The power of compound interest can turn small investments into huge sums.

Investing is often seen as a complicated and daunting task, but it is crucial to plan for the future and secure financial stability. One of the simplest and most effective ways to invest is through compound interest. The power of compound interest lies in its ability to generate substantial returns over time, even from small initial investments.

Compound interest is interest calculated on the initial principal and the accumulated interest from previous periods. The more frequently interest is compounded, the faster the investment grows. The key to unlocking the power of compound interest is to start early and be consistent with investments. Small contributions made regularly over a long period of time can result in substantial growth.

For example, if you invested Rs. 5000 per year for 30 years at an annual return rate of 8 per cent compounded annually, you would have a total investment of Rs. 1,50,000 and a final value of Rs. 8,26,385. The growth of the investment can be attributed to the power of compounding, where the interest earned in the earlier years is reinvested and grows along with the initial investment.

Savings accounts, fixed deposits, and mutual funds are just a few examples of investment vehicles where compound interest can be applied. The investment will need more time to grow, and the ultimate returns will be higher, the sooner one starts investing. To fully profit from compounding, investment requires a disciplined and persistent approach.

In India, there are various investment options that offer the power of compounding. For example, the Public Provident Fund (PPF) is a popular investment option for those looking for long-term savings. The PPF offers a fixed rate of interest, currently 7.1 per cent, and is compounded annually. The investment grows tax-free and the maturity period is 15 years.

Read more: LIC Jeevan Saral: Invest Rs 182 PD in this policy and get up to Rs 15.5 lakh

![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here

Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here![submenu-img]() BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....

BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....![submenu-img]() 'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case

'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case![submenu-img]() India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek

India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...

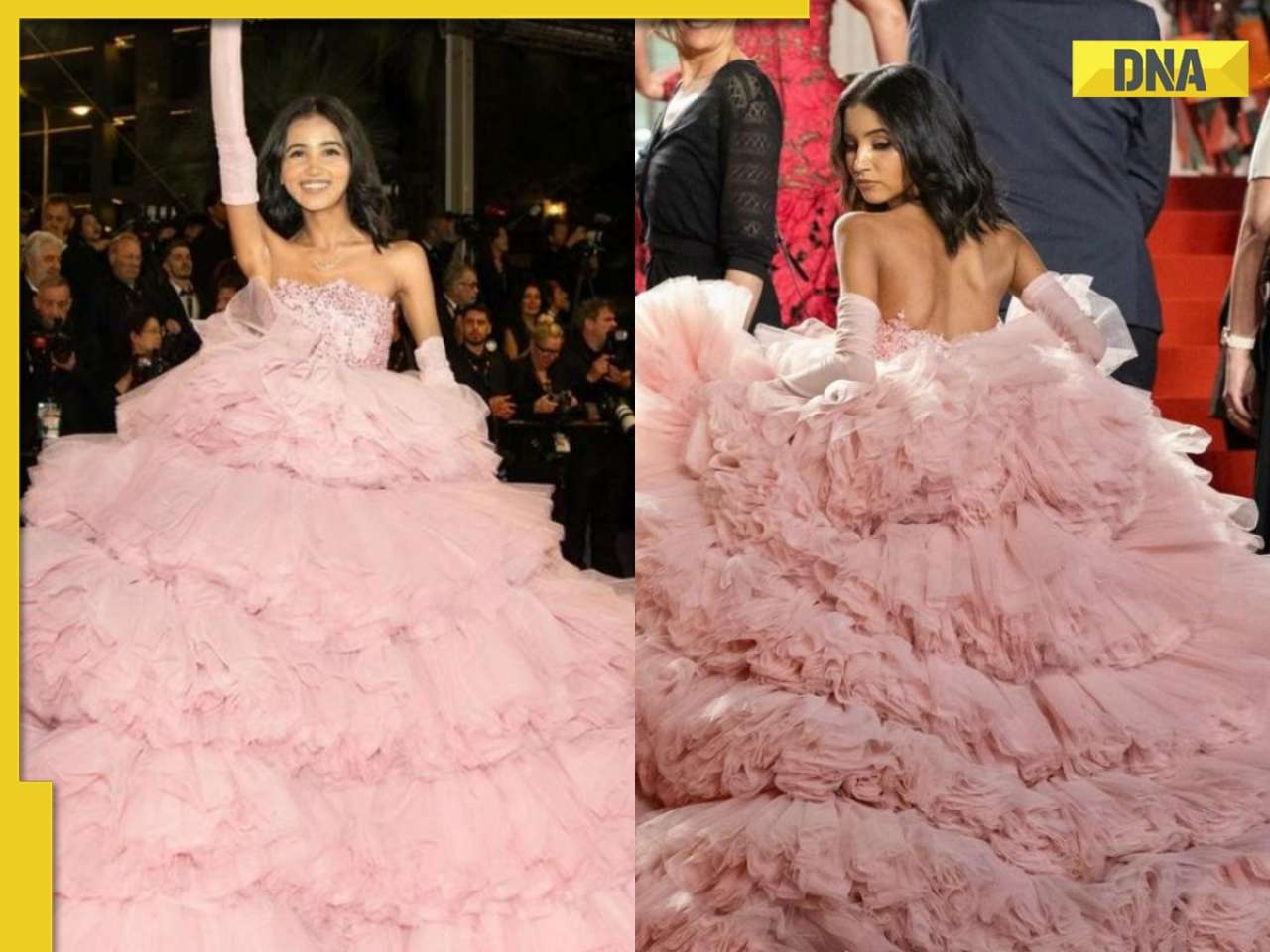

This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...![submenu-img]() Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet

Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet![submenu-img]() Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident

Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident![submenu-img]() Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..

Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..![submenu-img]() Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it

Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it![submenu-img]() Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww

Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww![submenu-img]() IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash

IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash![submenu-img]() Do you know which God Parsis worship? Find out here

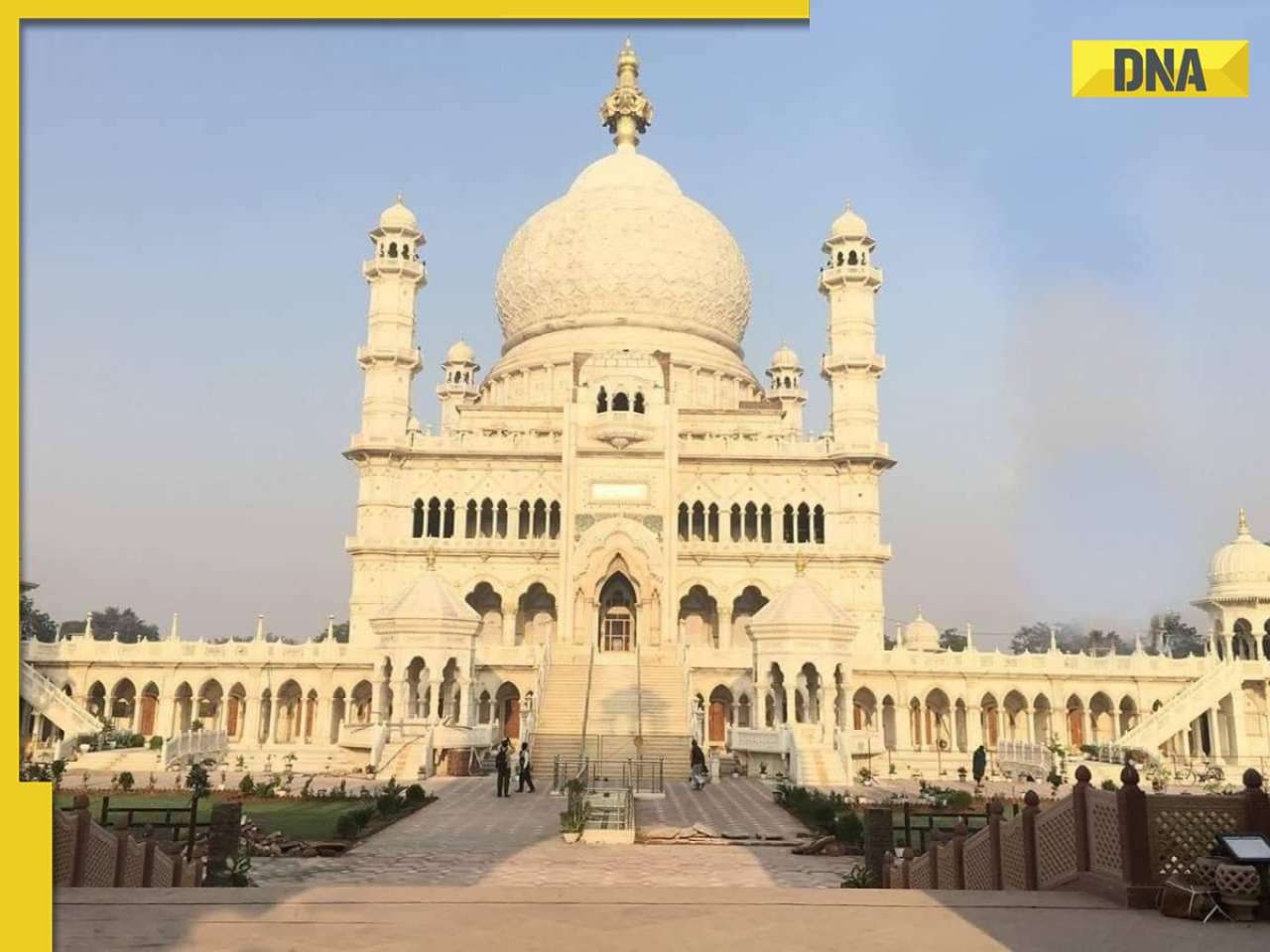

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

)

)

)

)

)

)

)