There are no tax implications under the pure reverse mortgage schemes as well as long as the property is not sold by any of the parties

Last week, we have discussed the salient features of a reverse mortgage scheme. I feel that unless the tax implications are fully understood, one would not be able to decide whether he should opt for reverse mortgage scheme to supplement his cash flow in retirement and which option to exercise. In this article I wish to discuss the tax implications of all the transactions involved under reverse mortgage scheme in two different options at different stages.

Tax implications for money received from the lender directly

As per the Indian tax laws any surplus realized on "transfer" of a capital assets is treated as capital gain and taxed differently based the nature of the asset and holding period of the asset. Section 47((xvi) of Income Tax act, 1961 defines as to what is a a transfer and includes any sale, relinquishment, exchange, extinguishments of rights etc. of any asset. Since the transaction of mortgaging a property which includes mortgage under the reverse mortgage scheme is not treated as transfer as envisaged by the tax laws, there is no tax liability at the time of mortgaging the house with the bank under this scheme.

Please note that though no tax incidence occurs at the time of mortgaging the house but if and when the house is sold whether by the lender or the senior citizen himself or the legal heirs, the transaction comes within the definition of transfer and is taxed accordingly. It is taxed in the hands of the senior citizen if he is alive and in the hands of legal heirs if the borrower has passed away. Please note that if the borrower or his legal heirs pay up the outstanding balance under the under the scheme, there is not tax liability in such situation, as there is no transfer of house yet.

TAX INCIDENCE

|

- There are no tax implications under the pure reverse mortgage schemes as well as long as the property is not sold by any of the parties

- The senior citizen may opt to buy an annuity from a life insurance company instead of opting to receive money from the lender directly

|

For the money received from lender whether as lump sum or in installments, there is a specific exemption provided under Section 10(43) of the Income Tax Act , 1961 in respect of such receipts.

So there are no tax implications under the pure reverse mortgage schemes as well as long as the property is not sold by any of the parties.

Tax implications under the annuity option from life insurance Company

As discussed in the previous article, the senior citizen may opt to buy an annuity from a life insurance company instead of opting to receive money from the lender directly. Under such situation in consideration of the senior citizen mortgaging the property in favour of the bank, the bank hands over a lump sum to the insurance company. This transaction of handing over the lump sum money to the insurance company does not give rise to any tax liability as this transaction is part of the mortgage transaction and mortgage is not a transfer as per the income tax laws as explained above.

Under the second type reverse mortgage transaction under the scheme, the life insurance company agrees to make periodic payments to the borrower. Such payments by the insurance company are treated as annuity and is treated as income under the Income Tax laws. Such annuity received from a life insurance company is taxed under the head "Income From Other Sources".

Though some amendments were made in the Reverse Mortgage Scheme 2008, in 2013 to provide for exemption for payment of lump sum amount by the lender to the life insurance companies under the scheme, there were no corresponding amendments in Section 10(43) to make the payment of annuity received from life insurance companies as exempt. So the annuity received under this scheme continues to remain taxable in the hands of the senior citizen.

So for the same type of benefit contemplated under the scheme, the tax treatment is different depending on whether you opt for receipt of money from the lender himself or from the life insurance company, which in my opinion is not fair. As the purpose of the reverse mortgage scheme is to help the borrowers supplement their cash flows, it seems unreasonable to extract tax from the hapless senior citizens out of the money which is supposed to help them meet their day today expenses in difficult phase of their life.

The option of taking annuity from life insurance company under this scheme can help the senior citizens continued in flow for their the remaining lifetime, without there being any restriction of 20 years as applicable for pure reverse mortgage schemes, the same needs to be made more attractive for the senior citizens.

Moreover as the scheme has not taken off well, I would urge the government to amend the tax laws to provide for exemption for annuity received from an insurance company under the reverse mortgage scheme.

I am sure the reader are now in a position to understand the tax implications of such a good scheme as Reverse Mortgage Scheme.

