How to retrieve online payment sent to the wrong account.

The surge in digital payments has become a prominent trend in India over the past few years. This shift can be attributed to the convenience of transferring funds between bank accounts seamlessly. Gone are the days when individuals had to make multiple trips to the bank. Now, even small shop owners and big traders have embraced digital transactions. However, it is not uncommon for payments to get stuck or end up in the wrong account. Thankfully, there are ways to rectify such errors and retrieve your money.

When faced with the predicament of mistakenly transferring money to the wrong UPI or bank account, it is essential not to panic. There is still hope for recovery even after the funds have been transferred. Follow these steps to retrieve your money:

1. Contact customer care: Reach out to the customer care of the payment platform you used, such as Google Pay, PhonePe, or Paytm UPI. Provide them with all the transaction details and file a complaint. This step is crucial as per the guidelines set by the Reserve Bank of India (RBI). Promptly filing a complaint within 3 working days of the transaction increases your chances of recovering the funds.

2. Lodge a complaint with your bank: In addition to contacting the payment platform's customer care, file a complaint with your bank as well. Inform them about the erroneous transaction and provide the necessary information. The RBI's guidelines state that money can be recovered within 48 hours of lodging a complaint about a wrong payment.

3. UPI wrong payment: If the wrong payment was made through UPI or net banking, the first step is to call 18001201740 and register a complaint. Afterward, visit your bank and complete the form, supplying the required details. In case the bank refuses to assist you, escalate the issue to the Ombudsman of the Reserve Bank of India via bankingombudsman.rbi.org.in.

4. Preserve transaction messages: It is crucial not to delete any transaction messages from your phone. These messages contain the necessary information, including the PPBL number, which is vital during the complaint process. Additionally, you can also file a complaint regarding wrong payments on the website of the National Payments Corporation of India (NPCI). NPCI, established by the Reserve Bank of India, is responsible for providing UPI services.

Always exercise caution before making online payments. Double-check that the account or UPI you are transferring money to is correct to avoid such complications.

By following these steps and promptly taking action, you can increase the chances of recovering funds sent to the wrong account. Stay vigilant during digital transactions and ensure accuracy to prevent unnecessary complications.

Read more: Home loan calculation: Know how much loan to take based on salary and other income

![submenu-img]() Watch: Cristiano Ronaldo in tears as Al-Nassr lose King's Cup final to Al Hilal

Watch: Cristiano Ronaldo in tears as Al-Nassr lose King's Cup final to Al Hilal![submenu-img]() No relief for Delhi CM Arvind Kejriwal, will have to surrender tomorrow

No relief for Delhi CM Arvind Kejriwal, will have to surrender tomorrow![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

