In April, Hinduja Group company IIHL placed the best bid of Rs 9,650 crore in the second round of the auction to acquire Anil Ambani's Reliance Capital.

Anil Ambani, the younger brother of Mukesh Ambani, who was once the richest man in India, is set to sell his company Reliance Capital. The resolution plan for Reliance Capital, the heavily indebted corporation of Anil Ambani, has been accepted by the Reserve Bank of India (RBI). This has paved the way for Hinduja Group company IndusInd International Holdings Limited (IIHL) to acquire the company.

The RBI has granted the corporation a nod of approval to act as Reliance Capital Limited's administrator. After the approval, the way has opened for IIHL, a Hinduja Group company to acquire Reliance Capital.

IIHL placed the highest bid of Rs 9,650 crore in the second round of the auction to acquire Reliance Capital.

Why did RBI dissolve Anil Ambani's Reliance Capital board?

On November 29, 2021, the RBI dissolved the Reliance Capital board because of payment defaults and significant governance problems.

Reliance Capital is a financial services company. It provides personal and business loans, insurance, investments and other financial services. The company went bankrupt in 2021.

Nageswara Rao Y was named administrator by RBI in relation to the company's corporate insolvency resolution procedure (CIRP). The RBI filed for bankruptcy under the IBC against Reliance Capital, the third-biggest NBFC company in the country. The central bank later filed an application in the Mumbai bench of the National Company Law Tribunal to initiate CIRP against the company.

Hinduja Group will be able to increase its footprint in the Indian financial services industry thanks to the acquisition. The group already owns a number of Indian financial services firms, such as Hinduja Bank, Hinduja AMC, and Hinduja Life.

Reliance Capital owns roughly twenty financial services firms. These consist of an ARC, insurance, and securities broking. With an offer of Rs 8,640 crore, Torrent Investment had placed the highest bid in the initial round. Reliance Capital informed its investors in September 2021 that the company owed over Rs 40,000 crore in debt.

Anil Ambani's company went through huge losses from its value being Rs 93,851 crore in 2018 to the man himself declaring bankrupt a few years ago. Lenders are expected to get Rs 10,000 crore after the sale of the company.

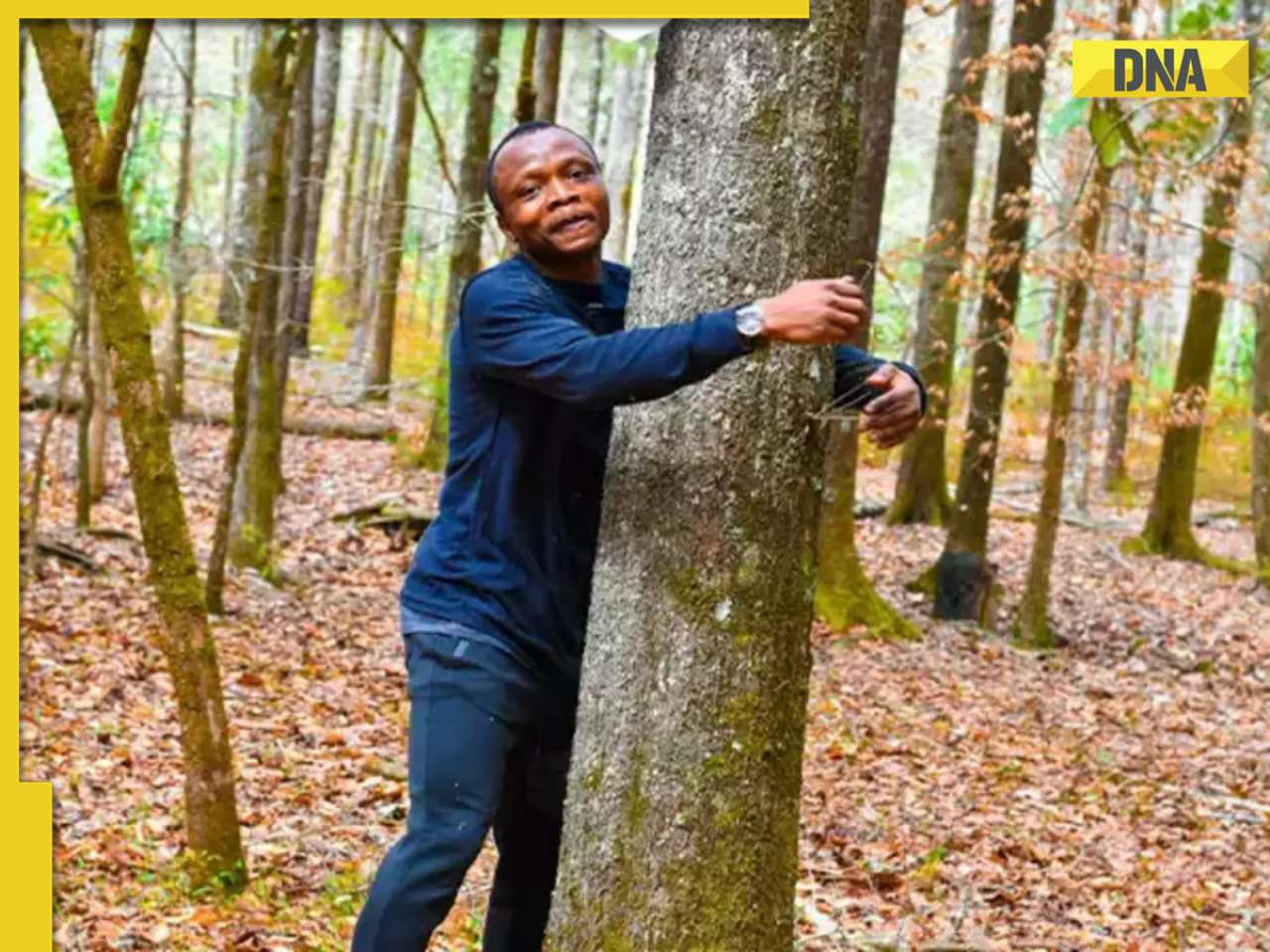

![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax

Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy

Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy![submenu-img]() Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’

Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’![submenu-img]() Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive

Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive![submenu-img]() IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets

IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets![submenu-img]() PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru

PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru![submenu-img]() Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral

Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() Tiger cub mimics its mother in viral video, internet can't help but go aww

Tiger cub mimics its mother in viral video, internet can't help but go aww![submenu-img]() Octopus crawls across dining table in viral video, internet is shocked

Octopus crawls across dining table in viral video, internet is shocked![submenu-img]() This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

)

)

)

)

)

)

)