- Home

- Latest News

![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

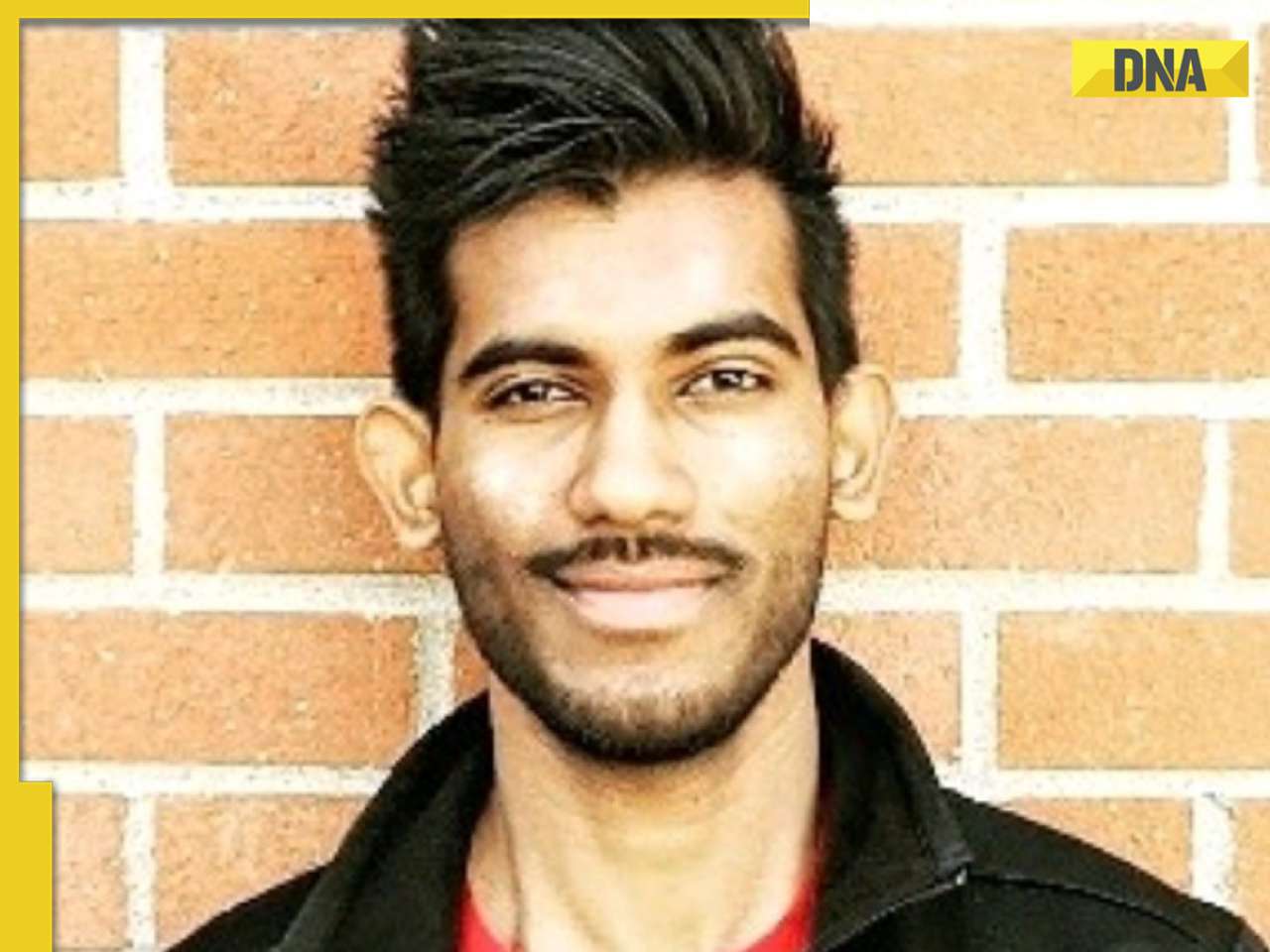

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Guardians of Cybersecurity: Inside Santosh Kumar Kande's Mission to Protect Corporate Networks

