Now if you want to become a crorepati through NPS, then its method is very easy, just a little trick is needed.

Retirement planning is advised to be done when you start earning, as it allows you to accumulate a huge amount till retirement. National Pension System is one such option in which you can invest in lump sum as well as arrange monthly pension after your retirement.

If you can save just Rs 74 a day and put it in NPS, then you will have Rs 1 crore in your hands till retirement. If you are 20 years old, you can start planning for your retirement from now, although people usually do not work at this age. Still, saving Rs 74 a day is not a big deal.

NPS is a market-linked retirement-oriented investment option. Under this scheme, NPS money is invested in two places, Equity i.e. Stock Market and Debt i.e. Government Bonds and Corporate Bonds. You can decide how much of the NPS money will go into equity only during account opening. Usually, up to 75% of the money can go into equity. This means that in this you are expected to get slightly higher returns than PPF or EPF.

Now if you want to become a crorepati through NPS, then its method is very easy, just a little trick is needed. Suppose you are 20 years old at this time. If you invest in NPS by saving Rs 74 for the day i.e. Rs 2,230 for the month, then when you retire after 40 years, you will be a crorepati. Now suppose you got a return at the rate of 9%. So when you retire, your total pension wealth will be Rs 1.03 crore.

Start investing in NPS

- Age: 20 years

- Investment per month Rs: 2230

- Investment period: 40 years

- Estimated return: 9%

- Bookkeeping of NPS Investments

- Total invested: Rs 10.7 lakh

- Total interest received: Rs 92.40 lakh

- Pension Wealth: Rs 1.03 crore

- Total tax saving: Rs 3.21 lakh

Notably, you cannot withdraw all this money at once, you can withdraw only 60 per cent of it, the remaining 40 per cent you have to put in an annuity plan, from which you get a pension every month. Suppose you put 40% of your money in an annuity. So when you are 60 years old, you will be able to withdraw a lump sum amount of 61.86 lakhs and assuming the interest is 8%, then every month pension will be around Rs 27,500.

Since it is a market-linked product, the returns may vary. The mantra of any investment is to start investing in it early.

![submenu-img]() ‘Paisa hi Paisa Hoga Ab’: Mukesh Ambani’s son Anant Ambani invites Pakistanis to UK estate, poses with ‘Bewafa’ singer…

