Traditionally, the growth rate depends upon the growth of the industrial, agriculture and service sector but the trading market is also one of the major sectors for capital formation.

From the viewpoint of Dr. (h.c.) Tushar Deochakke, Real estate has been the most favored form of the venture over centuries for those who can afford and generally, interest in Real Estate has implied purchasing private property essentially for self-residence. According to cross-country comparisons, individual country studies as well as industry and firm level analyses, a positive link exists between the sophistication of the financial system and economic growth. While some gaps remain, it is said that the financial system is vitally linked to economic performance. Nobel Laureate Joan Robertson declared in 1952 that "where enterprise leads, finance follows". According to this view, economic development creates demands for types of financial arrangements, and the financial system responds automatically to these demands.

Traditionally, the growth rate depends upon the growth of the industrial, agriculture and service sector but the trading market is also one of the major sectors for capital formation and has a direct impact on the economy across the world. Hence, the stock market in developing economies such as India is also growing very fast and it is estimated that the Indian real estate market will be a trillion-dollar industry by 2030. By facilitating longer term and more profitable investment, liquid markets improve the allocation of capital and enhance the prospects for long-term economic growth. Furthermore, by making investments relatively less risky by use of BlockChain Technology for governance, stock market liquidity can also lead to more savings and investments.

Real estate assets are valued at cost in the books while for many properties, the market value could be much higher. Listing these assets on the platform increases their trading opportunities by being accessible to multiple investors and by being liquid with cash flow generation potential, thus increases market capitalisation and creates economic impact on local and national economy via transactions and tax generated through them as well.

The Indian property Market is expected to Quadruple over next 6-8 years, while new Infrastructure development needs around USD 4.5 Trillion across India for everyone to sustain pace of growth and be the second largest economy by 2036.

While REITs regulations have been fine-tuned recently to accommodate smaller Asset owners it’s imperative to understand and digest that Indians are conservative by nature and real estate investments are used to hedge against the volatility of capital markets by the most. Thus, while the number of demat accounts registered have tripled in the last 5 years, the actual investor number is much lower. Though REITs were introduced in the 1960's, after more than six decades it has not crossed 2% of global real estate asset valuations.

ROI for small investors via REITs haven’t been great, while real estate developers, asset owners and managers continue to explore various funding options for new development assets and funding their pipeline. Further banks have sectoral restrictions for lending. On other hand we, Indians invest rupees 20 lakh crores every year in Fixed Deposit at banks wherein inflation adjusted returns are miniscule while entire economy has around Rupees 188 lakh crore as fixed deposit till end of last year.

While Jan-Dhan yojana (Banking for poorest of the poor) which was ridiculed earlier accumulated Rupees two lakh crore in a short period, with this can users visualise the impact a middle-class retail investor can create on the economy provided given a right opportunity. While Global fund managers are increasingly allocating higher absolute amounts for their India desk, it’s still hardly a considerable percentage from their global portfolio. This is while Ministry of Finance has established National Asset Monetisation Pipeline and National Bank for Financing Infrastructure Development.

Global Pension Funds and Private Equity Funds are investing in India, but the fact that repatriation on strategic exits take years if not decades does not encourage them enough. With RERA perspective of large global fund managers keen to invest in early stage of the project has changed. Being classified as promoter entails a multitude of obligations under RERA, including making regulatory filings, procuring completion or occupation certificate, insuring the project, etc., and grave penal consequences follow non-fulfilment of such obligations. While investment documents are generally framed to provide overarching rights to investors to protect their investments, it is now be worthwhile to structure investments in a way to reflect an investor’s non-participative role in day-to-day affairs and management of the entity or implementation of project.

While the world at large has gone digital, real estate markets rely on analogue and archaic methods for managing, trading, and settling assets. This is especially pronounced in the property markets that employs highly manual and time-consuming methods for administrating and trading assets. As a consequence, the real estate sector is notoriously illiquid and inaccessible.

Thus, Tokenisation of Real Assets viz Properties, Projects and Infrastructure would bring a paradigm shift in making investments radically transparent & inclusive from being questionably opaque for Institutional, HNI and retail investors alike be it domestic or foreign enterprises.

This challenge provides a real opportunity to provide a Unique Trustworthy Regulated, independent & Transparent Real Estate & Infrastructure Exchange on a robust Blockchain Technology for all Investors to showcase India’s vision across the World for Wealth distribution by making Global Investors invest in Indian Infrastructure market and vice-versa while also providing an opportunity for small investors to participate in contributing to emerging India without the risks of unrelated volatility on stock exchanges.

