Under ELSS, the mutual fund primarily invests in the equity market to enable growth over the long-term

Section 80C of Income Tax Act has approved some of the saving options as tax saving instruments to an individual or a Hindu Undivided Family (HUF). Any amount invested up to Rs 1,50,000 or below in one or more tax saving instruments during the financial year by an individual or a HUF can be claimed as the deduction from their total taxable income.

Mutual fund houses offer Equity Link Saving Scheme (ELSS) which qualifies as tax saving instrument under section 80C of Income Tax Act. Under this scheme, the mutual fund primarily invests in the equity market to enable growth over the long-term. These mutual fund schemes can be invested in throughout the year, but some people consider ELSS as a last moment decision when they do not have sufficient investments to showcase for the existing financial year.

Analyze your financial goal before investing in ELSS. Knowing your financial goal is important and then figuring out a rough estimate and set a timeline for each goal. Decide on the periodic payment based on the goal.

The following are the benefits of ELSS:

1. Lowest lock-in period: Lock-in period for ELSS is three years while other tax saving instruments like NSC, PPF etc has a lock-in period of anywhere between 5 to 15 years. It is very difficult to decide which fund to make your investment in.

2. Wealth Creation: ELSS primarily invest in the equity market, thus it has potential to give a better return than other tax saving option. ELSS are considered ideal for the first time investor in the stock market. The mandatory lock-in period would help investors to weather the volatility associated with the stock market. Also, since the fund manager in ELSS is not worried about huge unexpected redemption, he/she can adopt a buy and hold strategy to maximize returns. These funds are subject to market risk.

3. Systematic Investment Plan (SIP): If an investor starts a SIP in ELSS at the beginning of a financial year, he/she is likely to earn a better return than investing in the last few months of the financial year. A lump sum amount is not the ideal way of going for such investments as it might be very dear to your wallet. Documentation is required at first stage.

4. Taxability of Return: Returns generated from ELSS funds would attract Long Term Capital Gain Tax (LTCG) at the rate of 10% if the capital gains exceed Rs 1 Lakh in a financial year after the Union Budget 2018-19. There are no guaranteed returns, as this is an equity-based mutual fund which makes it subject to market returns.

5. Maturity date: Most tax saving investments such as PPF, tax saving deposit come with a maturity date. PPF matures in fifteen years and it can be renewed for another five years. ELSS has no such fixed maturity date or period.

There are three options while investing in ELSS:

Growth option: Investor will not get any benefits in the form of dividends. The investor will only receive the benefits at the end of the tenure which will help appreciate Net Asset Value (NAV) and thus multiply profits.

Dividend option: Under this option investor gets timely benefit of dividends. The best part is that any dividend which the investor receives is not liable for taxation by the government and investor will receive the entire amount.

Dividend reinvestments option: Investor has the option of giving back the dividends received in order to add to the NAV. An investor can gain substantially if the market is performing very well during the three-year tenure of the lock-in period.

MONEY GROWS

- Under ELSS, the mutual fund primarily invests in the equity market to enable growth over the long-term

- ELSS primarily invest in the equity market, and has potential to give a better return than other tax saving option

The writer is CIO of LIC Mutual Funds

![submenu-img]() This film made Dharmendra star, was originally offered to Sunil Dutt, actor suffered near-death injury, movie earned...

This film made Dharmendra star, was originally offered to Sunil Dutt, actor suffered near-death injury, movie earned...![submenu-img]() Sumatra Slim Belly Tonic Scam (Tested For 90 Days) Does This Blue Tonic Supplement Work For Weight Loss?

Sumatra Slim Belly Tonic Scam (Tested For 90 Days) Does This Blue Tonic Supplement Work For Weight Loss?![submenu-img]() Sugar Defender Scam (60 Days Of Testing) What Users Are Saying About This Blood Sugar Support Formula

Sugar Defender Scam (60 Days Of Testing) What Users Are Saying About This Blood Sugar Support Formula![submenu-img]() FitSpresso Scam (I've Used It For 180 Days) Are These Weight Loss Pills Effective?

