Beneficiaries of those who died during COVID were contacted through outreach programmes and communications from the banks.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) have had a lengthy history of adverse claims, thus in order to make them economically sustainable, their premium rates have been increased to Rs 1.25 per day for both schemes, which includes increasing PMJJBY from Rs. 330 to Rs. 436 and PMSBY from Rs. 12 to Rs. 20.

Also, Read: Bank Holiday Alert! Banks to remain closed for 8 days in June 2022, check full list

The number of active subscribers enrolled under PMJJBY and PMSBY as on 31.3.2022 are 6.4 crore and 22 crore, respectively. Since the launch of the PMSBY, an amount of Rs 1,134 crore has been collected by the implementing insurers towards premium and claims of Rs. 2,513 crore have been paid under PMSBY as on 31.3.2022. Further, an amount of Rs. 9,737 crore has been collected by the implementing insurers towards premium and claims of Rs. 14,144 crore have been paid under PMJJBY as on 31.3.2022. Claims under both the Schemes have been deposited into the bank account of the beneficiaries through the DBT route.

Beneficiaries of those who died during COVID were contacted through outreach programmes and communications from the banks, and the claim forms and evidence of death were simplified. These and other initiatives were made to simplify the processes and expedite claims.

When the schemes were first started in 2015, the original approval said that the premium amount (Rs. 12/- for Pradhan Mantri Suraksha Bima Yojana and Rs. 330/- for Pradhan Mantri Jeevan Jyoti Bima Yojana) would be reviewed every year based on the number of claims. But since the programmes began seven years ago, there has been no change to the premium rates, even though insurers have lost money over and over again.

Upon examination of the claims experience of the schemes, IRDAI informed that while the claims ratio (percentage of amount of claims paid to premium earned) pertaining to PMJJBY and PMSBY, for the period up to 31st March, 2022, is 145.24 % and 221.61% respectively the combined ratio (sum of claims ratio and expense ratios) pertaining to PMJJBY and PMSBY, for the period up to 31st March, 2022, is 163.98 % and 254.71% respectively.

In view of the adverse claims experience of the schemes, PMJJBY and PMSBY and in order to make them viable for the implementing insurers the premium rates of PMJJBY and PMSBY have been revised w.e.f. 1.6.2022. This would also encourage other private insurers to come on board for implementing the schemes, thereby increasing the saturation of the schemes amongst the eligible target population, especially those who are underserved or unserved population of India.

In order to reach the goal of Prime Minister Shri Narendra Modi of making India a fully insured society, a goal has been set to increase coverage from 6.4 crore to 15 crore under PMJJBY and from 22 crore to 37 crore under PMSBY in the next five years. This will bring people closer to covering the eligible population through these two flagship schemes for social security.

![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say

Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say![submenu-img]() Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..

Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..![submenu-img]() TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here

TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here![submenu-img]() Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here

Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here![submenu-img]() Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in

Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in![submenu-img]() Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check

Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive

Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive![submenu-img]() This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..

This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it

Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it![submenu-img]() Shocking! Woman discovers intruder living in her bedroom for four months, details inside

Shocking! Woman discovers intruder living in her bedroom for four months, details inside![submenu-img]() Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard

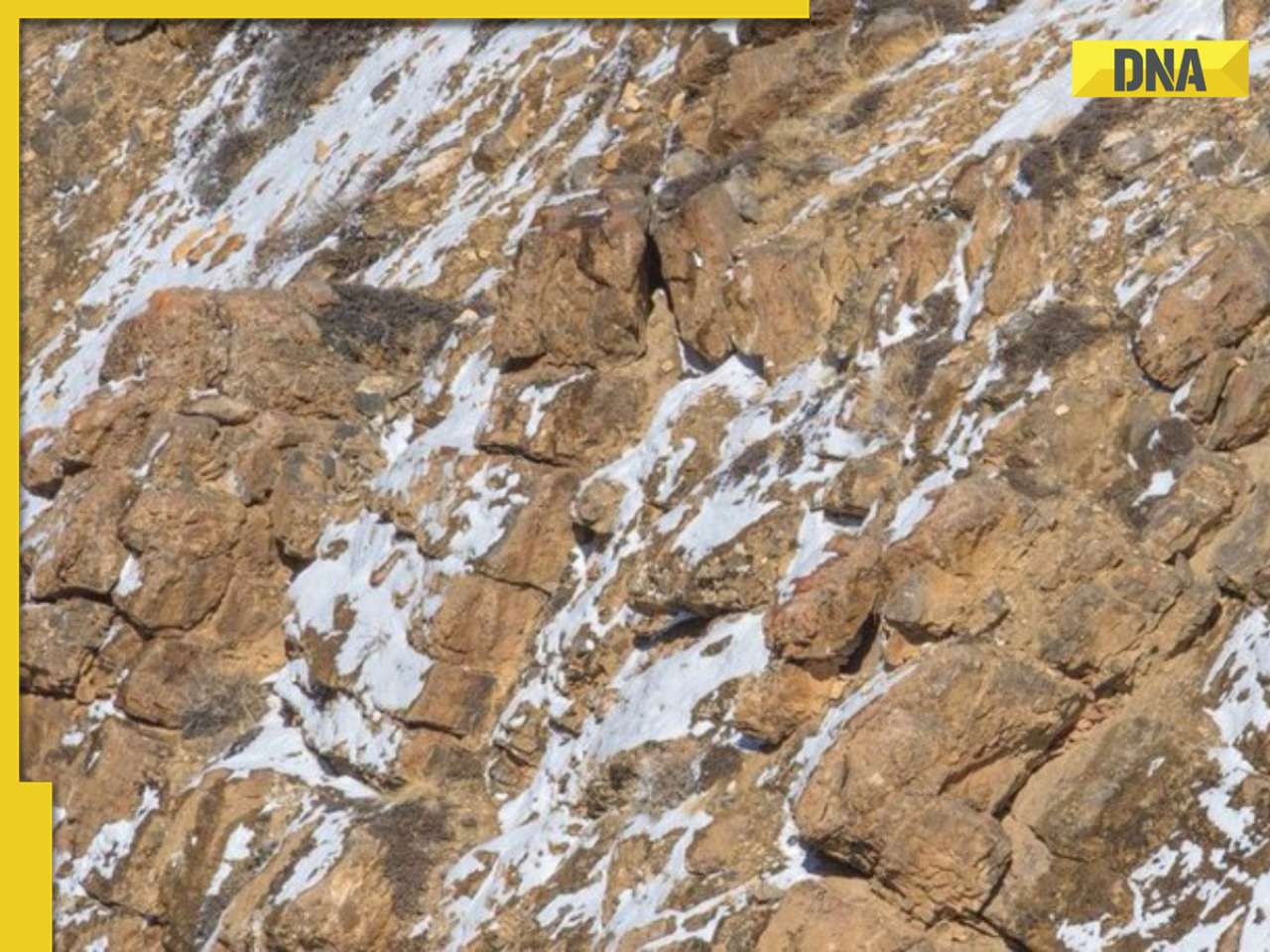

Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard![submenu-img]() Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

)

)

)

)

)

)

)