As Novartis considers asset sales that could raise $50 billion, investors are worried any cash raised may give the Swiss drugmaker firepower for another unsuccessful megadeal.

As Novartis considers asset sales that could raise $50 billion, investors are worried any cash raised may give the Swiss drugmaker firepower for another unsuccessful megadeal.

Novartis's $52 billion takeover of U.S.-based eye care giant Alcon, completed in 2011, saddled it with a business whose sales and profit have faltered two years running.

Now, Chief Executive Joe Jimenez is reviewing Alcon's surgical devices and contact lens businesses, suggesting they could be valued at $25-$35 billion if he unloads them.

The American CEO is also considering disposal of a roughly $14 billion stake in cross-town rival Roche, as well as his over-the-counter (OTC) drugs venture with GlaxoSmithKline , worth some $10 billion.

Given Alcon missteps, however, investors are wary about arming Novartis with a pile of cash, for fear managers eager to refocus on cancer drugs as they address a sales hit from patent expiries might blunder into a big takeover.

"We would applaud selling those stakes, generally," said Stephen Anness of Invesco Perpetual, Novartis's 23rd largest shareholder, according to Thomson Reuters data.

"But what do you do with that money?" Anness said. "I would be very cautious about selling stakes...in things to raise a war-chest to go and do a massive deal, only for that deal to go and be another poor deal."

To be sure, Jimenez has said Novartis's M&A focus remains on smaller transactions, including lower-risk drug licensing deals, ranging up to $5 billion.

Still, Jimenez has not dismissed the notion of a larger transaction. He suggested last year the Roche stake - amassed during former chairman and CEO Daniel Vasella's unrequited merger aspirations two decades ago - could be sold once another, potentially more significant transaction is lined up to absorb the proceeds.

"We're always monitoring what's going on but have not changed our position regarding our M&A strategy or potential disposals," Novartis spokesman Michael Willi told Reuters.

PORTFOLIO HOLES

Novartis, which is holding a two-day investor event in Boston on Tuesday and Wednesday, has portfolio holes a major deal could help fill.

Where rivals including Roche, Merck and Bristol-Myers Squibb have immuno-oncology drugs (I-O) on the market for a range of cancers, Novartis has only investigational molecules in this hot new therapy area.

Vas Narasimhan, Novartis's drug development chief, could be tempted to look outside the company, some analysts said, especially as competitors including AstraZeneca near approval for their own I-O molecules.

"We believe that Novartis may be pushed to liquidate assets in order to finance acquisitions in pharma," said Michael Leuchten, a UBS analyst.

Speculation that Novartis might buy AstraZeneca sparked a brief jump in the British company's stock last year. There has also been talk of its interest in Bristol-Myers.

PUT OPTION

For its OTC joint venture with GSK that emerged out of their 2014 asset swap, Novartis faces a March 2018 deadline to exercise its put option for its 36.5 percent stake.

People familiar with GSK's thinking confirmed the British group would be a willing buyer of the stake, which added $234 million to Novartis's profit last year.

Alcon, whose eye drugs portfolio was moved into Novartis's main pharmaceuticals unit last year, has been trimmed to include surgical equipment for conditions like cataracts as well as contact lenses and solutions.

When Jimenez began his strategic review this year, he said "all options were on the table". Sales have fallen nine quarters, necessitating a costly programme to arrest the fall.

Even Vasella, who bought Alcon as he sought to build up a European healthcare giant akin to Johnson & Johnson, now acknowledges the transaction was a mistake.

Alcon's problems have coincided not only with the patent expiration of its blockbuster cancer drug Gleevec but also with the lacklustre launch of Novartis's new heart failure medicine Entresto, which in 2016 missed sales expectations.

Like Alcon, Entresto has forced the company to step up marketing investments.

A fund manager among Novartis's top-60 investors said the Alcon and Entresto stumbles raise red flags about managers' ability to tackle business challenges like a big takeover.

