Besides worries of GST collection falling short of target, reduced customs and VAT on petro products may further strain fiscal situation

The below-par goods and services tax (GST) revenue collection reported by the government for the first six months of the current fiscal may put its carefully calculated fiscal math at risk. The total gross GST revenue collected in September was Rs 94,442 crore and the total during the April to September period was Rs 577,970 crore. When compared with the target of Rs one lakh crore in GST revenue each month, it becomes clear that the shortfall in the first six months in gross revenue is over Rs 22,000 crore. Of course, the government expects some of the shortfall to be made up through higher purchases during the festive season which commences this month. And it has also reiterated that the fiscal deficit target and other milestones for this fiscal (FY19) would be adhered to. But analysts continue to be concerned over the country's fiscal health.

Analysts at brokerage firm IIFL said in a note that GST collections have been weaker than budgeted in the first half of this fiscal, and excluding cess they averaged Rs 88,300 crore per month against the required rate of Rs 100,000 crore.

"While both central and state GST collections are below par, the shortfall is significantly higher for the union government. Also, given the current market conditions, it would be challenging to meet the target of non-debt capital receipts of Rs 92,200 crore. Reducing revenue expenditure would be difficult as fuel subsidy burden is expected to be higher than the budget estimates and curbs on capital expenditure would have a modest impact on the overall spending, which accounts for only about 12% of overall expenditure. Although the government has cut its borrowing plan by Rs 70,000 crore recently, it may need to revise this up sharply if the deficit is higher than estimates," IIFL analysts said.

Further, analysts believe that higher government borrowings may be needed, perhaps closer to the end of the current fiscal year.

But while briefing the media after the latest meeting of the GST Council last week, finance minister Arun Jaitley spoke of the positive trends seen in GST collections this fiscal and also reiterated the government's commitment to remain committed towards the fiscal target. He did not speak of the annual gross GST revenue target for the current fiscal.

Jaitley spoke of the encouraging trend in the deficit in revenue earned by states, which the Centre has to neutralise to zero by the fifth year. This has fallen from 16% in 2017-18 to 13% this year and could be lower still by the fiscal end. He counted out states where revenue was higher than anticipated: Mizoram, Arunachal, Nagaland, Sikkim and Andhra Pradesh. Then, states, where the revenue collection has been marginally lower, are Telangana, Maharashtra, UP, TN, Assam, WB and Rajasthan. Those where the revenue collection has been slightly higher than the target were Gujarat, Haryana, Meghalaya, MP, Jharkhand, Kerala, Tripura and Delhi.

The IIFL analysts said that shortfall in GST collections for Centre is significantly larger than for states. They said the Centre's budget estimates require a monthly collection rate of Rs 54,500 crore but "collections have averaged only Rs 41,500 crore in the first half of this fiscal. This collection rate needs to accelerate sharply to Rs 67,500 crore in the second half for achieving the budget estimates," the analysts added.

So why has there been a month on month shortfall in overall gross GST revenues? Sachin Menon, partner and national head (indirect tax) at KPMG, said that the shortfall can be attributed to multiple reasons such as a series of reductions in GST rates on several goods/services, especially the pruning of the list of articles attracting the 28% rate, lack of compliance by taxpayers, carried forward input credits etc. "The gap between the number of GST registered taxpayers and GST returns filed could be the testimony of non-compliance by taxpayers," he said.

Jaitley mentioned in his briefing that the number of taxpayers registered for GST has increased from 74,61,214 in July 2017 to 94,70,281 in July this year and also spoke of improving tax compliance under the GST regime.

But despite the good news from rising collections in some states and increasing compliance, a negative impact on the fiscal situation due to lower than expected overall GST revenues can still not be ruled out. Bipin Sapra, partner (indirect tax) at EY told DNA Money that "any shortfall in revenues, coupled with the pressure to reduce customs and VAT on petroleum products will further strain the fiscal situation. While expenditure cuts do remain a strong measure to maintain fiscal discipline, better monitoring of GST revenues and a simpler compliance mechanism will augment revenues."

The government's target this fiscal is to reduce the deficit to 3.3% of GDP from 3.53% in the last fiscal. This translates to a fiscal deficit target of Rs 6.24 lakh crore in the current year.