Guardians of Cybersecurity: Inside Santosh Kumar Kande's Mission to Protect Corporate Networks![submenu-img]() Meet man who leads Rs 642000 crore govt company, not from IIT, IIM

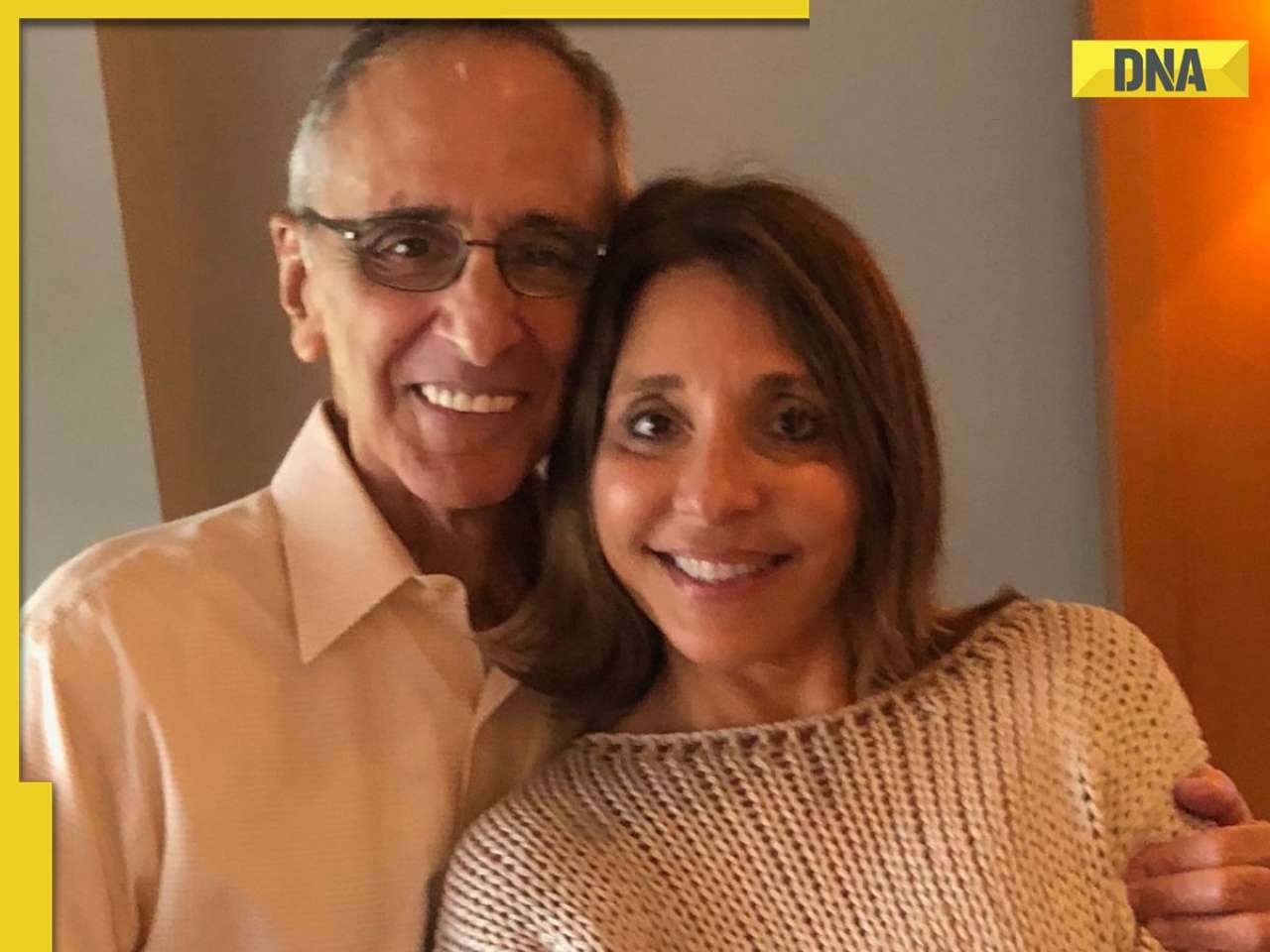

Meet man who leads Rs 642000 crore govt company, not from IIT, IIM![submenu-img]() Former RBI Governor Raghuram Rajan to join Congress? He says, ‘Rahul Gandhi is…’