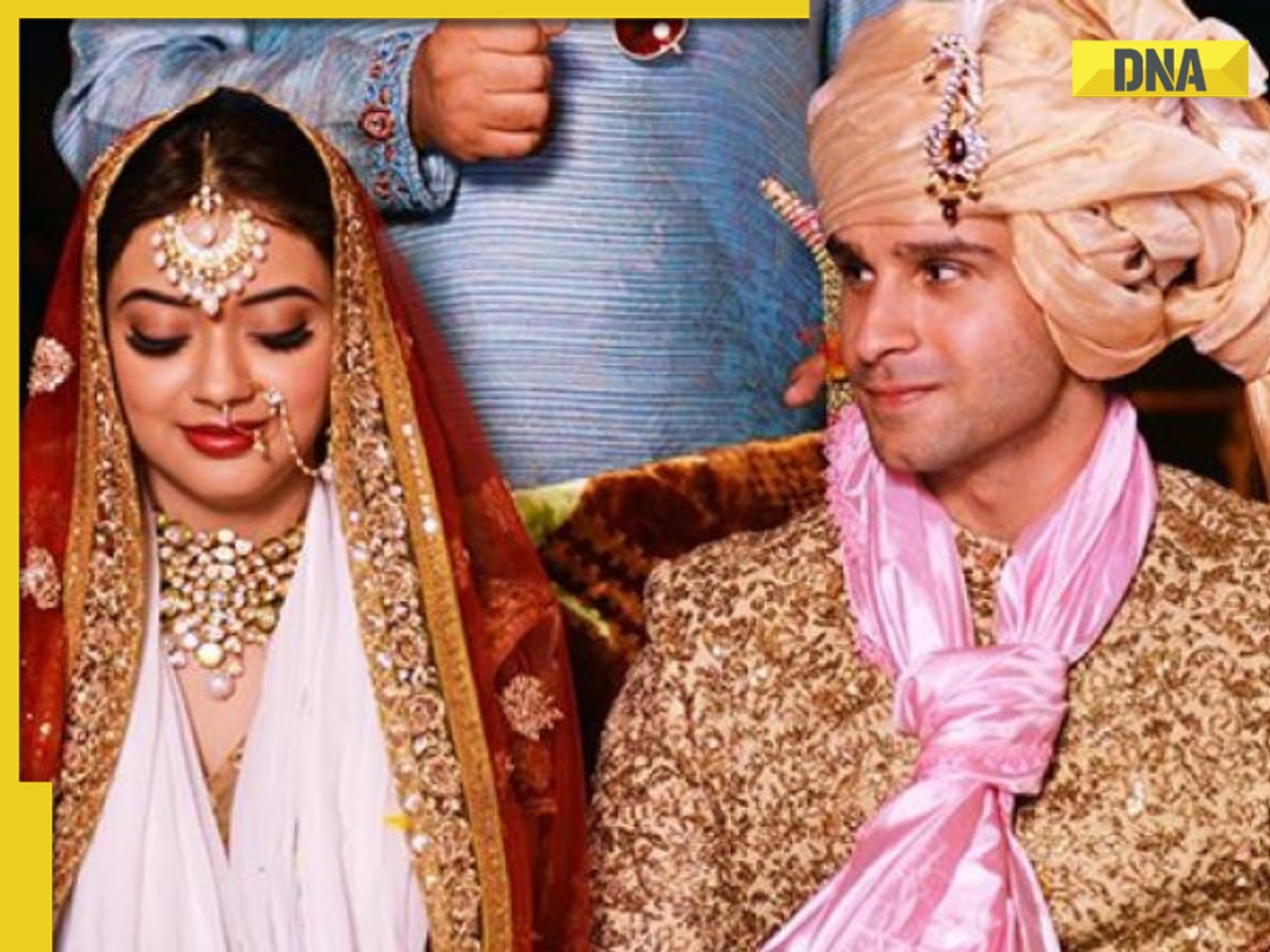

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() How Mukesh Ambani, Nita Ambani celebrated granddaughter Veda's birthday during Anant Ambani-Radhika’s pre-wedding bash

How Mukesh Ambani, Nita Ambani celebrated granddaughter Veda's birthday during Anant Ambani-Radhika’s pre-wedding bash![submenu-img]() Made in Rs 60 lakh, this cult horror film was inspired by director's real ghost encounter, actress disappeared, earned..