The writer is a tax and investments expert

![submenu-img]() This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards

This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards![submenu-img]() SL vs SA T20 World Cup 2024: Predicted playing XIs, live streaming details, weather and pitch report

SL vs SA T20 World Cup 2024: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Amul Milk price hiked by Rs 2 per litre across India, check new rates here

Amul Milk price hiked by Rs 2 per litre across India, check new rates here![submenu-img]() Maldives bans entry of Israeli passport holders in 'solidarity with Palestine'

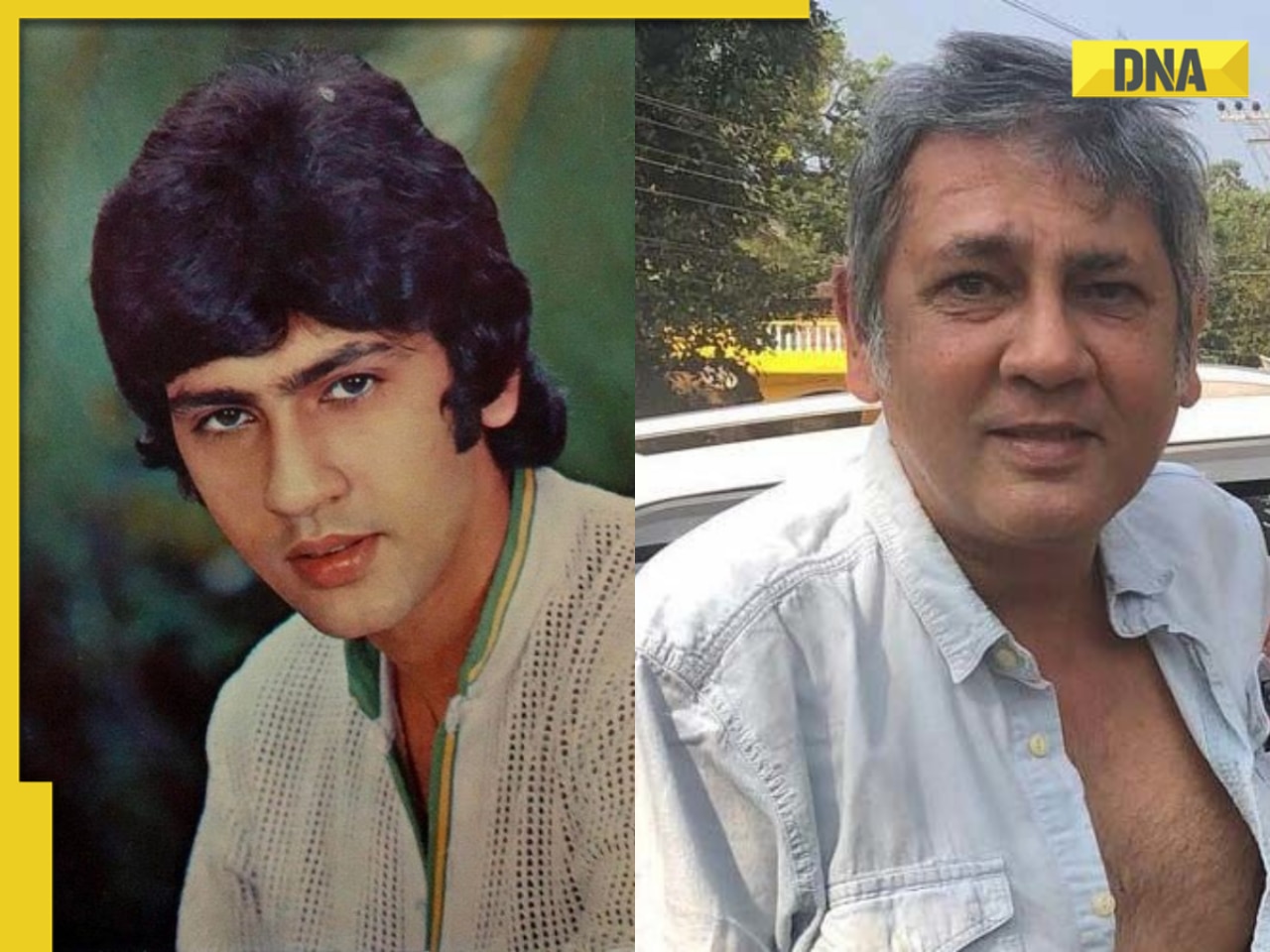

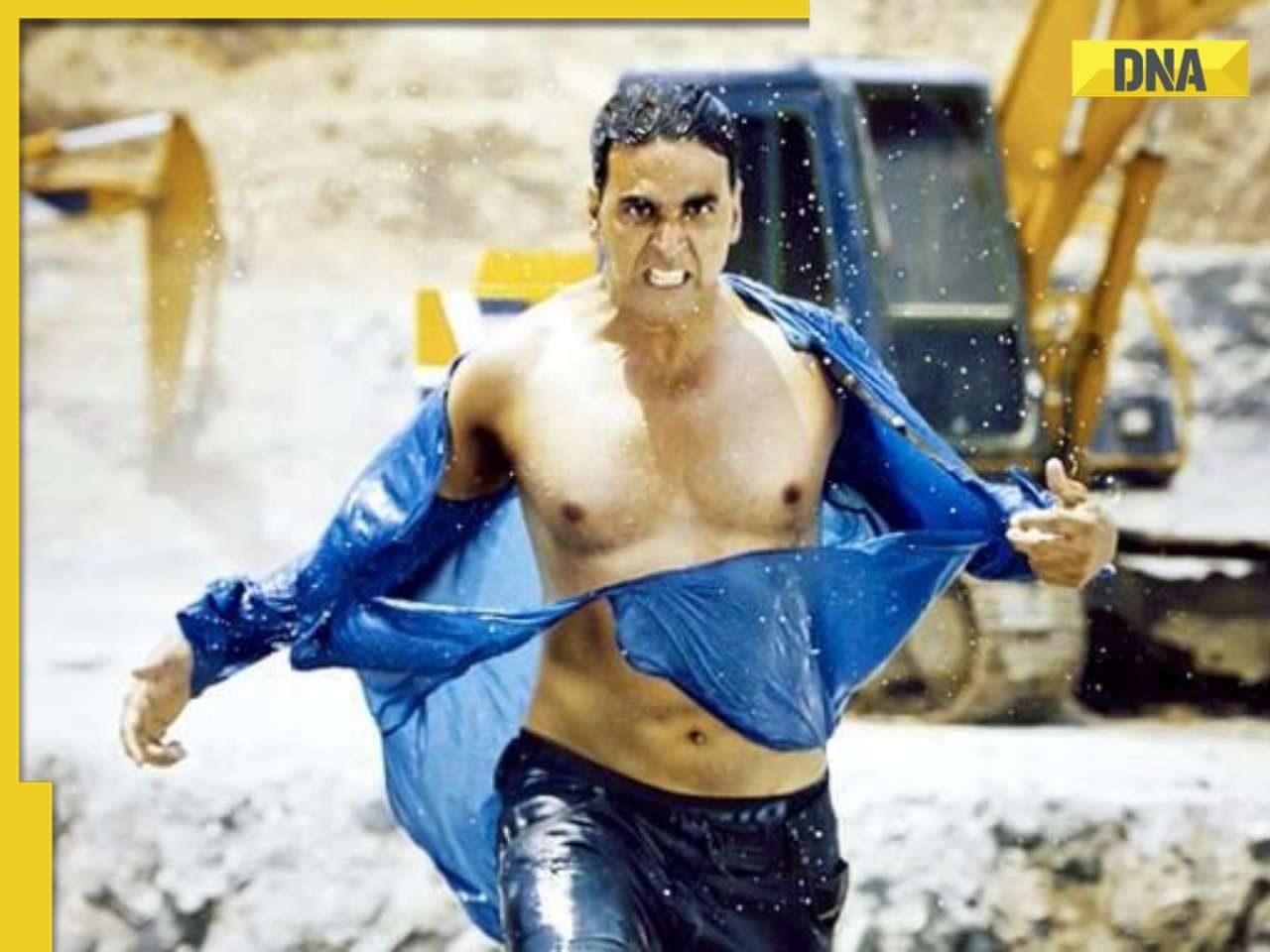

Maldives bans entry of Israeli passport holders in 'solidarity with Palestine'![submenu-img]() Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...

Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...![submenu-img]() Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..

Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..![submenu-img]() Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..

Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..![submenu-img]() Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...

Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...![submenu-img]() Meet woman, one of India’s youngest IAS officers who cracked UPSC in 1st attempt at 22 without coaching, her AIR was...

Meet woman, one of India’s youngest IAS officers who cracked UPSC in 1st attempt at 22 without coaching, her AIR was...![submenu-img]() Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...

Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Inside pics from Anant Ambani-Radhika Merchant's bash: Shah Rukh with new hairstyle, Sid-Kiara's private moment, & more

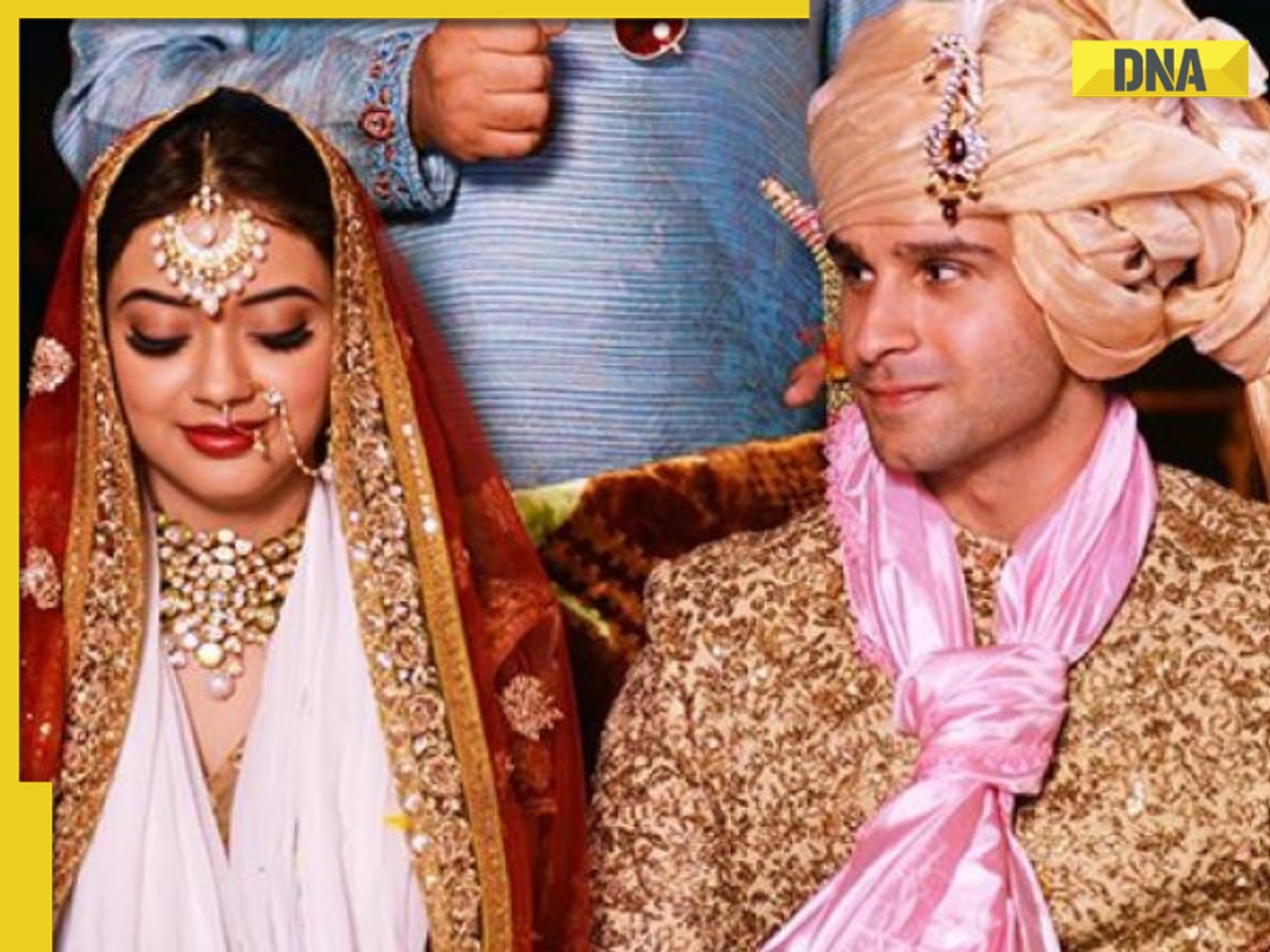

Inside pics from Anant Ambani-Radhika Merchant's bash: Shah Rukh with new hairstyle, Sid-Kiara's private moment, & more![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards

This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards![submenu-img]() Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...

Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...![submenu-img]() Malaika Arora shares cryptic post amid breakup rumours with Arjun Kapoor: 'When they say you can't...'

