Repo rate hike, how to decrease home loan EMI: The EMIs of existing floating home loans will also increase.

A day after the Reserve Bank of India increased the repo rate by 50 basis point in order to stem the fast spiralling inflation, several home loan lenders, including HDFC, ICICI, Bank of Baroda, RBL and Federal Bank, have increased their home loan interest rates. HDFC, one of the country's biggest lenders, said on Thursday its lowest home loans will now begin from 7.55 per cent, a whopping increase from 6.7 per cent in March. ICICI's loan rates will now begin at 8.6 percent, whereas RBL's at 8.55 percent. The EMIs of existing floating home loans will also increase. How you can keep your EMIs low?

There are many options for those who want to keep their EMIs low. A consumer can easily refinance her loan. Many lenders offer lower rates than the rates borrowers have got from their existing lender. A borrower can easily transfer the loan to the lender offering lower interest rates. Almost all the lenders offer this service. However, refinancing works if the borrower still has to repay a substantial amount of loan. There are associated charges as well.

Another option the borrower has is pre-payment. All the lenders provide a pre-payment option. Borrowers should keep paying off money lump-sum so that the principal decreases substantially over years. Lower principal means lower EMIs. This also means a person's loan will be closed earlier. Since most of the EMI comprises interest with a small principal component, prepayment facility makes a lot of financial sense.

Most of the banks offer loans with tenure upto 30 years. The most popular duration for loan repayment that borrowers opt for is 20 years. However, if one wants to lower EMIs, she can extend the tenure of loans. The downside of availing this is that she would have to pay a bigger interest amount. However, this also means freeing up more money for lump-sum prepayment.

If paying more EMI is not a problem, one can be prudent and increase her monthly repayment installment. This would help her repay the loan faster, which means she would have to pay lesser interest.

