RBI Governor Shaktikanta Das said that crypto has no underlying risks other than money laundering, terror financing, etc.

RBI Governor Shaktikanta Das reiterated his caution about crypto assets in the Indian economy on 13 January. According to Das, cryptocurrencies are a bad bet and might even weaken the authority of the central bank if they are allowed to continue growing uncontrolled.

“RBI’s position is very clear, it should be banned, all of them”, Mr Das said at the Business Today Banking and Economy Summit. “The technology of blockchain needs to be supported”, the Governor added.

For Shaktikanta Das, there is no underpinning in the case of cryptocurrency, except from the well-known risks of money laundering, terror financing, and so on.

“What’s crypto? Some call it an asset, some call it a financial product. There is no underlying problem in the case of crypto”, Mr Das explained. “Anything without any underlying, whose valuation is dependent entirely on belief is nothing but 100 per cent speculation or to put it bluntly, it’s gambling,” he explained.

The RBI Governor elaborated by positing a future in which 20% of all transactions are conducted using cryptocurrency (in India). To argue that cryptocurrency is a financial product or asset is to miss the point entirely. So-called crypto-assets have the makings of a decentralised currency since they use cryptography to secure transactions. Moreover, the vast majority of it is expressed in dollars.

Also, READ: Meet Ravi Kumar, Cognizant's new CEO whose salary is 4 times Mukesh Ambani's 2020 pay; his joining bonus is Rs 6 crore

The Reserve Bank of India (RBI) will lose control over twenty percent of the economy's transactions if twenty percent of those transactions are conducted in cryptocurrencies that were not issued by the RBI. The power of central banks to control the money supply, or monetary policy, will be weakened. Mr Das predicted that this would cause the economy to become dollarized.

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() 1 dead, many injured after London-Singapore flight hit by severe...

1 dead, many injured after London-Singapore flight hit by severe...![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...

Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…

Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…![submenu-img]() Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...

Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...![submenu-img]() Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check

Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..

Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..![submenu-img]() Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..

Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..![submenu-img]() 'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations

'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations ![submenu-img]() Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland

