Good credit scores, given all other parameters, ideal translate into competitive rates and higher sanction limits

Entrepreneurs typically have it tougher from lenders, most of which revolves around unpredictability of work, money etc. However, fundamentals to getting a good score are predictable. Good credit scores, given all other parameters, ideal translate into competitive rates and higher sanction limits. Here is a list to help steer you in the right direction.

Payments

Missed, delayed payments have a direct correlation with a negative impact on scores. Pay dues on time, every time and pay up the promised amount. This translates into racking up a good score. Set reminders for Equated Monthly Installment (EMI) payments, so you don't get mauled by late payments.

Residual credit card debt

The lure of plastic is enormous but accumulated, unpaid overextended credit is extremely detrimental to one's credit score. Hence, pay off your credit card debt, if any. Manage your finances and clear this chunk, if not all at least a sizeable amount. Planning credit card outlays in advance aids tremendously in positive reinforcement. If one has a tendency to max the credit card, adding on cards to your wallet may be unwise.

Credit portfolio

A plethora of unsecured personal loans is often viewed negatively. Diversification of credit is always a positive in the eyes of the credit scoring company. All other customer parameters being equal, it has been observed that customers with a mix of credit, such as education loan, credit card, secured loan, etc, tend to be less risky. Debt is essential but do build up your financial resilience slowly and steadily.

Credit utilisation

Restriction is the panacea. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. A good math to remember is the 30% rule, try to remain within that upper limit in terms of credit utilisation.

Review, monitor your score

It is extremely easy to neglect one's score because it is not one of those "go to" numbers, like a credit card balance or bank balance. Check your score regularly to be in control. It will tell you where you stand currently in the eyes of the lender and if that upsets you, you can always initiate corrective action. It also gives you the power of knowledge when dealing with institutions; you aren't blindsided by less than favourable loan terms.

Joint applicants, co-signed, guaranteed and joint accounts

Missed payments in joint applicants, co-signed, guaranteed accounts are held equally liable for missed payments. Your joint holder's (or the guaranteed individual) negligence could affect your ability to access credit when you need it. Be alert who you guarantee and or co-pilot with, this is a situation where you could suffer for no fault of your own

Restrain credit hoarding behaviour

Sustained hankering for credit concerns lenders who then may see you as reckless. Multiple loans also can trap one into a vicious unforgiving cycle of late and or non-payment of dues. Be prudent about the loans you want to avail, ensure a judicious mix of secured and unsecured debt. Repay a loan and then move on to the other, this will prevent your score from plummeting.

A poor or average credit score isn't the end of the world. Financial discipline can be initiated at any stage. Also, underwriting as a science, is multi-layered and extends beyond a single parameter.