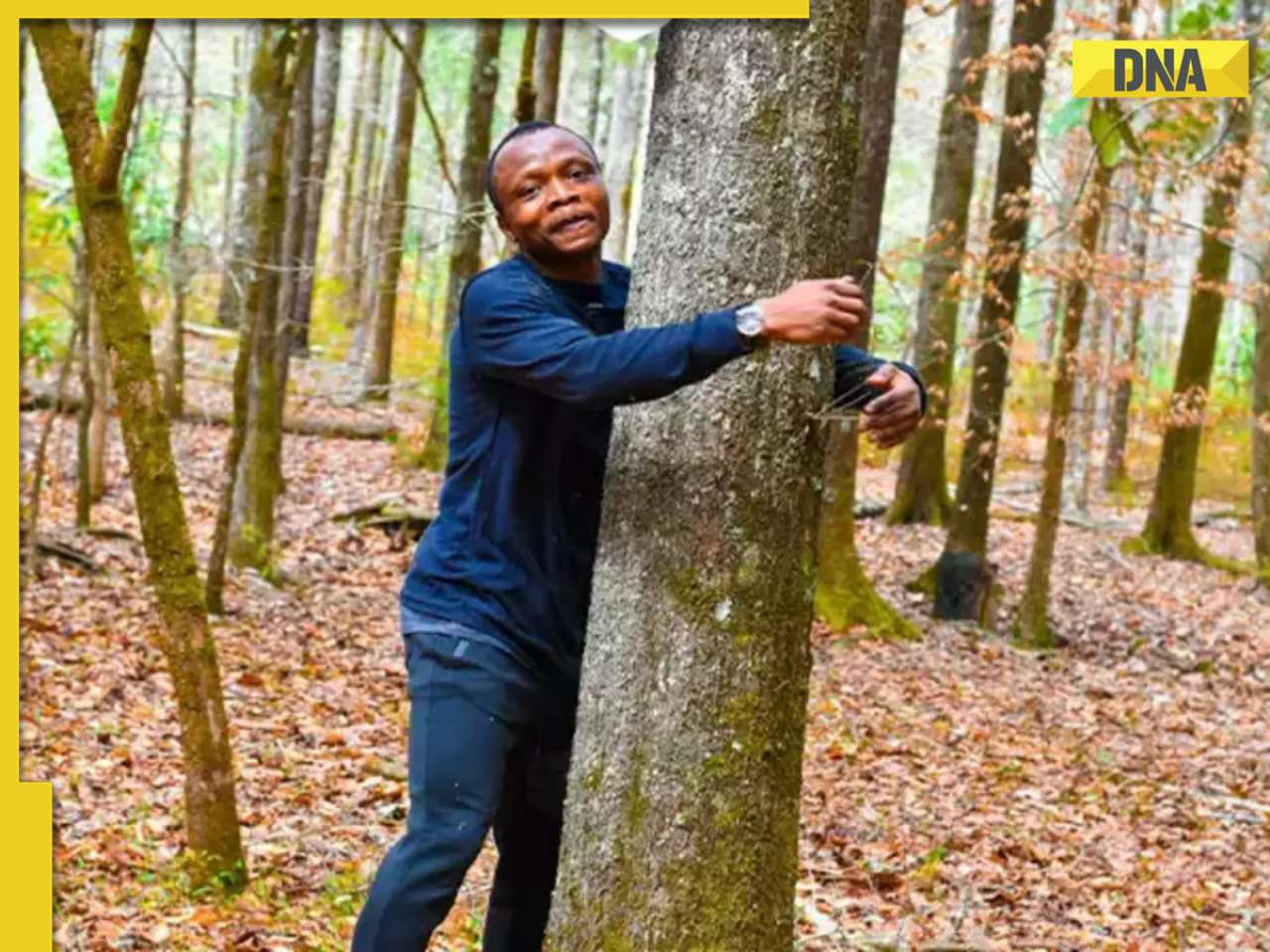

![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax

Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

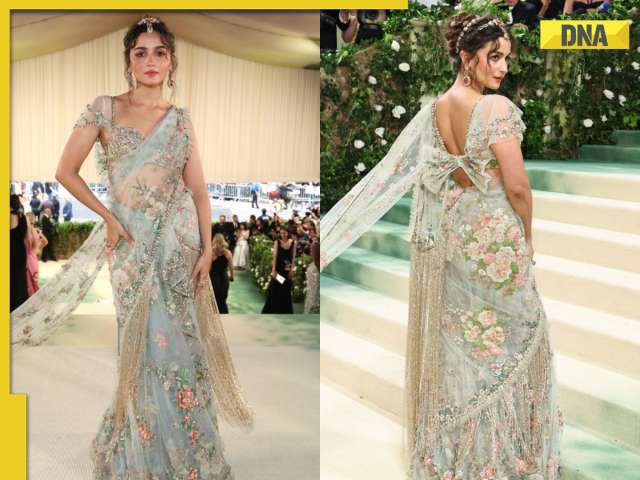

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy

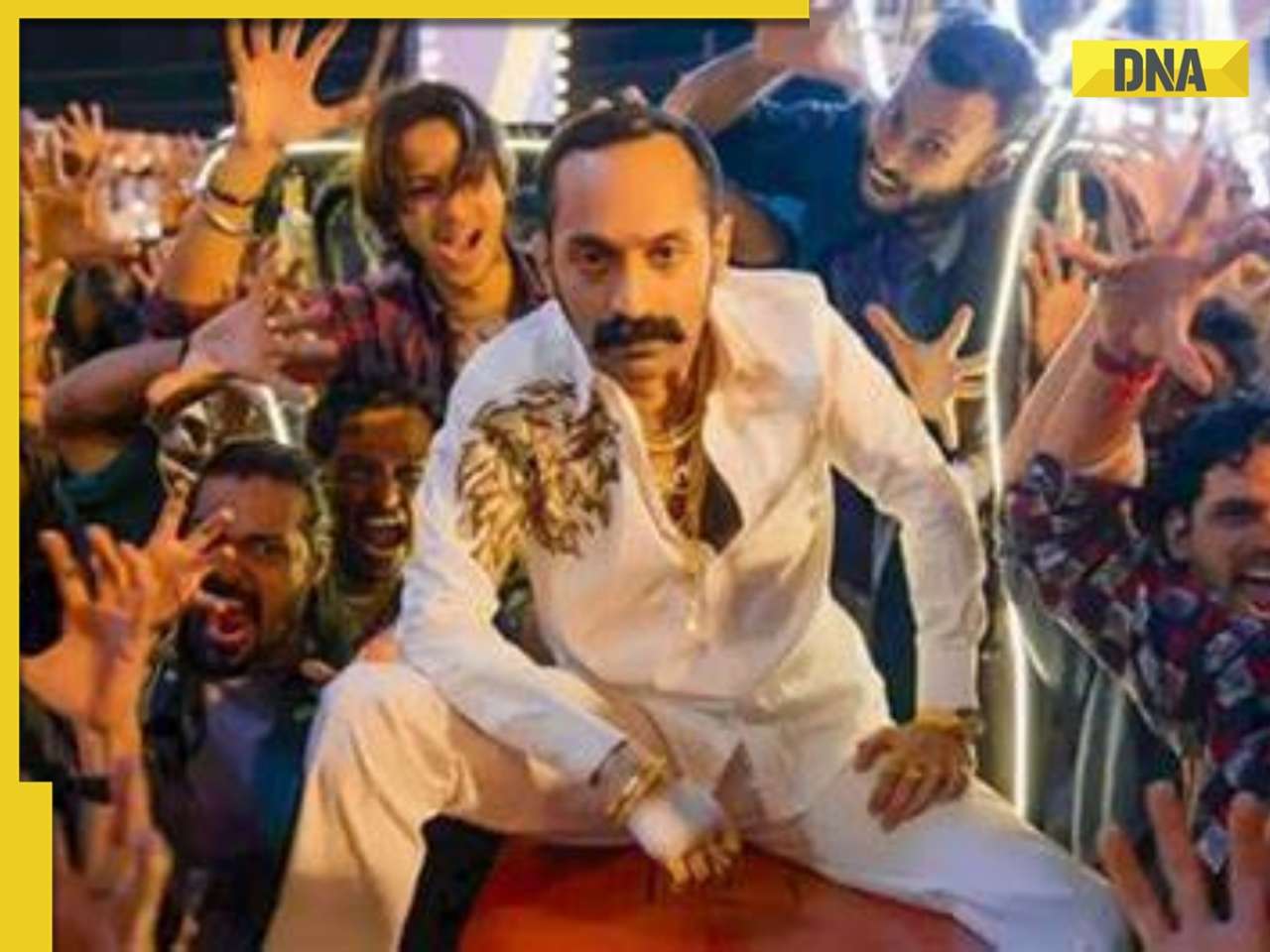

Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy![submenu-img]() Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’