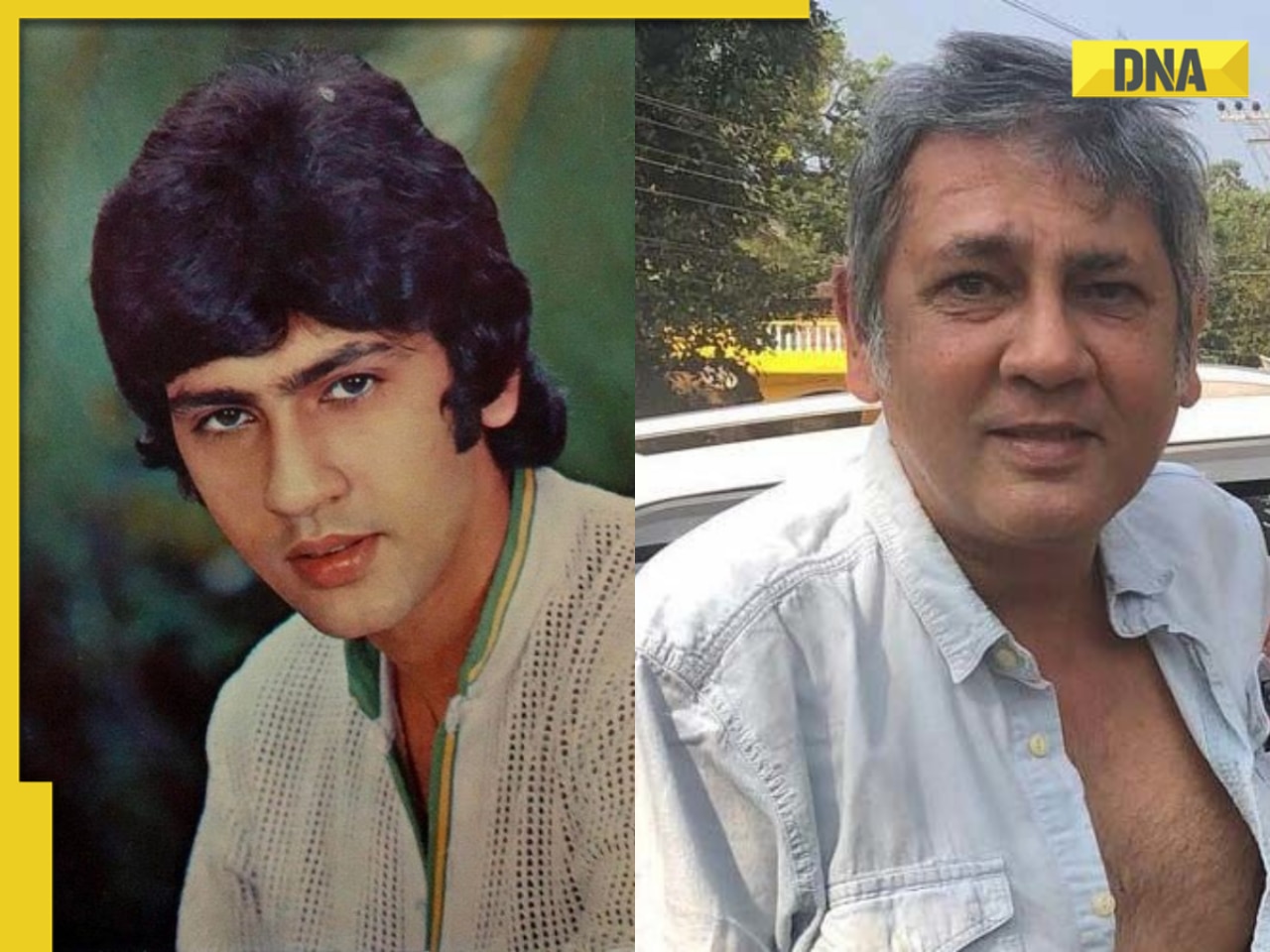

Made in Rs 60 lakh, this cult horror film was inspired by director's real ghost encounter, actress disappeared, earned..![submenu-img]() Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...

Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

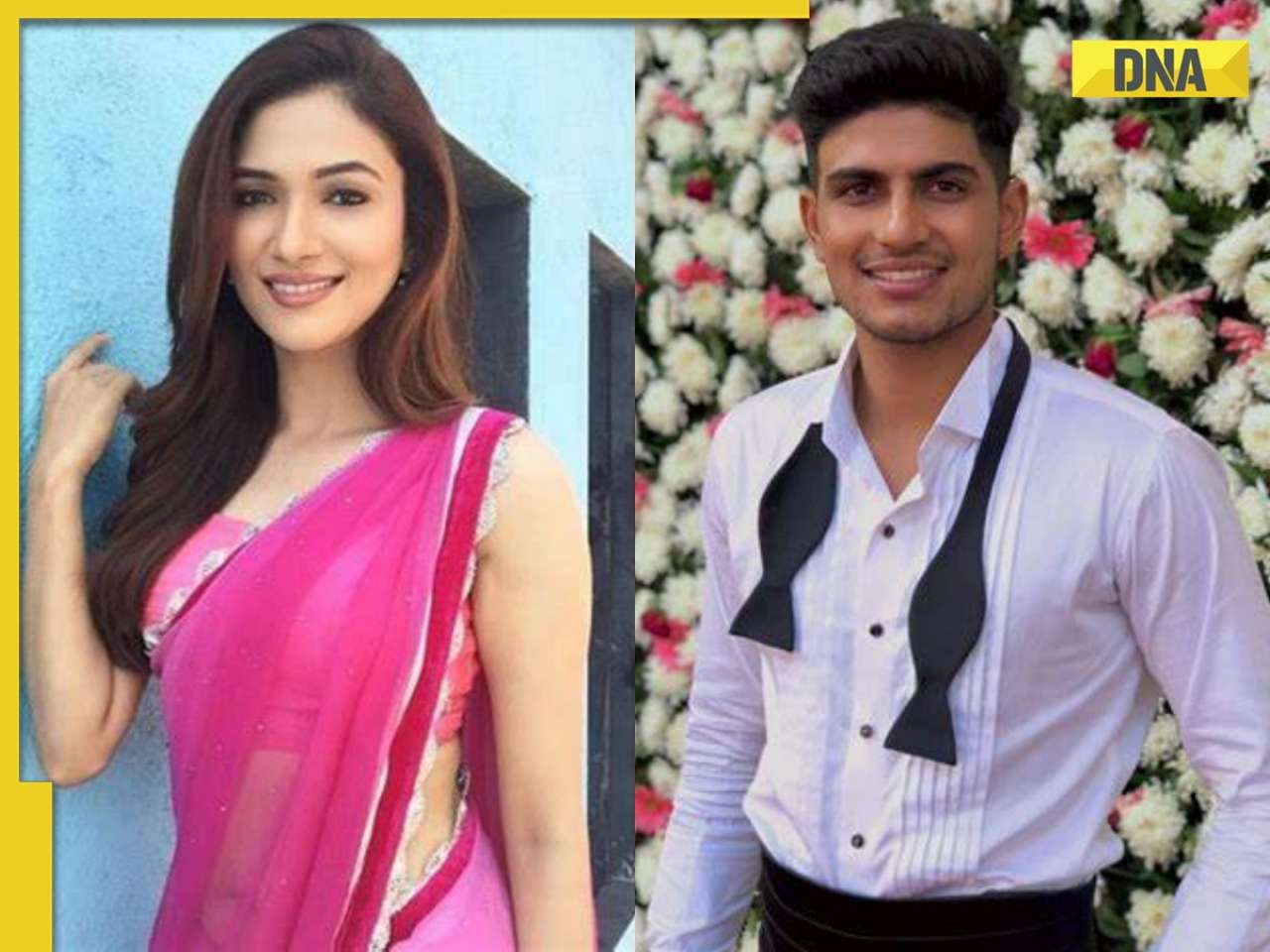

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Made in Rs 60 lakh, this cult horror film was inspired by director's real ghost encounter, actress disappeared, earned..

Made in Rs 60 lakh, this cult horror film was inspired by director's real ghost encounter, actress disappeared, earned..![submenu-img]() Payal Kapadia issues first statement after Cannes win, says government needs to...

Payal Kapadia issues first statement after Cannes win, says government needs to...![submenu-img]() Meet woman who is married to a superstar, never did acting, runs big business, father was millionaire, her husband is..

Meet woman who is married to a superstar, never did acting, runs big business, father was millionaire, her husband is..![submenu-img]() Watch: Katy Perry’s ‘Firework’ performance lights up Anant Ambani-Radhika Merchant’s pre-wedding cruise bash

Watch: Katy Perry’s ‘Firework’ performance lights up Anant Ambani-Radhika Merchant’s pre-wedding cruise bash![submenu-img]() Another plot on Salman Khan's life foiled, police arrest four Lawrence Bishnoi gang members, who planned to...

Another plot on Salman Khan's life foiled, police arrest four Lawrence Bishnoi gang members, who planned to...![submenu-img]() Caught on CCTV: Leopard's jaw-dropping leap over wall to snatch hen stuns internet, watch

Caught on CCTV: Leopard's jaw-dropping leap over wall to snatch hen stuns internet, watch![submenu-img]() NASA warns of strong solar storm with blackouts, likely to hit Earth on…

NASA warns of strong solar storm with blackouts, likely to hit Earth on…![submenu-img]() Nita Ambani nearly missed Anant Ambani, Radhika Merchant's 2nd pre-wedding bash due to....

Nita Ambani nearly missed Anant Ambani, Radhika Merchant's 2nd pre-wedding bash due to....![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch![submenu-img]() Anant Ambani-Radhika Merchant pre-wedding bash: Guru Randhawa offers glimpse of lavish cruise, watch

Anant Ambani-Radhika Merchant pre-wedding bash: Guru Randhawa offers glimpse of lavish cruise, watch

)

)

)

)

)

)

)