A husband should pay a salary to his wife and the government should allow it as a deductible expense in the form of a tax benefit

In one of their recent monthly coffee meets, three best friends, Soniya (beautician), Nidhi (homemaker) and Manish (salaried person), found themselves deviating from the usual topics of discussion of career, job, family or vacation to a more serious discussion about their personal finance looking at the scheduled Union Budget to be announced on February 1. Let's find the gist of their conversation and the expectations of a common Indian from the upcoming Union Budget:

Soniya (Beautician): Friends, I think the 'Make in India' campaign and the very recent Davos trip and the serious efforts towards its execution will surely make India emerge a global business centre. It will create more jobs as well and ample opportunities, but I also believe that apart from running 'Make in India' campaign, the government should also take care for the people who 'Make for India'. Our local small & medium enterprises (SMEs), right from manufacturing to services industry, have to be given easy access to finance and a much easier process of setting up their businesses. To foster entrepreneurship, many things needs to be implemented and tax system needs to be relaxed, such as the recent challenges of paying angel tax, for which every start-up which has raised angel money, has received a notice. They should create a mechanism and laws should surely be made to catch the black money hoarders or tax evaders, but not the genuine start-ups who has put everything on stake, their jobs, savings, houses, etc.

As soaring oil prices are again the main driving force behind inflation, the government should reduce taxes on it, and make sure that the benefit of taxes collected in the form of GST, customs, excise and personal income tax, etc, are passed on to common people in terms of basic things we expect, good air to breathe, clean water and better health and education facility.

Nidhi (homemaker): Well said Soniya, being a homemaker for me, every single penny saved is a penny earned for me. I expect the Budget to reduce my worry of increasing inflation, which raises the prices of basic necessities like food, gas and other household expenses, my children's education fees. All these costs have been on a rise without any respite. Being a homemaker, I aim to save and convert the same to some fruitful investments. So, I wish that our finance minister takes suitable measures to increase my savings by reducing our living expenses.

