Excerpts from the Securities and Exchange Commission case against Rajat Gupta, filed on Tuesday.

United States of America

Before the Securities and Exchange Commission

The Securities and Exchange Commission (SEC) deems it appropriate and in the public interest that public administrative and cease-and-desist proceedings be, and hereby are, instituted pursuant to Section 8A of the Securities Act of 1933, Sections 15(b) and 21C of the Securities Exchange Act of 1934, Section 203(f) of the Investment Advisers Act of 1940, and Section 9 (b) of the Investment Company Act of 1940 against Rajat K Gupta (“Respondent” or “Gupta”).

SUMMARY

This matter concerns insider trading by Rajat K Gupta, who on a number of occasions disclosed material non-public information that he obtained in the course of his duties as a member of the Boards of Directors of The Goldman Sachs Group, Inc and The Procter & Gamble Company to Raj Rajaratnam, the founder and a Managing General Partner of the hedge fund investment adviser Galleon Management, LP.

Rajaratnam, in turn, either caused the Galleon hedge funds that he managed to trade based on the material non-public information, or passed the information on to others at Galleon and caused trades based on the information.

Specifically, Gupta disclosed to Rajaratnam material non-public information concerning Berkshire Hathaway Inc’s $5 billion investment in Goldman Sachs before it was publicly announced on September 23, 2008, as well as Goldman Sachs’s financial results for both the second and fourth quarters of 2008.

Rajaratnam caused the various Galleon hedge funds that he managed to trade based on the material non-public information, generating illicit profits and loss avoidance of more than $17million. In addition, Gupta disclosed to Rajaratnam material non-public information concerning Procter & Gamble’s financial results for the quarter ending December 2008.Rajaratnam relayed this information to others at Galleon, who caused Galleon funds to trade based on the information, generating illicit profits of over $570,000.3. In the course of carrying out the insider trading scheme, Rajaratnam informed certain conspirators that he obtained non-public information concerning Goldman Sachs from his source on the company’s Board.

Rajaratnam informed at least one other conspirator that he obtained non-public information concerning Procter & Gamble from his source on Procter & Gamble’s Board. As set forth below, Gupta was Rajaratnam’s source on both companies’ Boards and knowingly or recklessly disclosed material non-public information to Rajaratnam for use in trading activities.

During the relevant period, Gupta had a variety of business dealings with Rajaratnam and stood to benefit from his relationship with Rajaratnam. In addition, Gupta was an investor in, and a director of, Galleon’s GB Voyager Multi-Strategy Fund SPC, Ltd., a master fund with assets that were invested in numerous Galleon hedge funds, including those that traded based on Gupta’s illegal tips.

By virtue of his conduct, Gupta willfully violated Section 17(a) of the Securities Act, and Section 10(b) of the Exchange Act and Rule 10b-5 thereunder.

THE RESPONDENT PROFILES

Gupta, age 62, resides in Westport, Connecticut. From November 2006 through May 2010, Gupta was a member of Goldman Sachs’s Board of Directors. During his tenure on Goldman Sachs’s Board, Gupta served as a member of the Board’s Audit Committee, Corporate Governance and Nominating Committee, and Compensation Committee. Since 2007, Gupta has also been a member of Procter & Gamble’s Board of Directors, and has served on the Board’s Audit Committee and its Innovation and Technology Committee. Gupta serves on the Boards of Directors of several other public companies and is affiliated with other entities, both public and private. Gupta is a Founding Partner and the Chairman of New Silk Route Partners LLC, an investment firm that was originally called Taj Capital Partners and was founded by Gupta, Rajaratnam, and others in 2006. Gupta holds a Bachelor of Technology degree in mechanical engineering from the Indian Institute of Technology and an MBA from Harvard Business School.

Rajaratnam, age 53, resides in New York, New York. Rajaratnam is the founder and a Managing General Partner of Galleon, and, during the relevant period, served as Portfolio Manager of the Galleon Tech funds. Prior to founding Galleon, Rajaratnam worked at Needham & Co, a registered broker-dealer, for 11 years, at which time he held Series 7 and Series 24 securities licenses. Rajaratnam obtained a degree from the University of Sussex, England, in 1980, and an MBA in Finance from the Wharton School of the University of Pennsylvania in 1983.

