Citigroup will be splitting itself into two businesses even as the financial colossus slipped deeper into the red, posting losses for the fifth straight quarter.

Citigroup will be splitting itself into two businesses even as the financial colossus slipped deeper into the red, posting losses for the fifth straight quarter.

The company which posted more than eight-billion-dollar loss for the December quarter said in statement, "Today, we announced that we would separate the company, for management purposes, into two separate businesses Citicorp and Citi Holdings."

Hit by writedowns and losses in securities and banking verticals, higher credit losses and restructuring costs, the Vikram Pandit-led Citi on Friday posted a loss of 8.29 billion dollars in the fourth quarter.

The company had a loss of 9.83 billion dollars in the year-ago period.

Following the split, traditional banking businesses would be held under Citicorp, while other riskier assets would come under Citi Holdings.

The banking major had revenues to the tune of 5.59 billion dollars for the December quarter, against 6.42 billion dollars in the corresponding period a year earlier.

"Results reflect the negative impact from 7.8 billion dollars in revenue marks in securities and banking, a 5.3- billion dollar downward credit value adjustment on derivative positions, excluding monolines."

The firm also had a "2.5 billion dollar of losses in private equity and equity investments, 2 billion dollar of restructuring costs, and a 6 billion dollar net loan loss reserve build," the statement added.

For the fourth quarter, Citi had the highest losses in the North American region to the tune of 11.02 billion dollars, while losses in Asia stood at 371 million dollars and in Europe, Middle East and Africa at 332 million dollars.

"Our results continued to be depressed by an unprecedented dislocation in the capital markets and a weak economy," Pandit said, adding that in 2008, "Citi made significant progress in reducing risk from our balance sheet".

"Our legacy assets declined to approximately 300 billion dollars, over 300 billion dollars of assets are now covered by a loss sharing arrangement, and we added 14 billion dollars to our loan loss reserves," he noted.

For the year, Citi reported a a net loss of 18.72 billion dollars on revenues of 52.8 billion dollars.

The company said since the third quarter of 2008, about 29,000 employees were given the pink slip. Further, nearly 52,000 jobs were cut globally last year.

Pandit said despite "unprecedented turbulence in the global financial markets," Citi employees have conducted themselves with the highest professionalism and integrity.

"... we will emerge from the current environment stronger, smarter, and better positioned to realise the full earnings power of this great franchise," he added.

Meanwhile Citi has received two lifelines from the Federal government worth USD 45 billion in addition to receiving guarantees for toxic assets worth over 300 billion dollars.

On January 13, Citi had said it would combine the retail brokerage operations Smith Barney with the wealth management business of Morgan Stanley. In the joint venture Morgan Stanley Smith Barney, Citi would exchange Smith Barney for a 49 per cent stake in the joint venture Morgan Stanley Smith Barney and a USD 2.7 billion cash payment.

The deal is expected to result in a pre-tax gain of USD 9.5 billion for Citi.

