You might not be able to beat inflation by simply relying on the returns of traditional investment avenues.

People in India have finally started recognising the importance of retirement planning. Facing financial challenges post-retirement can get tricky, which is why you need to focus on creating wealth for retirement early on. One of the biggest challenges in retirement planning is saving less than what is required to live a comfortable life once you stop working. You might not be able to beat inflation by simply relying on the returns of traditional investment avenues. This is why you need to consider investing in mutual funds to work towards achieving your desired retirement goal.

Understanding retirement mutual funds

- What are retirement mutual funds?

Retirement mutual funds, also known as pension funds, aim to provide a regular income to investors after they reach the age of 55 or 60 years. Usually, pension payments start from age 55-60 years and continue till the investor’s demise. The remaining sum is then transferred to the nominee.

Retirement mutual funds are pension funds that typically invest in debt instruments such as corporate bonds, government securities, and money market instruments. Some retirement funds also invest in equity-related instruments. Do note that retirement funds usually include a lock-in period of 5 years or until the investor’s retirement. The investment cannot be withdrawn during this period.

- Types of retirement mutual funds

- Large-cap mutual funds: Large-cap mutual funds primarily invest in the stocks of large-cap companies and are suitable for stability and long-term growth.

- Mid-cap mutual funds: These funds invest in the stocks of mid-sized companies aiming to strike a balance between growth potential and risk.

- Balanced funds: These funds are also known as hybrid funds, investing in a combination of stocks and bonds. These funds aim to establish a mix of income and capital appreciation.

- Debt funds: Debt funds are mutual fund schemes investing in fixed-income instruments such as corporate debt securities, money market instruments, government bonds, etc. The goal of these funds is to offer a regular income while minimising risk.

Benefits of mutual funds in retirement planning

Being able to maintain a diversified portfolio is one of the key benefits of investing in mutual funds. By investing in a mutual fund, the money is spread across various investments. This helps in reducing your dependence on a single asset’s performance. This diversification provides assurance by mitigating the risks involved with market volatility. Your retirement savings would not be entirely susceptible to the fluctuations of a single stock since the investment is spread out across various asset classes and different sectors.

You do not have to worry about being a mutual fund expert. Your mutual fund investments are managed by investment professionals who have years of experience under their belt. These fund managers use their expertise and regularly analyse market trends and various investment opportunities, based on which they adjust the mutual fund holdings for optimising returns and managing risk.

- Flexibility and accessibility

As a retired individual, having access to your funds is essential for dealing with any sudden expenses. Retirement mutual funds offer that accessibility, allowing you to redeem your investments on a daily basis. This way, you have the flexibility required to get the money from your investments whenever required.

Selecting the right retirement mutual fund

- Risk tolerance: Before investing in mutual funds, you should be aware of the level of risk you are ready to undertake. Choose a mutual fund that is aligned with your risk tolerance.

- The ultimate goal: There are several mutual funds that you can choose to invest in, so choose a fund type that matches your preferred income, capital increase, and diversity.

- Years remaining for retirement: If you are in the early years of your career (20-35 years), you can consider opting for a mutual fund with moderate risk levels to establish steady investment growth. If you are older, your investment approach might need to be aggressive in order to beat inflation and grow a corpus for retirement.

- Fees and charges: Always remember to keep an eye on the management fees, exit and entry loads, redemption charges, etc. before investing in a mutual fund.

- Matching funds to retirement goals

Retirement mutual funds include various options to cater to your investment goals. While debt funds can provide a regular source of income, equity funds are more focused on capital appreciation. You can also choose to establish a balanced portfolio including a mix of both equity and debt instruments.

Strategies for effective retirement planning using mutual funds

- Asset allocation strategies

- Strategic asset allocation

The strategic asset allocation strategy includes determining your exposure to equity and debt, and then staying consistent on the ratio. This strategy requires you to rebalance your portfolio on a periodic basis based on market fluctuations to maintain the specific asset allocation. This type of strategy can be considered by investors who are seasoned and proactive.

- Dynamic asset allocation

Dynamic asset allocation is considered to be one of the most popular strategies when it comes to handling mutual fund investments. This strategy does not focus on a fixed ratio for asset allocation but invests funds depending on market movements. As per this strategy, you would favour exposure towards equity when there is an upward market trend and shift your focus from equity to debt during a downward market trend. You can also choose to go the opposite way for buying low and selling high.