THE SEC ALLEGATIONS

1. Gupta disclosed material non-public information to Rajaratnam concerning Berkshire’s $5 billion investment in Goldman Sachs

In September 2008, Gupta disclosed to Rajaratnam material non-public information he learned as a member of the Goldman Sachs Board of Directors concerning, among other things, Berkshire’s $5 billion investment in Goldman Sachs, which was publicly announced on September 23, 2008. Rajaratnam, in turn, caused the Galleon Tech funds to trade based on the material non-public information that Gupta disclosed.13. Soon after the bankruptcy filing of Lehman Brothers Holdings Inc on September 15, 2008, which sent the financial markets into an unprecedented tailspin senior management of Goldman Sachs began considering various strategic alternatives as they tried to navigate through the ongoing financial crisis. These alternatives included a potential investment from an institutional investor like Berkshire, and were variously discussed at Goldman Sachs Board meetings and posting calls during the week and a half following Lehman’s bankruptcy filing.

Goldman Sachs executives continued to explore various strategic alternatives the weekend after the Lehman bankruptcy. The Goldman Sachs Board convened a Special Meeting on Sunday, September 21, 2008. During that meeting, which Gupta attended via teleconference, the Board approved Goldman Sachs becoming a Bank Holding Company. The Goldman Sachs Board was also updated on certain strategic alternatives that had been considered over the weekend 15.

Goldman Sachs CEO Lloyd Blankfein had a long-standing practice of informing the Board during posting calls, meetings and phone calls about the then-current financial status of the firm. Goldman’s net revenues had been particularly strong in the week leading up to the meeting - despite the fact that the week had begun with Lehman’s bankruptcy and that the financial markets were in a general state of turmoil.

While the Board’s determination to convert Goldman Sachs into a Bank Holding Company was publicly disclosed on the evening of September 21, information concerning Goldman Sachs’s strategic alternatives and strong net revenue remained confidential.

Telephone records and calendar entries indicate that, on the morning of Monday, September 22, the day after the Sunday evening Goldman Sachs Board meeting, Gupta and Rajaratnam very likely had a telephone conversation. Shortly after that conversation, Rajaratnam caused the Galleon Tech funds, which held no pre-existing long or short position in Goldman Sachs securities at the time, to purchase over 80,000 Goldman Sachs shares.

On the morning of September 23, Rajaratnam placed a call to Gupta which lasted over 14 minutes. Less than a minute after the call began, Rajaratnam caused the Galleon Tech funds to purchase more than 40,000 additional Goldman Sachs shares.

A Special Telephonic Meeting of the Goldman Sachs Board was convened at 3:15 p.m. on September 23, during which the Board considered and approved a $5 billion preferred stock investment by Berkshire in Goldman Sachs and a public equity offering.

As Gupta knew, Berkshire was one of the most respected and influential investors and its decision to make such a large investment in Goldman Sachs would likely be viewed as a strong vote of confidence in the firm when the information was disclosed to the public. The infusion of a large amount of new capital in the firm also would likely be viewed favourably by investors. Gupta participated in the Board meeting telephonically, staying connected to the call until approximately 3:53 p.m.

Immediately after disconnecting from the Board call, Gupta called Rajaratnam from the same line. Within a minute after this telephone conversation, at 3:56 p.m. and 3:57 p.m., and just minutes before the close of the markets, Rajaratnam caused the Galleon Tech funds to purchase more than 175,000 additional Goldman Sachs shares. Rajaratnam later informed a conspirator that he received the information upon which he placed the trades minutes before the close.

Goldman Sachs publicly announced the Berkshire investment, along with a $2.5 billion public stock offering, after the market close on September 23. Goldman Sachs’s stock price, which had closed at $125.05 per share on September 23, opened at$128.44 per share the following day and rose to a closing price that day of $133 per share, a gain of 6.36% from the prior day’s closing price.

On September 24, Rajaratnam caused the Galleon Tech funds to liquidate the long position they had built on September 23, generating profits of over $900,000.

2. Gupta disclosed material non-public information to Rajaratnam concerning Goldman Sachs’s financial results for the fourth quarter of 2008.

