Govind Shrikhande of Shoppers Stop Ltd, shares his views about 100% FDI in e-marketplace.

Govind Shrikhande, customer care associate and managing director, Shoppers Stop Ltd, shares his views about 100% FDI in e-marketplace, consumption scenario, company's business performance, outlook for the new fiscal and more, with Ashish K Tiwari.

Q. How has the fiscal gone by turned out for Shoppers Stop in terms of overall business performance?

A. We have seen very good business growth, especially in the third quarter. While the second quarter was muted, after a long period of time, the December quarter witnessed high double-digit like-to-like growth of 17% that was led by a very busy festive season. So I'd say it definitely was a satisfying year. Interestingly, the current fiscal 2016-17 will have various festivals in separate quarters, so things might look slightly different from the previous year. If we compare the 2016 fiscal with the previous year, I'd say it's not dramatically different. We ended 2014-15 with about 7% like-to-like growth and it's going to be between 7.5% and 8% in 2015-16. In terms of store additions, we opened seven new stores and will continue to add stores in the fiscal 2017 as well. In fact, six stores are getting added in both the years i.e. the current fiscal and the year after.

Q. What aspects in your view will influence consumption in the current fiscal?

A. Implementation of the seventh pay commission will increase salaries of the central government employees. That I'd think should bring some more money into the market. And with inflation holding, that should help to a great extent for sure. I believe 2016-17 should turn out to be a better year than the one gone by.

Q. But last fiscal also witnessed significant slowdown in consumption as a result of stress on overall spending...

A. That situation hasn't changed much on the ground if you ask me. The only good part is that inflation is likely to be under control which really means if there is a salary growth of say 8% to 10%, it will not get eaten away by inflation. The consumer didn't really have much in hand to spend earlier. However, with inflation coming down, there will be a little bit of breather. The market sentiment hasn't changed much as we have had a bad monsoon last year. It (bad monsoon) is likely to get compensated by a good rainy season this year.

Q. What's your reading of the government's approval for 100% foreign direct investment in e-marketplaces?

A. The best part is that there is now a paper defining each one of these components which was not the case earlier. While business to business (B2B) was clearly defined, there was ambiguity on the marketplace and inventory-based models. So having a definition to start off I think is a great step. Now how do you really take the definition and argue against or for it, are the next levels. Currently a lot of argument is going on wherein some are saying that is 'it is anti-customer'. This anti-customer theory is being talked about largely by players who are burning cash. For them it's easy to keep on saying this, but fundamentally no business operates for acquisitions only. Businesses have to become self-sustainable at some point of time and that cannot happen by killing everyone else in the market. It has to be a self-sustainable model by itself. So it's a great step forward for sure. Besides, if there are any clauses that seem to be out of place; for instance they cannot really control discounting, which to my mind is right, but obviously there would be various players who would want to talk and lobby for getting it amended. Those will keep on happening. But to my mind, what has been proposed is very good.

Q. The guidelines also talk about providing a level playing field for offline players. Do you think it will?

A. From what we read, it certainly looks like there will be a level playing field. But we also know how most of the online players operate and even in the current model, they have come up with all kinds of loopholes to beat various issues. Be it considering discount as marketing or capitalising some of the expenses, there are a lot of such loopholes being used right now. I am not sure if they will stop exploiting those loopholes. I'm not really saying, does it kill competition or not? But if you are asking, do the guidelines create a level playing field? Yes, a better level-playing field in fact, but on paper. Having said that, one has to also understand that all these guys (e-marketplaces) are over-funded and they still have the funds for the next 12-18 months or so. What has happened recently (FDI guidelines) is a good move forward and we can work on it and keep developing on it.

Q. We have been hearing about major initiatives being taken by the management to spruce up the business. What is the progress there?

A. Well, a lot of focus is being laid on the omni-channel approach wherein we have made necessary investments for the kind of execution being planned. The first phase involving investment in hybrids is already over and if you visit our website now, it has a completely different navigation experience. We have just recently launched a mobile application on both android and iOS platforms. The idea is to help customers shop exclusively on shoppersstop.com through the app while continuing with their shopping experience. The second phase will start now in the area of warehouse management and we have already picked the RedPrairie software from JDA for it. The execution is currently on and the first phase should get completed by July while full-fledged operations will happen in October this year. Thereafter, we will kick-start the third and final phase of our omni-channel which should get completed by June next year. That's where we are right now. We have set a target of hitting 10% of overall sales coming from online over a three-year period. With all these initiatives rolled-out, I am quite sure we will be able to achieve it easily. Currently online sales are just about 1% and all of it is coming from our own website.

