Modern software tools are instrumental in navigating this demanding period efficiently.

As 2023 gets underway, bookkeepers and accountants have tax season on their minds. With individual and business tax filing deadlines approaching in April, financial professionals have a limited window to collect client paperwork, generate tax reports, identify deductions, and submit accurate returns. Modern software tools are instrumental in navigating this demanding period efficiently. One key innovation to enter the scene recently is automated bank and credit card statement converters, which extract key details from PDFs into easy-to-use Excel and CSV formats in seconds using machine learning.

In this article, we’ll explore how leveraging bank statement converters can benefit bookkeepers during busy seasons by eliminating tedious manual data entry and integrating seamlessly with existing accounting platforms. We’ll also overview the key details these tools extract and highlight leading solutions tax professionals recommend.

The Problem of PDF Statements

While digital bank and credit card statements have made record keeping and retrieving past transactions convenient, the PDF format most institutions provide makes using the underlying data cumbersome. Unlike spreadsheets, PDF statements cannot be easily searched, filtered or manipulated to uncover trends. Copying hundreds of lines of transactions into accounting systems by hand is also hugely time-consuming and risks introducing human error. This data entry grind detracts bookkeepers’ limited time away from more strategic services during tax season like deductions maximization and tax planning.

A common scenario tax professionals face is clients predominantly supplying financial statements as non-editable PDF files rather than handy Excel or CSV formats. Whether they directly download from online banking portals or receive piles of paper statements in the mail, PDFs remain the norm for how most individuals and businesses access bank records. This locks essential transaction data needed for deductions behind static documents never designed for reporting. Rather than exhaustively communicating back-and-forth requesting Excel spreadsheets most clients likely do not have, bookkeepers able to adeptly convert provided PDF statements into dynamic datasets using automation tools gain tremendous efficiency. Waiting on statements to be reformatted risks squandering precious time as deadlines fast approach. Coming armed with bank statement converters empowers getting right to data extraction regardless of submittal format.

Introducing Automated CSV/Excel Converters

The solution to PDF statement limitations is converting them into Excel or CSV files containing just the transaction data in an organized digital format. New software tools have been developed specifically for this purpose - to automatically turn messy PDF bank statements into filtered spreadsheets in a matter of seconds with no copying and pasting required.

These tools, like Rocket Statements converter, eliminate frustrating manual processes by using advanced machine learning and optical character recognition (OCR) to extract key details including:

● Posting dates

● Descriptions

● Categories

● Type (debit or credit)

● Amounts

In addition to automated data extraction in a format compatible with all major accounting platforms, the best statement converters also allow appending multiple PDFs into a single unified spreadsheet. This enables consolidating all accounts across the entire tax year into one CSV/Excel file for simplified reporting. Some tools even auto-categorize fuzzy transaction descriptions like “SQ *Hair Salon” into intuitive labels like “Personal Services”.

Seamless Accounting Platform Integrations

A key benefit of using bank statement converters is how they integrate directly with popular bookkeeping systems like QuickBooks Online and Xero. Rather than submitting raw PDF statements or manually transcribed data, converters provide clean CSV/Excel files that sync effortlessly. This gives bookkeepers fully digitized transaction data sets that simplify reconciling bank/CC accounts, identifying deductible expenses, and generating insightful reports.

Optimizing Deductions & Tax Planning

With advanced statement converters automatically handling the drudgery of transaction data entry, bookkeepers unlock more time during tax season for high-value services. Analyzing full years of synchronized financial data allows them to better understand client spending patterns and cash flows. This enables pinpointing frequently overlooked deduction opportunities. Additionally, easily imported transactional data facilitates better-informed tax planning conversations.

When clients ask about the benefits of itemizing versus taking standard deductions or what accounting method best minimizes their tax liability, bookkeepers can generate detailed reports to provide specific personalized advice. Year-over-year data insights also inform proactive recommendations for tax reduction strategies and appropriate retirement savings or college fund contributions. Business clients further benefit from tools to measure growth, manage budgets, and benchmark against past performance or industry standards.

The Power of Integrations & Automation

Forward-thinking bookkeeping and accounting professionals recognize automation and seamless platform integration as the key to better client service. Tedious and repetitive manual processes like transaction data entry steals finite time that is better allocated to advising and planning during tax crunch time. Intelligent tools that extract information from messy formats like bank statement PDFs into usable, platform-agnostic datasets streamline operations.