Former RBI Governor Raghuram Rajan to join Congress? He says, ‘Rahul Gandhi is…’![submenu-img]() Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'

Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'

- Election 2024

- Webstory

- IPL 2024

- Education

![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...

Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...![submenu-img]() Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..

Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..![submenu-img]() Meet man who used to walk to work, eat free meals, left high-paying corporate job at 29 due to...

Meet man who used to walk to work, eat free meals, left high-paying corporate job at 29 due to...![submenu-img]() Meet woman who left high-paying job as NASA scientist to crack UPSC exam twice, became IRS then IPS officer with AIR…

Meet woman who left high-paying job as NASA scientist to crack UPSC exam twice, became IRS then IPS officer with AIR…

- DNA Verified

![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

- Her DNA

- Photos

![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer

- DNA Explainers

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

- Entertainment

![submenu-img]() Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'

Maharagni teaser: Kajol looks badass, beats up goons in action-packed first look, fans call her 'lady Singham'![submenu-img]() Shikhar Dhawan on what made him turn talk show host for Dhawan Karenge, addresses Kapil Sharma comparison | Exclusive

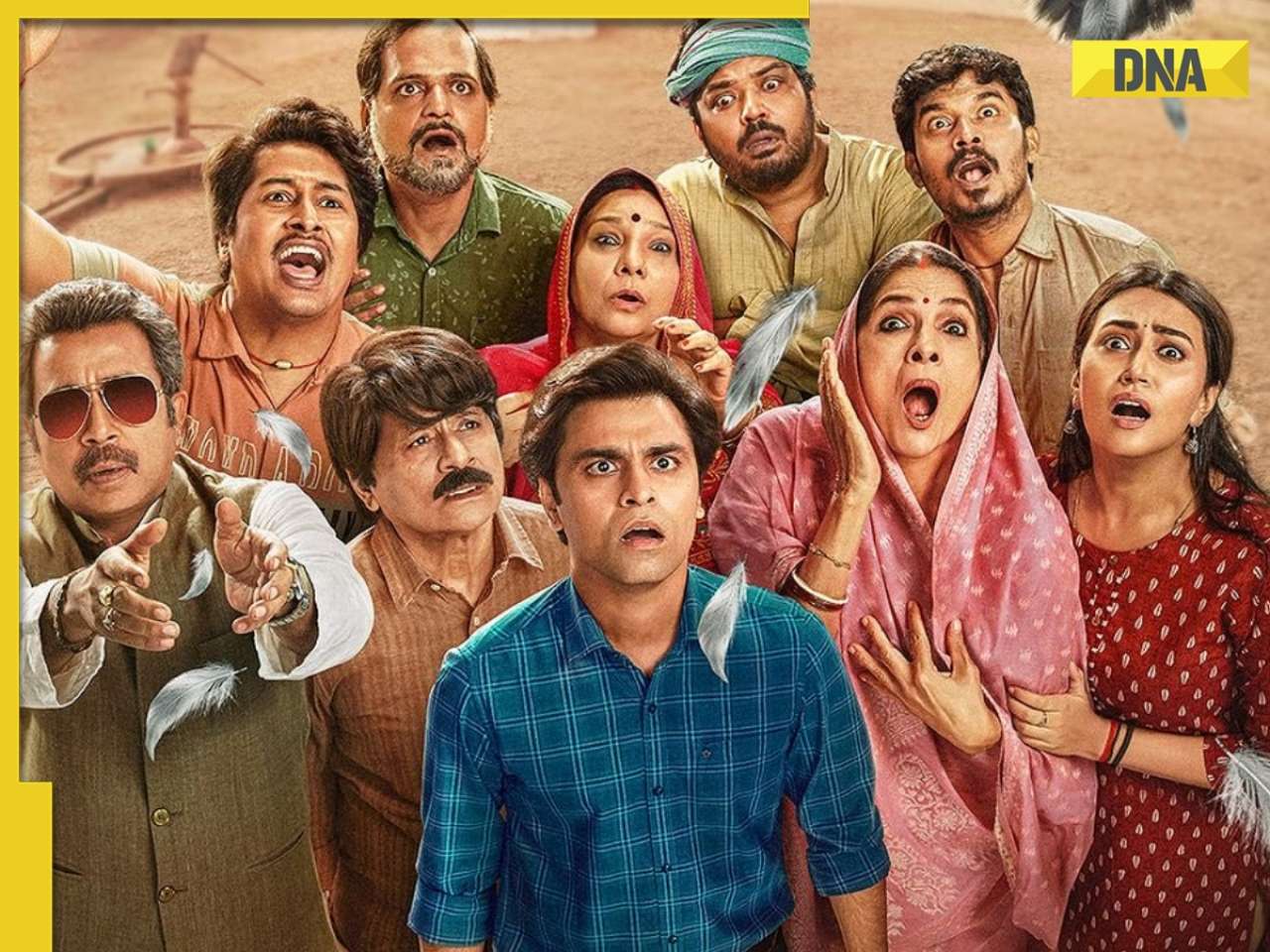

Shikhar Dhawan on what made him turn talk show host for Dhawan Karenge, addresses Kapil Sharma comparison | Exclusive![submenu-img]() Panchayat season 3 public review: Fans hail Neena Gupta, Jitendra Kumar's 'emotional, unbeatable series', call it banger