Q. But you have also presence on e-marketplaces...

A. We have still not driven it hard on e-marketplaces. There again we are putting in extensive efforts, combining it with our online team so that it gets the kind of traction that is required. We believe, starting second quarter this fiscal, we should see good traction for both our website and the e-marketplaces.

Q. There were quite a few senior managerial level movements from Shoppers Stop and now, you've got a completely new set of people in key positions.

A. Well, let me tell you that our success rate of retaining people for a longer period is very high. Having said that, there will always be some who would want to look for growth outside and you can't really stop them from doing so. That's on your query about people who have moved up and or moved out. With the new set of people on board, what we have done is got talent into the organisation that we have been missing earlier. For instance, we didn't have anyone with good experience and insights into the online world and with Sachin Oswal on board last year that gap was filled. Having a specialist in Sachin has added value to the organisation in terms of understanding the ecosystem better while also mapping the technology and the speed with which things need to be achieved in this space. Similarly, Sumit Puri joined from Payback. There again, we were fairly strong on analytics and loyalty, but we didn't have anyone from the coalition side of it. He now leads the division and is building a coalition loyalty programme involving all of Shoppers, HyperCity and Crossword customers and his expertise on putting this together helps big time. Third is Debasish Gupta who brings a lot of domestic and international experience on the department store front. He brings in a different perspective of managing a variety of brands, for instance M&S, which is a private brand as well as an international department store. They have a different perspective on private brands, as well as managing customers and service standards etc., which again is a big advantage to us.

Q. Are there any other areas where you will be looking to add expert talent?

A. Not on the senior level, but technology is where we will be looking at bringing in a lot of young talent. I think they are much more inclined towards digital and look at tech in a strategic way. For instance, our reality-based dressing room called Magic Mirror experience is a tech initiative. While we see at it from a consumer point of view, but how do you really utilise across all parameters is something that can be ascertained from these youngsters.

Q. How many stores currently have Magic Mirror installed?

A. We started with the Kolkata store and found it to be offering an innovative customer experience. Now we have four of them installed in our Malad store. We are currently in the process of fine-tuning it and will roll-out across the country after it has been perfected. I think, by December this year we should have it in the top seven, eight stores for sure.

Q. Have HyperCity operations stabilised now? The company has been facing some challenges there...

A. The good news with HyperCity is that we have got Ramesh Menon as the chief executive officer last month. I think we should be back on track as far as company Ebitda positive is concerned though we have been hitting Ebitda positive at store level for quite some time now. In fact, we hit store Ebitda positive in two quarters out of five, but we missed it in the last three quarters. My sense is we should be back on track in the second quarter of current fiscal and turning into PAT positive over the eight quarters. I think we will be on track for that. All the corrections in terms of merchandise, assortment, positioning, etc, are getting completed and we should start seeing results soon. As for store additions, we added two in FY16 and will continue adding two stores every year.

Q. Have you taken the final call on the duty-free retailing joint venture with Nuance?

A. We have taken a hit of Rs 23 crore in the first quarter of 2015-16 to basically revalue the business. This has been done to actually know its correct value and was done fundamentally based on the fact that we are not going to see many more airports coming up. When we'd earlier looked at this business, we had taken into account six or seven airports that were likely to come up. Currently we are operational in Bangalore airport and some part of Mumbai airport. We don't see Chennai and Kolkata getting into privatisation, so there is no point in thinking that this business is of higher value and just carry on with it. Having corrected the valuation, there is now scope for us to decide and conclude if there are any buyers or takers for this business. Besides, our joint venture partner (Nuance) has been acquired by Dufry which is also on an acquisition spree globally. If I remember it right, Dufry now has a large duty-free operation that is worth over $6 billion and are a leading player globally. So in that sense it's a good player to be with. Having said that, we have to keep thinking about the future of our businesses and the call is if you are able to exit then we would like to exit.

