Insurance must be projected as a contingency to ensure peace of mind from unforeseen risk, which could lead to financial burdens in the future

Have you ever sat down with your children to ask - what if we were to lose our home or a car in a natural calamity? What would they do if you were to fall sick and become incapacitated?

It is important to be prepared for the risk and uncertainties and importantly educate our dependent children for any such eventualities. The most natural solution is covering risks by insurance, with an appropriate insurance cover.

Many personal finance experts consider it to be a necessity to impart the basics of insurance to those who are dependent on the insured – a task easier said than done – since most of them would be young children or early teenagers, unexposed to the financial jargon. Hence, here are few tips to make them understand the need for insurance in our lives.

The fundamental concept of spreading the risk: While explaining the basics of insurance, focus on how insurance spreads the risk around a group of people, by pooling their money collected in the form of premiums – or simply put – introduce it as a teamwork. As a concept, insurance must be projected as a contingency to ensure peace of mind from unforeseen risk, which could lead to financial burdens in the future.

Give consequential perspectives: It may not be easy for young children to grasp the concept of Insurance, and hence they need to be given rain check scenarios across insurance options such as home insurance, health insurance and auto insurance to understand the need for protection. For example, health insurance takes care of not only the timely hospitalisation and treatment of family members but also leaves no burden on family earnings (or savings) since the insurance pays for the hospital bills.

In case of a home and asset insurance, children may be asked to imagine a scenario – in which, a natural calamity makes them lose their homes along with all their belongings – hence the need to insure everything that they have to ensure continuity in life. Insurance allows a family to cushion the blow of an inconvenient or catastrophic event for a moderate sum.

Being exposed to the media, children are smart to appreciate implications of a loss of something dear to them. Thus, health insurance which is critical for the entire family must be introduced as vital to keeping them happy and healthy without troubling their regular life. Automobiles are popular among children and hence, it is easy to make them understand the auto insurance which maintains it in shape and efficiency. While explaining the need for insurance, parents need to use imaginative and chosen words so that the young dependents may realise the critical aspects of insurance.

Help them gauge the real value of every asset: Children would understand the true value of a car or a house only if you can spell it proportional to your salary or something that they cherish. Let them know the price tag and how it was acquired – through an expensive loan or spending out of savings. Most importantly, tell them how valuable it is to the entire family, especially to you and that you could hardly afford another one – if it is damaged. Thus, insurance can help you to regain the asset without paying the high cost.

Make them realise a disaster can happen to anyone: They may have known of or watched catastrophic events such as hurricane, tsunami, flood or earthquake in other geographies, but they must realise that a disaster -natural or otherwise – is a possibility in their lifetimes and they must protect themselves as well as their assets through insurance. An example is an accident on the road in which your vehicle can be subject to a mishap by the fault of someone else or a natural disaster. Similarly, explain to them that no one is immune to illnesses or death.

Given their high exposure to information today, children are maturing faster than their previous generations. Besides instilling good values and manners, they need to be given basic lessons in personal finance; save for the rainy day, protect their assets by insurance, create a good credit score by fulfilling obligations on time and spreading your risk through an insurance cover is the smartest lesson of all.

CREATING AWARENESS

- Insurance must be projected as a contingency to ensure peace of mind from unforeseen risk, which could lead to financial burdens in the future.

- In case of a home and asset insurance, children may be asked to imagine a scenario – in which, a natural calamity makes them lose their homes along with all their belongings.

- Such ways will help them understand the need to insure everything and remain shielded in money matters in continuity