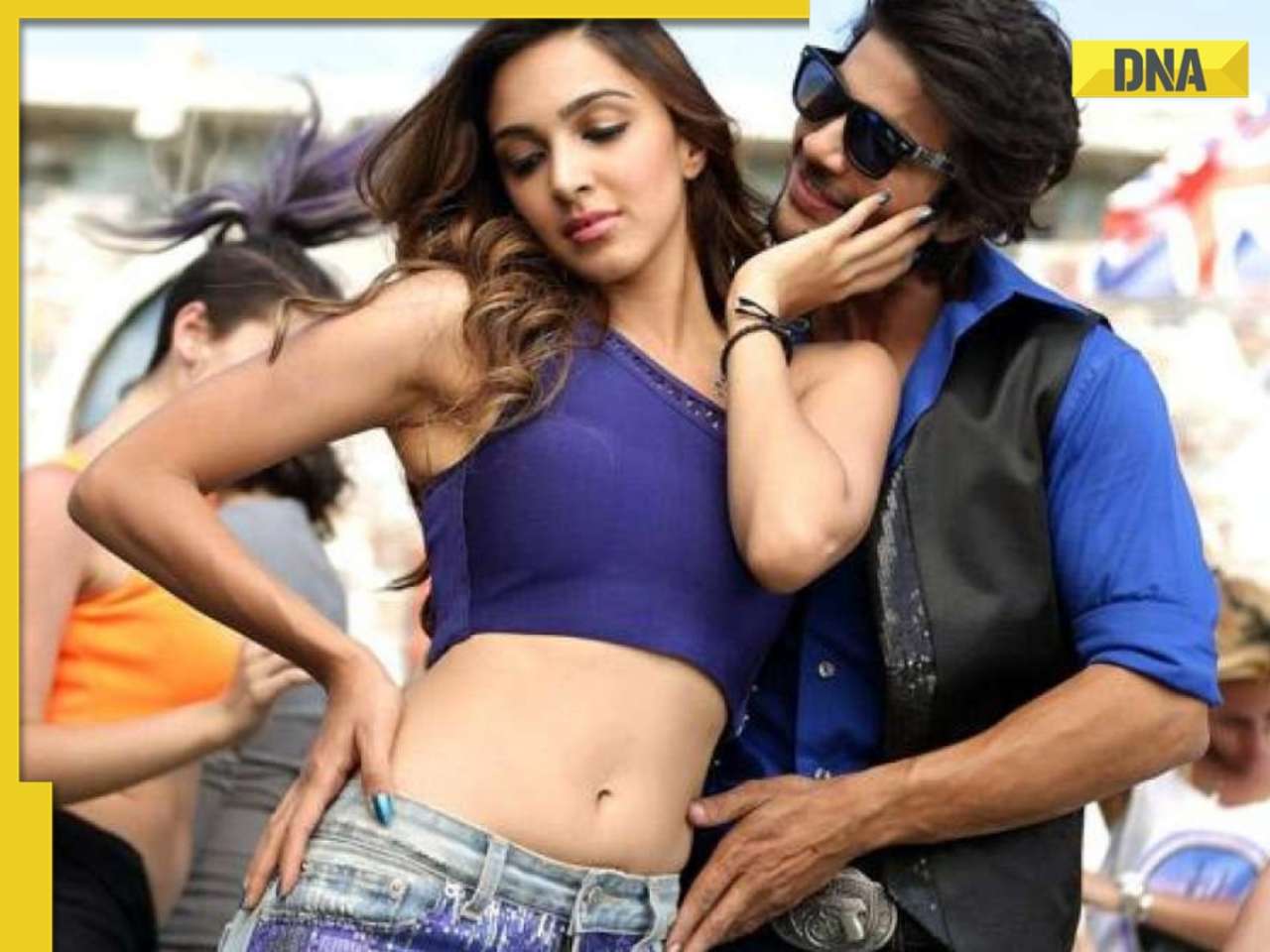

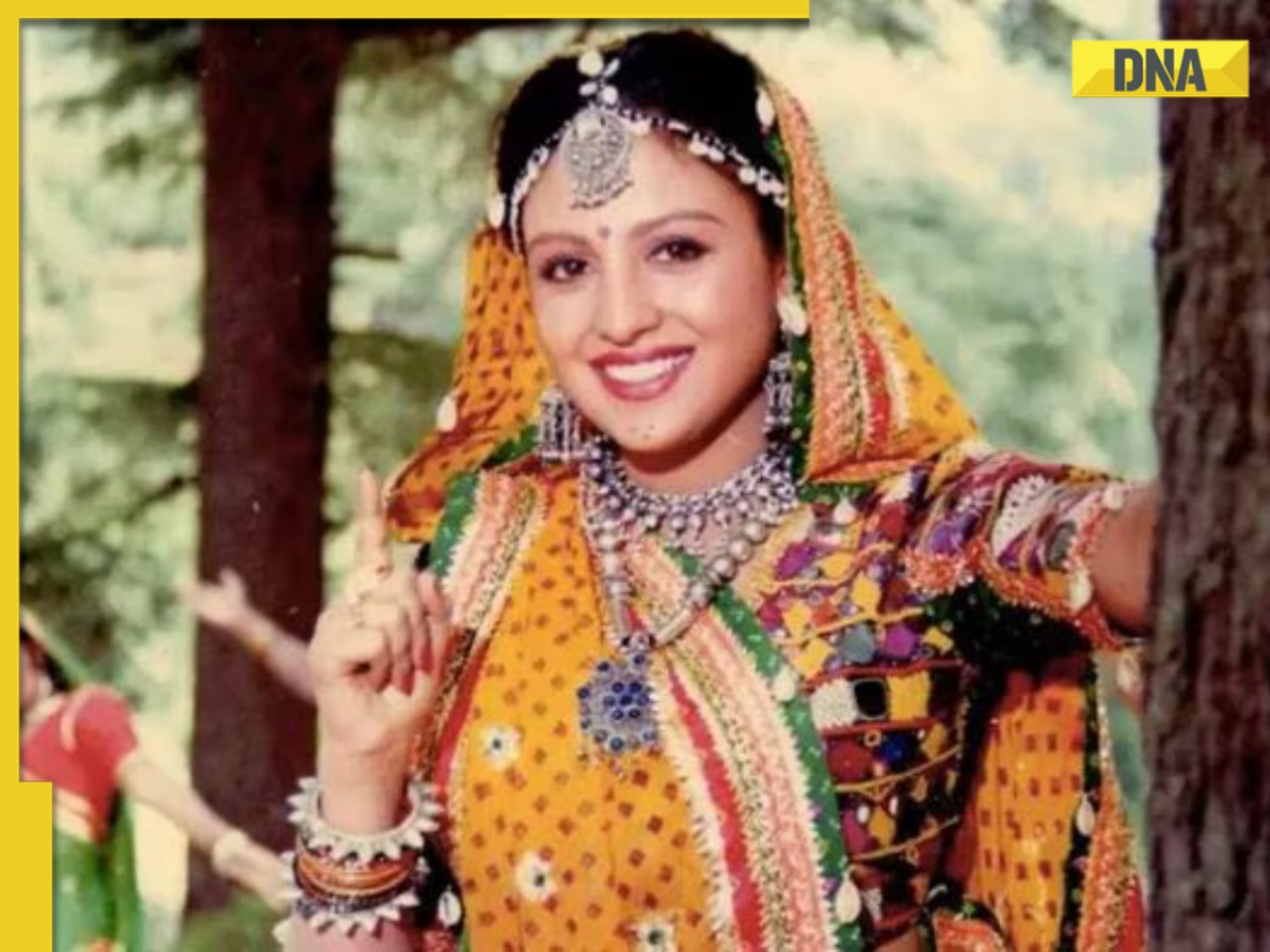

Panchayat season 3 public review: Fans hail Neena Gupta, Jitendra Kumar's 'emotional, unbeatable series', call it banger![submenu-img]() Meet superstar who gave Bollywood's first Rs 100 crore film, quit acting at peak of her career, married man with..

Meet superstar who gave Bollywood's first Rs 100 crore film, quit acting at peak of her career, married man with..![submenu-img]() 'Is she engaged?': Avneet Kaur confuses fans as she flaunts ring, says 'can’t wait to tell the world about this union'

