The banking sector is undergoing significant transformations, and leading this charge are neo-tech banking solutions like Kotak811. Marking a departure from traditional banking norms, Kotak811 offers a full-fledged digital bank account, equipped with a unique zero-contact Video KYC service. This innovation not only makes the banking process smoother but also aligns with the trending #BankFromHome movement, heralding a new era of financial management in India.

An Overview of the Kotak811 Video KYC Account

Kotak811's unique offerings serve as a testament to the evolution of modern banking:

1. A Seamless KYC Journey: With Kotak811's video KYC feature, customers can effortlessly open an account and complete their KYC process, from the comfort of their homes. This is a welcome deviation from the traditional "KYC bank account limit" systems.

2. Absolute Convenience: The account opening process is not only online and paperless, but it also eliminates the need for any physical interactions. This facilitates the opening of a zero-balance savings account from one’s own space.

3. Zero Restrictions: Another standout feature of the Kotak811 account created via the video KYC route is its lack of restrictions. There are no boundaries set on deposits, account balances, or spends, thus sidestepping the usual concerns about "KYC bank account limit".

4. Kotak811 Lite: For those not looking for the full KYC account, there’s also the Kotak811 Lite or Limited KYC account option, offering flexibility based on the customer's needs.

5. Expansive Features: With a plethora of over 180 features and services, the account assures a comprehensive banking experience. From removing the account balance limit of ₹1 Lakh to availing exclusive health and accident covers online sans paperwork, and accessing myriad services like Savings Accounts, Credit Cards, Debit Cards and Fixed Deposits, Kotak811 is a game-changer.

Prepping for the Video KYC Process

Prior to commencing the video KYC journey with Kotak811, customers should ensure they have:

• Aadhaar Number or Virtual ID

• PAN card

• A mobile device with a camera

• A white sheet and a black pen

• A well-lit room with a plain backdrop

• Consistent and uninterrupted data connectivity

• Physical presence in India during the process

After these prerequisites are in order, the process is simple. Post the video KYC, and subsequent due diligence verification by the bank, the account becomes active and fully operational.

Understanding Full KYC

Full KYC, or Know Your Customer, is a vital protocol which enables banks to authenticate and identify customers through their documents and signature. This is instrumental in safeguarding the sanctity and security of monetary transactions.

The Future of KYC: Secure, Simple, and Swift

Kotak811 has truly redefined the KYC paradigm. Their video KYC, with its emphasis on security and simplicity, takes a mere 5 minutes, all thanks to seamless online processes and dedicated Kotak811 officials. This not only showcases commitment to customer ease but also stands as a milestone in the modernisation of India's banking realm.

To wrap up, Kotak811's video KYC savings account is not just a banking product; it's a vision for the future. With zero-contact and streamlined operations, it speaks to the contemporary user, ensuring efficiency, security, and unparalleled convenience. As the first of its kind in India, Kotak811 paves the way for an ever expanding horizon for banking in India.

Disclaimer : Above mentioned article is a sponsored feature, This article is a paid publication and does not have journalistic/editorial involvement of IDPL, and IDPL claims no responsibility whatsoever.