Gupta also disclosed material non-public information that he learned during a Goldman Sachs Board posting call about Goldman Sachs’s financial results for the fourth quarter of 2008 to Rajaratnam, who caused the Galleon funds he managed to trade based on the information.

Goldman Sachs announced negative results for the fourth quarter of 2008 on December 16, 2008, reporting a $2.1 billion loss, its first (and only) quarterly loss as a publicly traded company.

Blankfein began to appreciate very early in the quarter that results weregoing to be poor. About mid-quarter, on October 23, 2008, at 4:15 p.m., Blankfein, Goldman Sachs chief financial officer David Viniar, and other senior executives at Goldman Sachs conducted a Board posting call during which they informed the Board of the company’s then-current financial situation.

The daily and weekly profit and loss statements that Blankfein and Viniar would typically rely on as the basis for their presentations to the Board show that the company was then operating at a quarter to date loss of $1.96 per share at the time.

Gupta dialled into the October 23, 2008, Board meeting around the time it was scheduled to start and remained on the call until 4:49 p.m. Just 23 seconds after disconnecting from the call, Gupta called Rajaratnam. The call lasted approximately 13minutes.

The following morning, just as the financial markets opened at 9:30 a.m, Rajaratnam caused the Galleon Tech funds to begin selling their holdings of Goldman Sachs stock. The funds finished selling off their holdings which had consisted of over120,000 shares that same day at prices ranging from $97.74 to $102.17 per share.

The same day (October 24, 2008), in discussing trading and market information with another participant in the trading scheme, Rajaratnam explained that Wall Street expects Goldman Sachs to earn $2.50 per share but that Rajaratnam had heard the prior day from a member of the Goldman Sachs Board that the company was actually going to lose $2 per share. As a result of Rajaratnam’s trades based on the material non-public information that Gupta provided, the Galleon Tech funds avoided losses of over $3 million.

3. Gupta disclosed material non-public information to Rajaratnam concerning Goldman Sachs’s financial results for the second quarter of 2008.

Gupta also disclosed to Rajaratnam material non-public information-concerning Goldman Sachs’s positive financial results for the second quarter of 2008,which were publicly announced on June 17, 2008. Rajaratnam caused the Galleon funds he managed to trade based on the information.

Approximately one week before the announcement, on June 10, 2008, at 5:41 p.m., Blankfein placed a call to Gupta that lasted more than 8 minutes. The call was one of several Blankfein made to various Goldman Sachs outside directors around the same time that evening. Blankfein’s practice was to apprise Directors of the then-current financial status of the firm when he spoke to them.27. Goldman Sachs’s second quarter of 2008 had ended on May 30, 2008.

By June 10, 2008, Goldman Sachs’s financial reporting team had already compiled and analysed the quarterly financial data and put together a draft earnings press release that had been circulated to various finance personnel, including Viniar, prior to Blankfein’s call with Gupta. The company’s financial performance was strong in an extremely difficult environment, and significantly better than analyst consensus estimates.

Blankfein knew the earnings numbers (which were positive) and discussed them with Gupta during their June 10, 2008, telephone conversation.

On the night of June 10, 2008, at 9:24 p.m., Gupta placed a short call to Rajaratnam’s home. The call was the first in a flurry of short calls between the two over an18-minute span that night, which culminated in a 4-minute call from Rajaratnam to Gupta, at 9:42 p.m. On the following morning, June 11, at 8:43 a.m, Rajaratnam placed another call to Gupta that lasted about 2.5 minutes.

Beginning at 9:35 a.m., minutes after the markets opened, Rajaratnam caused the Galleon Tech funds to significantly increase an existing long position it had established in Goldman Sachs shares by purchasing over 5,500 Goldman Sachs June $170 call option contracts (Goldman Sachs’s share price had opened at $167.00 per share on June 11).

Rajaratnam also caused the Galleon Tech funds to purchase over 350,000 additional Goldman Sachs shares on June 11 and 12, selling only a small portion on June13.

On June 16, after a positive Goldman Sachs earnings preview was issued sending Goldman Sachs’s stock price up more than 2%, Rajaratnam caused the GalleonTech funds to sell the June $170 call option contracts they had purchased on June 11, generating profits of approximately $7 million.