The writer is founder & CEO Syntellect

![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

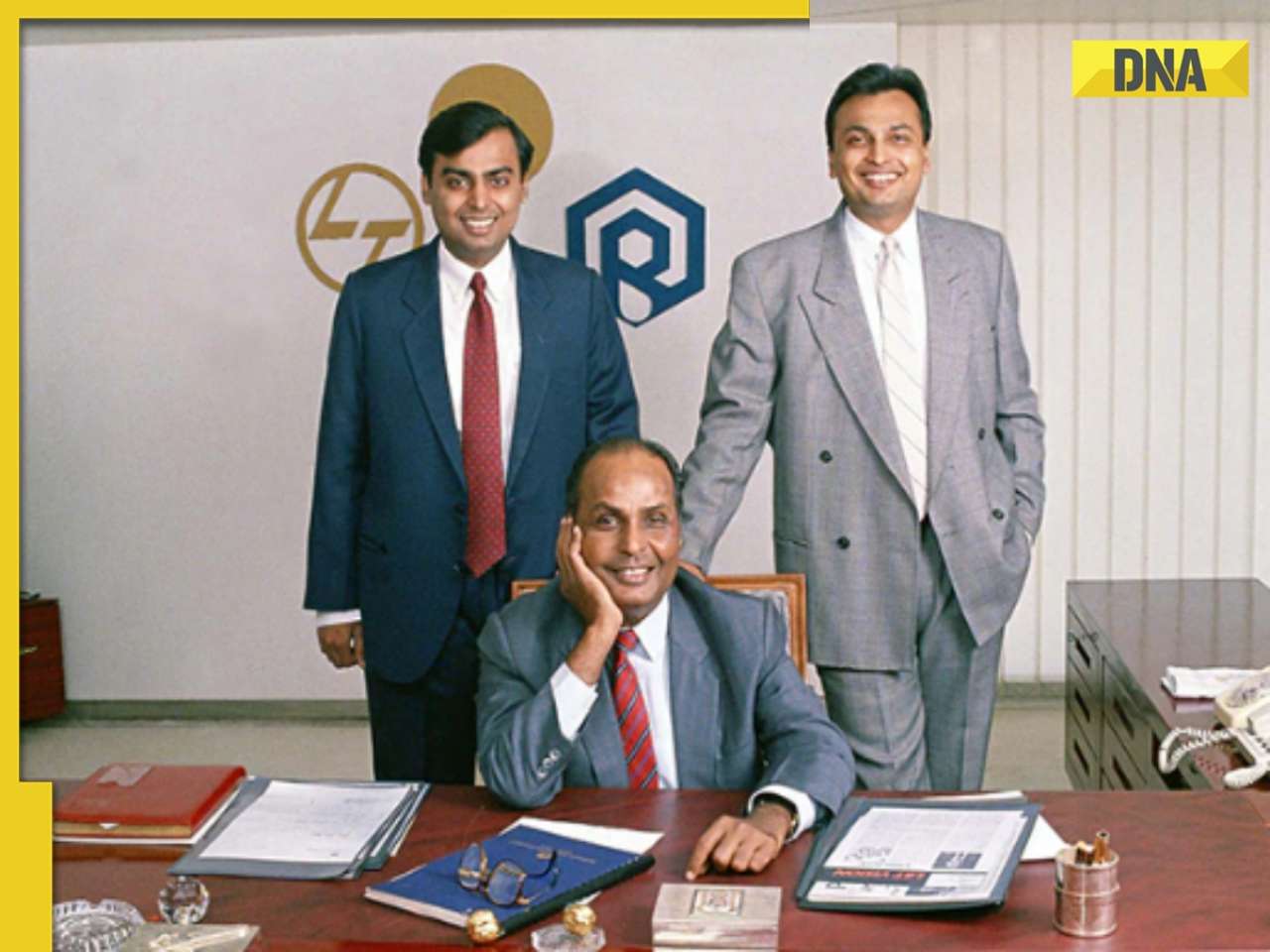

Indian-origin man says Apple CEO Tim Cook pushed him...![submenu-img]() Anil Ambani’s Rs 96500000000 Reliance deal still waiting for green signal? IRDAI nod awaited as deadline nears