This would not only unlock the value of the Private Markets Globally for Real Estate and Infrastructure asset class worth Hundreds of Trillion Dollars but also to make it inclusive for all stakeholders. Further this would substantially reduce cost of governance of regulators, Tax authorities and other Government authorities using BCT (BlockChain Technology). For asset owners to investors getting direct access to the markets would reduce timeline to launch new investment products, thus saving costs and time. This would empower people and businesses in real terms in the age of BlockChain Technology and the internet by really Democratisation of markets and pave way for “Minimum Government with Maximum Governance.”

Disclaimer : Above mentioned article is a Consumer connect initiative. This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever.

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

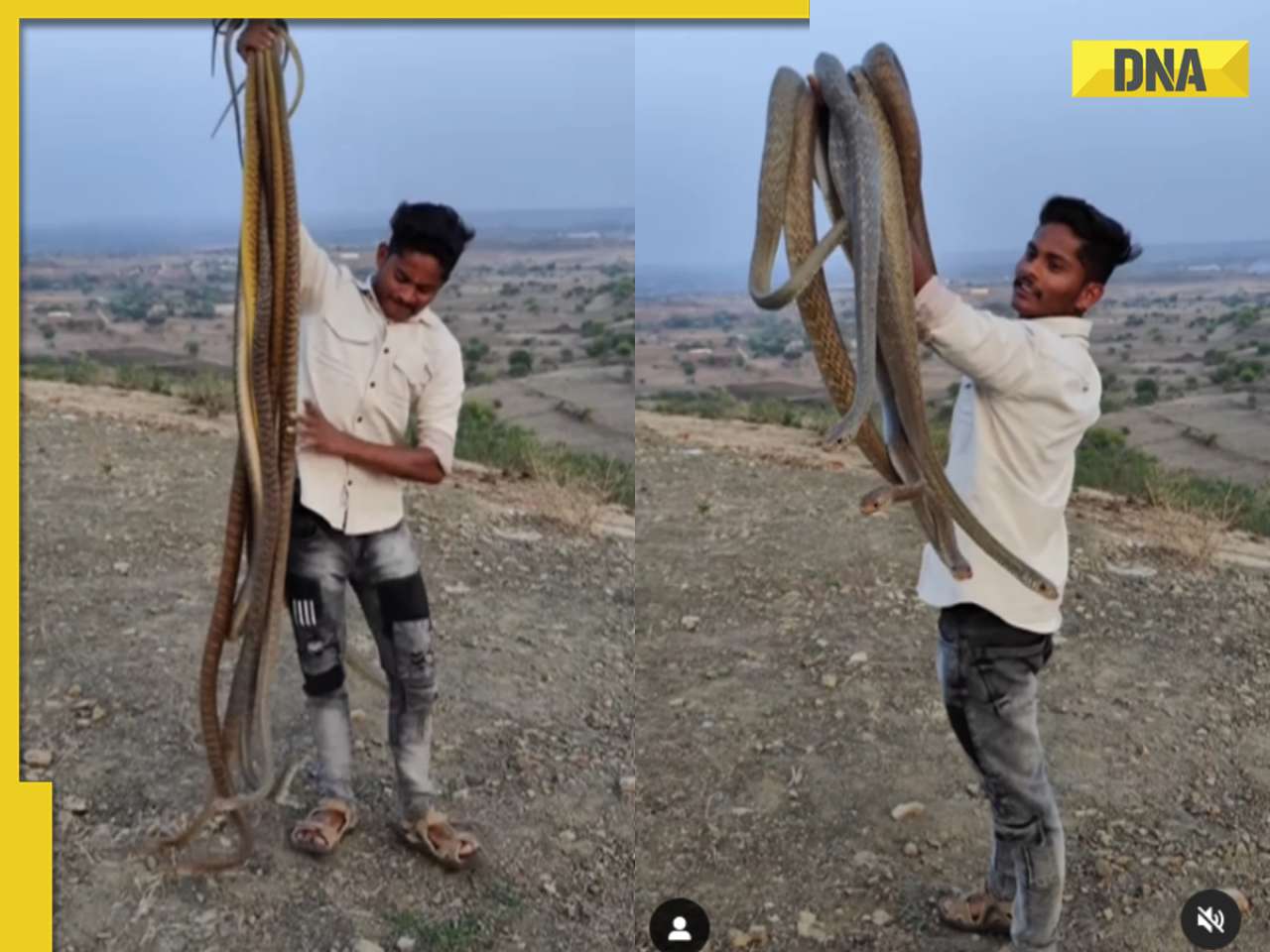

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)

)