The effective interest rate for the loan is only 1% more than the interest on PPF.

Public Provident Fund (PPF) is not only a great way to invest, but it also has many other benefits. Along with saving tax, a major advantage of investing in a PPF account is that you can take a loan against it. A loan against PPF is very useful in times of need as it is easily available.

Trouble can approach at any time. In such a situation, to overcome the shortage of money, we get involved in the loan process, but you cannot get any loan without a guarantee as in return, you have to give something to the bank. However, to take a loan against PPF, you do not need to pledge anything.

Also, taking a loan against PPF is also cheaper and its interest rate is very low.

The loan can be taken on PPF after the completion of one year from the end of the financial year in which you opened the account and before the completion of 5 years. Remember that after the completion of 5 years of the PPF account, money can be withdrawn from it. But once you have started the withdrawal, you cannot take a loan against PPF. At the end of the two years preceding the year in which you are applying for the loan, up to 25% of the amount in the PPF account can be availed for the loan.

On taking a loan against PPF, the principal amount of the loan has to be paid first and its interest is paid later. The principal amount can be repaid in two or more installments or monthly installments. Remember, the principal amount of the loan has to be paid by the account holder till the end of 36 months from the first day of the month in which the loan is taken.

The effective interest rate for the loan is only 1% more than the interest on PPF. PPF is currently getting 7.1% annual interest. That is, if you take a loan, then the interest rate of the loan will be 8.1%. The interest can be paid in two EMIs or lump sum. If the principal amount has been paid on time, but some part of the interest is due, then it is deducted from your PPF account.

If the loan is not repaid or only partially repaid within a period of 36 months, the remaining loan amount will attract interest at the rate of 6% per annum. This 6% interest will be from the first day of the next month in which the loan is taken, till the last day of the month in which the last installment will be paid. That is, if the loan is not repaid within 36 months, the interest rate that was earlier becoming 1 percent will become 6 percent.

Interest on the outstanding loan will be deducted from the account holder's account at the end of every year if the interest is not paid before the end of the period of 36 months. If the account holder dies, then his nominee or legal heir will pay the interest on his loan. If your PPF account is not active then you cannot take loan against it. Apart from this, till the first loan taken against PPF is not repaid, second loan cannot be taken on it.

