Wins bids for operation, management and development of airports at Ahmedabad, Jaipur, Lucknow, Thiruvananthapuram and Mangaluru

Ports-to-power conglomerate Adani Group, which now has aviation sector on its radar, was declared the highest bidder for five of the six airports opened for privatisation. The development comes just days after the infrastructure major showed interest in acquiring a stake in Mumbai airport.

Adani Enterprises Ltd won the bid for operation, management and development of airports at Ahmedabad, Jaipur, Lucknow, Thiruvananthapuram and Mangaluru. The bids for Guwahati airport are likely to be declared today.

"We would be aiming to scale up the infrastructure to bring these facilities on par with global standards," Adani group said in a statement.

According to government officials, this time, the bidding was based on per passenger basis instead of revenue sharing seen in earlier privatisation of Mumbai, Delhi, Bengaluru and Hyderabad airports. Also, the concession period is 50 years as against 30 years previously.

The six airports together carried over 20.6 million 5.1 million domestic and international passengers, respectively, for April to December 2018 period.

The executives from Adani Group refused to share information on the investment that will be required for these airports and the plans going forward. However, industry insiders aware of the details of the bidding claim that the winner is required to underwrite the investment already made by Airport Authority of India (AAI) in each of these airports apart from additional development costs that would be incurred for a period of over 15 years.

An analysis done by Mark Martin, founder and CEO of Dubai-based Martin Consulting, expects the underwriting costs to in Rs 850-1,250 crore range for each of the airports. Further, the airport developer is required to make an additional investment of around Rs 3,500-4,500 crore per airport over the decade-and-a-half. The experts claim that these airports are likely to get saturated within the next 15 years.

The Adani group, which recently forayed into real estate and power distribution businesses, has been circling airport assets. Adani Enterprises is believed to have shown interest in buying the 23.5% stake held by Bidvest and ACSA - two private equity partners of GVK Airport Ltd - in Mumbai airport. GVK, which has the first right of refusal, has agreed to acquire the 13.5% stake of Bidvest in order to keep Adani Enterprises at bay. Apart from that, the company has already lined up Rs 1,500 crore investment plan to upgrade Mundra airport in Gujarat to a full-fledged commercial aerodrome.

The details available with AAI reveal that Adani Enterprises offered Rs 177 per passenger for Ahmedabad airport. In contrast, the closest competing offer came from NIIF & Zurich Airport International at Rs 146. GMR Airports, which operates a number of airports across the globe, offered Rs 85.

Similarly, for Jaipur, Adani offered Rs 174 per passenger, while the nearest rival NIIF & Zurich Airport stood at Rs 155 per passenger. For Lucknow, Adani Enterprises's bid was Rs 171 per passenger as against Rs 139 per passenger quoted by AMP Capital. For Thiruvananthapuram, Adani bid Rs 168 in comparison to Rs 135 offered by KSIDC.

Interestingly, GMR, the only other player to have bid for all the airports, put in bids much lower than Adani, with the difference for Mangaluru airport most stark. While GMR quoted Rs 18, Adani offered Rs 118. An official from one of the airports said, "After being so long in the business, GMR knows what to offer."

Industry sources said this time, the government wanted the privatisation process to get done at the earliest as previous instances saw opposition from employees, political groups and others. A lot of legal cases have already been filed against the government's move, the sources added.

Aviation consultancy CAPA estimates that to keep pace with the projected growth in airport traffic, up to $45 billion of investment will be required for airport expansion and construction in India by 2030.

Minister of State for Civil Aviation Jayant Sinha last year said the airport infrastructure sector is set to get around Rs 1 lakh crore in the next five years. Of that amount, around Rs 95,178 crore of investment is expected to come from private investments in the joint venture airports, creation of new terminals and development of greenfield airports. AAI has an annual terminal capacity of 155 million passengers, which it intends to raise to 300 million by 2026-27. The government has an outlay of over Rs 50,000 crore for developing greenfield airports.