![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

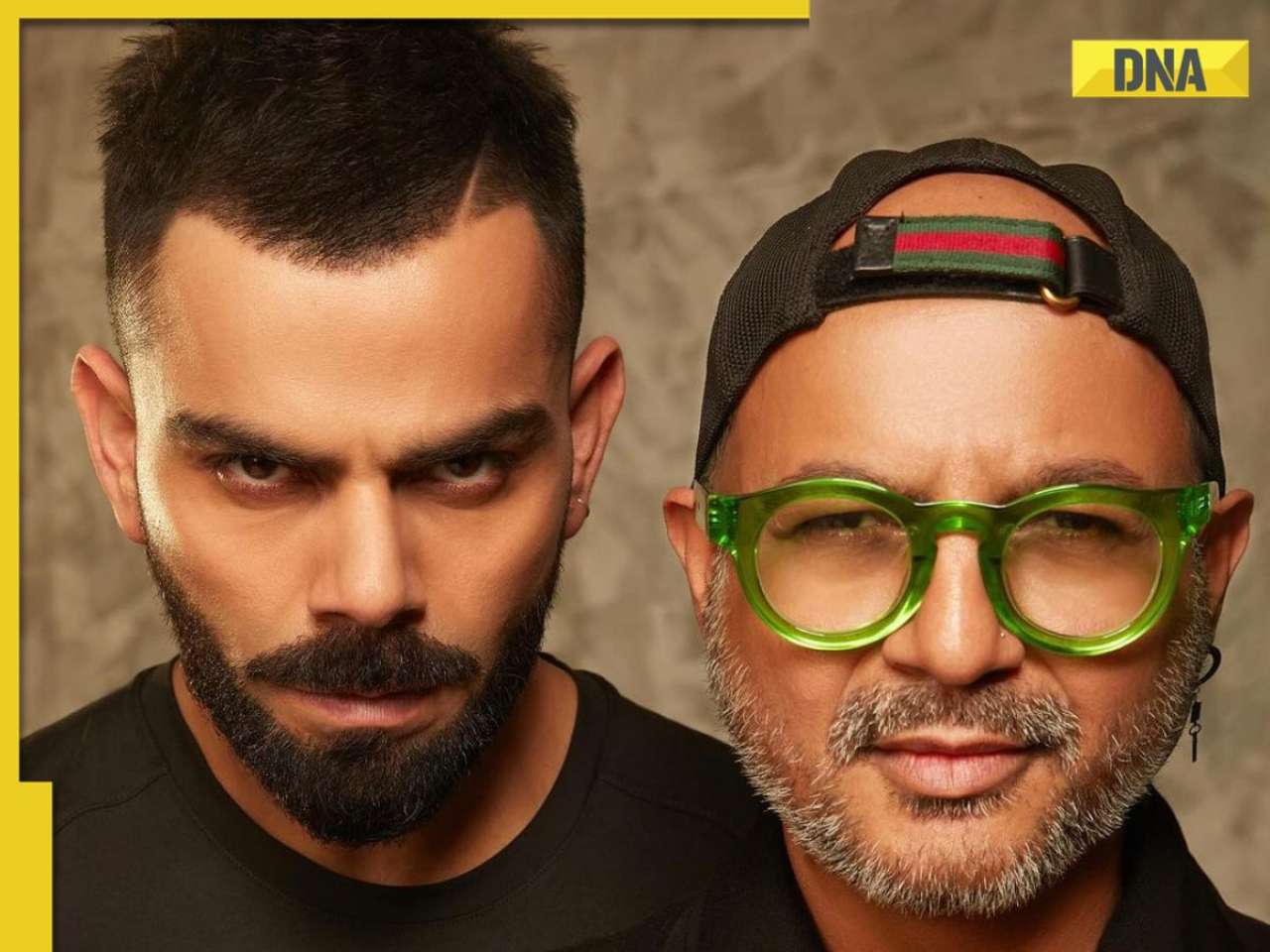

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here

Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here![submenu-img]() BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....

BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....![submenu-img]() 'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case

'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case![submenu-img]() India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek

India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...