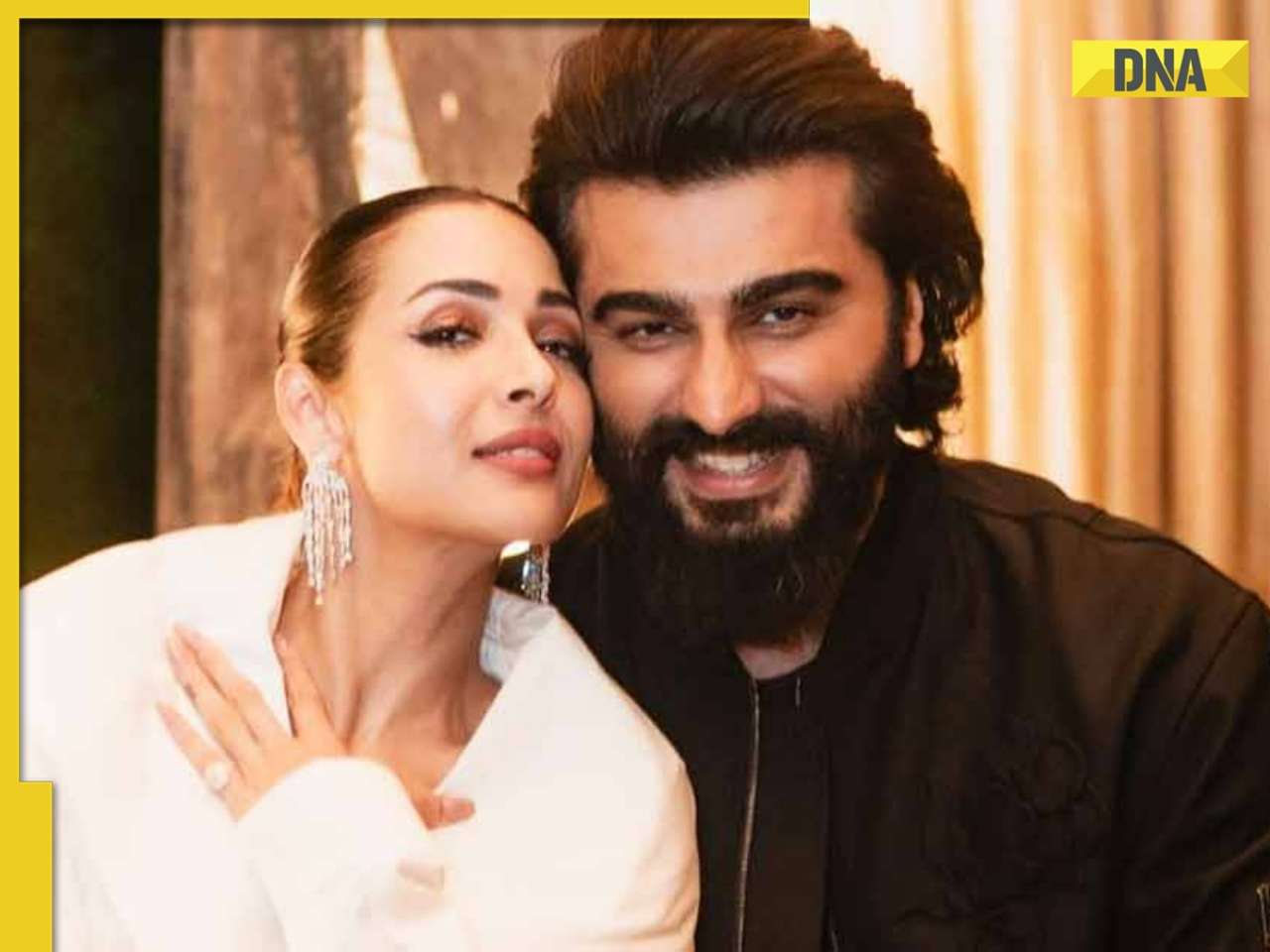

Malaika Arora shares cryptic post amid breakup rumours with Arjun Kapoor: 'When they say you can't...'![submenu-img]() Sanjeeda Shaikh recalls shocking incident when a woman groped her: 'She just touched my breast, ladkiyaan bhi koi...'

Sanjeeda Shaikh recalls shocking incident when a woman groped her: 'She just touched my breast, ladkiyaan bhi koi...'![submenu-img]() Adah Sharma opens up on living in Sushant Singh Rajput's house: 'The place gives me...'