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

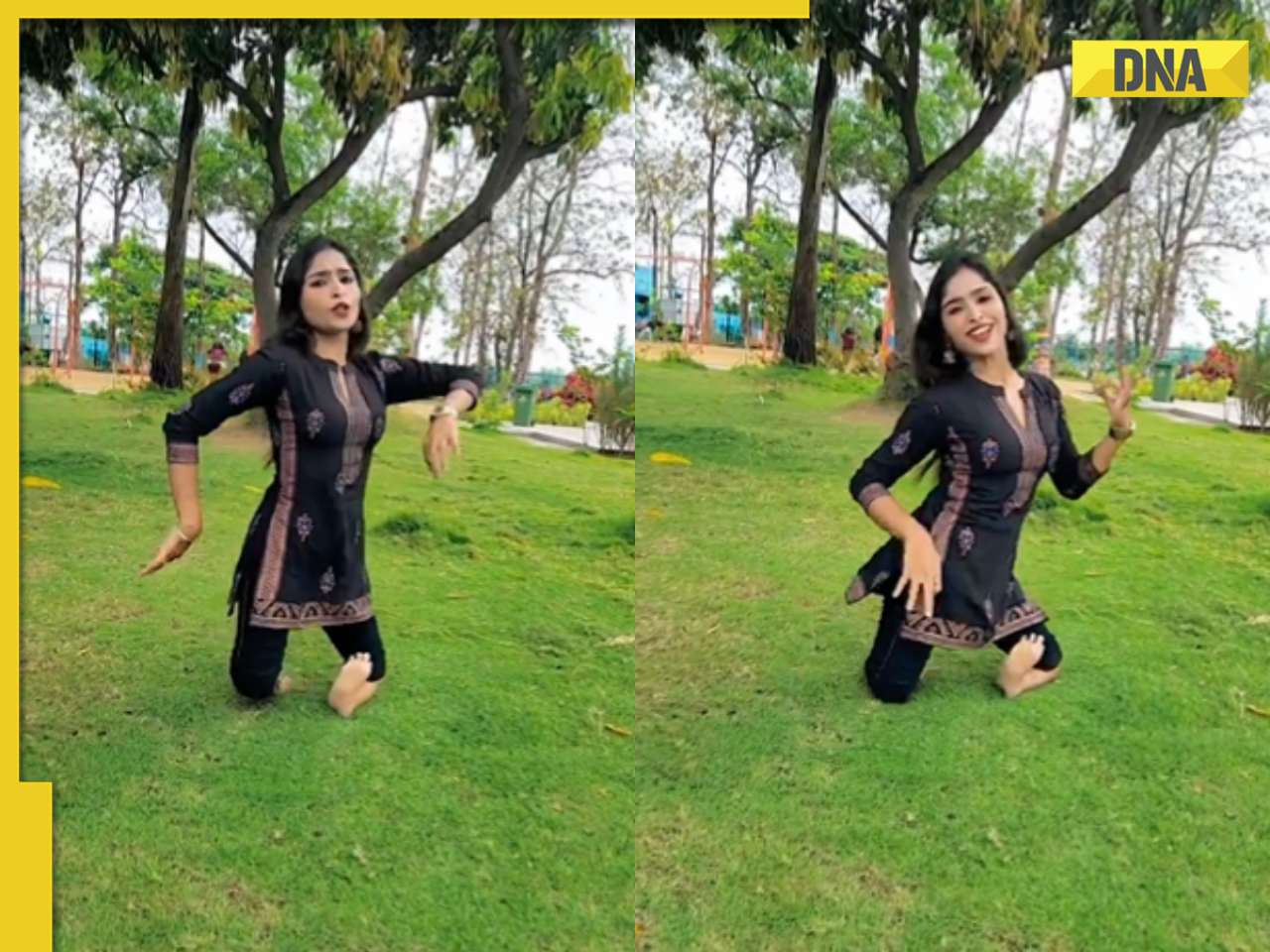

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

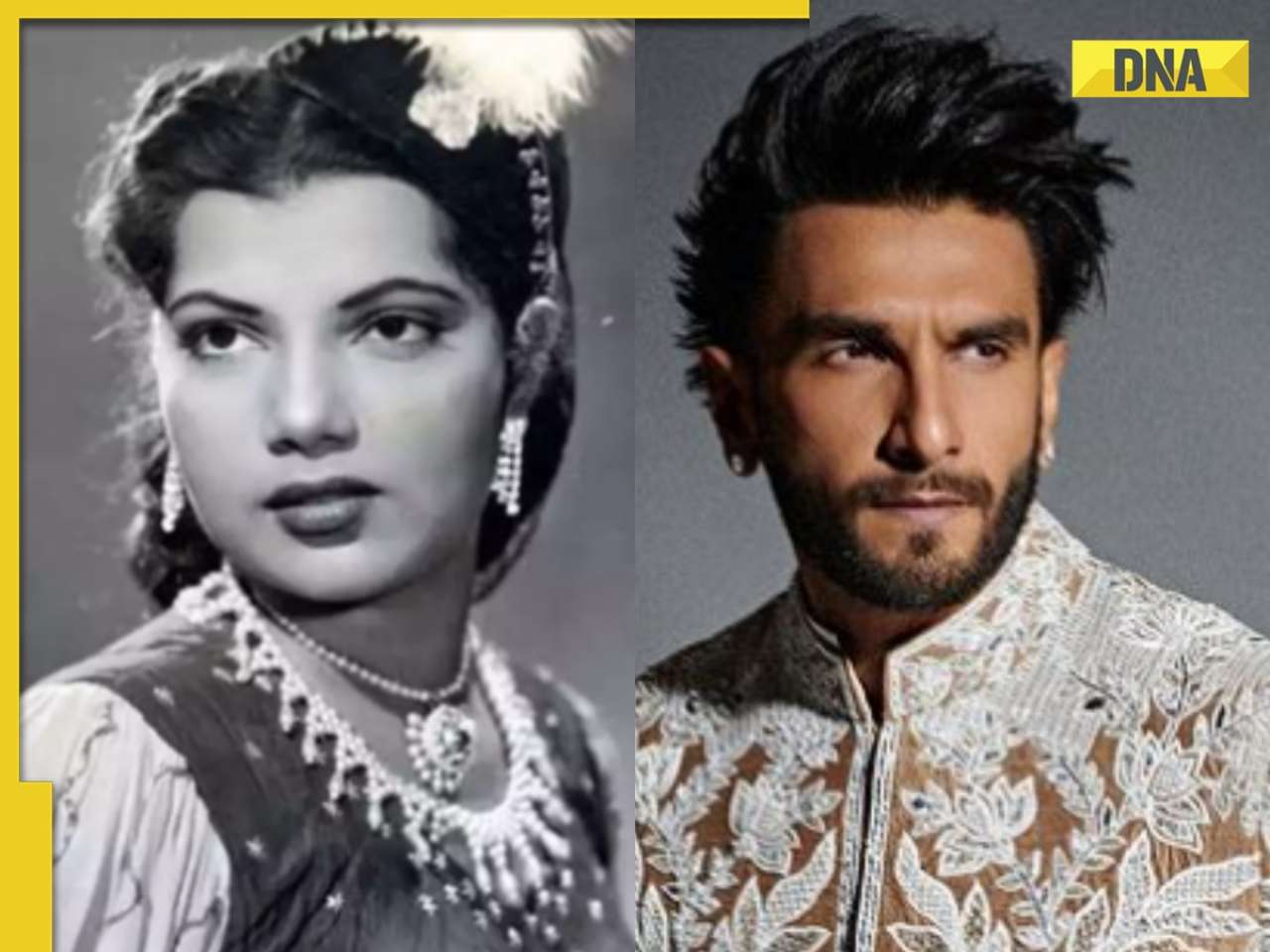

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)

)