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

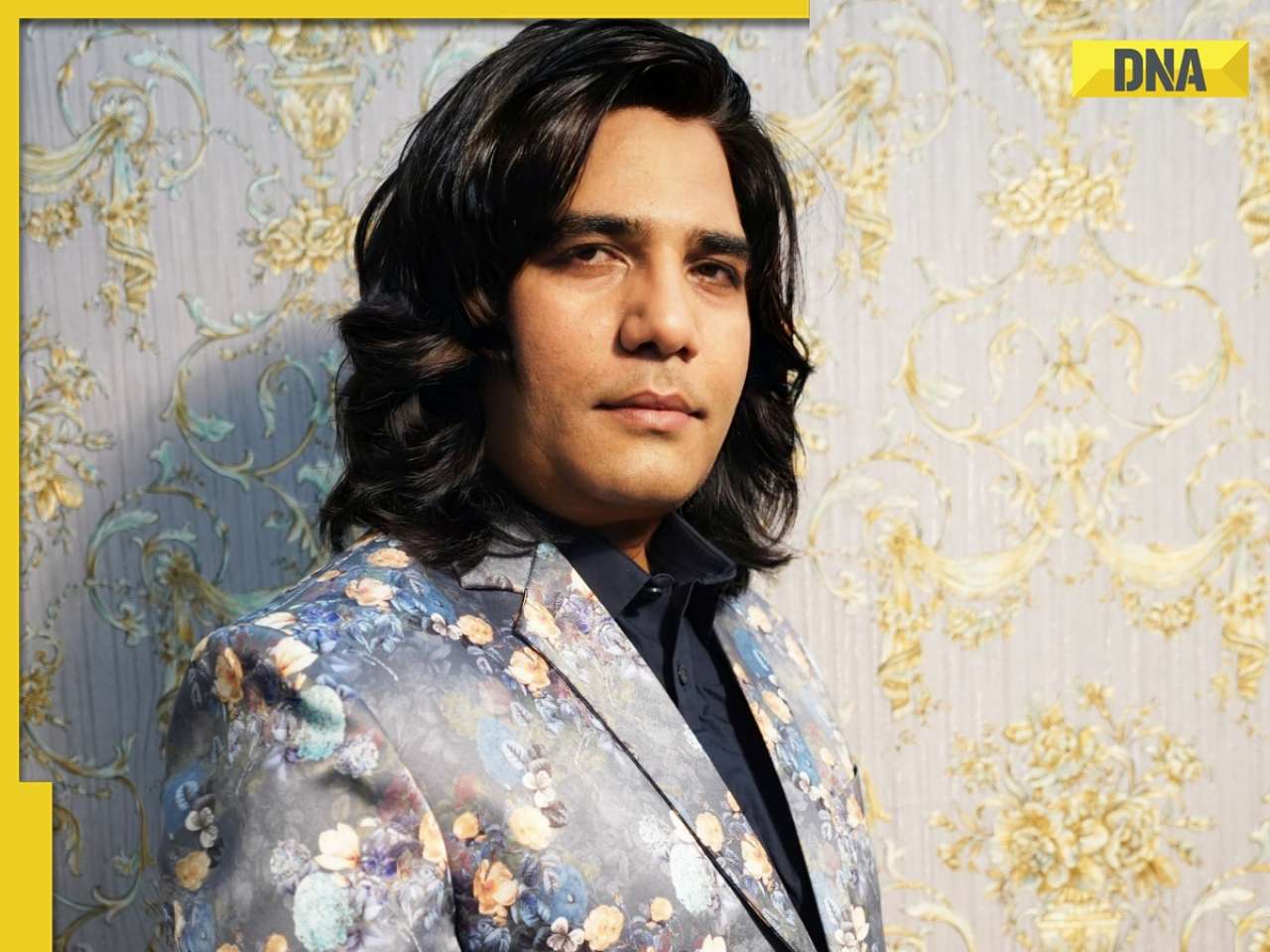