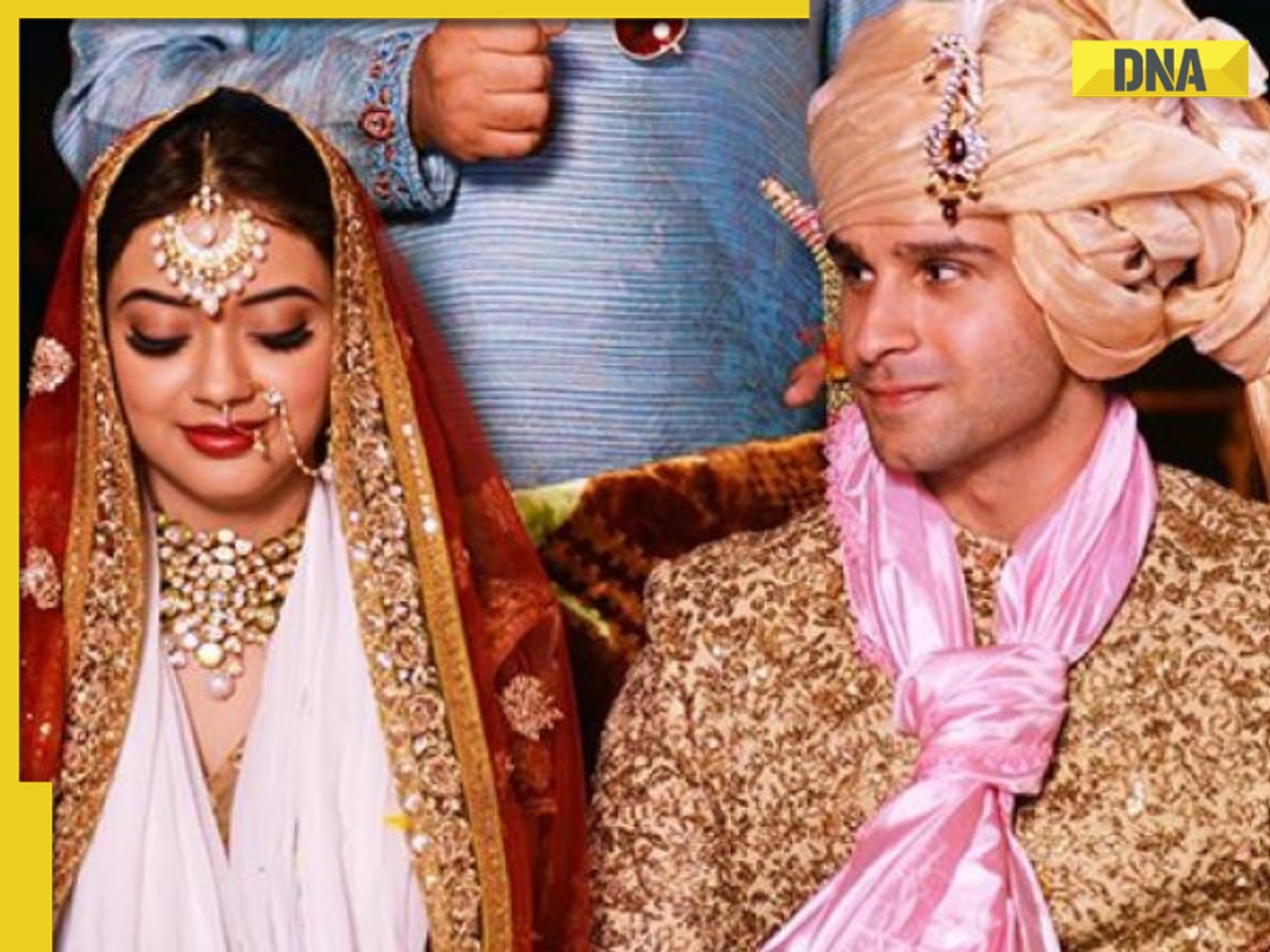

Very recently India's wonder girl Manushi Chhillar who have recently won the beauty pageant, have beautifully said that it is the mother who deserve the highest amount of salary and keeping that in mind, I also have a strong suggestion, every husband should pay a salary to his wife and the government should allow it as a deductible expense in the form of a tax benefit.

Manish (salaried person): Well said Soniya and Nidhi, you have hit the bullseye, in fact I also have a long list of expectations which most of the salaried class taxpayers have from our FM:-

Increase the basic exemption limit: The basic exemption limit needs to be increased from Rs 2.50 lakh to at least Rs 5 lakh looking at the many taxes I pay in the form of GST and direct income tax, everything I buy or earn, I pay tax. Apart from that the inflation in every sector, exemption limit should to be raised by good margin.

Section 80C limit: At present, Section 80C deduction limit is kept at Rs 1.50 lakh only for past many years and again the reasons as mentioned in the first point applies here also. This limit should be revised and to be raised at least to Rs 3 lakh or 4 lakh.

Interest on bank savings account: The current limit of Rs 10,000 exemption from savings account interest should be hiked too.

Medical expenses: Health is one of the biggest worry for any Indian and the government should increase the existing exemption limit of Rs 15,000 towards medical reimbursement to Rs 1 lakh minimum.

Home loan interest and principal benefits: The limits for both the tax deduction options from interest and principal should be increased, the interest on our home loans are more than Rs 2 lakh and the same should be revised to a higher limit and principal benefit should be kept outside the Section 80C limit and provided separately.

Re-introducing standard deduction: Salaried taxpayers don't enjoy any deduction of expenses from income as compared with their self-employed and businessmen friends. I wish they bring the standard deduction back in the rule book for every salaried taxpayer.

By this time, the waiter came with the bill and they shook hands and promised to meet next week hoping that their voices are heard.