FitSpresso Scam (I've Used It For 180 Days) Are These Weight Loss Pills Effective?![submenu-img]() Understanding Legal Entity Identifiers: The Advantages and Benefits

Understanding Legal Entity Identifiers: The Advantages and Benefits![submenu-img]() Meet man who almost failed in class 12, IIT alumnus, who quit high-paying job at Infosys for UPSC exam, secured AIR...

Meet man who almost failed in class 12, IIT alumnus, who quit high-paying job at Infosys for UPSC exam, secured AIR...![submenu-img]() Meghalaya Board 10th, 12th Result 2024: MBOSE SSLC, HSSLC Arts results to be declared on this date

Meghalaya Board 10th, 12th Result 2024: MBOSE SSLC, HSSLC Arts results to be declared on this date![submenu-img]() Campus placement: Over 7700 students of IIT 2024 batch yet to get jobs, finds RTI

Campus placement: Over 7700 students of IIT 2024 batch yet to get jobs, finds RTI![submenu-img]() IIT-JEE topper joins IIT Bombay with AIR 1, skips placement drive, now working as a...

IIT-JEE topper joins IIT Bombay with AIR 1, skips placement drive, now working as a...![submenu-img]() IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….

IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() Jacqueliene Fernandez is all smiles in white shimmery bodycon at Cannes 2024, fans call her 'real Barbie'

Jacqueliene Fernandez is all smiles in white shimmery bodycon at Cannes 2024, fans call her 'real Barbie'![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film made Dharmendra star, was originally offered to Sunil Dutt, actor suffered near-death injury, movie earned...

This film made Dharmendra star, was originally offered to Sunil Dutt, actor suffered near-death injury, movie earned...![submenu-img]() Sanjay Leela Bhansali breaks silence on Sharmin Segal's performance in Heeramandi: She kept saying, 'Mama, I will...'

Sanjay Leela Bhansali breaks silence on Sharmin Segal's performance in Heeramandi: She kept saying, 'Mama, I will...'![submenu-img]() 'To my surprise...': Neena Gupta says she is amazed as everyone from different backgrounds loves Panchayat

'To my surprise...': Neena Gupta says she is amazed as everyone from different backgrounds loves Panchayat![submenu-img]() Worst Indian film ever ended actor's career, saw court cases; it's not Jaani Dushman, Adipurush, RGV Ki Aag, Himmatwala

Worst Indian film ever ended actor's career, saw court cases; it's not Jaani Dushman, Adipurush, RGV Ki Aag, Himmatwala![submenu-img]() Meet director, was thrown out of film for advising Salman Khan, gave flops; later made 6 actors stars with just one film

Meet director, was thrown out of film for advising Salman Khan, gave flops; later made 6 actors stars with just one film![submenu-img]() Old video resurfaces: Hippo attempts zoo breakout, gets slapped by security guard

Old video resurfaces: Hippo attempts zoo breakout, gets slapped by security guard![submenu-img]() Mysterious pillars of light in sky spark alien speculation, know what they are

Mysterious pillars of light in sky spark alien speculation, know what they are![submenu-img]() Shaadi.com's innovative dowry calculator garners social media praise, here's why

Shaadi.com's innovative dowry calculator garners social media praise, here's why![submenu-img]() Viral video: Woman gracefully grooves to Aditi Rao Hydari’s Saiyaan Hatto Jaao from Heeramandi, watch