On June 17, prior to market open, Goldman Sachs announced its quarterly results. Revenues and earnings per share beat analysts’ estimates, and Goldman Sachs’s share price opened the day at $185.04 per share, about 1.62% higher than the prior day’s closing price of $182.09 per share.

After the announcement, Rajaratnam caused the Galleon Tech funds to sell the Goldman Sachs shares they had purchased after Rajaratnam received the material non-public information from Gupta on June 10, generating profits of over $6.6 million.33. The total illicit profits made by the Galleon Tech funds by virtue of their trading based on Gupta’s material non-public information concerning Goldman Sachs’s second quarter of 2008 results exceeded $13.6 million.

4. Gupta disclosed material non-public information to Rajaratnam concerning Procter& Gamble’s financial results for the quarter ending December 2008

Gupta also disclosed to Rajaratnam material non-public information that Gupta learned as a member of Procter & Gamble’s Board of Directors about Procter &Gamble’s financial results for the October through December 2008 quarter.

Rajaratnam then passed the material non-public information to his Galleon colleagues, who then caused Galleon funds to trade based on the information.

At 9:00 a.m. on January 29, 2009, the day before Procter & Gamble’s pre-market quarterly earnings release was issued, Procter & Gamble’s Audit Committee, of which Gupta was a member, met telephonically to discuss the planned release. Gupta dialed into the Audit Committee meeting at its scheduled start time and remained on the call for over 19 minutes.

A draft of the earnings release, which had been mailed to Gupta and the other committee members two days before the meeting, stated, among other things, that the company expected organic sales, or sales related to pre-existing rather than newly acquired business segments, to grow 2-5% in the fiscal year. This compared negatively to the 4-6% growth the company had previously publicly predicted.

Gupta called Rajaratnam in the early afternoon on January 29, 2009. Shortly afterwards, Rajaratnam advised another participant in the insider trading conspiracy that he had learned from a contact on Procter & Gamble’s Board that the company’s organic sales growth would be lower than expected.

In the late afternoon of January 29, 2009, Galleon funds sold short approximately 180,000 Procter & Gamble shares.

After Procter & Gamble issued its earnings release in the pre-market on January 30 (the actual release was substantially the same as the draft release Gupta had been provided), Procter & Gamble’s stock price, which had closed at $58.22 per share on January 29, opened on January 30 at $56.50 per share. The stock price declined further to $54.50 per share by the close on January 30, down approximately 6.39% from the prior day’s closing price.

By virtue of their trades, which were based on the material non-public information that Gupta provided to Rajaratnam, the Galleon funds generated illicit profits of over $570,000.

In view of the allegations made by the Division of Enforcement, the Securities and Exchange Commission deems it necessary and appropriate in the public interest that public administrative and cease-and-desist proceedings be instituted to determine:

A. Whether the allegations set forth in Section II hereof are true and, in connection therewith, to afford Respondent an opportunity to establish any defenses to such allegations;

B. What, if any, remedial action is appropriate in the public interest against Respondent pursuant to Section 15(b) of the Exchange Act including, but not limited to, disgorgement and civil penalties pursuant to Section 21B of the Exchange Act….

ElizabethM Murphy

Secretary

![submenu-img]() 'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media

'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media ![submenu-img]() As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?

As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?![submenu-img]() Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations

Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations![submenu-img]() Your Essential Guide To Caring For Ageing Parents

Your Essential Guide To Caring For Ageing Parents![submenu-img]() 'Death threats for criticising Virat Kohli': IPL commentator makes shocking revelation

'Death threats for criticising Virat Kohli': IPL commentator makes shocking revelation![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() RBSE Rajasthan Class 10 board results out, check direct link here to know results

RBSE Rajasthan Class 10 board results out, check direct link here to know results![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations