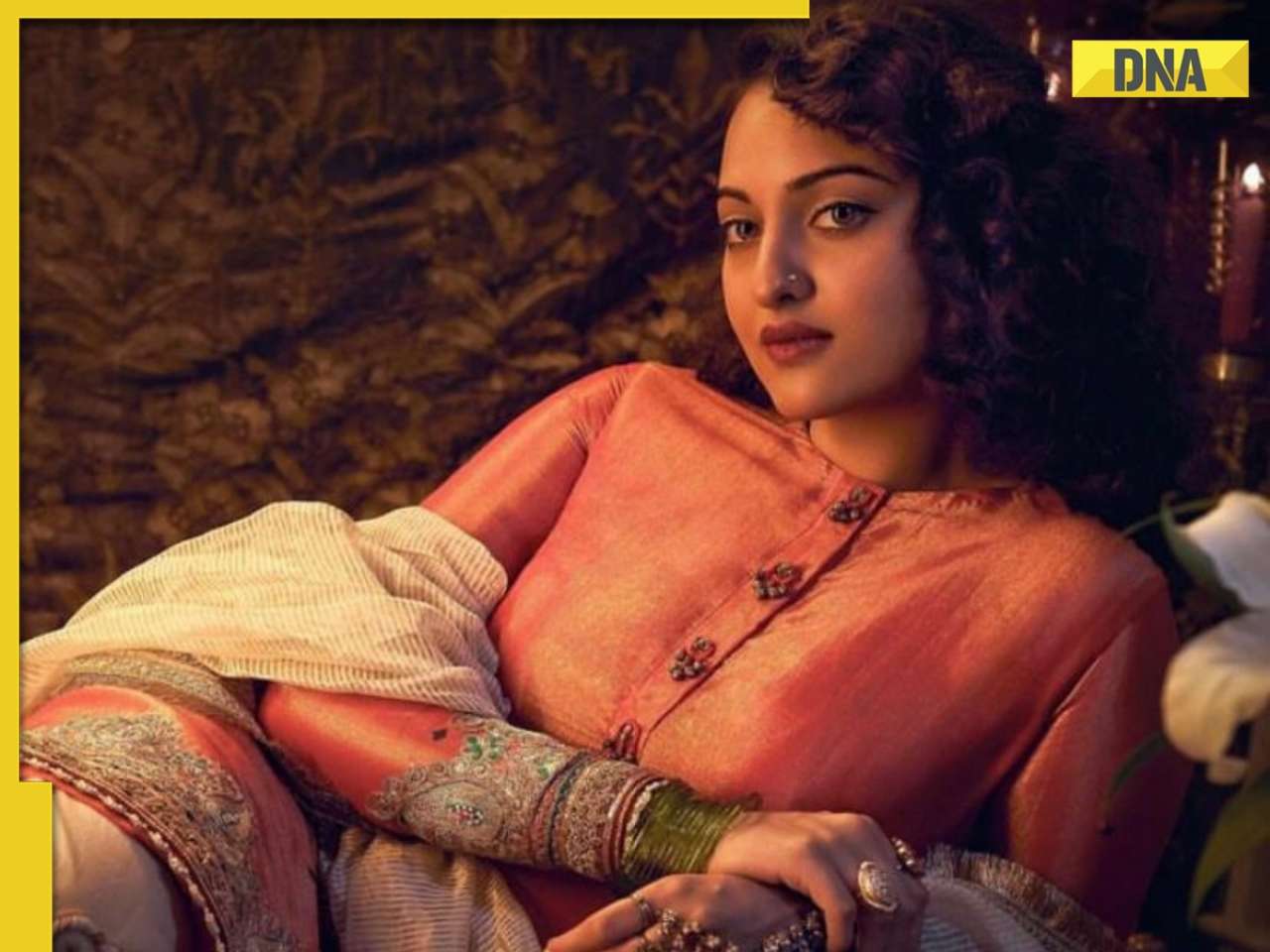

Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’![submenu-img]() Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive

Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive![submenu-img]() IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets

IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets![submenu-img]() PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru

PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru![submenu-img]() Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral

Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() Tiger cub mimics its mother in viral video, internet can't help but go aww

Tiger cub mimics its mother in viral video, internet can't help but go aww![submenu-img]() Octopus crawls across dining table in viral video, internet is shocked

Octopus crawls across dining table in viral video, internet is shocked![submenu-img]() This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

)

)

)

)

)

)

)