This liberates professionals to provide more value by analyzing entire years of synchronized financial data and identifying the customized strategies that maximize each client’s tax advantage. As integration capabilities and advanced automation continue expanding through artificial intelligence and machine learning, so too will the strategic capabilities of 21st-century bookkeepers and accountants. Financial period recurring deadlines like tax season are when the multiplying benefits of workplace digitization become most apparent.

With tax season crunch time fast approaching, technology innovations like automated bank statement converters are invaluable for easing bookkeepers’ burdens. By extracting essential transaction information from PDF statements into Excel and CSVs, they eliminate the frustrating grind of manual data entry. This mitigates risk of human error while integrating smoothly with all major accounting platforms.

The time and energy saved from adopting tools that simplify financial data synchronizing and reporting is better redirected toward high-value services like tax strategy planning during busy season. As accounting professionals race toward April filing deadlines, leveraging automation and integration accelerates success. Work smarter, not harder this tax season with the power of advances like reliable bank statement converters!

Disclaimer : Above mentioned article is a Consumer connect initiative, This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever.

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

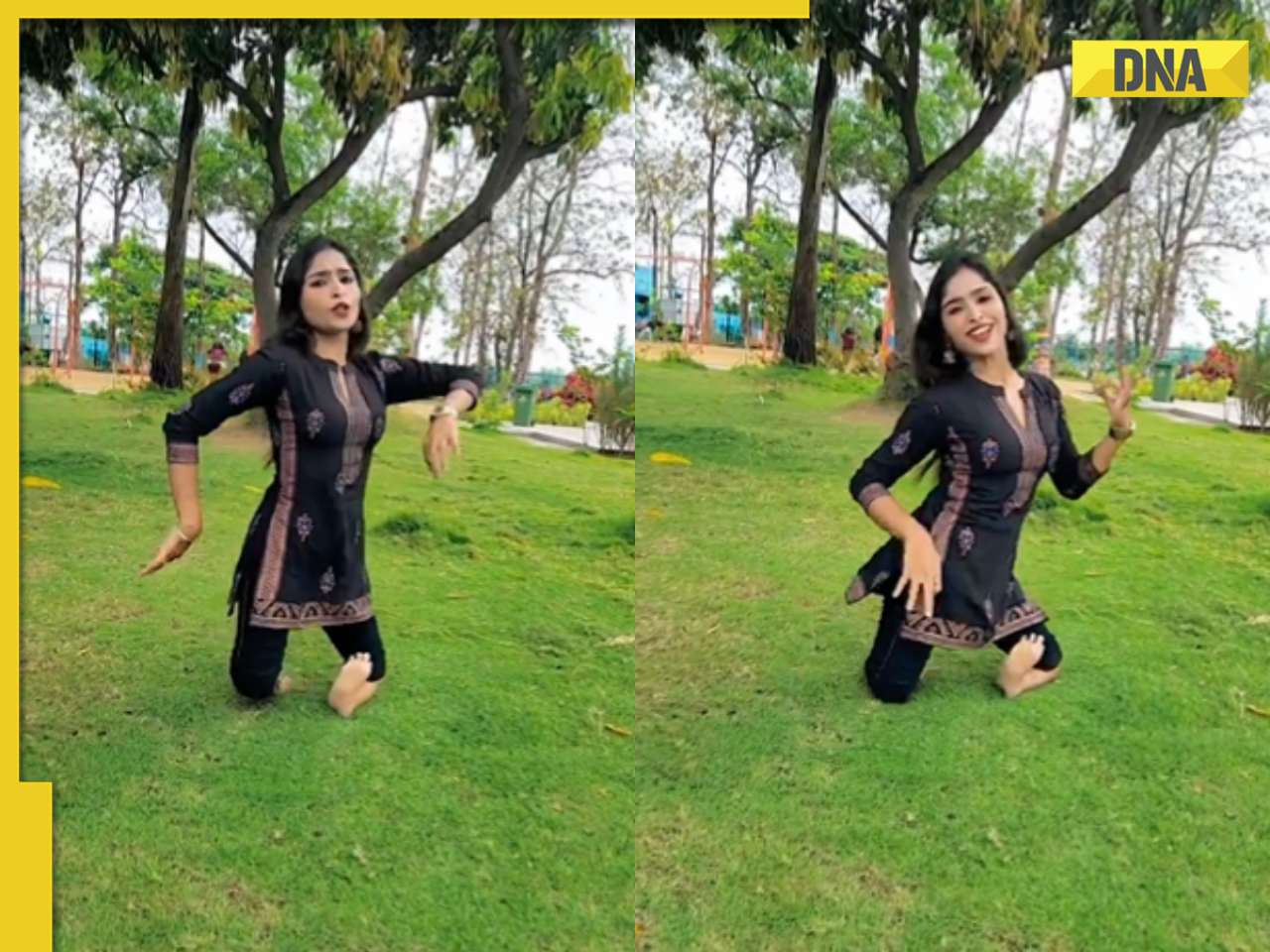

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

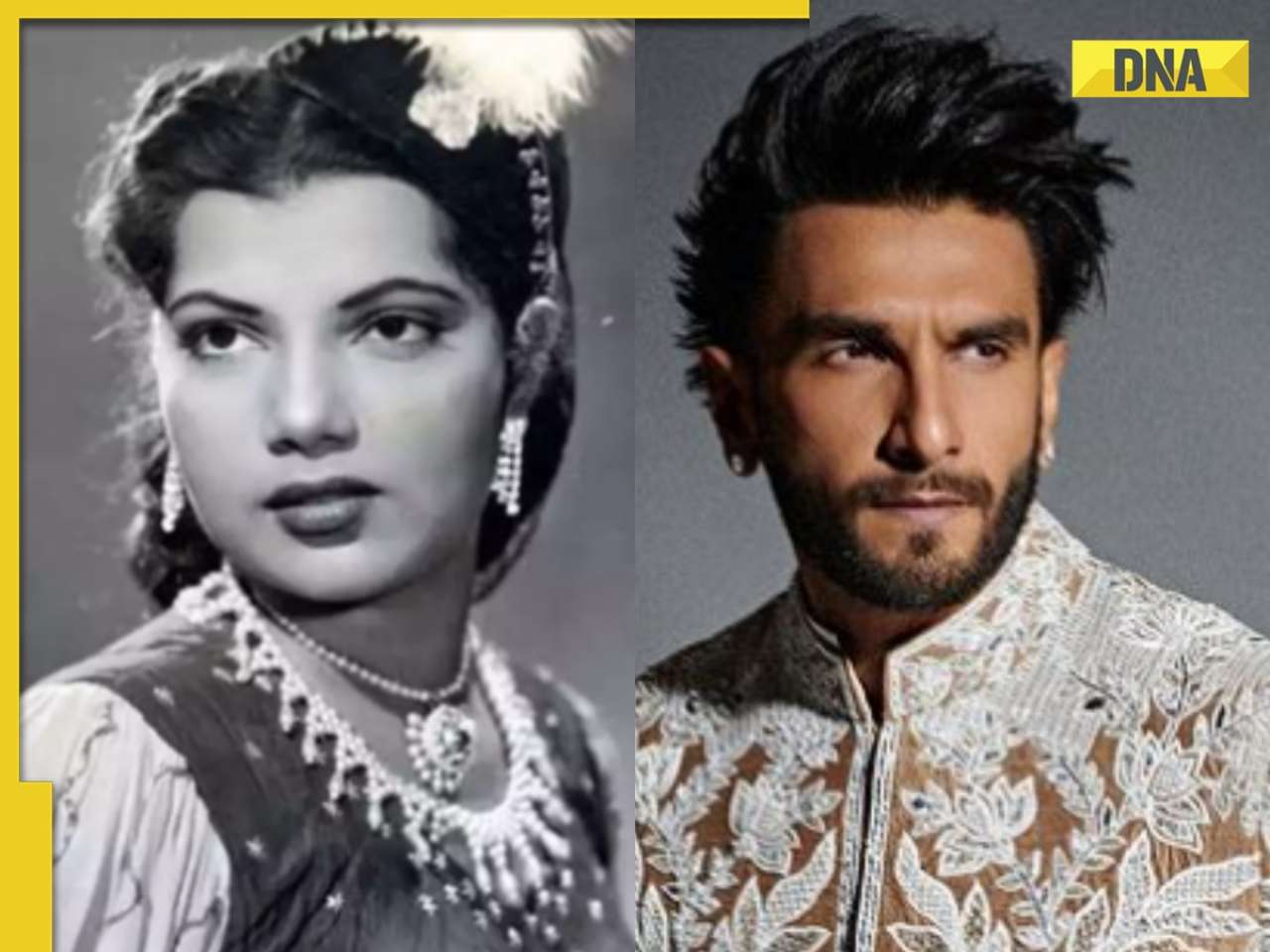

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)

)