- Tactical asset allocation

Tactical asset allocation is a flexible strategy that focuses on altering the asset allocation for cashing in when the market is favourable. You can adopt this strategy and change your ratio to make short-term capital gains. This strategy requires an ability to understand market movements for maximising returns by reallocating assets.

- Regular reviews and rebalancing

It is of the utmost importance to regularly monitor and adjust your mutual fund investments to ensure that they are aligned with your retirement goals. Getting your portfolio rebalanced from time to time can help in avoiding excessive risk and maintain optimal returns.

You can also opt for tax-saving mutual funds, known as equity-linked savings schemes (ELSS). With ELSS funds, you can claim a tax rebate of Rs 1,50,000 under Section 80C of the Income Tax Act. By investing in ELSS funds, you can get the dual benefit of wealth accumulation along with tax deductions.

Conclusion

Retirement mutual funds can potentially offer capital appreciation and stable returns along with the flexibility required. It is ideal to seek professional guidance from a fund manager who can cater to your specific retirement goals.

Disclaimer: Above mentioned article is a Consumer connect initiative, This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever.

![submenu-img]() 2024 Maruti Suzuki Swift officially teased ahead of launch, bookings open at price of Rs…

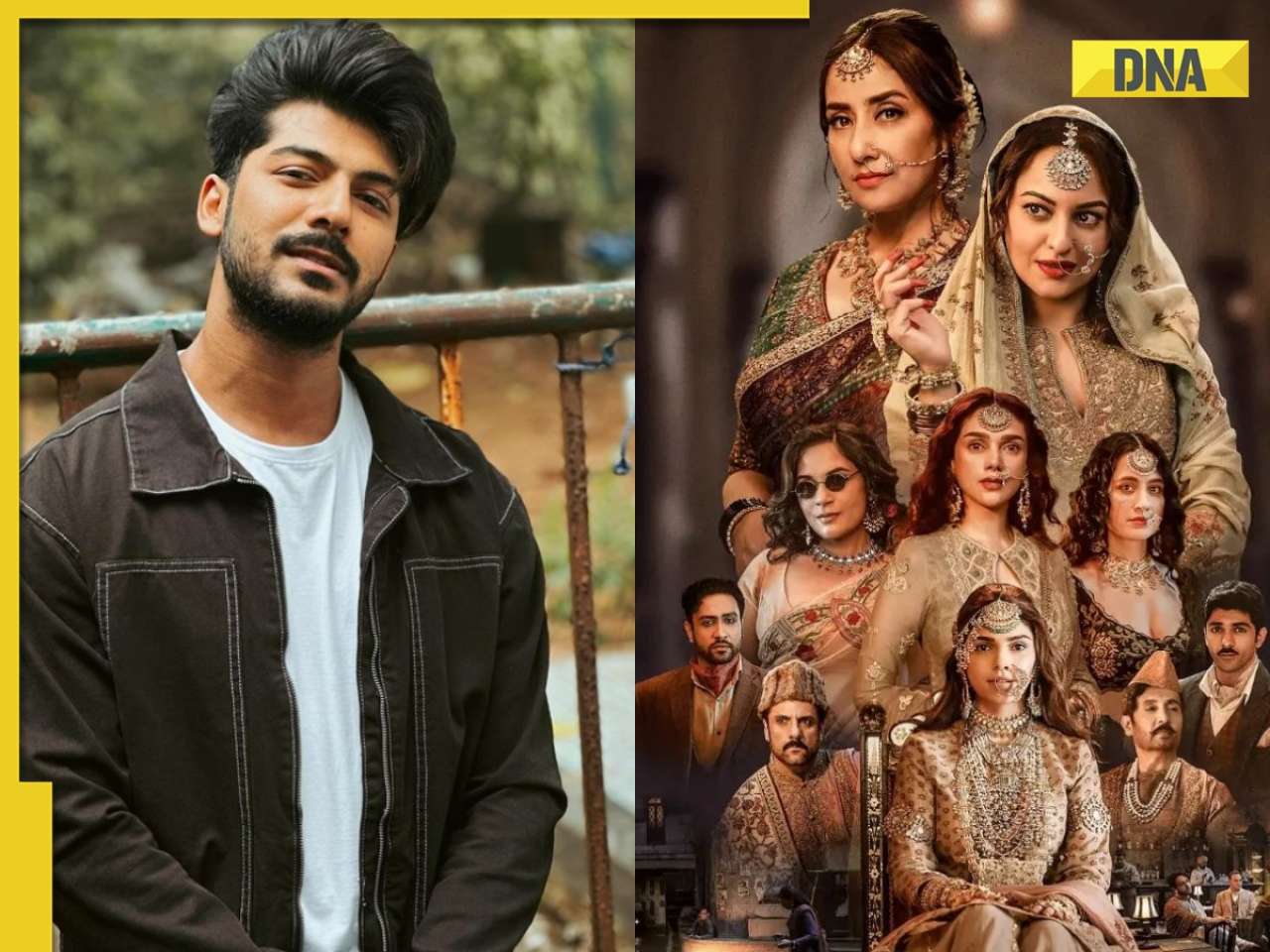

2024 Maruti Suzuki Swift officially teased ahead of launch, bookings open at price of Rs…![submenu-img]() 'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'

'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'![submenu-img]() Meet Jai Anmol, his father had net worth of over Rs 183000 crore, he is Mukesh Ambani’s…

Meet Jai Anmol, his father had net worth of over Rs 183000 crore, he is Mukesh Ambani’s…![submenu-img]() Shooting victim in California not gangster Goldy Brar, accused of Sidhu Moosewala’s murder, confirm US police

Shooting victim in California not gangster Goldy Brar, accused of Sidhu Moosewala’s murder, confirm US police![submenu-img]() Suspense continues over Rahul Gandhi, Priyanka Gandhi's candidatures from Raebareli and Amethi, final decision today

Suspense continues over Rahul Gandhi, Priyanka Gandhi's candidatures from Raebareli and Amethi, final decision today![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'

'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'![submenu-img]() Meet actress who once competed with Aishwarya Rai on her mother's insistence, became single mother at 24, she is now..

