Budget 2018 presents an opportunity for the government to unleash significant investment potential in the power sector

The government's initiatives aiming to deliver '24X7 power for all' and promote renewables as the future source of energy have led to calibrated reforms in the power sector in the past two to three years. The targeted 175 gigawatt (gw) renewables capacity by 2022 has had a decent onset with cumulative renewables capacity at around 60 gw. There is a need to accelerate the pace of new capacity addition over next five years or so to get even closer to the targeted capacity. Yet, the potential of renewables sector remains far from fully unleashed.

The investment drive towards clean energy projects arguably has witnessed intermittent setbacks, largely self-inflicted, owing to financing challenges and nosediving tariffs for solar and wind projects. Evolving tax policies have pushed the sector to the receiving end too. Sunset on tax holidays and limitation on tax deductibility of borrowing costs led to financing woes; GST transition has added to the overall cost of constructing solar and wind projects. Recurrent flip-flops on levy of anti-dumping duty and customs classification of panels have not helped the cause of investors either.

Yet the industry believes these are temporary hiccups. It is in this backdrop, the developers and investors will look up to the Budget to redeem legacy tax issues and for the power sector to be conferred a special infrastructure status through a more conducive regulatory and tax framework which encourages rapid capacity addition, including in newer areas of sustainability and energy efficiency.

From tax wishlist standpoint, an across-the-board reduction in the corporate tax rate, grant of investment-linked tax deduction and rationalisation of the minimum alternate tax (MAT) continue to be the two key asks of the power sector, both in the context of generation and distribution and transmission projects.

End of income-linked tax holiday with effect from April 2017 has impacted significant pipeline of capex investments. MAT liability (of 20% on book profits) materially neutralises the economic benefit of accelerated tax depreciation for special purpose vehicles. Further, introduction of weighted tax deduction for expenditures incurred on energy-efficient and emission reduction technologies could help catalyse large capex in cleaner technologies.

Limitation on tax-deductibility of interest cost introduced vide Finance Act 2017 as a measure to curb tax base erosion and profit-shifting, has hit the capital-intensive infrastructure (including power projects) the most. Given the highly-leveraged nature of capex, a '30%-of-Ebitda' rule for interest deductibility invariably causes material increase in overall cost of capital, and in some cases, renders investments economically unviable. It is imperative that for capital-intensive infrastructure projects, Ebitda-based interest disallowance is either withdrawn or rationalised.

GST levy on procurements for power projects perpetrates the inverted duty/ tax structure for the power sector, especially since generation/distribution of electricity is yet not subsumed in the GST fold. It is critical to redeem the added cost of constructing and operating such assets, by either exempting or zero-rating of all procurements for setting up and operation of renewable energy projects. To further promote solar roof tops, installation under EPC contract should be classified as 'solar power generating system' liable to GST at 5%. Exempting renewable energy certificates (RECs) from GST levy would also yield attractive, albeit marginal, incentive for developers. Besides, a policy guidance on consistent policy framing by states and measures to minimise payment defaults by utilities could relieve the overall stress of the renewables industry at large.

Overall, Budget 2018 presents an opportunity for the government to unleash significant investment potential in the power sector. Tweaking of tax rules to incentivise large capex could be one big step forward in this endeavour.

Sumit Singhania - Partner, Deloitte India

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

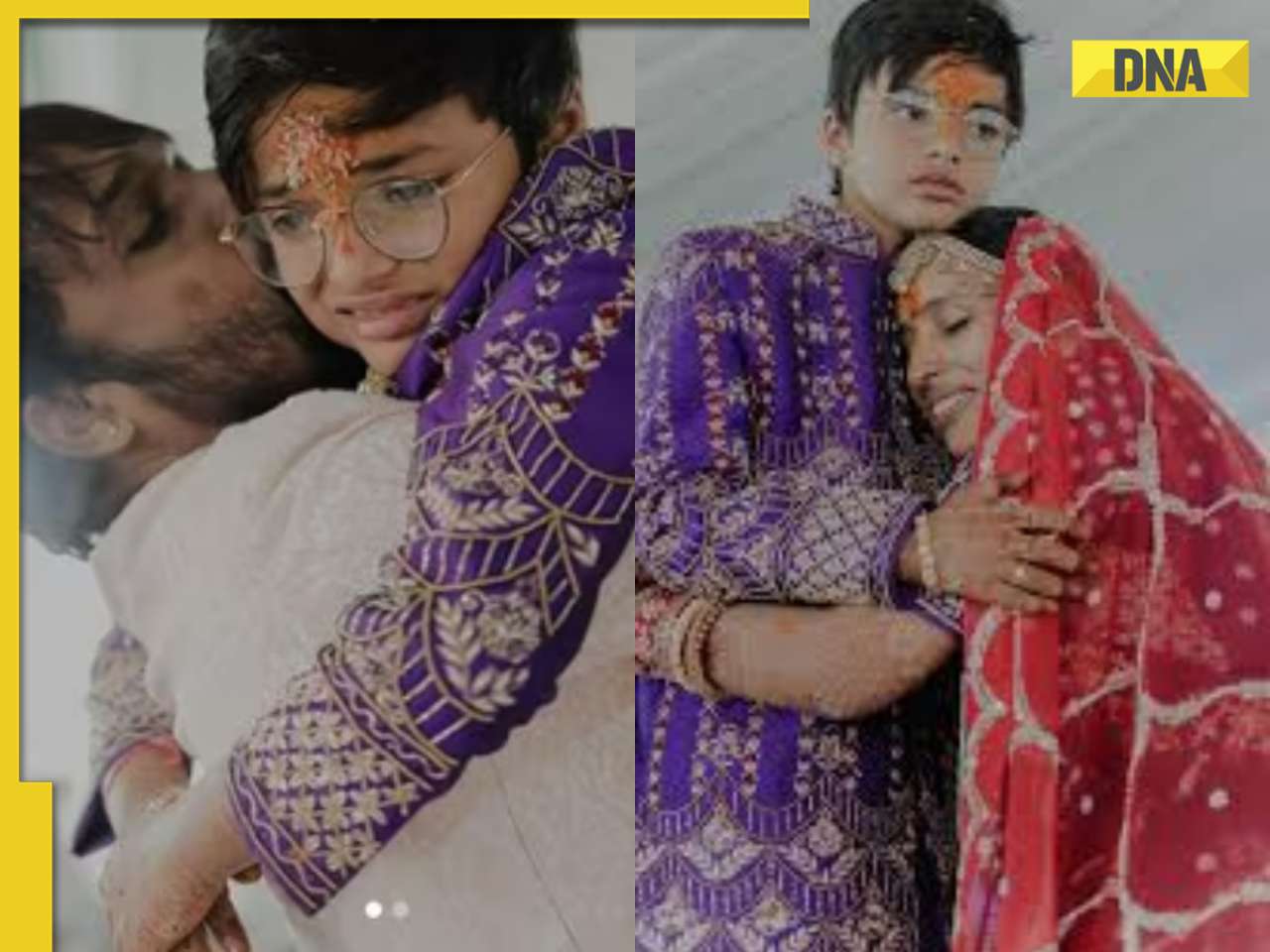

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)

)