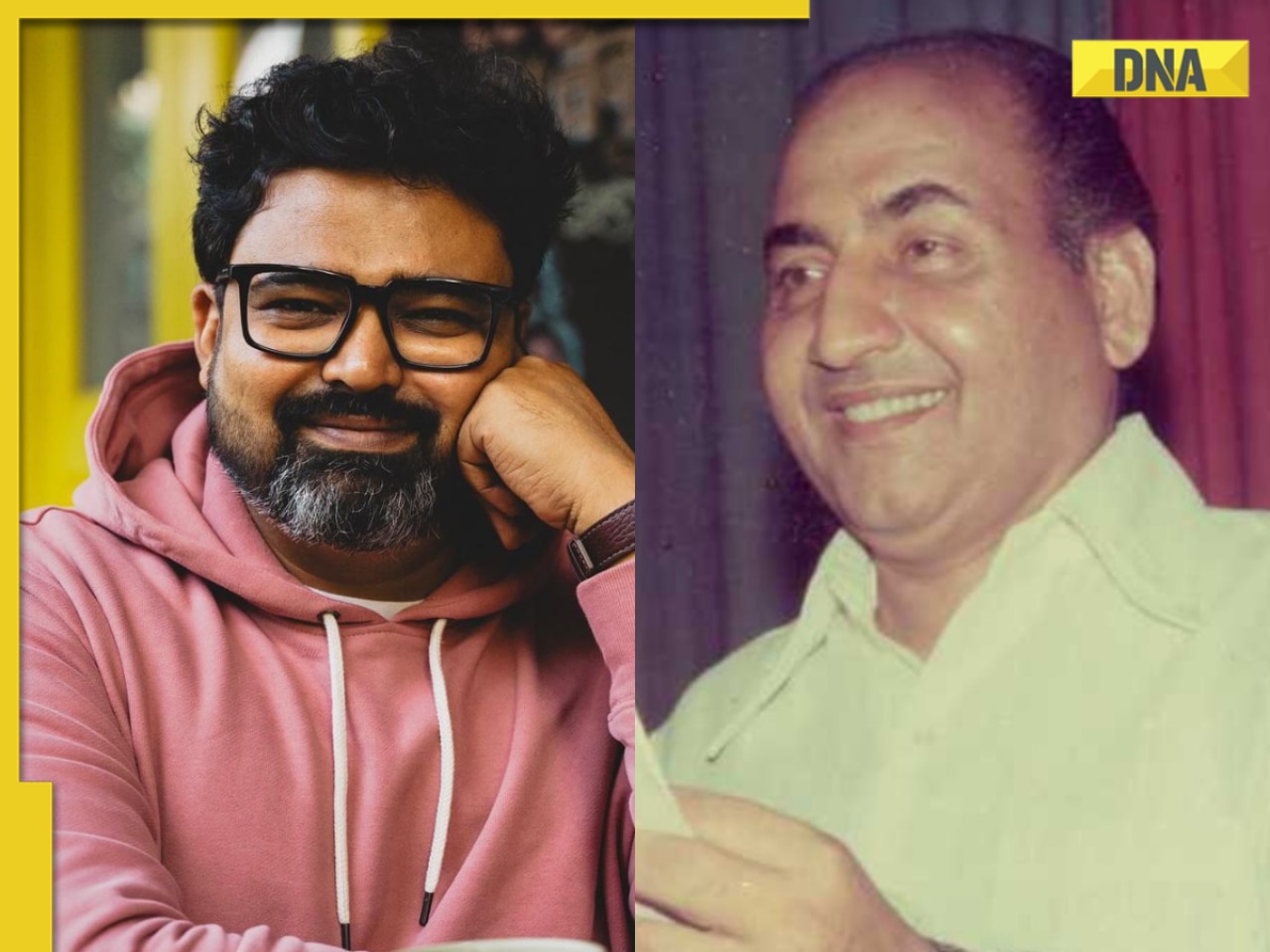

‘Paisa hi Paisa Hoga Ab’: Mukesh Ambani’s son Anant Ambani invites Pakistanis to UK estate, poses with ‘Bewafa’ singer…![submenu-img]() Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive