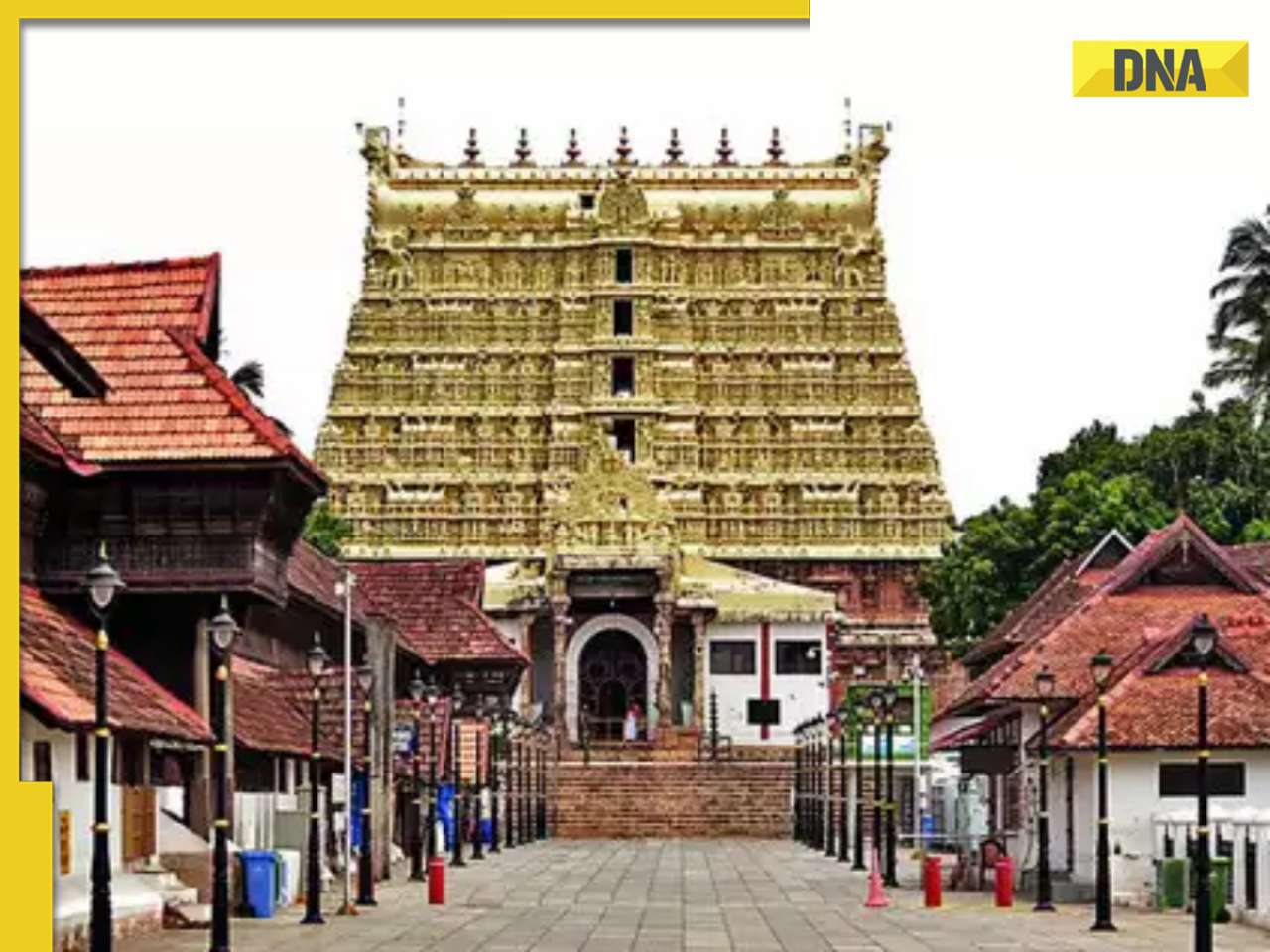

Viral video: Woman gracefully grooves to Aditi Rao Hydari’s Saiyaan Hatto Jaao from Heeramandi, watch![submenu-img]() Know about Travancore royal family that controls treasure of the wealthiest temple on Earth

Know about Travancore royal family that controls treasure of the wealthiest temple on Earth

)

)

)

)

)

)

)