If you don’t have family or friends to fall back on, you can choose from a range of secured or unsecured loans from banks and NBFCs

It was Asia’s richest man Mukesh Ambani who helped his younger brother Anil avert jail. ‘Mota bhai’ stepped for his sibling, who completed the required payment just ahead of the court’s one-month deadline. Not everybody has an elder brother like Mukesh. Plus, borrowing money from relatives, even for the smallest period of time, puts you under obligation. So, what do you do if you need out to fork out cash at a short notice? DNA Money tells you about six ways to raise funds quickly.

Everything personal

You don’t need to pledge any security or collateral while availing a personal loan. You can take a personal loan from a bank, a non-banking financial company (NBFC) or a new-age fintech firm. Typically, you can get a personal loan for a minimum of Rs 50,000 and maximum Rs 25 lakh. Some lenders like Citibank give up to Rs 30 lakh loan while HDFC Bank gives up to Rs 40 lakh loan. The personal loan amount sanctioned depends on your repayment capacity as assessed by the lender. Repayment tenure is three months to five years in most cases. Few like Tata Capital give up to six years time to repay.

“Personal loan interest rates start from 11% and go up to 20% or more,” says Navin Chandani, chief business development officer, BankBazaar. Apart from interest, lenders charge a processing fee (0.4 -3% of the loan amount). The loan disbursal process can take three to four working days. Pre-approved customers can get an instant personal loan in a few hours.

Go for gold

For contingencies, there is nothing like a gold loan. Generally, the maximum loan amount is Rs 2 crore. Gold loan tenures range from 12-36 months. The loan amount depends on the value of the gold presented for pledge. Gold loan rates from banks are cheaper, but they take more time. Gold loan firms charge slightly more but are faster. “As per current RBI guidelines, up to 75% of the value of the gold contained in the jewellery can be given as a loan. Our customers can effectively borrow at 9.9% after accounting for the rebates available on prompt repayment and re-pledge,” says VP Nandakumar, MD and CEO Manappuram Finance. PAN details are mandatory for loans above Rs 5 lakh, while loans exceeding Rs 10 lakh have additional background verification.

“Customers can effectively get disbursements within 10-15 minutes. Once KYC formalities are completed, along with valuation of the gold, the loan amount is credited immediately to customers’ bank account, or given out in cash up to limits permitted by regulations,” added Nandakumar. There may be a low one-time processing fee.

Credit card loan

Credit cards charge up to 42% interest. But loans taken against credit cards can be availed at similar rates to personal loan rates. The rates would depend on your credit score and history. The amount of loan on credit card usually depends on the credit limit. However, issuers also offer loan over and above the credit limit where the availed loan amount will not be blocked against the credit limit.

“For instance, if your credit card limit is Rs 50,000, you may still be able to avail a loan for Rs 1 lakh while retaining the Rs 50,000 limit on your credit card,” says Chandani of BankBazaar. Cardholder should have a commendable credit history and a good purchase and repayment pattern to apply for a loan on credit card.

In case of loan against credit cards, banks provide a loan basis your existing credit card. The loan amount is paid in the form of a demand draft or through direct transfer to your bank account. Banks charge a nominal processing fee.

Use stocks, bonds

You may have stocks and bonds, but would not like to sell them. Use them to take a loan. Loan against securities (LAS) is a loan facility offered against equity shares. “You can avail LAS against your existing investment portfolio, which is not churned regularly for liquidity requirements. To put it simply, LAS is a loan that provides you the money you need by pledging your securities and letting you retain them too,” says Stefan Groening, COO, Sharekhan by BNP Paribas. The interest rate ranges between 10 and 12%. Generally, you can borrow a minimum of Rs 50,000 and maximum of Rs 20 crore. You could get 50% of the current value of shares as loan. In case of bonds, the loan can be 70-90% of the current market value. Account opening can take two to four working days. Post account opening, pledging of securities takes approximately 12 hours and once the limit is set, the account can be credited within four hours, says Groening. In addition, there could be processing fees, charges for documentation, annual renewal, prepayment, pledge/depledge, stamp duty, etc.

