According to the rules of the Income Tax Department, a person cannot possess more than one PAN card. Each individual has permission to have only one PAN Card issued in their name, unique to them.

PAN or Permanent Account Number is a unique ten-digit alphanumeric identifier that is issued by the Income Tax Department to individuals, companies, and other entities. The PAN Card is a proof of identity and is much needed for financial transactions like opening a bank account, loan application, and income tax filing, among others.

The PAN card stores a lot of information about the holder including their name, photograph, date of birth, and PAN number. The PAN number is unique to each cardholder and is used as a reference number for all financial transactions.

Can a person keep multiple or more than one PAN Card?

According to the rules of the Income Tax Department, a person cannot possess more than one PAN card. Each individual has permission to have only one PAN Card issued in their name, unique to them.

If you have more than one PAN Card, there will be penalties and legal consequences as it is considered a violation of the Income Tax Act.

READ | Amid Google layoffs, CEO Sundar Pichai took home this whopping amount in 2022

What is the penalty if you have more than one PAN Card?

If a person possesses more than one PAN Card, the IT Department may initiate proceedings against them under Section 272B of the Income Tax Act, 1961. A penalty of Rs. 10,000 can be imposed on the individual under this act.

READ | Covid-19 news: PM Modi chairs high-level review meeting, stresses on Covid-appropriate behaviour

Linking of PAN with Aadhaar card, a step-by-step guide

An individual, without fail, has to link their PAN with their Aadhaar card by July 1, 2017.

If you are yet to link the PAN Card with your Aadhaar card, you have time to do so by June 30, 2023. Otherwise, you will not be able to use the same from July 1, 2023.

Once the PAN Card holders cross the deadline, the 10-digit unique alphanumeric number or PAN Card will become inoperative.

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() 1 dead, many injured after London-Singapore flight hit by severe...

1 dead, many injured after London-Singapore flight hit by severe...![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...

Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…

Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…![submenu-img]() Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...

Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...![submenu-img]() Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check

Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..

Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..![submenu-img]() Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..

Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..![submenu-img]() 'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations