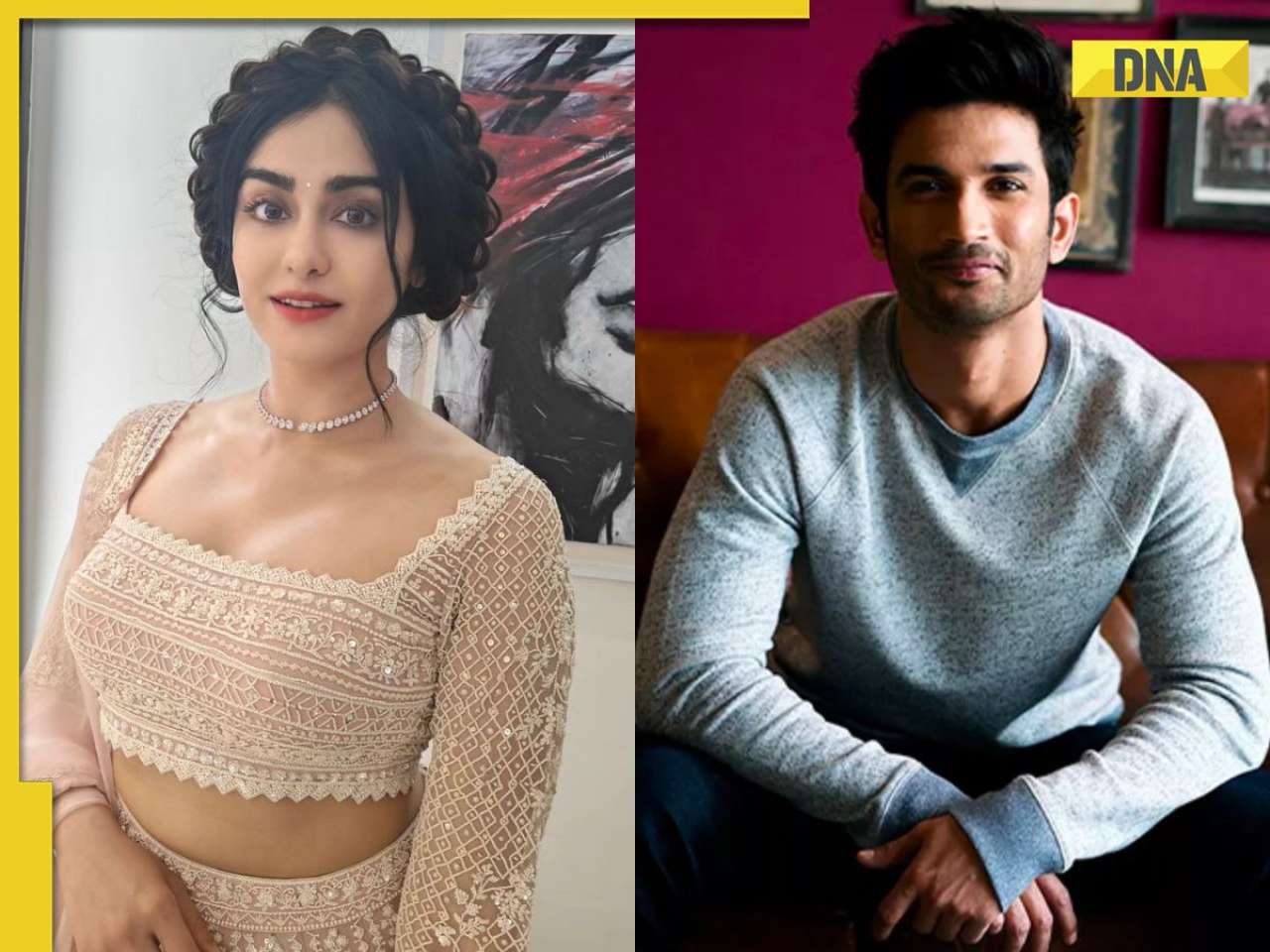

Adah Sharma opens up on living in Sushant Singh Rajput's house: 'The place gives me...'![submenu-img]() Radhika Merchant, Anant Ambani's first look from their 2nd pre-wedding in Italy goes viral