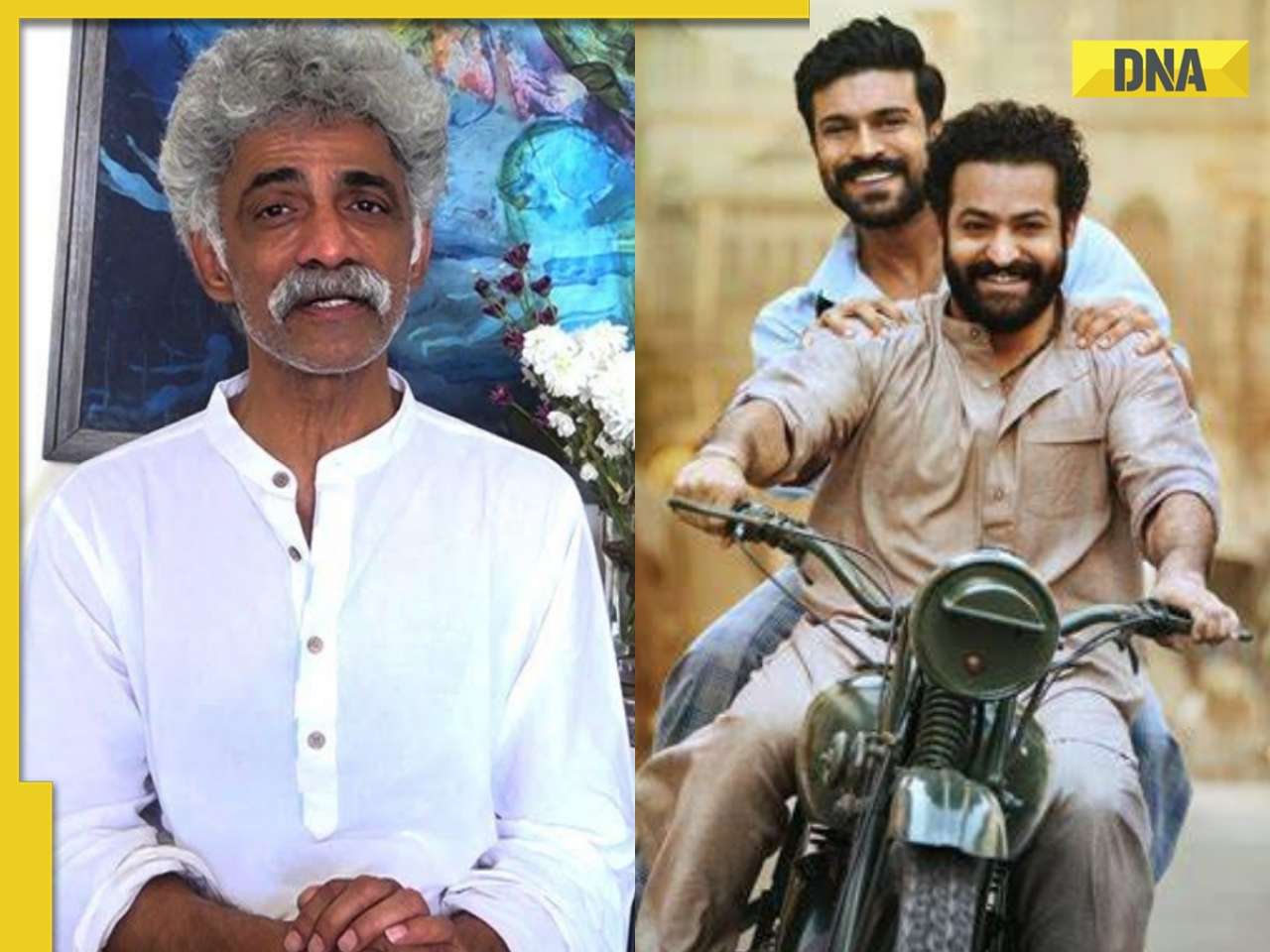

Meet actress who once competed with Aishwarya Rai on her mother's insistence, became single mother at 24, she is now..![submenu-img]() Makarand Deshpande says his scenes were cut in SS Rajamouli’s RRR: ‘It became difficult for…’

Makarand Deshpande says his scenes were cut in SS Rajamouli’s RRR: ‘It became difficult for…’![submenu-img]() Meet 70s' most daring actress, who created controversy with nude scenes, was rumoured to be dating Ratan Tata, is now...

Meet 70s' most daring actress, who created controversy with nude scenes, was rumoured to be dating Ratan Tata, is now...![submenu-img]() Meet superstar’s sister, who debuted at 57, worked with SRK, Akshay, Ajay Devgn; her films earned over Rs 1600 crore

Meet superstar’s sister, who debuted at 57, worked with SRK, Akshay, Ajay Devgn; her films earned over Rs 1600 crore![submenu-img]() IPL 2024: Spinners dominate as Punjab Kings beat Chennai Super Kings by 7 wickets

IPL 2024: Spinners dominate as Punjab Kings beat Chennai Super Kings by 7 wickets![submenu-img]() Australia T20 World Cup 2024 squad: Mitchell Marsh named captain, Steve Smith misses out, check full list here