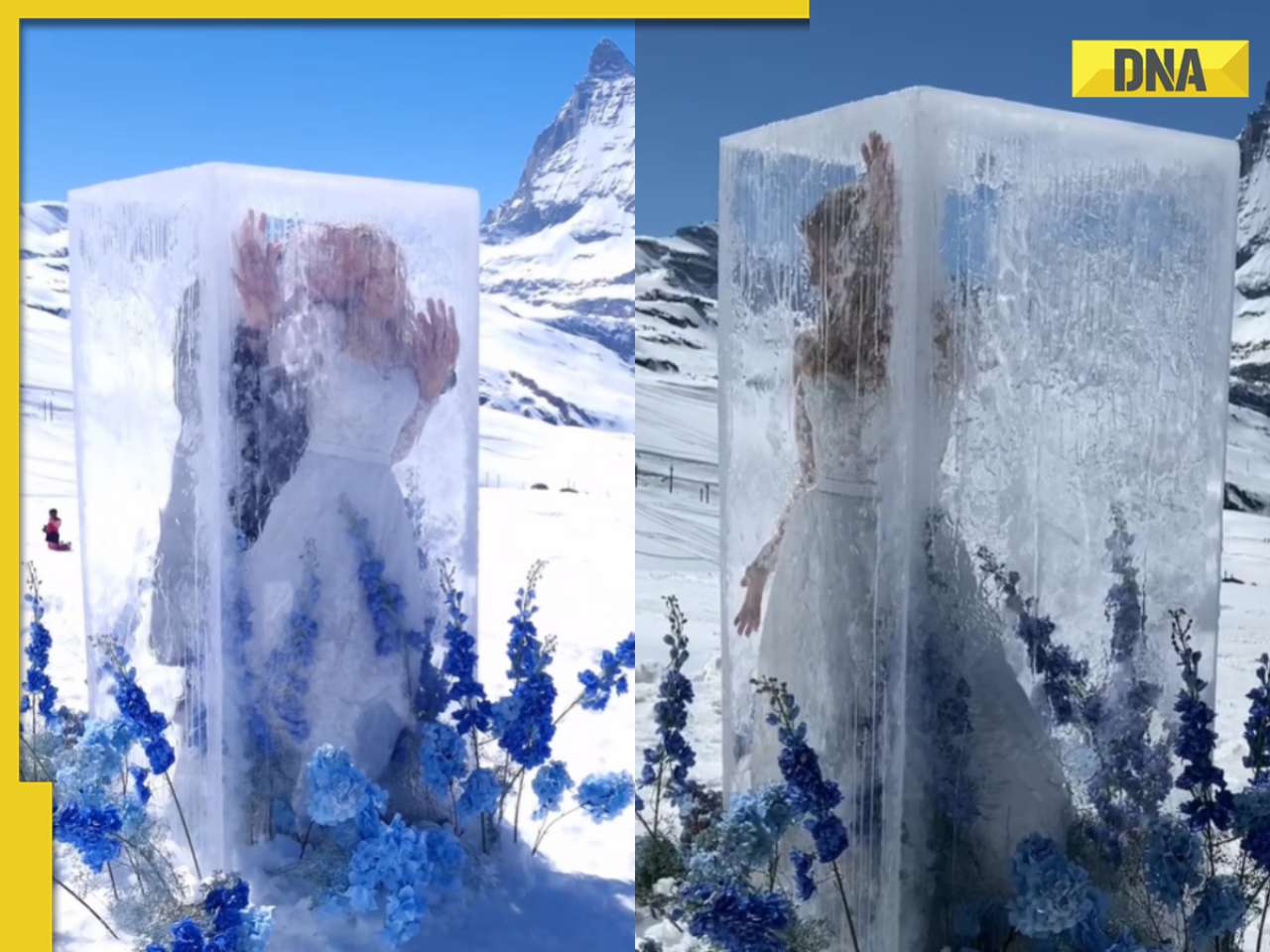

Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland![submenu-img]() Elephant lifts safari truck with tourists in shocking viral video, watch

Elephant lifts safari truck with tourists in shocking viral video, watch![submenu-img]() In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video

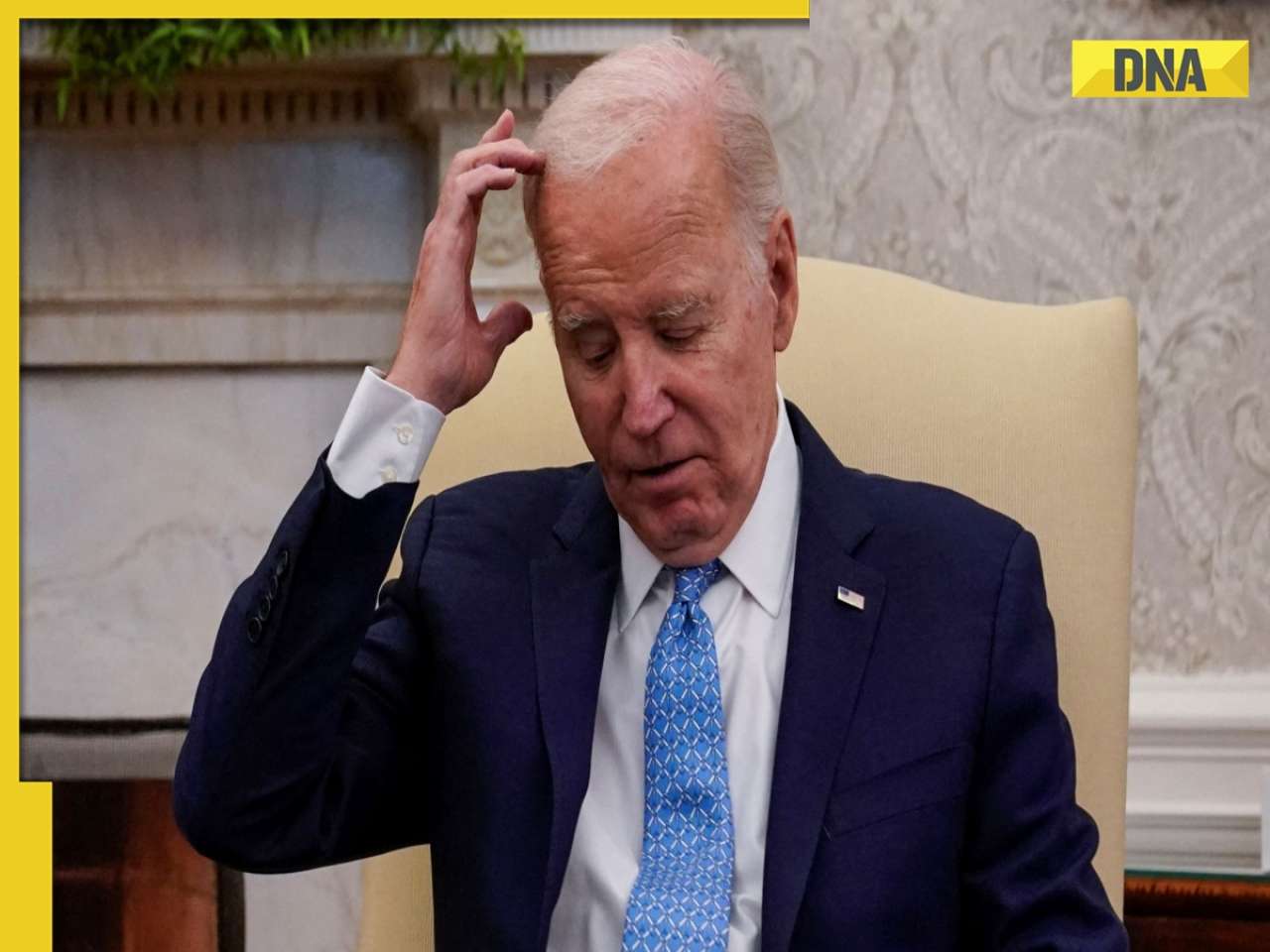

In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video![submenu-img]() Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...

Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...![submenu-img]() Heroic buffalo herd rescues one of their own from lion ambush, video is viral

Heroic buffalo herd rescues one of their own from lion ambush, video is viral

)

)

)

)

)

)

)