Know how investing 15 thousand per month for 15 years can secure your financial future.

The financial rule of 15*15*15 is a straightforward yet impactful concept that can ensure your financial stability in the long run. It entails investing 15,000 rupees per month with a growth rate of 15 per cent annually for 15 years. Adhering to this rule can help you build a substantial fund for your retirement or other financial objectives.

To implement this rule, you need to allocate 15,000 rupees every month towards investment. You can opt for a systematic investment plan (SIP) in stocks, mutual funds or any other investment avenue to achieve this. Consistently investing a fixed amount every month can help you make the most of rupee cost averaging and reduce the impact of market fluctuations on your portfolio.

The growth rate of 15 per cent per annum is another crucial aspect of the rule. While it may seem high, it is achievable over the long term through equity investments. The Indian stock market has historically delivered an average annual return of around 15 per cent over the past few decades, which is higher than other asset classes like bonds, fixed deposits and gold.

Finally, the investment horizon of 15 years is also critical for attaining your financial goals. This time frame allows your investments to compound and grow steadily over the long term. By remaining invested for 15 years, you can enjoy the benefits of compounding, wherein your investment returns generate further returns, thereby enhancing the growth of your portfolio.

Assuming that you invest 15,000 rupees per month with a growth rate of 15 per cent per annum, your corpus after 15 years would be approximately 1.38 crore rupees. This is a considerable amount that can help you meet your financial objectives, be it funding your child's education, buying a home, or retiring comfortably.

Read more: Short Term Loans: Know the types of short term loans and benefits of each option

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() 1 dead, many injured after London-Singapore flight hit by severe...

1 dead, many injured after London-Singapore flight hit by severe...![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...

Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…

Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…![submenu-img]() Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...

Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...![submenu-img]() Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check

Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..

Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..![submenu-img]() Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..

Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..![submenu-img]() 'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations

'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations ![submenu-img]() Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland

