bank job to crack UPSC exam, secured AIR...![submenu-img]() Meet man, gets more than Rs 300 crore salary, accused of killing Google Search, he left Yahoo to…

Meet man, gets more than Rs 300 crore salary, accused of killing Google Search, he left Yahoo to…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet actor, wasted 20 years in alcohol addiction, lost blockbuster to Salman, cult classic saved career at 49, now he...

Meet actor, wasted 20 years in alcohol addiction, lost blockbuster to Salman, cult classic saved career at 49, now he...![submenu-img]() Justin Bieber breaks down in tears amid rumours of split with wife Hailey in new pictures; concerned fans react

Justin Bieber breaks down in tears amid rumours of split with wife Hailey in new pictures; concerned fans react![submenu-img]() This film on AI had 'bizarre' orgasm scene, angry hero walked out, heroine got panic attacks, film grossed Rs 320 crore

This film on AI had 'bizarre' orgasm scene, angry hero walked out, heroine got panic attacks, film grossed Rs 320 crore![submenu-img]() This actor was only competition to Amitabh; bigger than Kapoors, Khans; quit films at peak to become sanyasi, died in..

This actor was only competition to Amitabh; bigger than Kapoors, Khans; quit films at peak to become sanyasi, died in..![submenu-img]() Meet actress who had no money for food, saw failed marriage, faced death due to illness, now charges Rs 1 crore a minute

Meet actress who had no money for food, saw failed marriage, faced death due to illness, now charges Rs 1 crore a minute![submenu-img]() IPL 2024: Ruturaj Gaikwad, Tushar Deshpande power Chennai Super Kings to 78-run win over Sunrisers Hyderabad

IPL 2024: Ruturaj Gaikwad, Tushar Deshpande power Chennai Super Kings to 78-run win over Sunrisers Hyderabad![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Royal Challengers Bengaluru beat GT by 9 wickets

IPL 2024 Points table, Orange and Purple Cap list after Royal Challengers Bengaluru beat GT by 9 wickets![submenu-img]() PCB appoints Gary Kirsten and Jason Gillespie as head coaches ahead of T20 World Cup

PCB appoints Gary Kirsten and Jason Gillespie as head coaches ahead of T20 World Cup![submenu-img]() IPL 2024: Will Jacks, Virat Kohli power Royal Challengers Bengaluru to big win against Gujarat Titans

IPL 2024: Will Jacks, Virat Kohli power Royal Challengers Bengaluru to big win against Gujarat Titans![submenu-img]() DC vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Viral Video: 4 girls get into ugly fight on road, fly punches, pull hair; watch

Viral Video: 4 girls get into ugly fight on road, fly punches, pull hair; watch![submenu-img]() Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt

Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt![submenu-img]() Viral video captures mama tiger and cubs' playful time in Ranthambore, watch

Viral video captures mama tiger and cubs' playful time in Ranthambore, watch![submenu-img]() Heartwarming video of cat napping among puppies goes viral, watch

Heartwarming video of cat napping among puppies goes viral, watch![submenu-img]() Viral video: Man squeezes his body through tennis racquet, internet is stunned

Viral video: Man squeezes his body through tennis racquet, internet is stunned

)

)

)

)

)

)