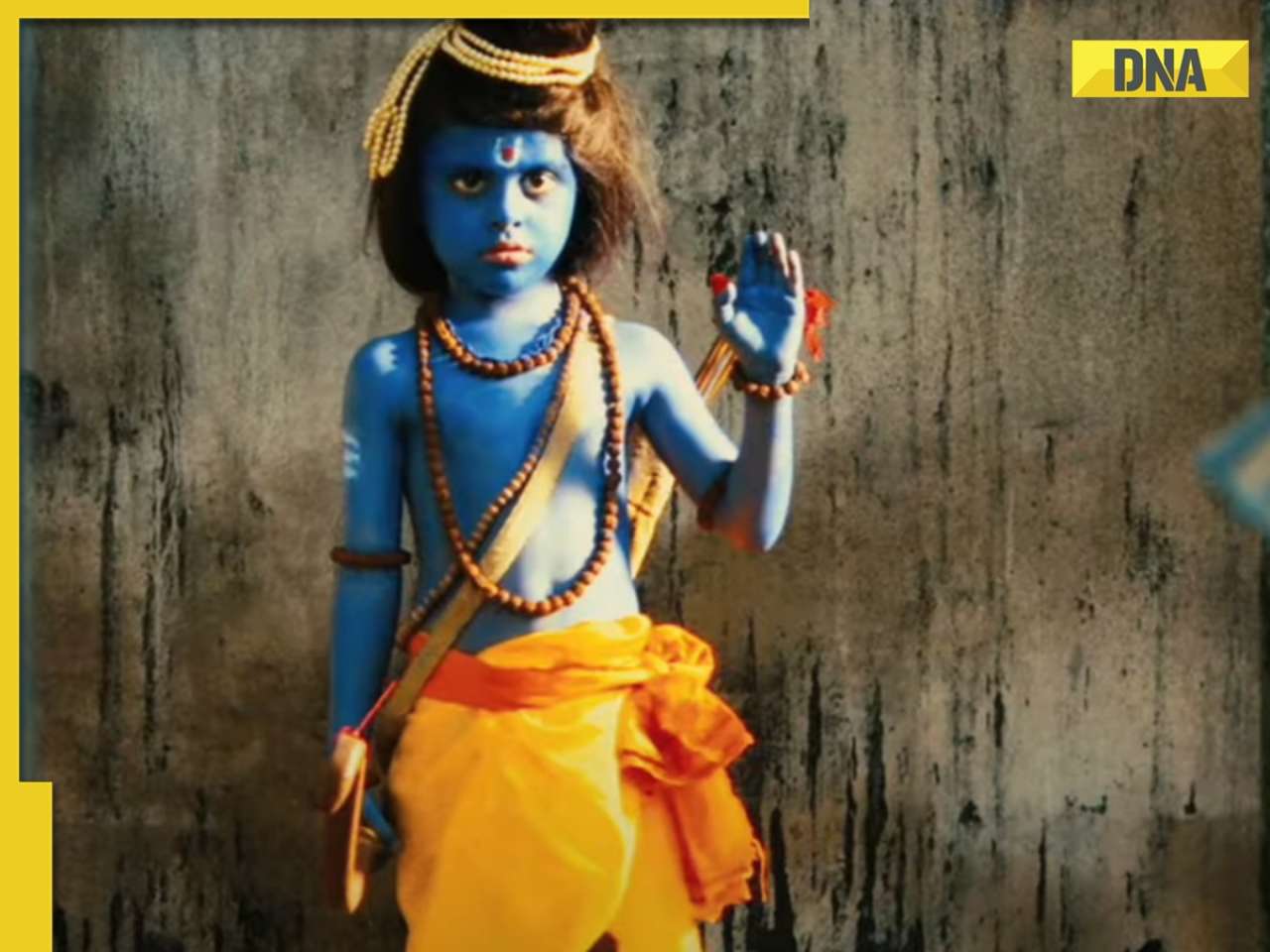

Anil Ambani’s Rs 96500000000 Reliance deal still waiting for green signal? IRDAI nod awaited as deadline nears![submenu-img]() Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina