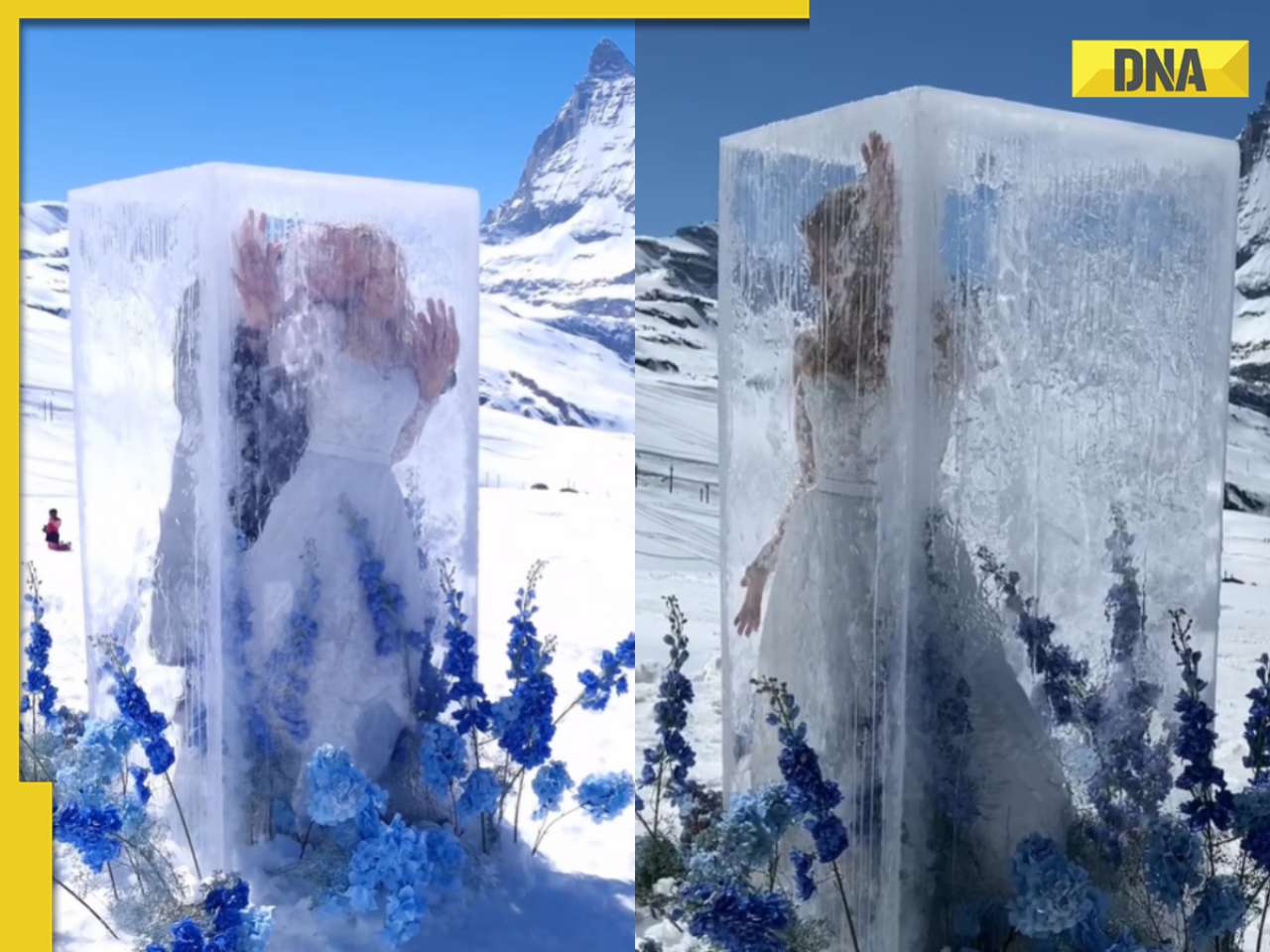

'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations ![submenu-img]() Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland

Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland![submenu-img]() Elephant lifts safari truck with tourists in shocking viral video, watch

Elephant lifts safari truck with tourists in shocking viral video, watch![submenu-img]() In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video

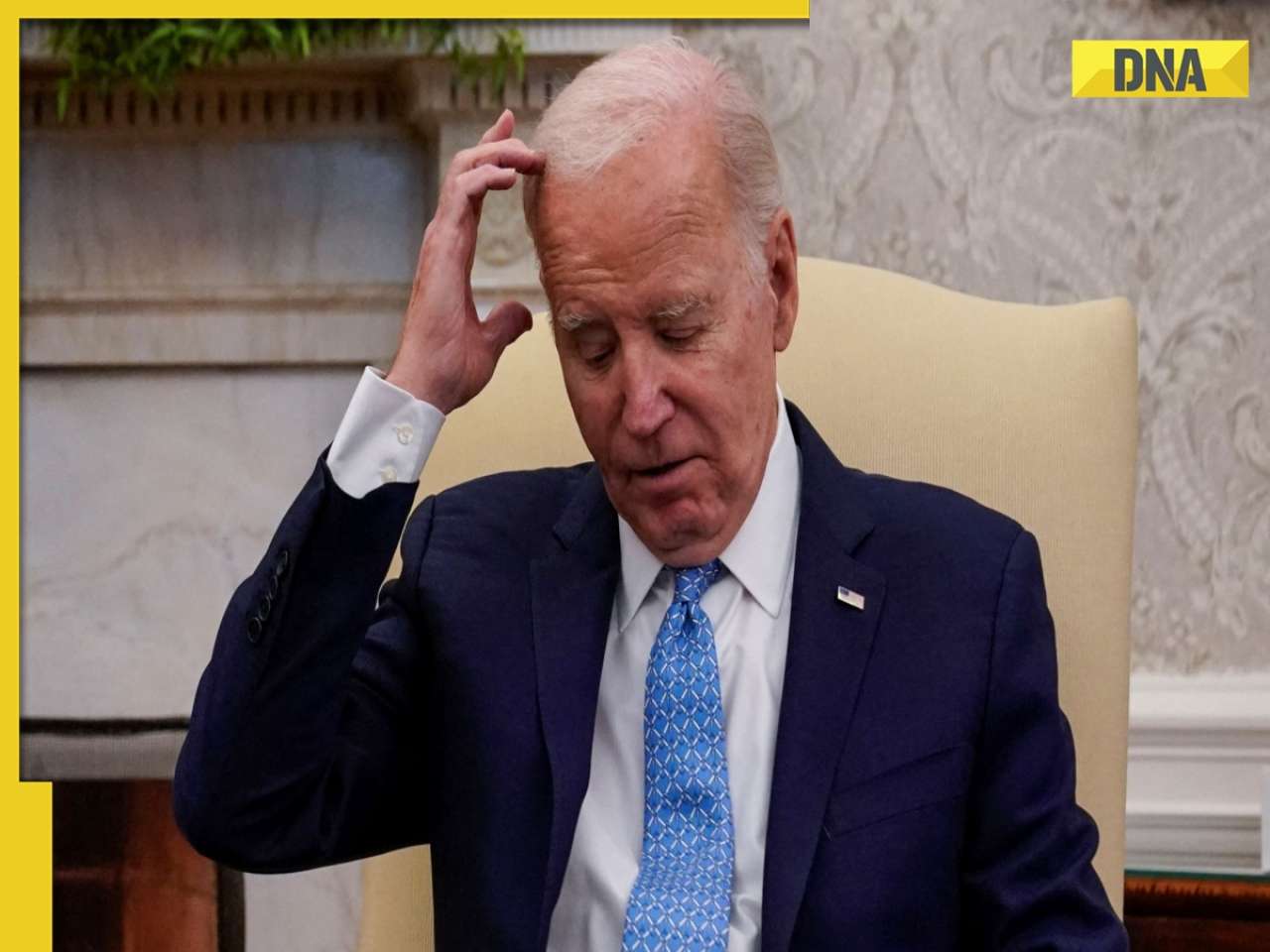

In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video![submenu-img]() Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...

Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...![submenu-img]() Heroic buffalo herd rescues one of their own from lion ambush, video is viral

Heroic buffalo herd rescues one of their own from lion ambush, video is viral

)

)

)

)

)

)

)