LEIs are not just technical tools for identifying legal entities but are pivotal in enhancing transparency, efficiency, and stability in the global market landscape.

The ability to quickly and accurately identify business entities across borders is paramount in today's increasingly interconnected global economy. This need has given rise to the adoption of Legal Entity Identifiers (LEIs), a 20-character alphanumeric code that uniquely identifies distinct legal entities engaged in financial transactions. The concept of LEIs was developed in response to the 2008 financial crisis with countries such as the United States and India, as you can see here on LEI.net - official LEI, aimed to provide more transparency in the financial markets and reduce systemic risk.

LEIs are more than just a string of numbers and letters. They serve as a global passport for companies, enabling them to be recognized universally. This system is managed by the Global Legal Entity Identifier Foundation (GLEIF), established by the Financial Stability Board in 2014 to support the implementation and use of LEIs.

The Advantages of LEIs

1. Enhanced Transparency: LEIs' primary advantage is their role in promoting transparency in the global financial system. By uniquely identifying legal entities, LEIs make it easier to track financial transactions and the entities involved in them. This unique identification helps in the effective monitoring and analysis of market participants, thereby making it easier to detect and mitigate risks at an early stage.

2. Improved Risk Management: Financial institutions and other stakeholders use LEIs to accurately assess counterpart risk. During financial crises, companies often scramble to assess the exposure of their investments and credit lines. LEIs simplify this process by providing a clear and consistent identifier that can be used to quickly retrieve all necessary information about an entity.

3. Operational Efficiency: LEIs help in streamlining various administrative processes by reducing the need for manual cross-checks and duplicative reporting efforts. For instance, LEIs can be integrated into anti-money laundering checks and other regulatory compliance processes, thereby saving time and reducing errors. This streamlined approach leads to considerable cost savings for businesses.

4. Facilitating Global Operations: LEIs simplify dealings by providing a common identifier that is recognized universally for companies that operate across different regulatory environments. This universality removes the complexities associated with using different identification systems in different countries, thereby facilitating smoother international transactions.

5. Enhancing Market Integrity: By ensuring that each financial transaction can be explicitly linked to legal entities, LEIs help maintain the integrity of the financial markets. This clarity helps in creating a more stable market environment, which is crucial for attracting investments.

The Benefits of LEIs

Economic Development: LEIs contribute to broader economic development by making it easier for companies to engage in international trade and investment. With LEIs, the process of verifying a company’s identity in a foreign market becomes less cumbersome, encouraging more cross-border collaborations and investments.

Regulatory Compliance: LEIs are increasingly being integrated into regulatory frameworks globally. Regulators use LEIs to monitor trading activities, enforce compliance, and perform their supervisory duties more effectively. This helps in creating a more disciplined market structure where entities are held accountable.

Supporting SMEs: Small and medium-sized enterprises (SMEs) often face challenges in establishing their credibility. LEIs can play a significant role in helping SMEs demonstrate their legitimacy when entering new business relationships or accessing financing. By having an LEI, SMEs can enhance their visibility and trustworthiness both domestically and internationally.

Final Notes

LEIs are not just technical tools for identifying legal entities but are pivotal in enhancing transparency, efficiency, and stability in the global market landscape. As the world moves towards greater economic interdependence, the role of LEIs is likely to grow, underpinning the smooth functioning of international markets and supporting global economic development. Embracing this system can provide entities with a strategic advantage, opening up numerous opportunities in a dynamic global economy.

Disclaimer- Consumer connect initiative

(This article is part of IndiaDotCom Pvt Ltd’s Consumer Connect Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The IDPL Editorial team is not responsible for this content.)

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday

Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday![submenu-img]() PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details

PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details![submenu-img]() Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence

Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence![submenu-img]() Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?![submenu-img]() Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..

Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..![submenu-img]() Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process

Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process![submenu-img]() NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents

NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents![submenu-img]() Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...

Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..

Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..![submenu-img]() Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...

Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...![submenu-img]() 'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films

'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films![submenu-img]() Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...![submenu-img]() Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..

Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..![submenu-img]() Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral

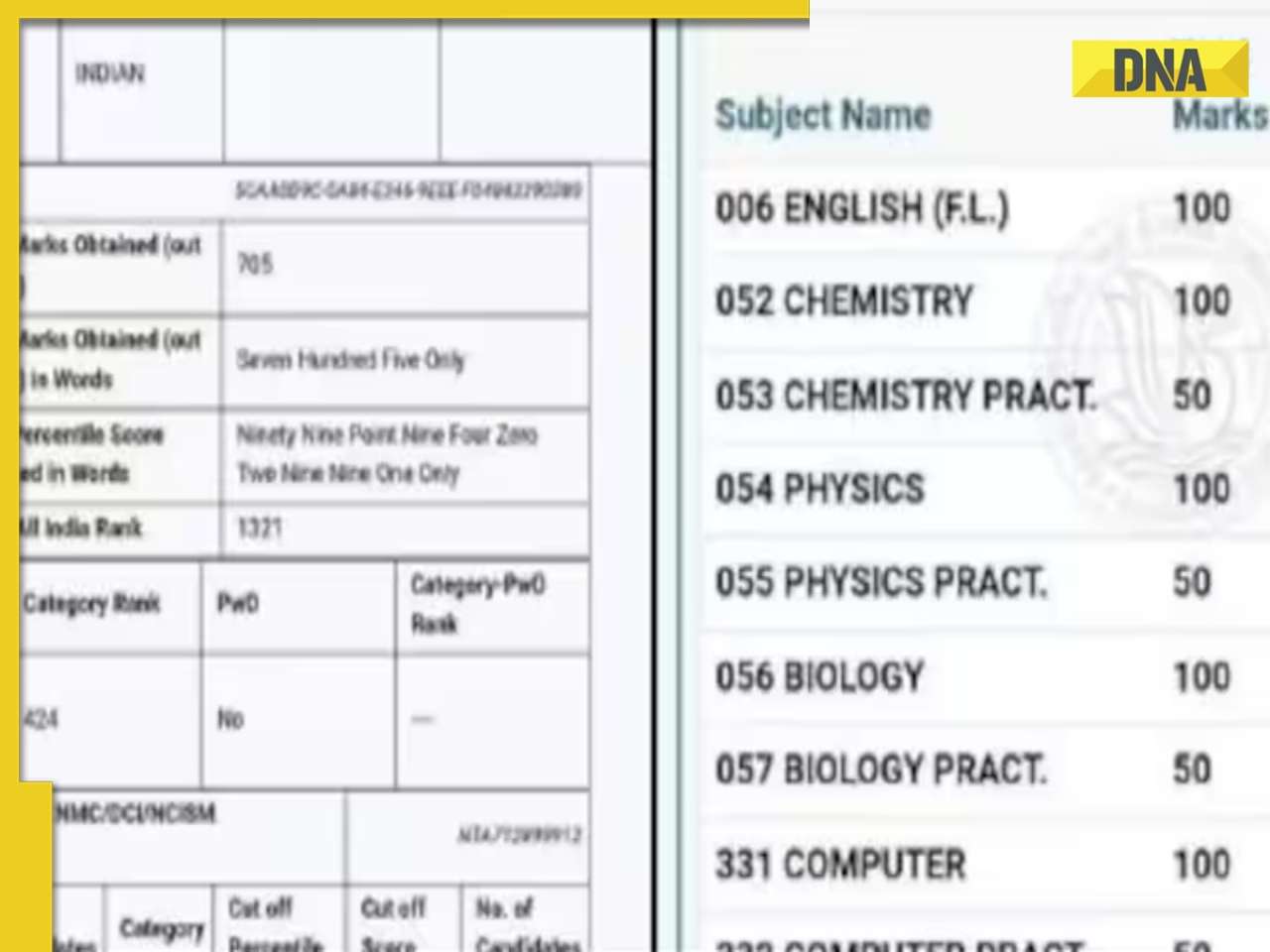

Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral![submenu-img]() Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference

Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference![submenu-img]() Girl shocks internet by eating snake like snack in viral video, watch

Girl shocks internet by eating snake like snack in viral video, watch![submenu-img]() Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

)

)

)

)

)

)

)