A healthy credit score will increase your chance of getting a loan and will also empower you to negotiate better loan terms

Keeping your credit score up can seem like a daunting task. Many Indians don't even understand how their credit score is kept track of, especially those who are new to the workforce. Lenders refer to your credit score to assess your potential to pay loans. Hence, it is important to maintain a reasonable credit behaviour with a good repayment track record.

Let’s break down this concept for those who are new to this topic and see how one can improve their credit score.

What is a Credit score?

A credit score is a three-digit number ranging from 300 to 900. Your credit report, which includes your payment history, credit inquiries, number of credit accounts, credit utilisation ratio, and account ages, is the basis for the calculation. A score between 750 and 900 is regarded as healthy, while one between 300 and 600 is considered poor or low.

A healthy credit score will increase your chance of getting a loan and will also empower you to negotiate better loan terms whereas a poor credit score can make it difficult for you to get a loan and if you do get one, you will have to settle for higher interest rates.

Here are some tips on how you can improve your credit score:

1. Keep a check on your credit report:

If you haven't taken any loan in the past years, that doesn't mean you have a good credit score; rather if there is no data to track the credit behaviour of the customer, the credit score in such cases tend to be on the lower side. Monitoring credit score on a regular basis can help you keep a good track of errors. Every time a lender or financial institution checks your credit score, CIBIL or CRIF may be deducted a few points because they view this as a sign that you are attempting to borrow more money. Checking your own score, on the other hand, does not affect it.

2. Be disciplined about paying off your dues on time:

One of the most effective ways to maintain a good credit score is by timely paying off your dues. If you’re unsure about your ability to pay these in a timely manner, reduce your credit usage.

3. Minimise hard enquiries:

The lender or issuing company will check your credit report while considering your application when you apply for a loan or credit card. A hard enquiry is what is referred to as the lender's request for a credit report. Multiple hard inquiries can give the impression that you are credit-hungry and lower your credit score. Avoid applying for multiple credit lines if you're trying to raise your credit score.

4. Elongate your good debt:

You might be in a position where you can quickly pay off a loan in full or even make a significant purchase without taking out a loan. Your credit score is not aided by this, though. Even though the RBI has mandated that early loan closures be legal and free, doing so can lower your credit score because it reduces the amount of credit you have open. Keep making on-time loan payments unless you're switching to a loan with a more reasonable interest rate.

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

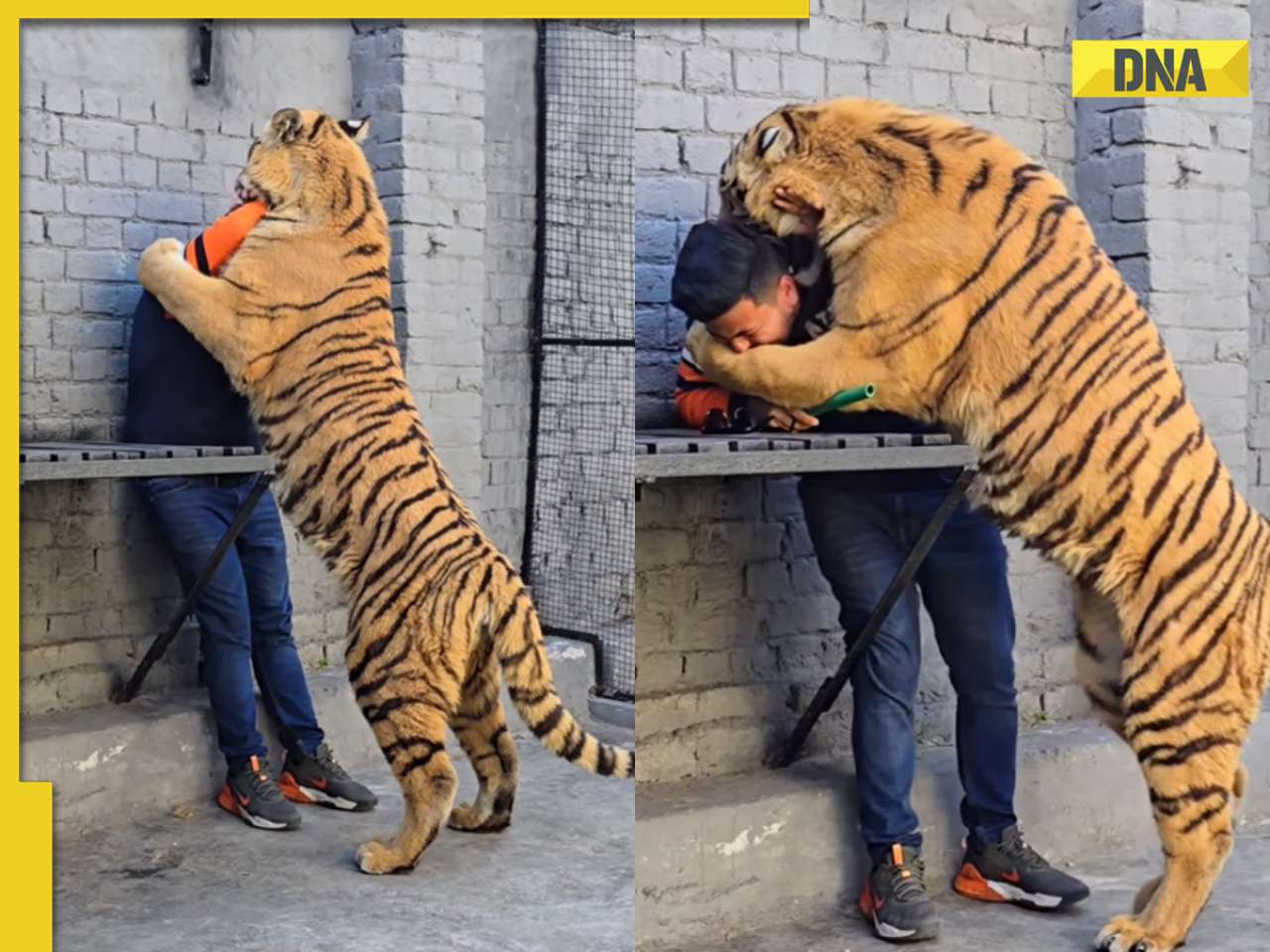

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)

)