So, let the common people have their share of fun, too.

POINTS TO PONDER

- A husband should pay a salary to his wife and the government should allow it as a deductible expense in the form of a tax benefit

- The Budget should reduce the worry of increasing inflation, which raises the prices of basic necessities like food, gas and other household expenses

- The basic exemption limit needs to be increased from Rs 2.50 lakh to at least Rs 5 lakh

- The government should increase the existing exemption limit of Rs 15,000 towards medical reimbursement to Rs 1 lakh minimum

The writer is a chartered account and chief gardener at Money Plant Consultancy

![submenu-img]() Nagaland Lok Sabha Election Result 2024: Full list of winner and loser candidates will be announced soon

Nagaland Lok Sabha Election Result 2024: Full list of winner and loser candidates will be announced soon![submenu-img]() Meghalaya Lok Sabha Election Result 2024: Full list of winner and loser candidates will be announced Soon

Meghalaya Lok Sabha Election Result 2024: Full list of winner and loser candidates will be announced Soon![submenu-img]() Delhi Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon

Delhi Lok Sabha Election Results 2024: Full List of Winner and Loser Candidates will be announced Soon![submenu-img]() Varun Dhawan, Natasha Dalal blessed with a baby girl, grandfather David Dhawan shares good news

Varun Dhawan, Natasha Dalal blessed with a baby girl, grandfather David Dhawan shares good news![submenu-img]() DNA TV Show: Opposition rejects exit polls results, demands counting of postal ballots first

DNA TV Show: Opposition rejects exit polls results, demands counting of postal ballots first![submenu-img]() Meet man who won medals for India in bodybuilding, cracked UPSC in 1st attempt, resigned as IRS after 10 years due to...

Meet man who won medals for India in bodybuilding, cracked UPSC in 1st attempt, resigned as IRS after 10 years due to...![submenu-img]() IIT-JEE topper with AIR 1 joins IIT Bombay, gets job at NASA as scientist, leaves to work as…

IIT-JEE topper with AIR 1 joins IIT Bombay, gets job at NASA as scientist, leaves to work as…![submenu-img]() Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..

Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..![submenu-img]() Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..

Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..![submenu-img]() Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...

Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Varun Dhawan, Natasha Dalal blessed with a baby girl, grandfather David Dhawan shares good news