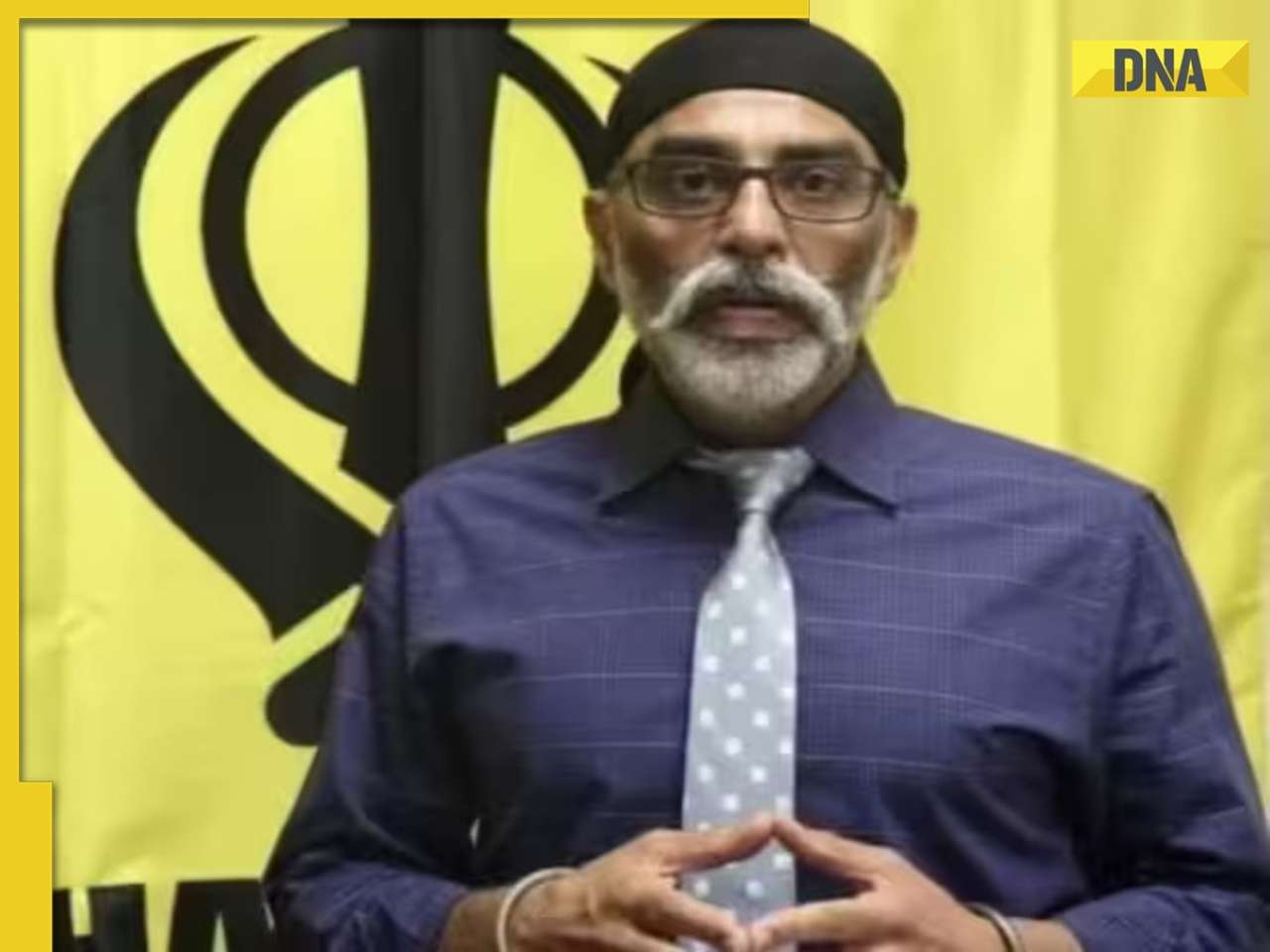

Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive ![submenu-img]() 'Unwarranted, unsubstantiated claims': India slams US media report on alleged Pannun murder plot

'Unwarranted, unsubstantiated claims': India slams US media report on alleged Pannun murder plot![submenu-img]() JD(s) to suspend NDA Hassan candidate Prajwal Revanna: Kumaraswamy

JD(s) to suspend NDA Hassan candidate Prajwal Revanna: Kumaraswamy![submenu-img]() AstraZeneca admits its COVID-19 vaccine Covishield can cause rare...

AstraZeneca admits its COVID-19 vaccine Covishield can cause rare...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive

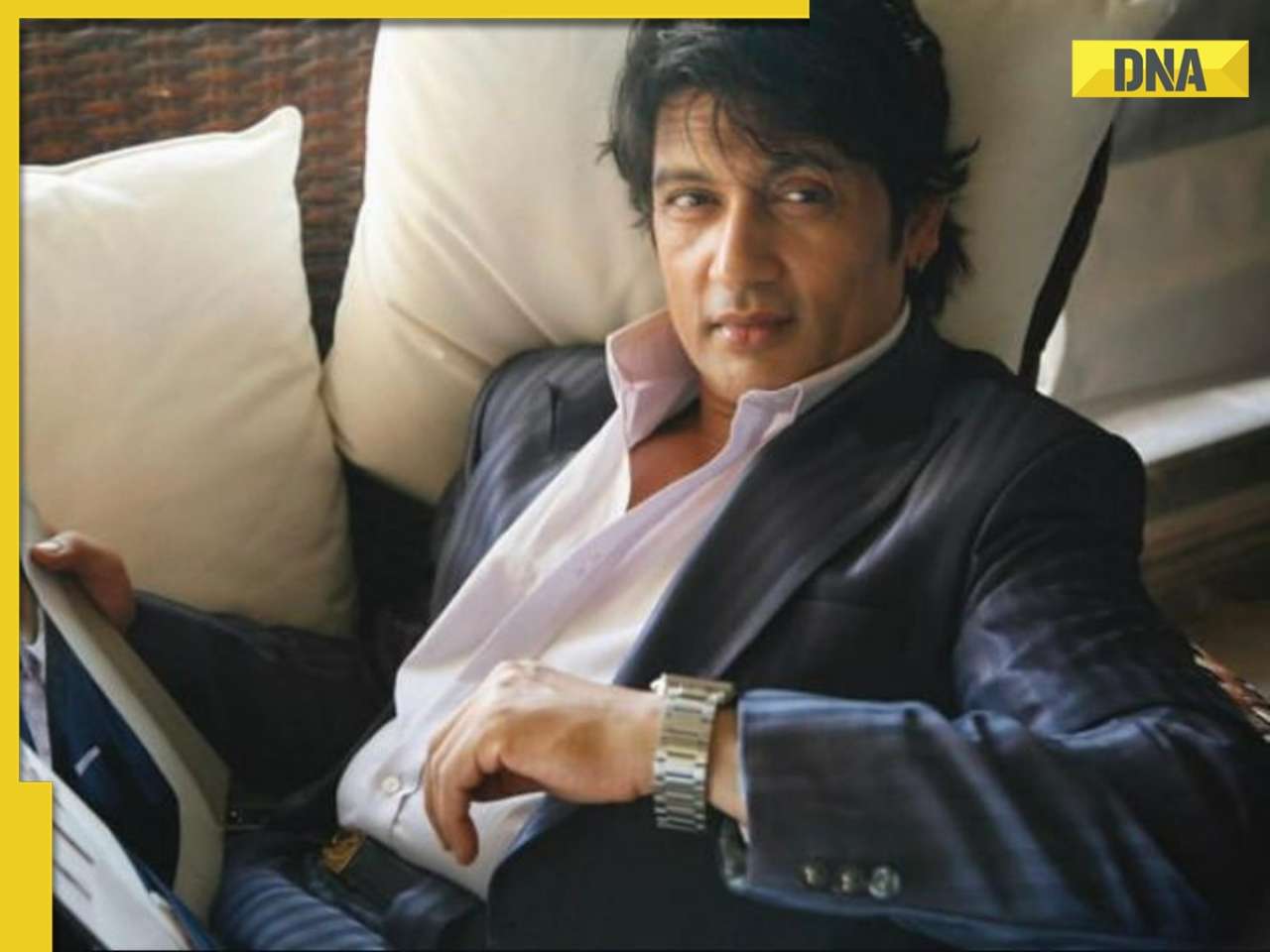

Raj Shekhar reacts to AI-generated Mohammed Rafi version of 'Pehle Bhi Main': 'I sent it to my father' | Exclusive ![submenu-img]() Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’

Shekhar Suman slams young actors who ‘want stardom overnight’: ‘Why do they act…’![submenu-img]() Meet man who lived naked, alone, away from civilisation for 'cruel' reality show; remained in trauma for years, is now..

Meet man who lived naked, alone, away from civilisation for 'cruel' reality show; remained in trauma for years, is now..![submenu-img]() Meet actor, who failed auditions, was thrown out of theatre, a curfew made him superstar; he’s now worth Rs 1800 crore

Meet actor, who failed auditions, was thrown out of theatre, a curfew made him superstar; he’s now worth Rs 1800 crore![submenu-img]() Meet actor, who became star overnight, was called superhero of children, later quit acting; he now works as...

Meet actor, who became star overnight, was called superhero of children, later quit acting; he now works as...![submenu-img]() IPL 2024: Varun Chakaravarthy, Phil Salt power Kolkata Knight Riders to 7-wicket win over Delhi Capitals

IPL 2024: Varun Chakaravarthy, Phil Salt power Kolkata Knight Riders to 7-wicket win over Delhi Capitals![submenu-img]() 'Won't find a place in my team': Virender Sehwag slams legendary India player for his comments on T20 cricket

'Won't find a place in my team': Virender Sehwag slams legendary India player for his comments on T20 cricket![submenu-img]() 'When people create imbalances....': Virat Kohli's sister reacts to RCB batter's strike rate chatter in IPL 2024

'When people create imbalances....': Virat Kohli's sister reacts to RCB batter's strike rate chatter in IPL 2024![submenu-img]() LSG vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs MI, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Mumbai Indians

LSG vs MI IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Mumbai Indians![submenu-img]() Viral Video: 4 girls get into ugly fight on Noida road, fly punches, pull hair; watch

Viral Video: 4 girls get into ugly fight on Noida road, fly punches, pull hair; watch![submenu-img]() Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt

Private jets, pyramids and more: Indian-origin billionaire Ankur Jain marries ex-WWE star Erika Hammond in Egypt![submenu-img]() Viral video captures mama tiger and cubs' playful time in Ranthambore, watch

Viral video captures mama tiger and cubs' playful time in Ranthambore, watch![submenu-img]() Heartwarming video of cat napping among puppies goes viral, watch

Heartwarming video of cat napping among puppies goes viral, watch![submenu-img]() Viral video: Man squeezes his body through tennis racquet, internet is stunned

Viral video: Man squeezes his body through tennis racquet, internet is stunned

)

)

)

)

)

)

)