Mutual funds

Taking a loan against your mutual funds helps you access a corpus of funds without losing out on the ownership of your investment. Big lenders have an approved list of MF schemes of up to 2,000 schemes. You can get more loan for debt/FMP (fixed maturity plan) compared to equity/hybrid/ETF units. The maximum loan amount can be Rs 10 crore to Rs 20 crore. Interest rates range from 9.25 to 13%. While some lenders have started disbursing instant online loan against securities, the processing of physical loan application can take up to seven working days. “A current account is opened in the borrower’s name with overdrawing limit sanctioned on the basis of the valuation of the pledged MFs,” says Naveen Kukreja, CEO and co-founder, Paisabazaar.com. There is a processing fee of 0.1 to 2%. Renewal charges can range from Rs 1,000-5,000 annually.

Insurance policies

You can take a loan against life insurance policies, but only against endowment plans as they have a surrender value. The interest rate varies from insurer to insurer. “However, since this is a secured loan, the rate of interest is lower than an unsecured loan like personal loan,” says Dhirendra Mahyavanshi, co-founder, Turtlemint. You can get loan up to 90% of surrender value. “The policy needs to be in force and all due premiums should have been duly paid at the time of applying for the loan. Original policy bond needs to be submitted along with the policyholder’s KYC documents and a cancelled cheque,” adds Mahyavanshi. It usually takes about three to five working days for the amount to be credited in your bank account. There is no obligation to pay the EMI for a policy loan, as it would be recovered against the policy.

QUICK MONEY

- Unsecured loans like personal loans are the most expensive but also the fastest, with some lenders approving the loan in a few hours

- Loans against collateral security like gold, shares, bonds, mutual funds or insurance policies are cheaper, but disbursal may take up to five days

- In case the value of the collateral - gold, shares, or bonds - falls, the lender will ask for additional margin money from the borrower