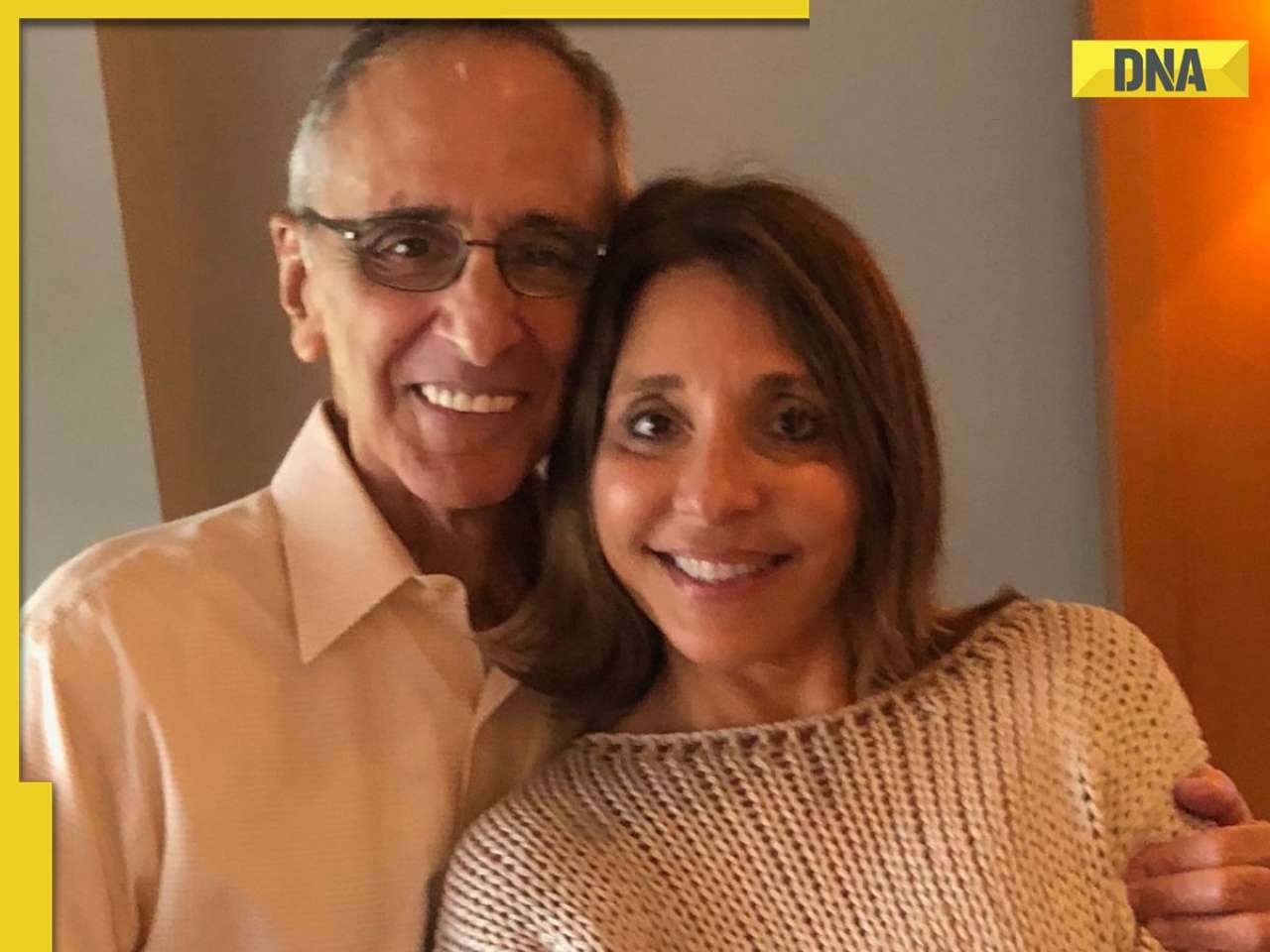

Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations![submenu-img]() This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...

This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...![submenu-img]() ‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books

‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books![submenu-img]() Meet India's most unsuccessful star kid, was bigger than Shah Rukh, Aamir, Salman, then gave 25 flops, now lives in...