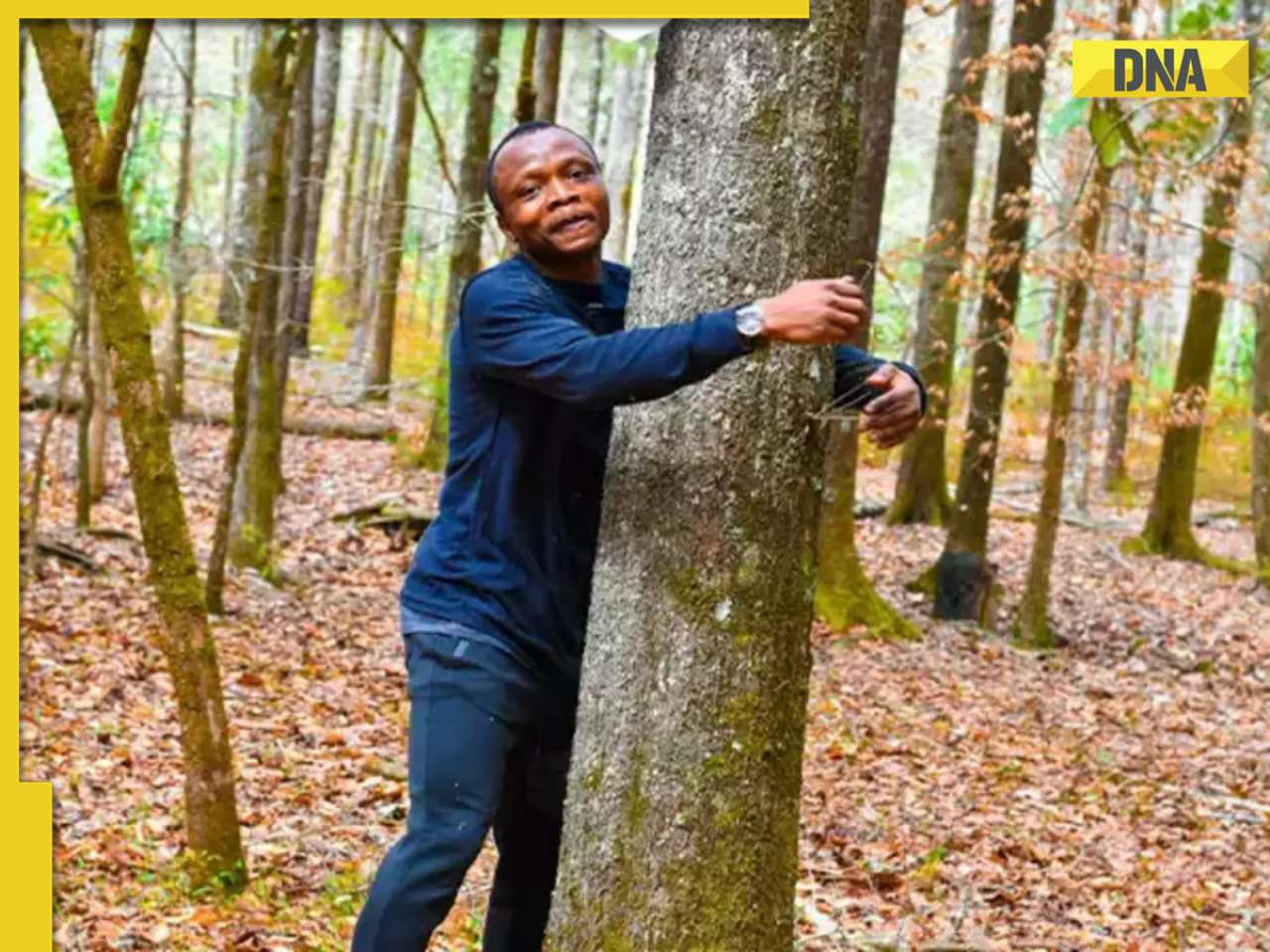

![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax

Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

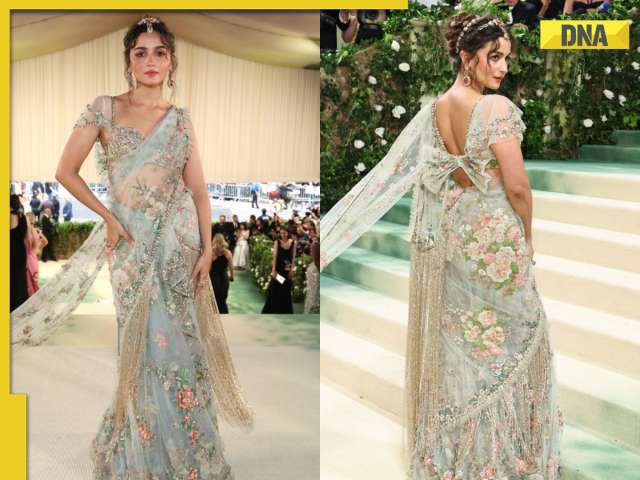

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