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

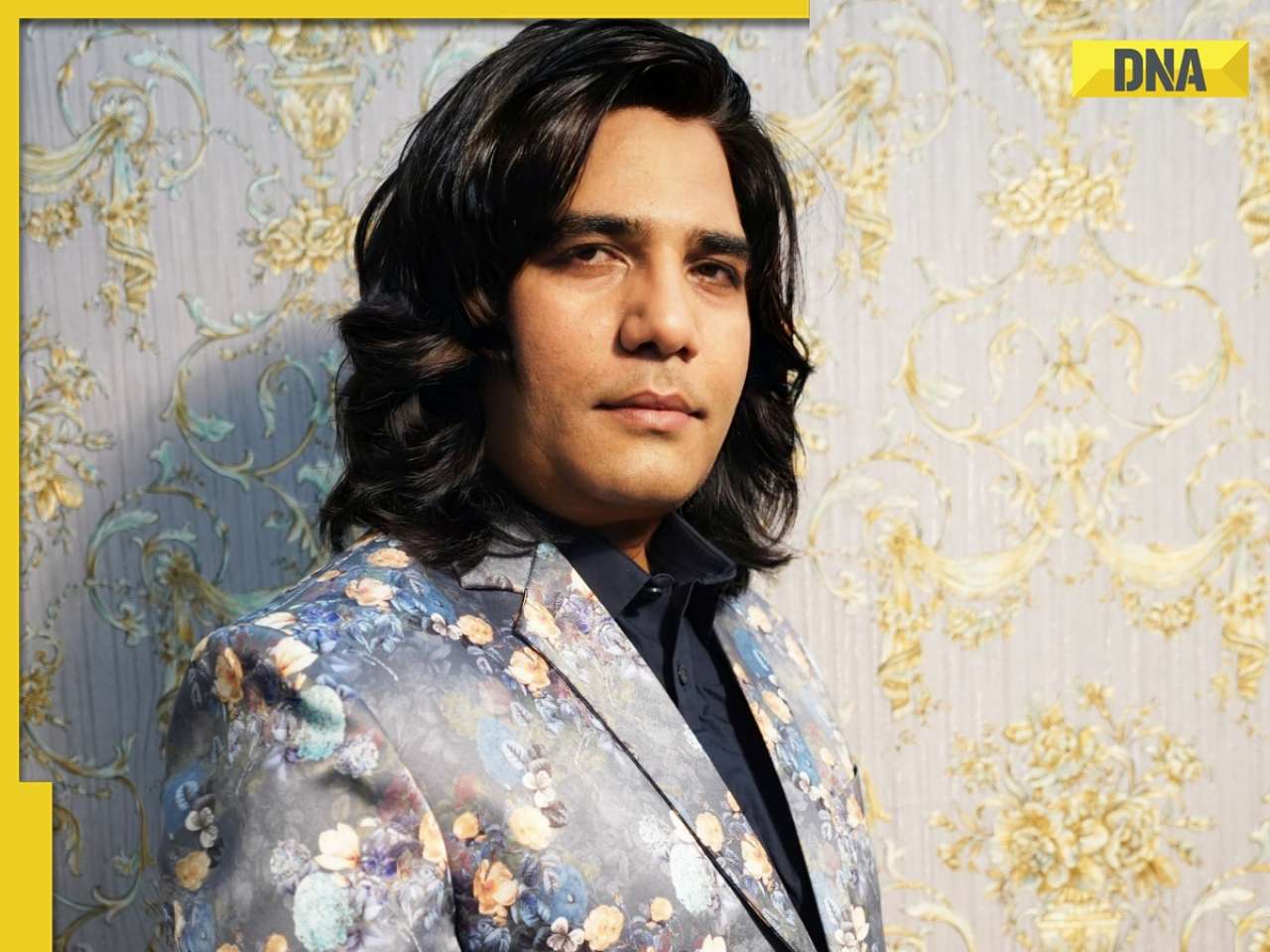

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

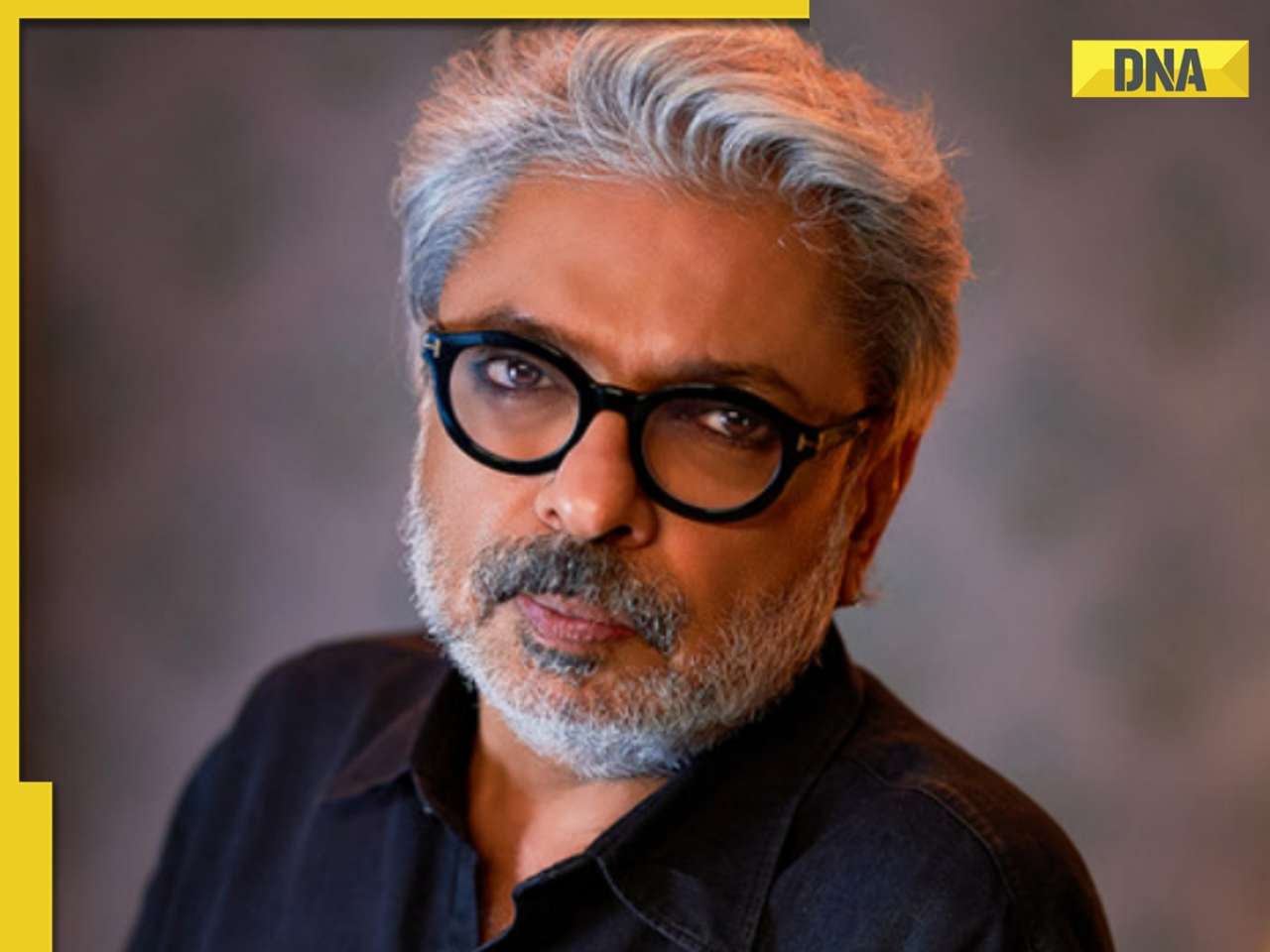