Australia T20 World Cup 2024 squad: Mitchell Marsh named captain, Steve Smith misses out, check full list here![submenu-img]() SRH vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() SRH vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Rajasthan Royals

SRH vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Rajasthan Royals ![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() Viral video: Man's 'peek-a-boo' moment with tiger sends shockwaves online, watch

Viral video: Man's 'peek-a-boo' moment with tiger sends shockwaves online, watch![submenu-img]() Viral video: Desi woman's sizzling dance to Jacqueline Fernandez’s ‘Yimmy Yimmy’ burns internet, watch

Viral video: Desi woman's sizzling dance to Jacqueline Fernandez’s ‘Yimmy Yimmy’ burns internet, watch![submenu-img]() Viral video: Men turn car into mobile swimming pool, internet reacts

Viral video: Men turn car into mobile swimming pool, internet reacts![submenu-img]() Meet Youtuber Dhruv Rathee's wife Julie, know viral claims about her and how did the two meet

Meet Youtuber Dhruv Rathee's wife Julie, know viral claims about her and how did the two meet![submenu-img]() Viral video of baby gorilla throwing tantrum in front of mother will cure your midweek blues, watch

Viral video of baby gorilla throwing tantrum in front of mother will cure your midweek blues, watch

)

)

)

)

)

)

)