Saving and investing strategies for college students in India.

As a college student in India, it's important to start thinking about your financial future early on. Investing and saving money can help you build wealth and achieve your financial goals, but it can be challenging to do so on a student budget. Here are five ways that college students in India can invest and save money:

Open a savings account

One of the easiest ways to start saving money is to open a savings account at a bank or credit union. Look for an account with a high interest rate and no monthly fees. Make a habit of depositing a portion of your income into this account on a regular basis, even if it's just a small amount. This will help you build an emergency fund and establish good saving habits.

Invest in a public provident fund (PPF)

A PPF is a long-term investment option offered by the government of India. It allows you to contribute money on a regular basis and earn a fixed rate of interest. The money you contribute to a PPF is tax-exempt, and the interest you earn is also tax-free. This makes a PPF a good option for college students looking to save and invest for the long term.

Buy a term life insurance policy

While it may seem premature to think about life insurance as a college student, it's actually a smart financial move. Term life insurance is an affordable way to protect your loved ones in the event of your unexpected death. Look for a policy with a high-quality insurer that offers a level premium for the length of the term.

Also read: Post Office Time Deposit scheme will fetch you higher returns than fixed deposit with tax exemptions

Start a side hustle

A side hustle is a way to earn extra money on the side, outside of your regular job or studies. This could be something as simple as freelance writing or dog walking, or something more ambitious like starting your own business. A side hustle can help you save more money and invest in your future.

Invest in your education

Investing in your education can pay off in the long run. Consider taking advantage of scholarships and grants to help pay for tuition and other education-related expenses. Look for internships and other opportunities to gain experience in your field of study, as this can help you stand out to potential employers and increase your earning potential.

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday

Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday![submenu-img]() PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details

PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details![submenu-img]() Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence

Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence![submenu-img]() Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?![submenu-img]() Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..

Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..![submenu-img]() Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process

Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process![submenu-img]() NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents

NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents![submenu-img]() Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...

Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

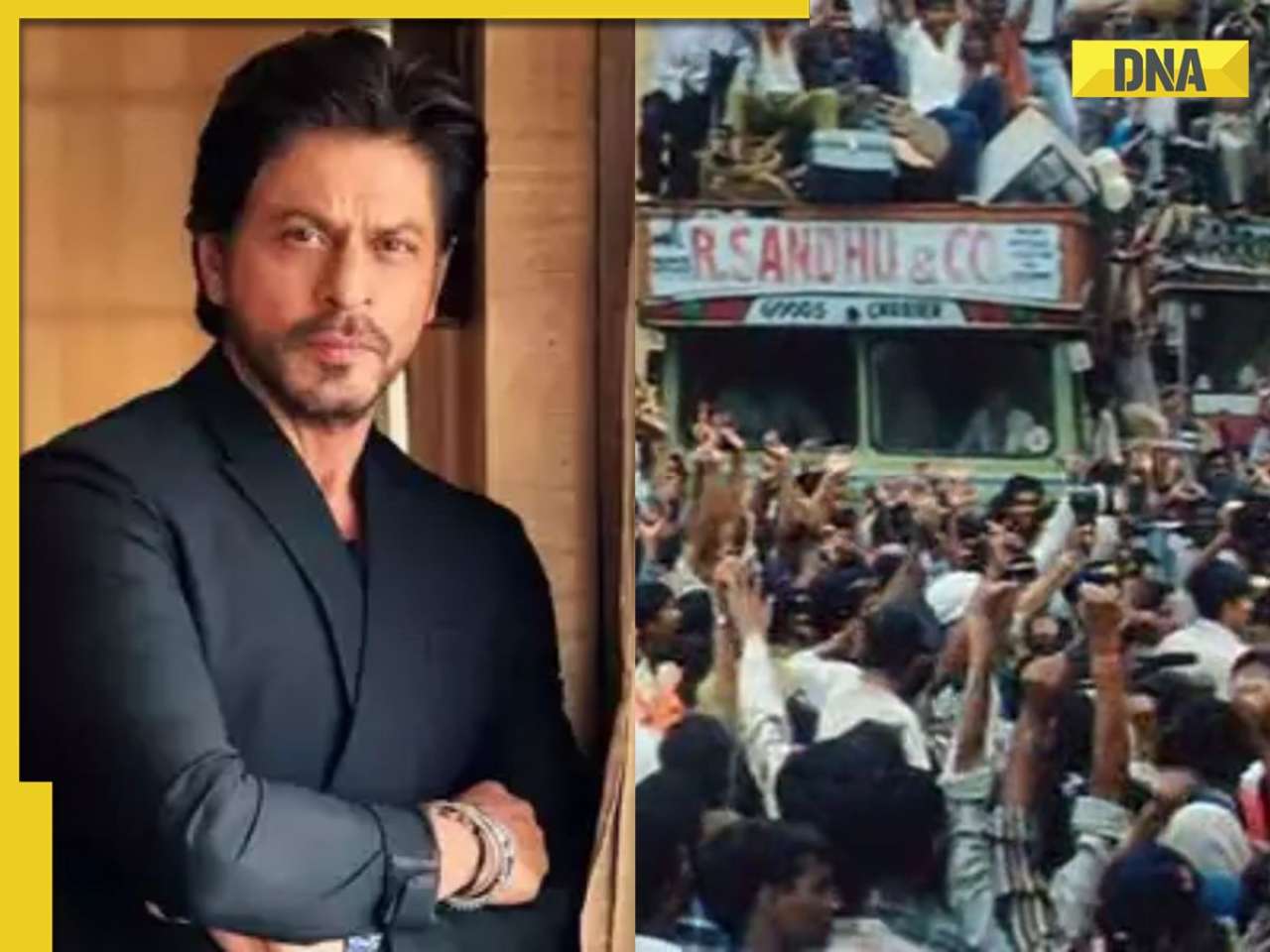

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..

Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..![submenu-img]() Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...

Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...![submenu-img]() 'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films

'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films![submenu-img]() Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...![submenu-img]() Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..

Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..![submenu-img]() Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral

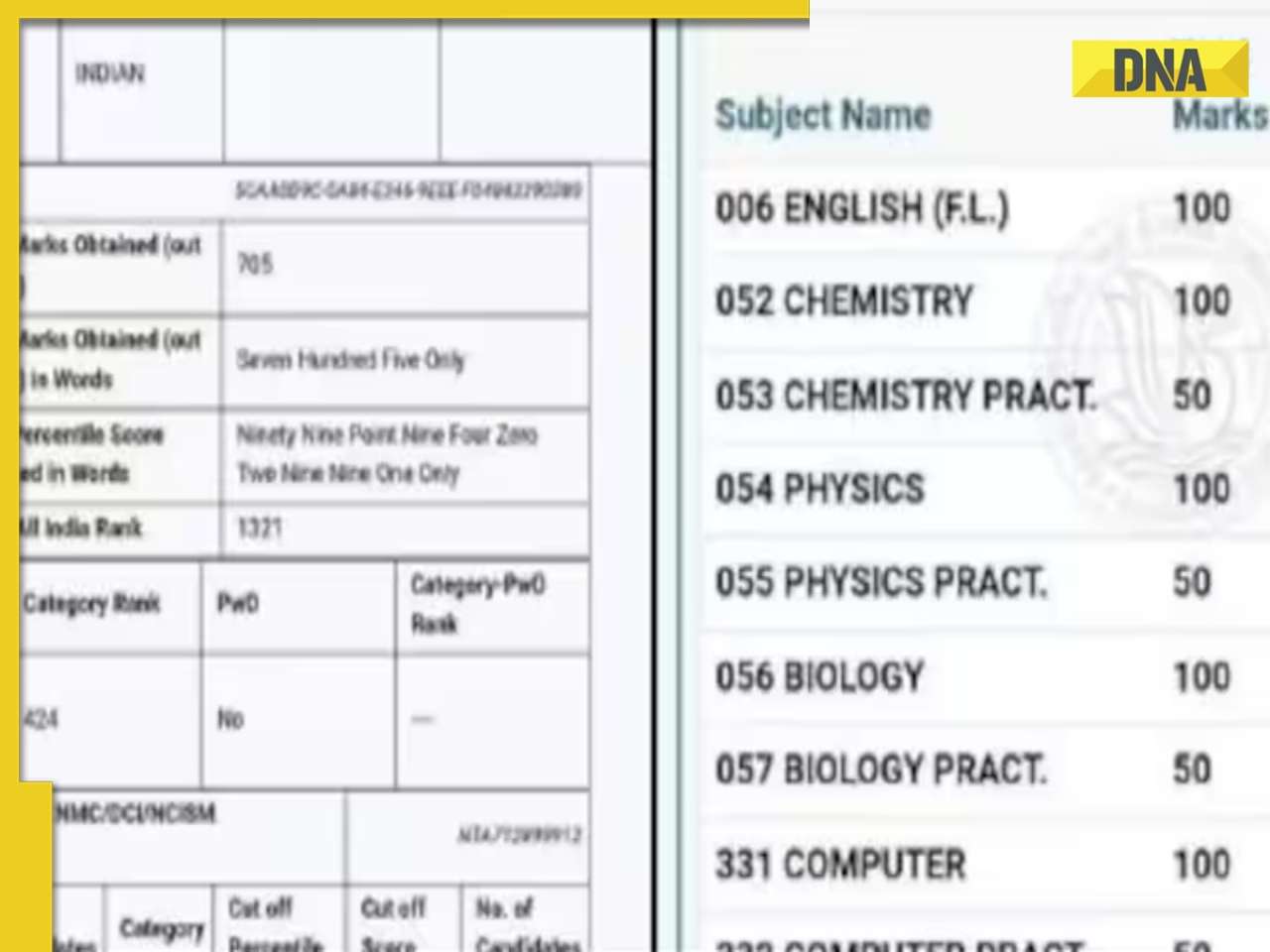

Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral![submenu-img]() Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference

Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference![submenu-img]() Girl shocks internet by eating snake like snack in viral video, watch

Girl shocks internet by eating snake like snack in viral video, watch![submenu-img]() Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

)

)

)

)

)

)

)