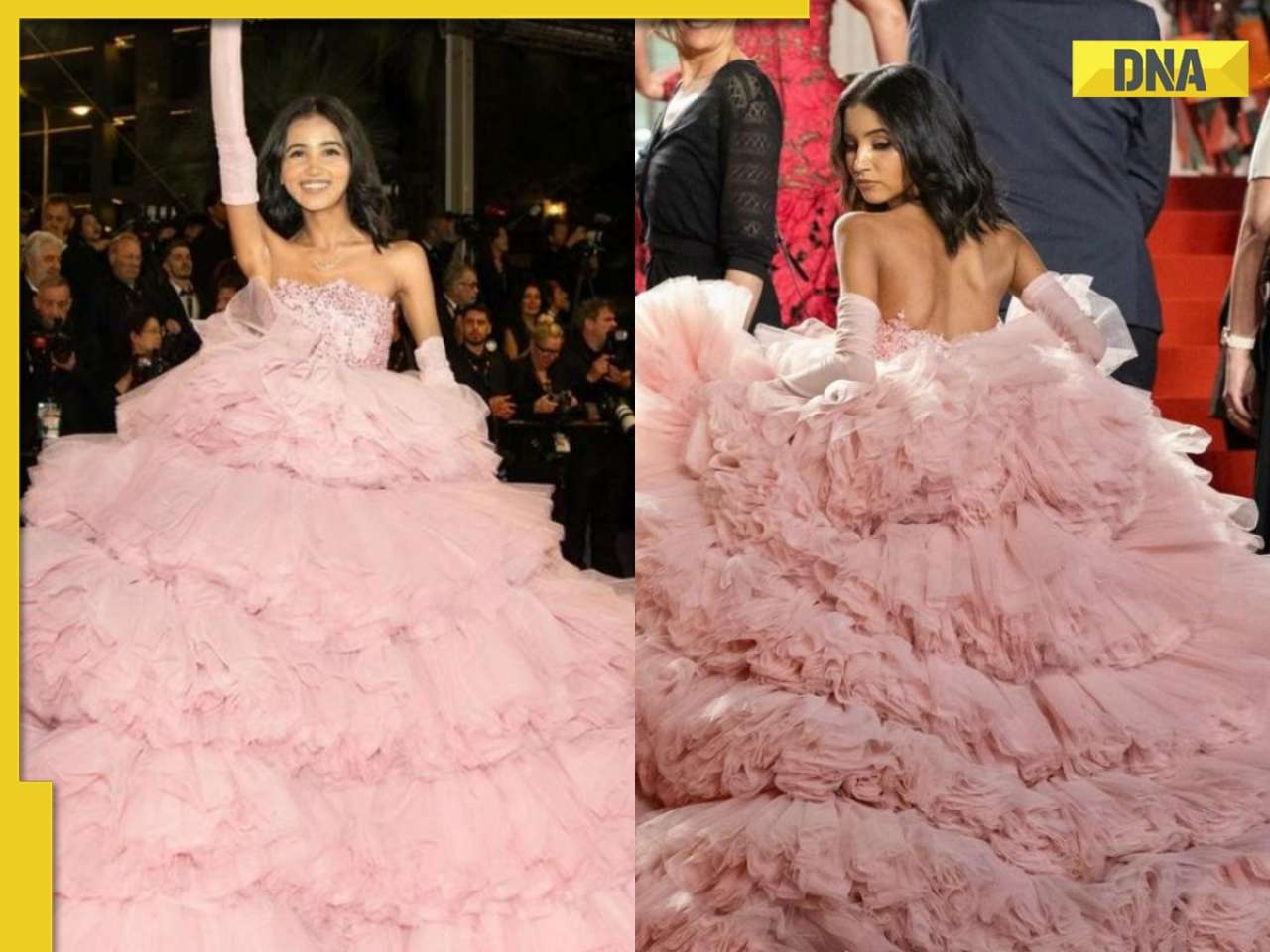

This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...![submenu-img]() Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet

Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet![submenu-img]() Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident

Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident![submenu-img]() Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..

Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..![submenu-img]() Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it

Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it![submenu-img]() Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww

Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww![submenu-img]() IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash

IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash![submenu-img]() Do you know which God Parsis worship? Find out here

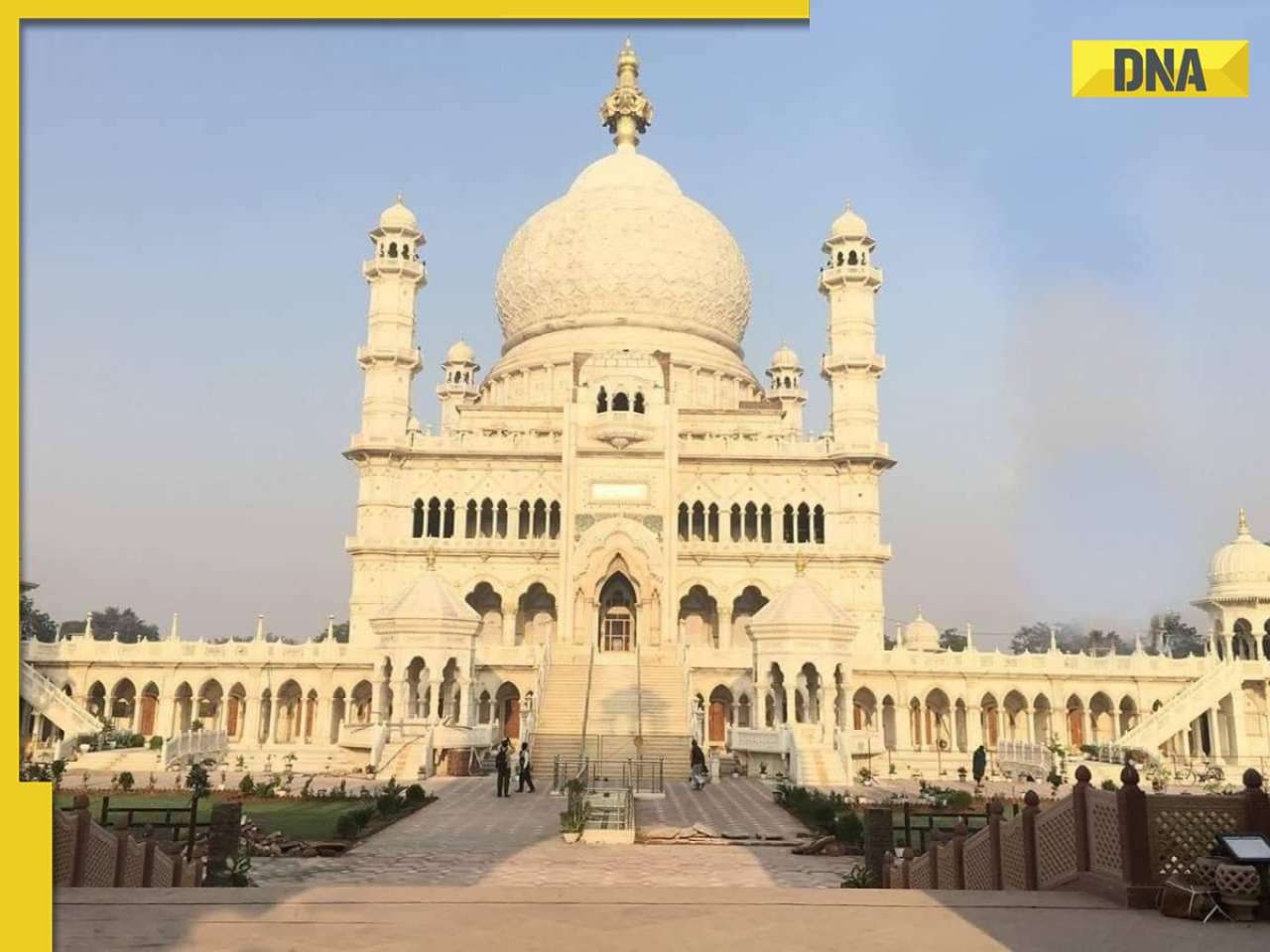

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

)

)

)

)

)

)

)