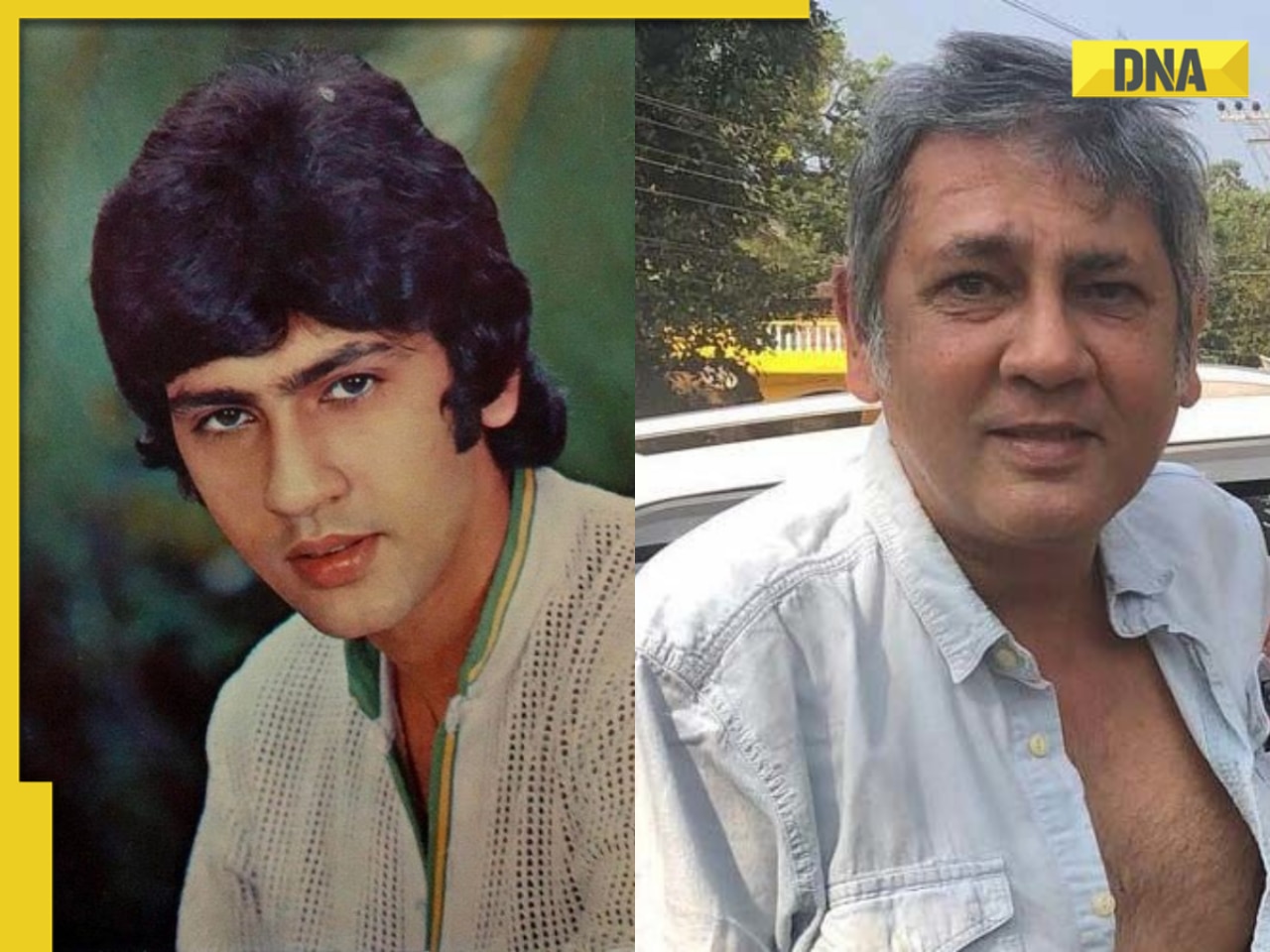

Meet India's most unsuccessful star kid, was bigger than Shah Rukh, Aamir, Salman, then gave 25 flops, now lives in...![submenu-img]() Meet only young Bollywood star who is part of two cinematic universes, an outsider; not Sara, Janhvi, Ananya, Suhana

Meet only young Bollywood star who is part of two cinematic universes, an outsider; not Sara, Janhvi, Ananya, Suhana![submenu-img]() 'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation

'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation![submenu-img]() 'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media