"A big deal might solve some of their issues, but personally I would prefer to see them doing smaller acquisitions," the investor said. "A cash mountain of $50 billion would definitely make me nervous." (Additional reporting by Simon Jessop and Ben Hirschler in London; editing by Anna Willard)

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

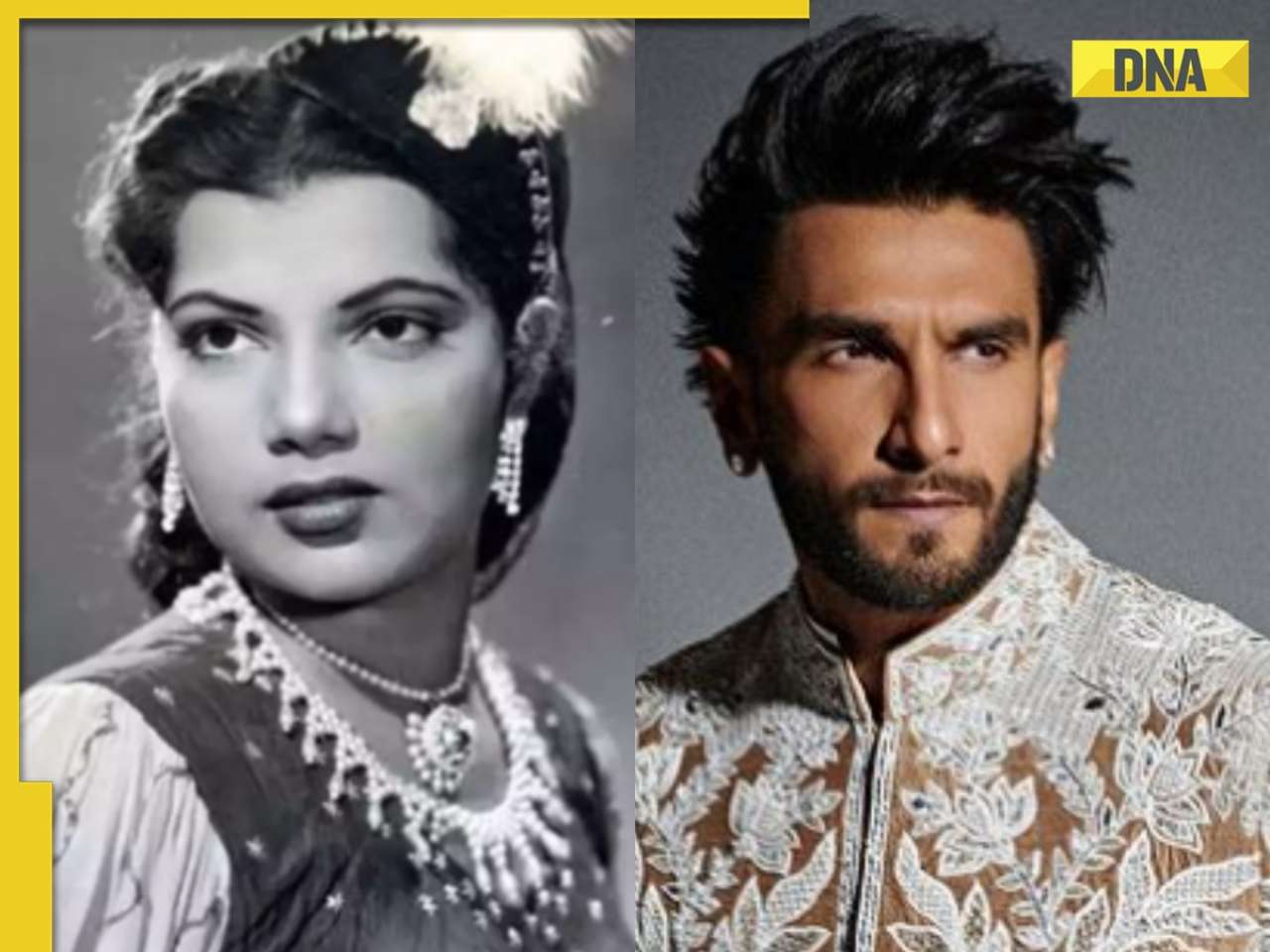

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)