'Is she engaged?': Avneet Kaur confuses fans as she flaunts ring, says 'can’t wait to tell the world about this union'

- Viral News

![submenu-img]() Anant Ambani-Radhika Merchant pre-wedding bash: Here's what Mukesh Ambani's guests will get to eat during ceremony

Anant Ambani-Radhika Merchant pre-wedding bash: Here's what Mukesh Ambani's guests will get to eat during ceremony![submenu-img]() Mukesh Ambani, Nita Ambani to celebrate Akash, Shloka's daughter Veda's birthday on cruise, check theme, other details

Mukesh Ambani, Nita Ambani to celebrate Akash, Shloka's daughter Veda's birthday on cruise, check theme, other details ![submenu-img]() Terra and Mare: Hidden meaning behind Mukesh Ambani's son Anant Ambani-Radhika Merchant's second pre-wedding bash theme

Terra and Mare: Hidden meaning behind Mukesh Ambani's son Anant Ambani-Radhika Merchant's second pre-wedding bash theme![submenu-img]() 'Simple, boring resume can get you...,' says former recruiter with Google, Apple, Samsung

'Simple, boring resume can get you...,' says former recruiter with Google, Apple, Samsung![submenu-img]() Mukesh Ambani's son Anant-Radhika Merchant pre wedding bash: Cruise set sails from Malta not from Miami due to...

Mukesh Ambani's son Anant-Radhika Merchant pre wedding bash: Cruise set sails from Malta not from Miami due to...

)

)

)

)

)

)