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

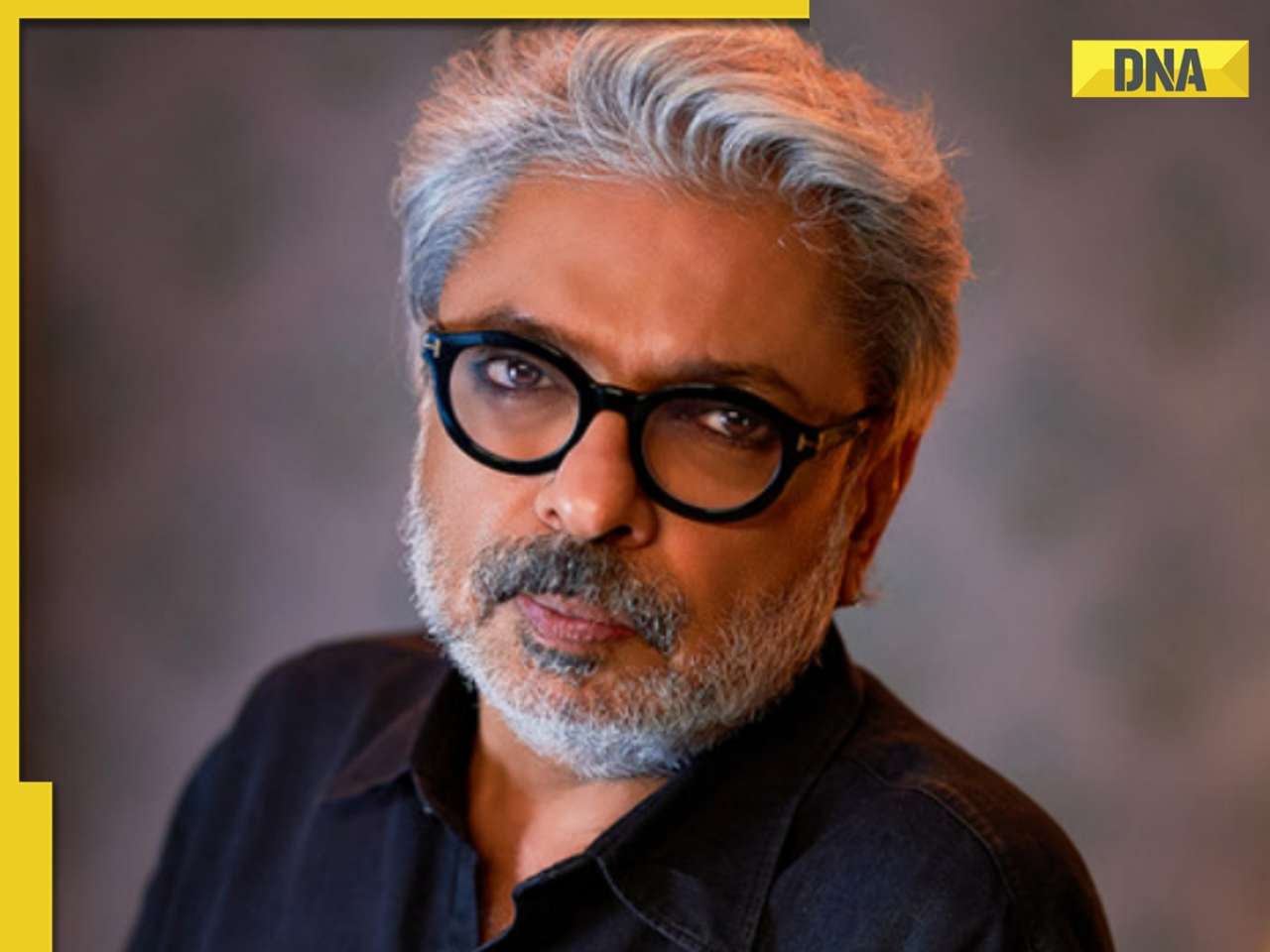

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