The writer is executive director, HDFC ERGO General Insurance

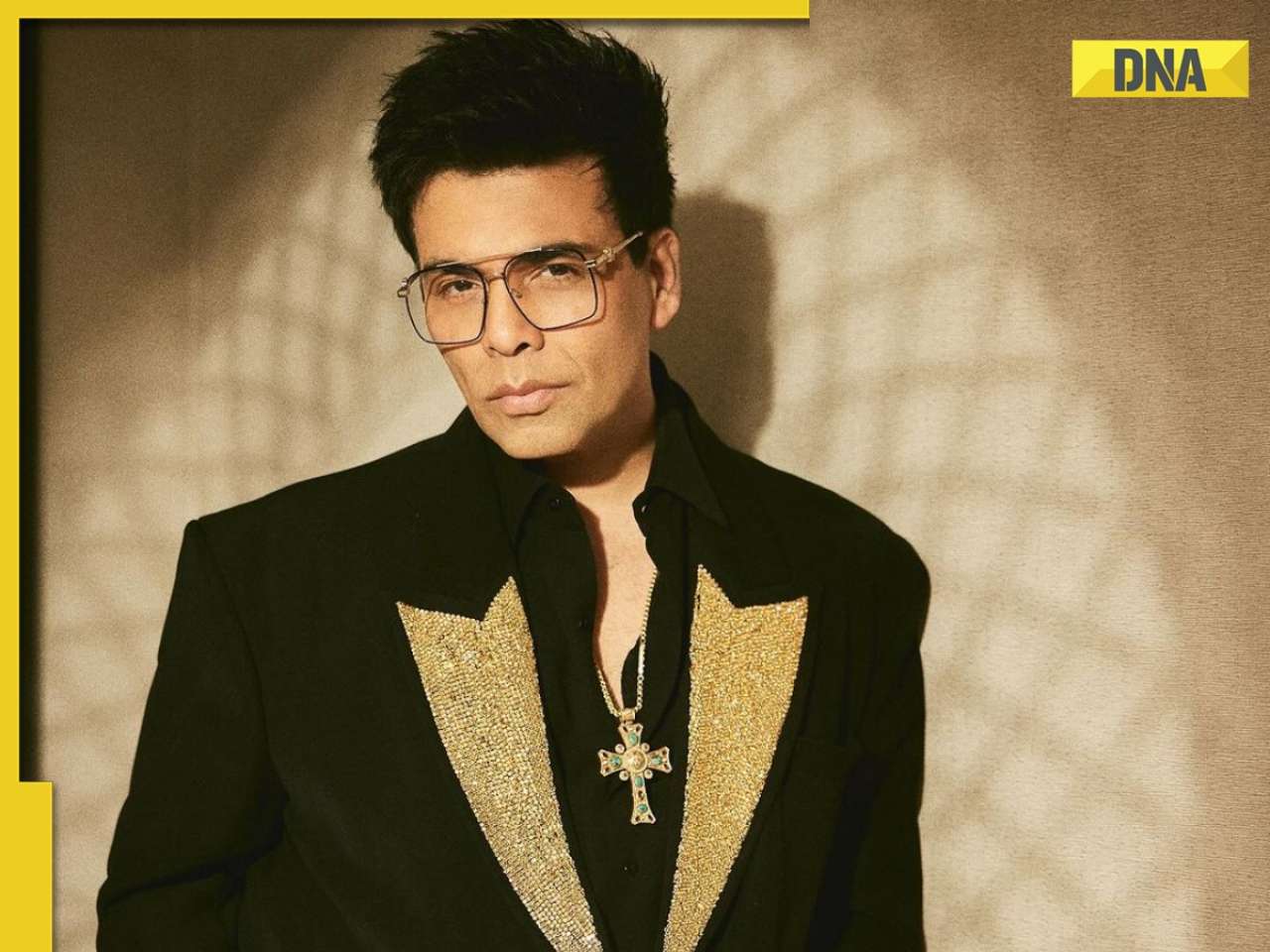

![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() Indian government issues warning for Google users, sensitive information can be leaked if…

Indian government issues warning for Google users, sensitive information can be leaked if…![submenu-img]() Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report

Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report![submenu-img]() Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…

Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…![submenu-img]() Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…

Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

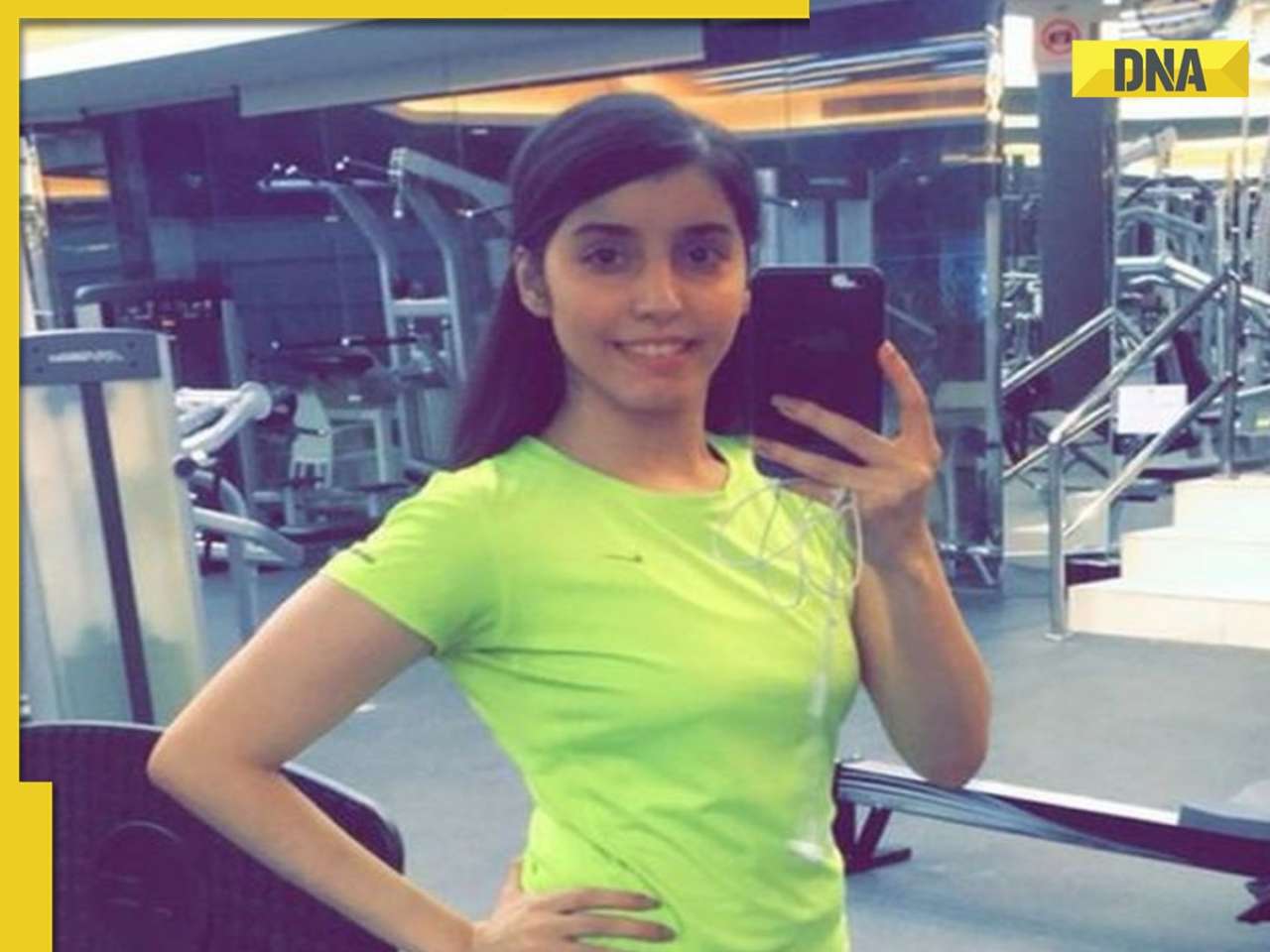

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...

This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...![submenu-img]() Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'

Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'![submenu-img]() Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...

Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...![submenu-img]() Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...

Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....

ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....![submenu-img]() IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs

IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs![submenu-img]() IPL 2024: Big blow to CSK as star pacer returns home due to...

IPL 2024: Big blow to CSK as star pacer returns home due to...![submenu-img]() SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer![submenu-img]() Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?

Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?![submenu-img]() In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

)

)

)

)

)

)

)