Q. How is the debt situation at present and where is it headed in the near future?

A. In the last three to four years, we have been generating cash and consuming it for investing in new stores for Shoppers, HyperCity and others. So debt has been going up slightly. However, in the current and next year we are targeting that the debt should actually start reducing. I say this because in four years, we have doubled the number of our stores. However, going ahead, we don't see too many new stores getting added. So on an average, six is what we target and end up opening nine to 10 stores on an average.

![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here

Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here![submenu-img]() BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....

BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....![submenu-img]() 'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case

'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case![submenu-img]() India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek

India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...

This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...![submenu-img]() Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet

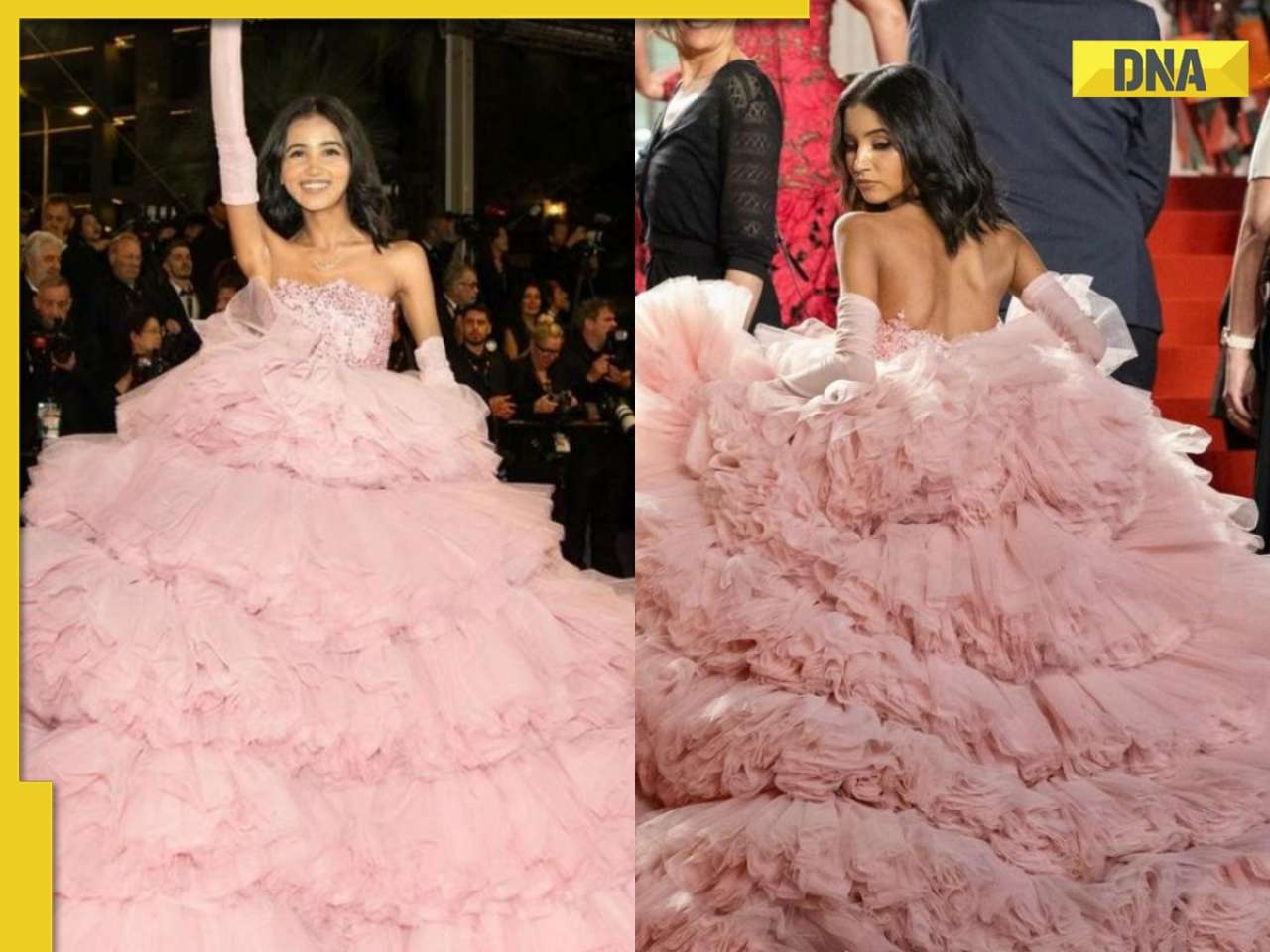

Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet![submenu-img]() Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident

Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident![submenu-img]() Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..

Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..![submenu-img]() Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it

Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it![submenu-img]() Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww

Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww![submenu-img]() IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash

IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash![submenu-img]() Do you know which God Parsis worship? Find out here

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

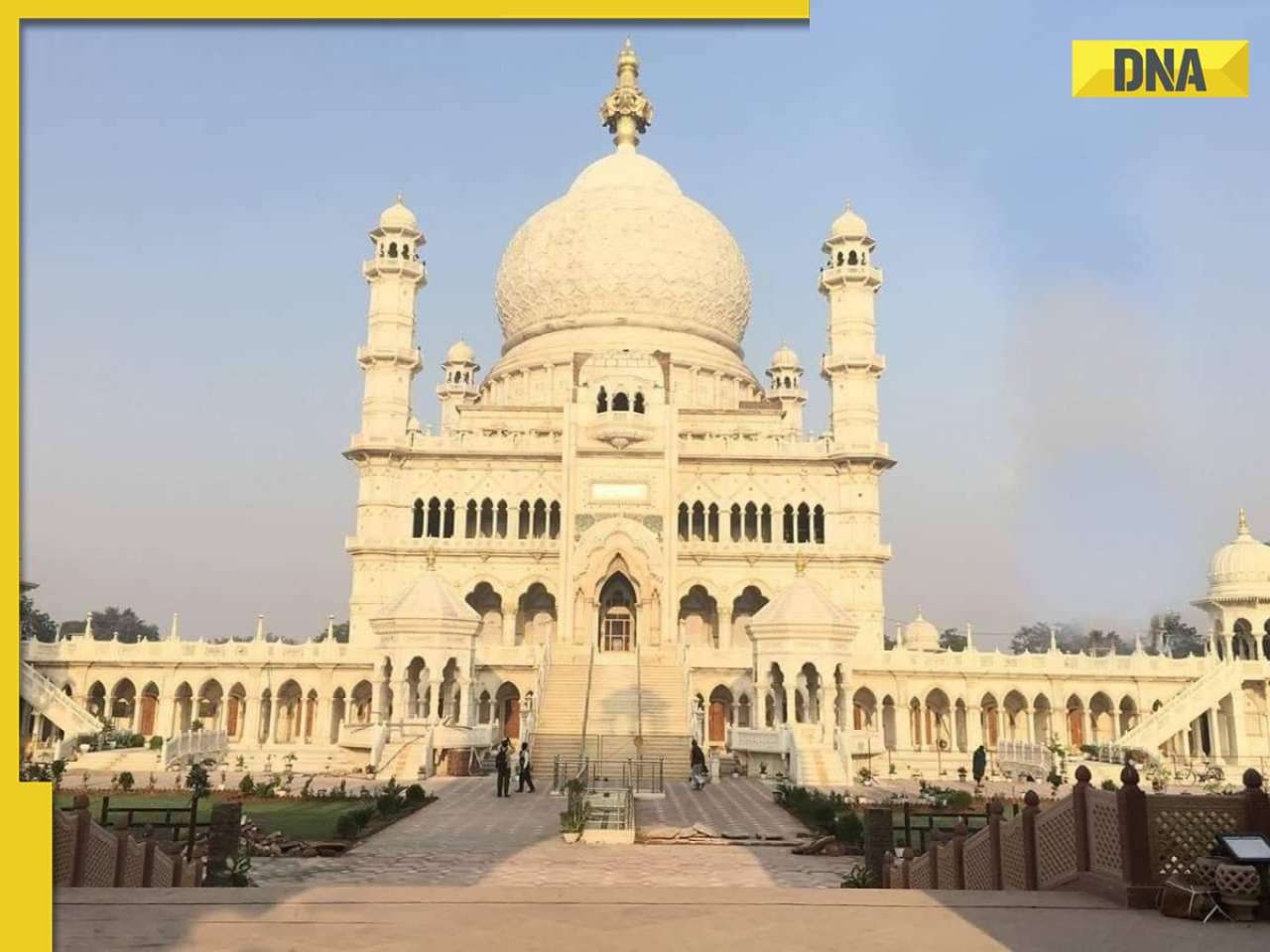

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

)

)

)

)

)

)

)