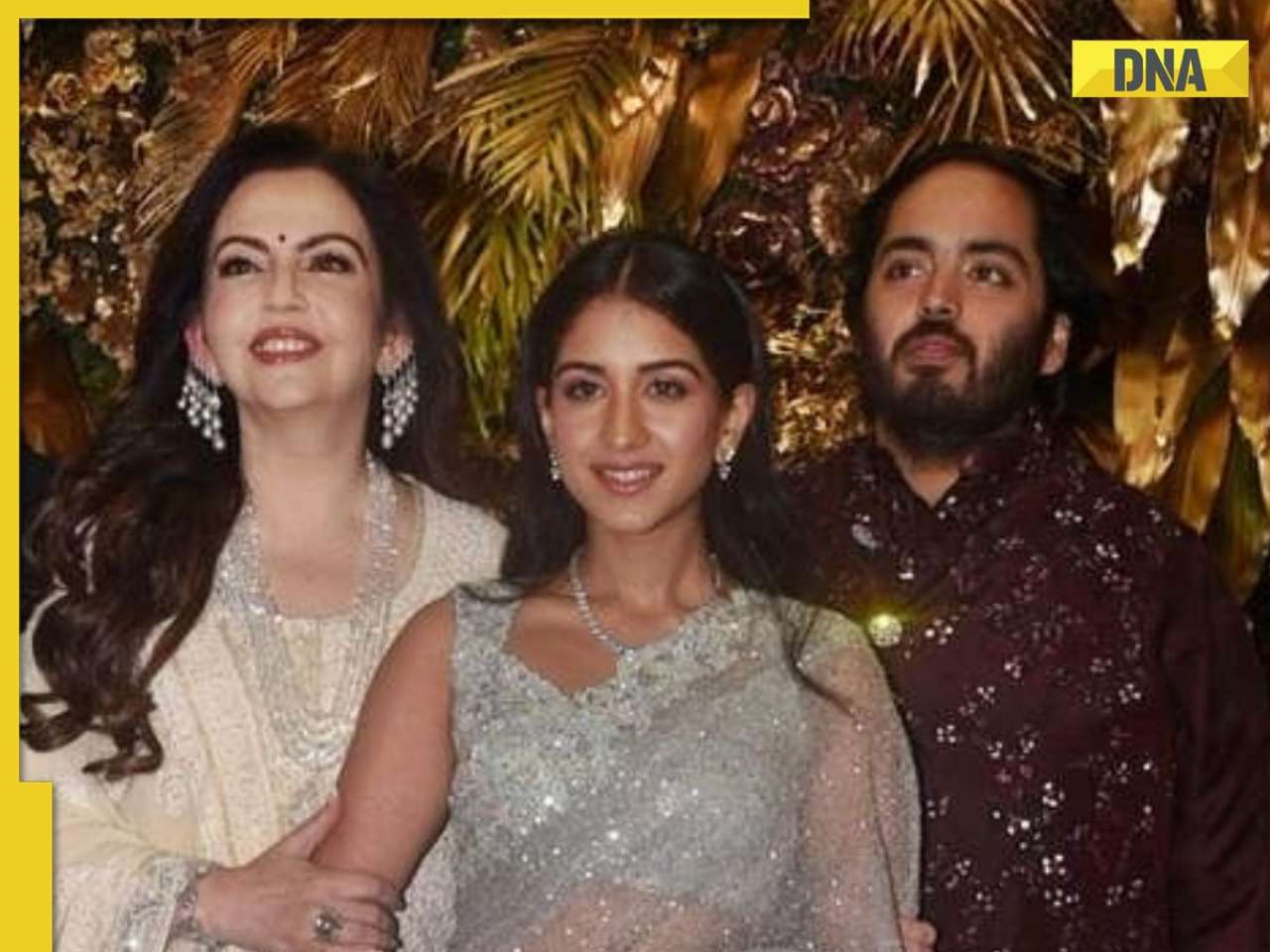

Radhika Merchant, Anant Ambani's first look from their 2nd pre-wedding in Italy goes viral![submenu-img]() MrBeast beats T-Series to become most subscribed YouTuber, followers reached...

MrBeast beats T-Series to become most subscribed YouTuber, followers reached...![submenu-img]() Terrifying encounter: Mama elephant battles crocodile to protect her calf, video goes viral

Terrifying encounter: Mama elephant battles crocodile to protect her calf, video goes viral![submenu-img]() Pawsitively adorable: Viral video shows real-life Tom & Jerry cuddling after cute catfight

Pawsitively adorable: Viral video shows real-life Tom & Jerry cuddling after cute catfight![submenu-img]() Meet Chillikompan, the mango-loving tusker from Kerala

Meet Chillikompan, the mango-loving tusker from Kerala

)

)

)

)

)

)

)