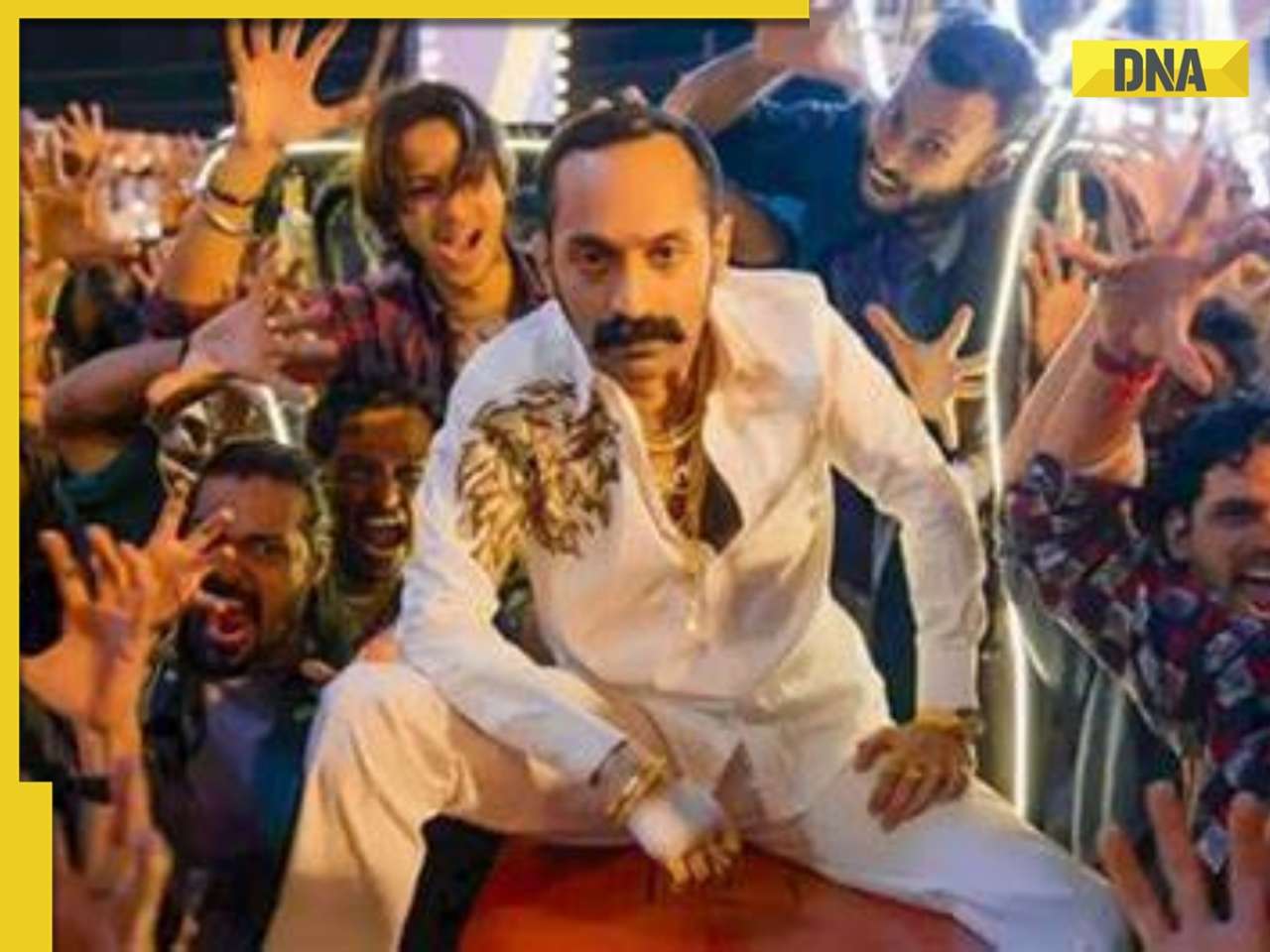

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy

Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy![submenu-img]() Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’