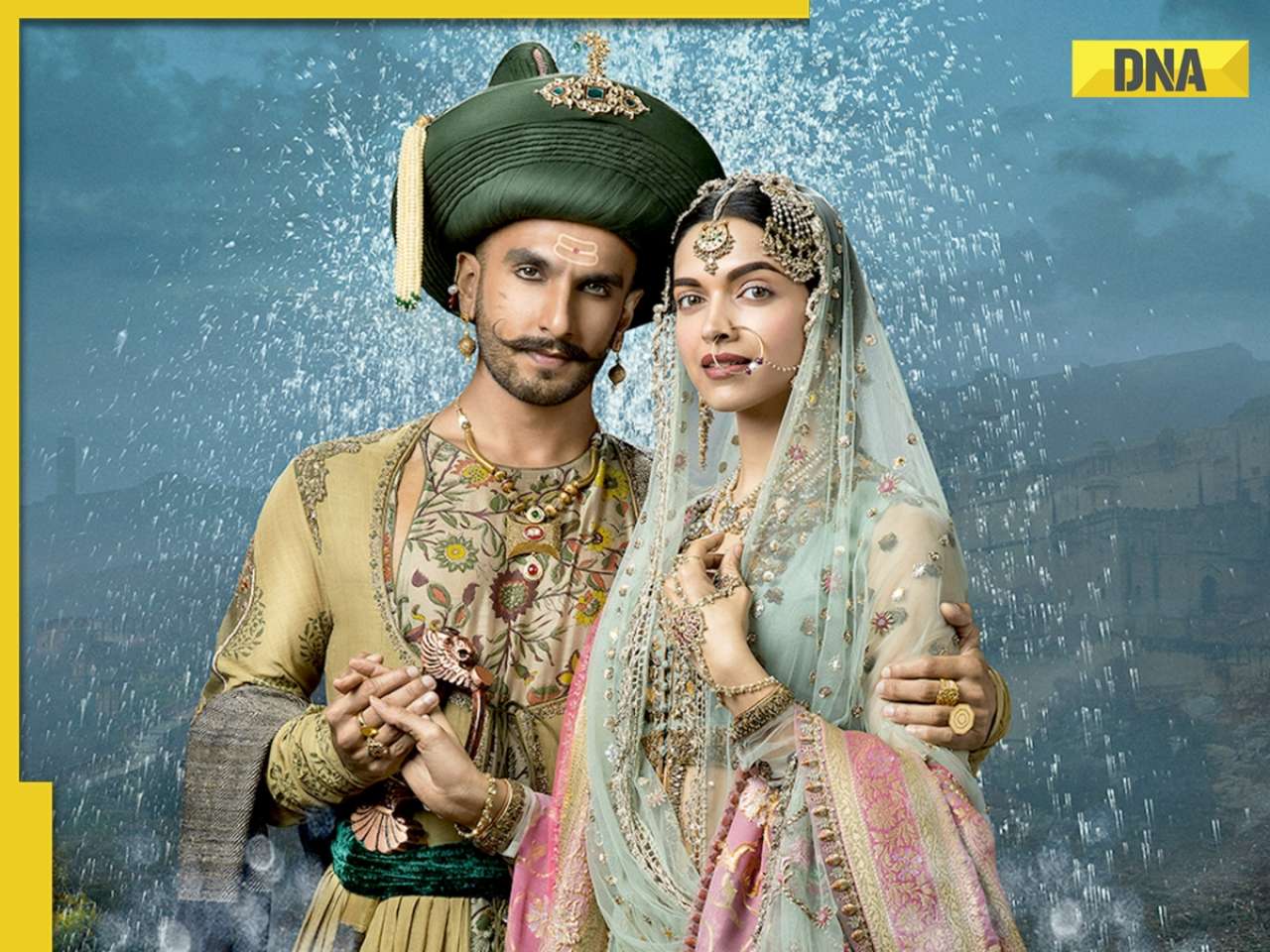

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)

)

)