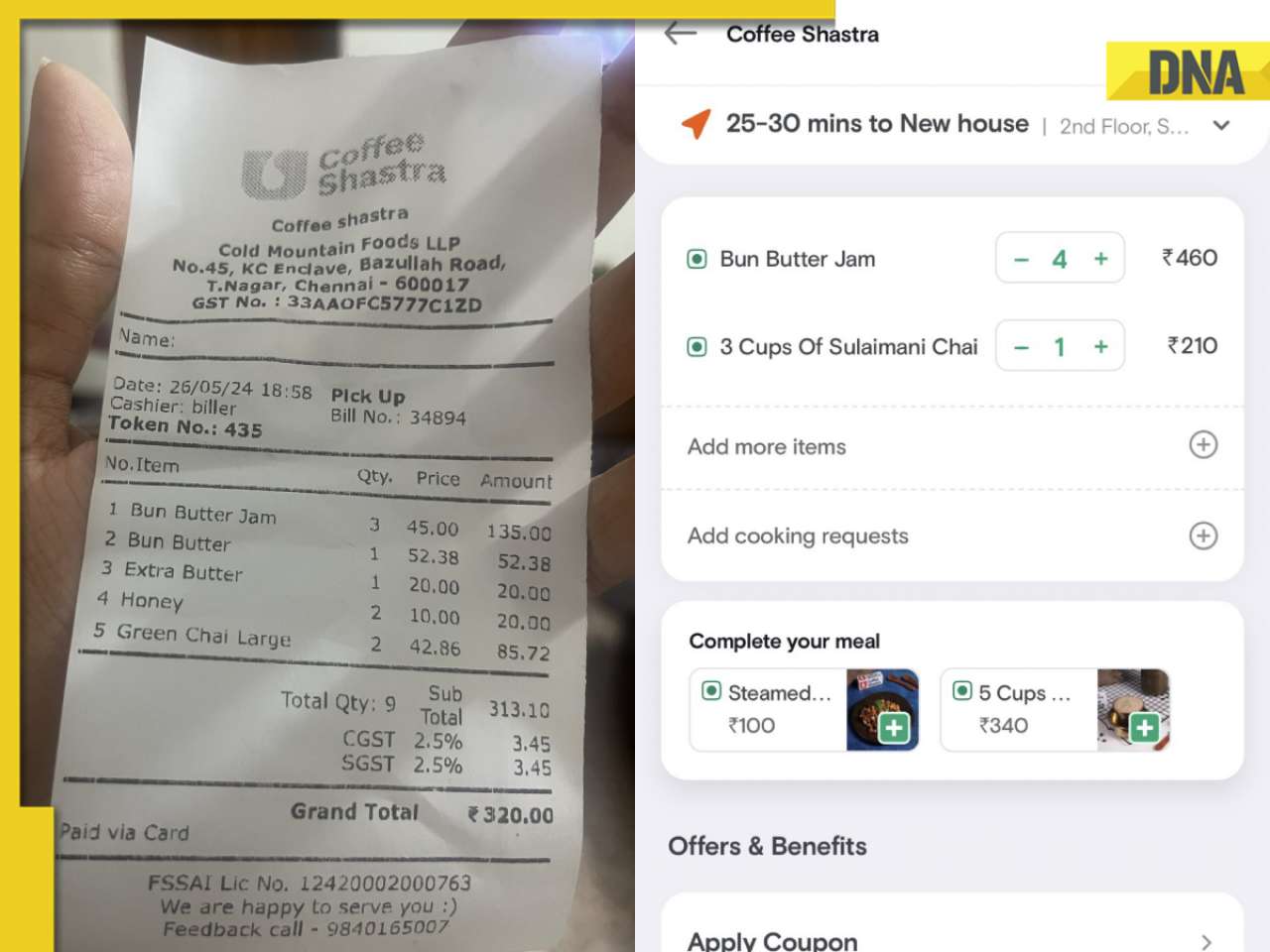

'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media![submenu-img]() 'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill

'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill![submenu-img]() Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts

Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts![submenu-img]() Man dies after being sucked into plane engine in front of passengers at airport

Man dies after being sucked into plane engine in front of passengers at airport

)

)

)

)

)

)