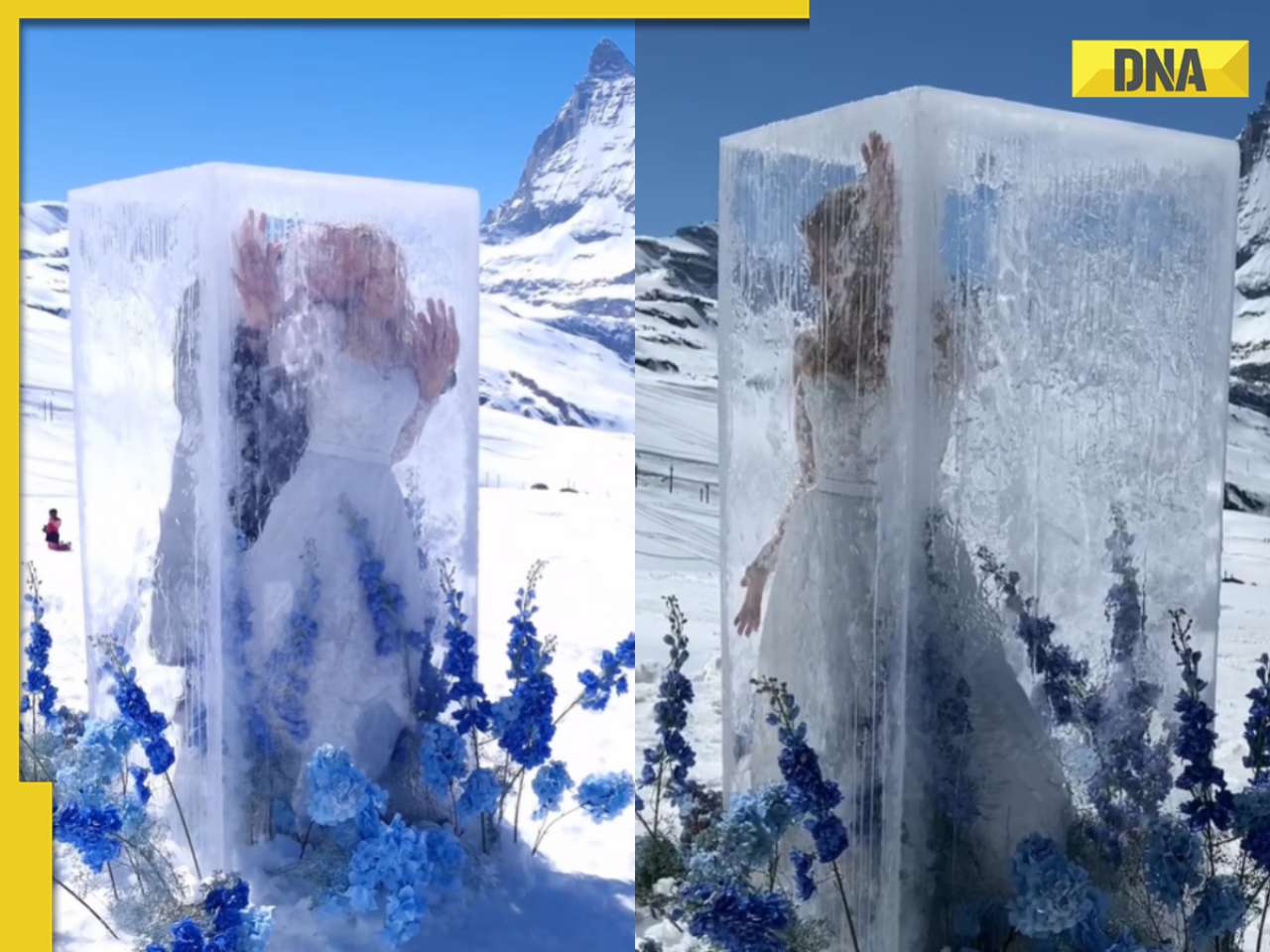

Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland![submenu-img]() Elephant lifts safari truck with tourists in shocking viral video, watch

Elephant lifts safari truck with tourists in shocking viral video, watch![submenu-img]() In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video

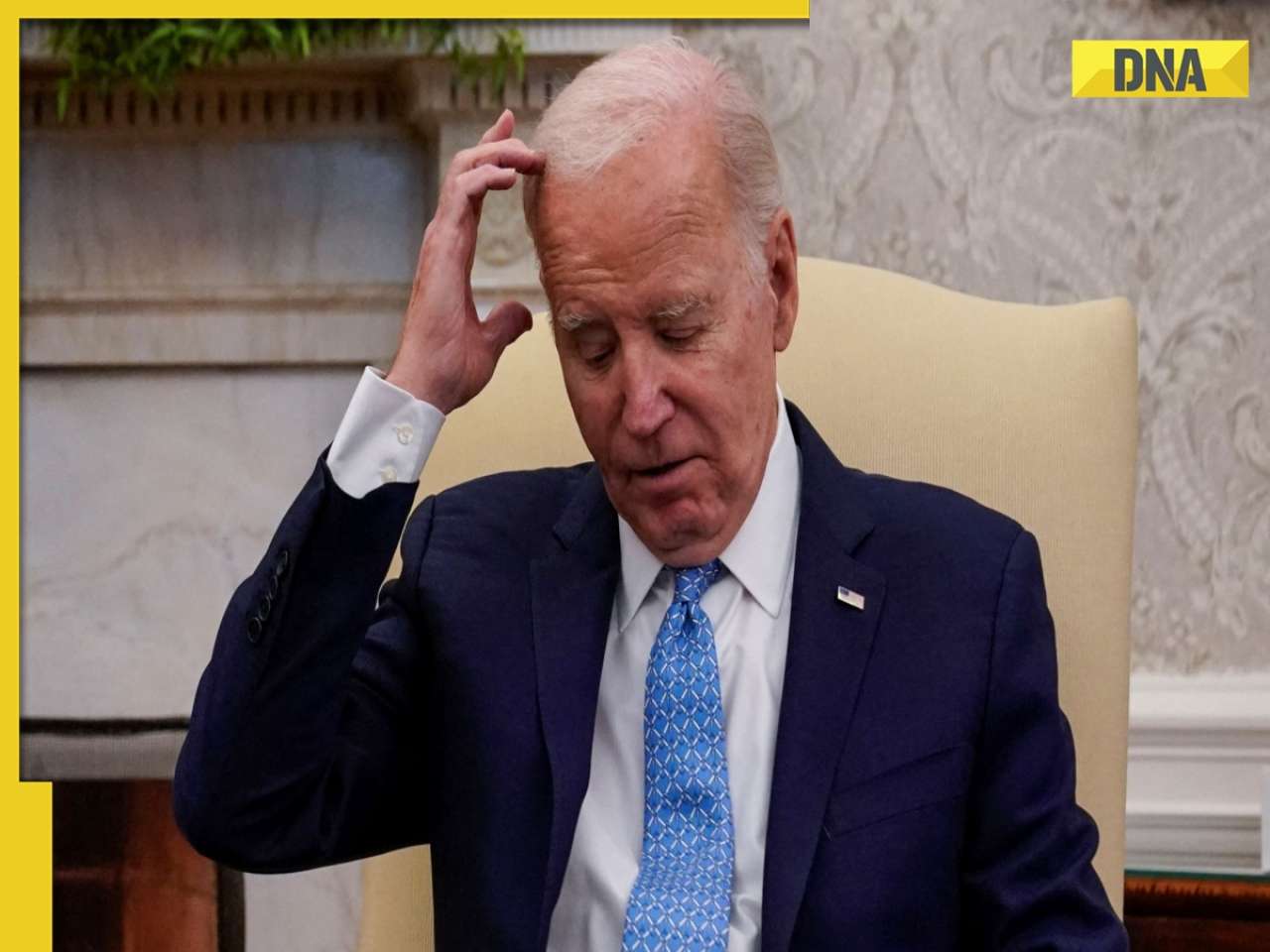

In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video![submenu-img]() Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...

Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...![submenu-img]() Heroic buffalo herd rescues one of their own from lion ambush, video is viral

Heroic buffalo herd rescues one of their own from lion ambush, video is viral

)

)

)

)

)

)

)