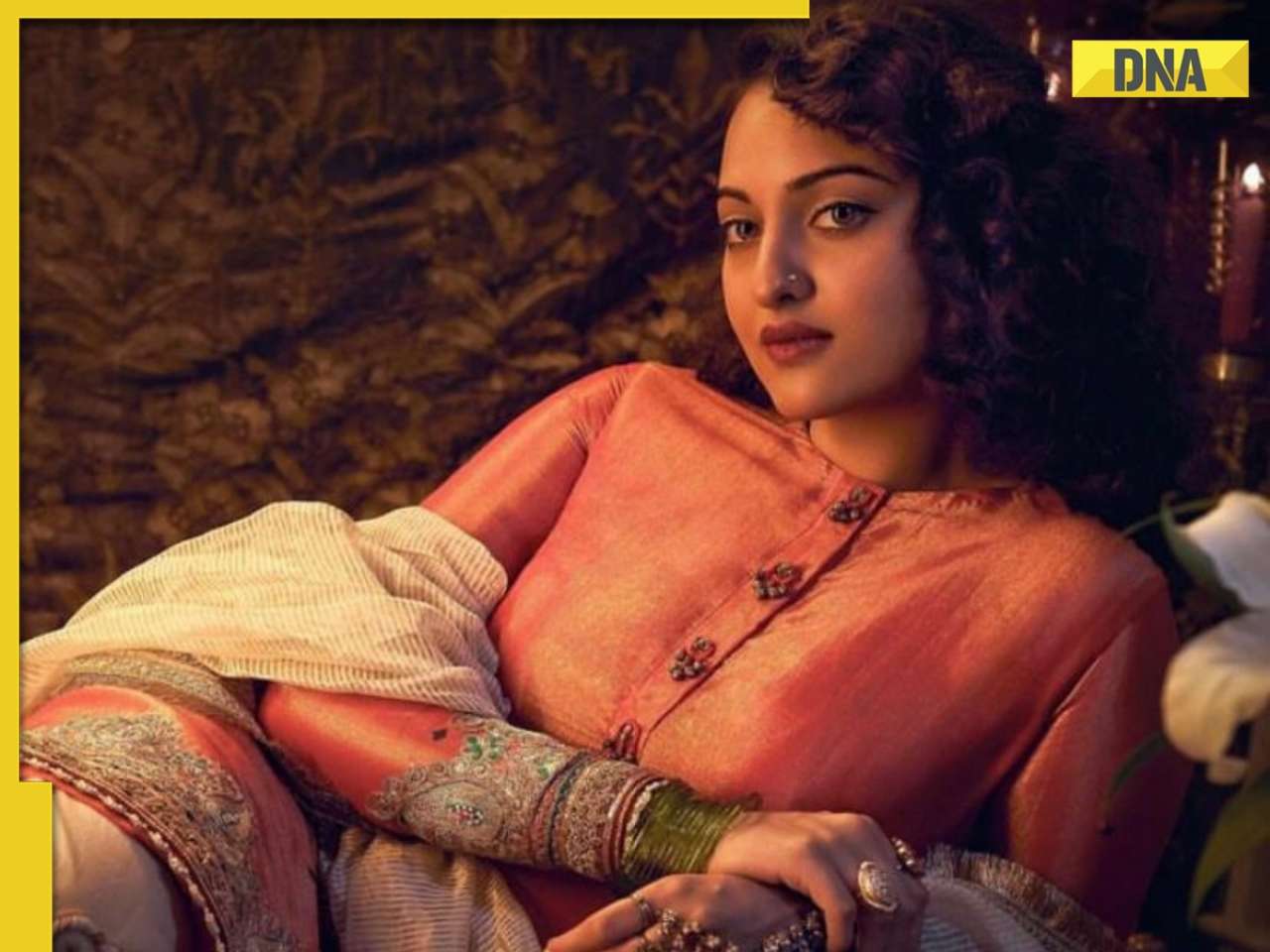

Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’![submenu-img]() Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive

Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive![submenu-img]() IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets

IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets![submenu-img]() PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru

PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru![submenu-img]() Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral

Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() Tiger cub mimics its mother in viral video, internet can't help but go aww

Tiger cub mimics its mother in viral video, internet can't help but go aww![submenu-img]() Octopus crawls across dining table in viral video, internet is shocked

Octopus crawls across dining table in viral video, internet is shocked![submenu-img]() This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

)

)

)

)

)

)