REVENUE CHALLENGE

Rs 5,77,970 cr

Total GST mop-up during April to September

Rs 1L cr

GST revenue target for each month

Rs 94,442 cr

GST revenue collected in September

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

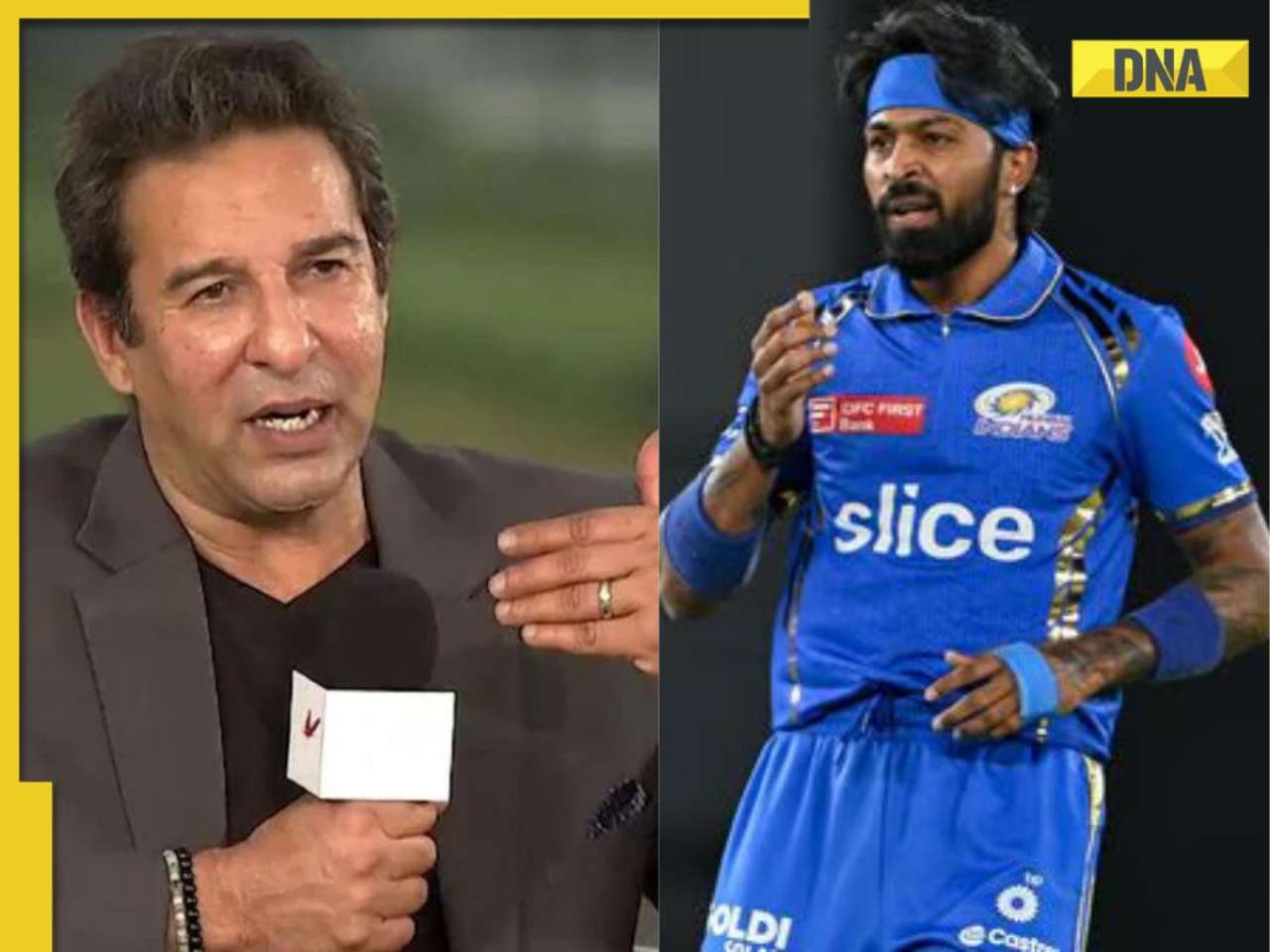

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)

)