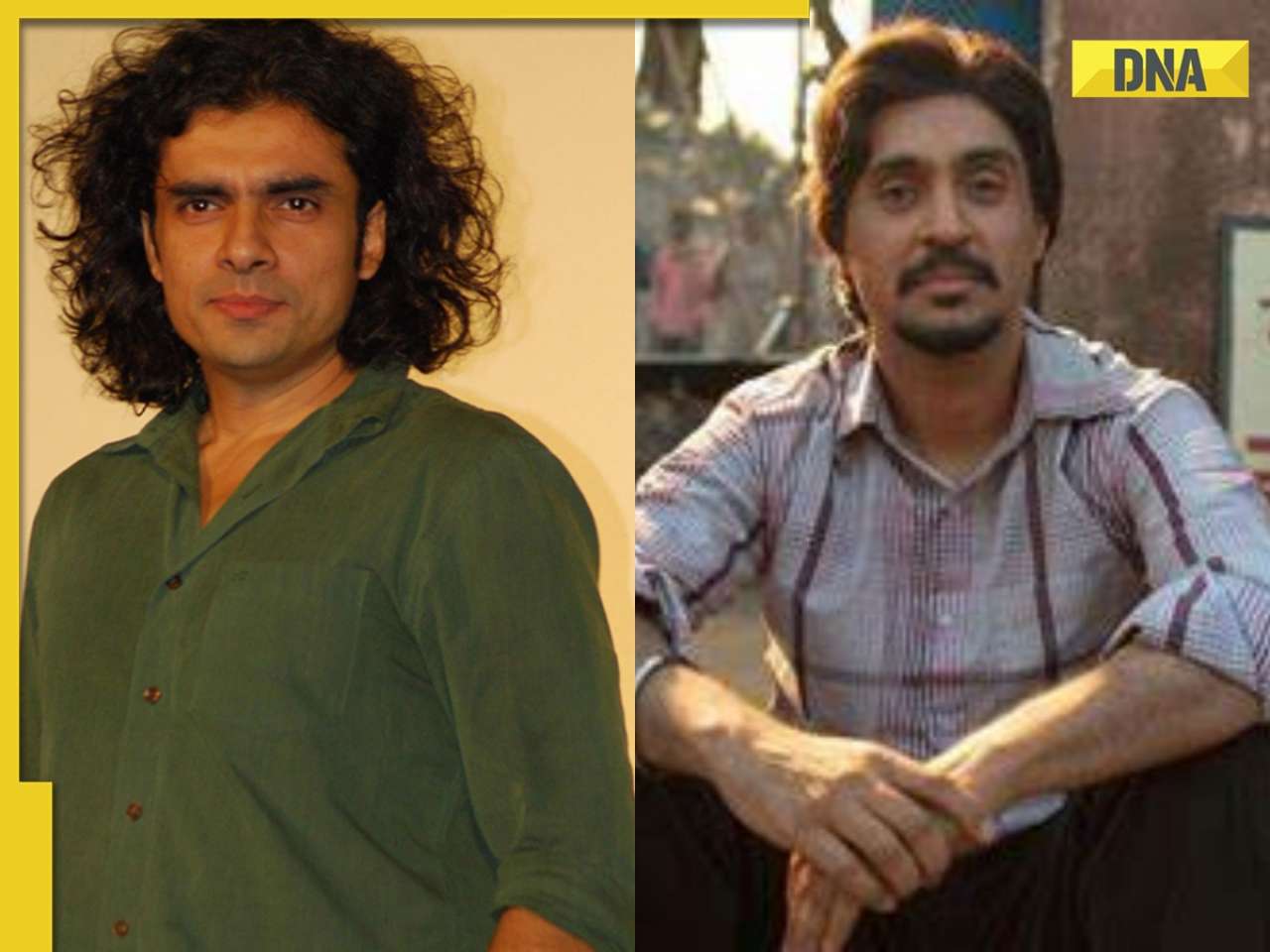

Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina![submenu-img]() Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’

Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’ ![submenu-img]() India's election process is an example for world's democracies: PM Modi after casting his vote

India's election process is an example for world's democracies: PM Modi after casting his vote![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina

Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina![submenu-img]() Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’

Did Diljit Dosanjh cut his hair for Amar Singh Chamkila? Imtiaz Ali reveals ‘he managed to…’ ![submenu-img]() Watch: Arti Singh gets grand welcome at husband Dipak's house with fairy lights and fireworks, fans say '

Watch: Arti Singh gets grand welcome at husband Dipak's house with fairy lights and fireworks, fans say '![submenu-img]() Meet actress, who belongs to family of superstars, quit films after 19 flops, no single hit in 9 years; is still worth…

Meet actress, who belongs to family of superstars, quit films after 19 flops, no single hit in 9 years; is still worth…![submenu-img]() Meet star, TV’s SRK, who used to drink alcohol on set, one mistake ruined career; was jobless for 3 years, is now...

Meet star, TV’s SRK, who used to drink alcohol on set, one mistake ruined career; was jobless for 3 years, is now...![submenu-img]() IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH

IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH![submenu-img]() DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Watch: Team India’s new jersey for T20 World Cup 2024 unveiled

Watch: Team India’s new jersey for T20 World Cup 2024 unveiled![submenu-img]() DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals

DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...![submenu-img]() Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...

Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer

)

)

)

)

)

)

)