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

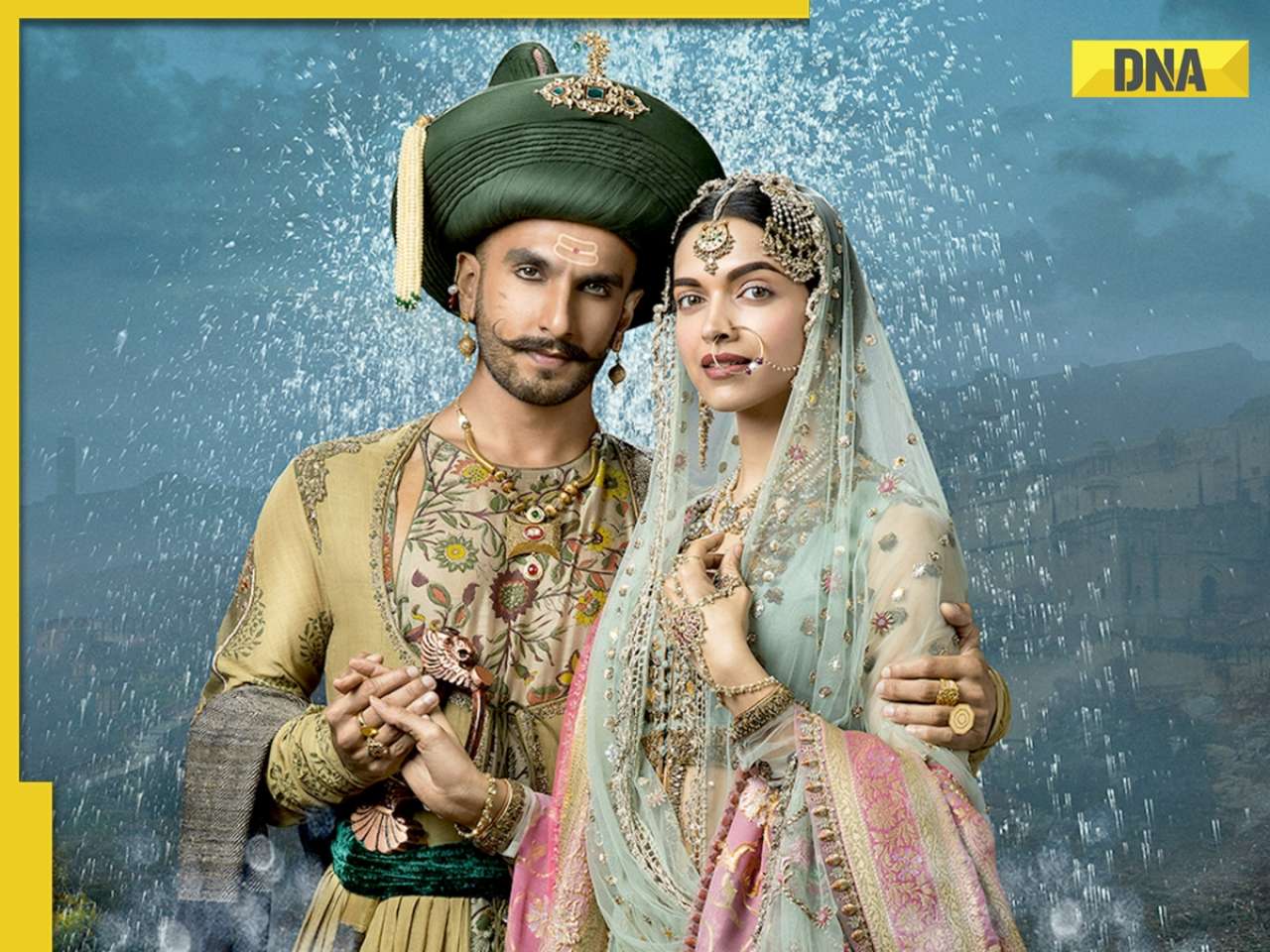

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)

)