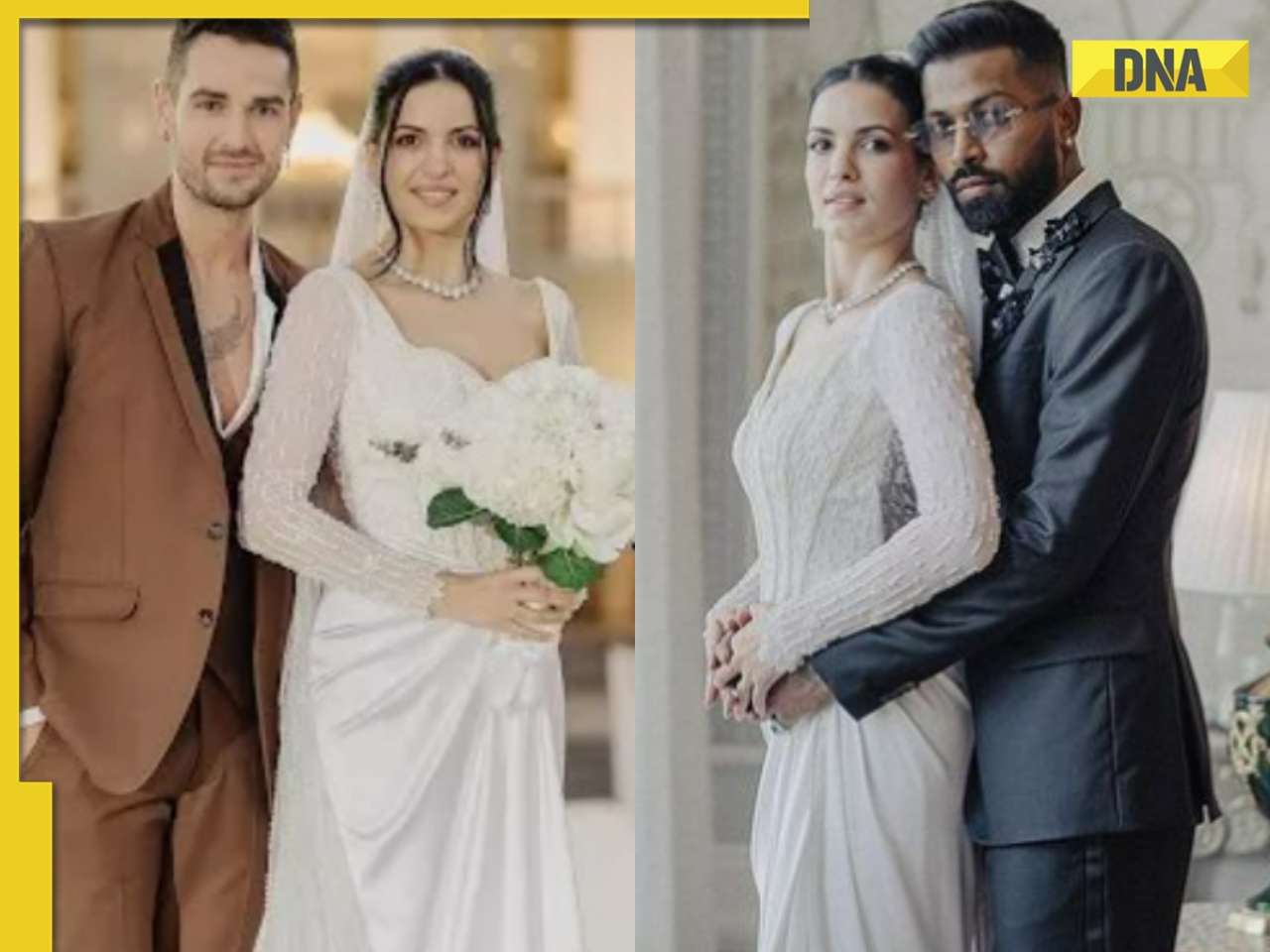

Varun Dhawan, Natasha Dalal blessed with a baby girl, grandfather David Dhawan shares good news![submenu-img]() Natasa Stankovic's friend Aleksandar Ilic slams troll saying he broke her marriage with Hardik Pandya: 'Should I...'

Natasa Stankovic's friend Aleksandar Ilic slams troll saying he broke her marriage with Hardik Pandya: 'Should I...'![submenu-img]() Neha Sharma reveals if her father's political career has backfired on her in Bollywood: 'I am not here to promote...'

Neha Sharma reveals if her father's political career has backfired on her in Bollywood: 'I am not here to promote...'![submenu-img]() Venom The Last Dance trailer: Tom Hardy and his symbiote fight aliens in trilogy's finale, film to release on...

Venom The Last Dance trailer: Tom Hardy and his symbiote fight aliens in trilogy's finale, film to release on...![submenu-img]() Ammy Virk defends Diljit Dosanjh's decision to not wear a turban in Amar Singh Chamkila: 'You can't stop the trolls'

Ammy Virk defends Diljit Dosanjh's decision to not wear a turban in Amar Singh Chamkila: 'You can't stop the trolls'![submenu-img]() Watch viral video: Isha Ambani stuns during Anant Ambani and Radhika Merchant's pre-wedding celebrations in Italy

Watch viral video: Isha Ambani stuns during Anant Ambani and Radhika Merchant's pre-wedding celebrations in Italy![submenu-img]() Former air hostess reveals harsh realities of flight attendant job, says 'people think...'

Former air hostess reveals harsh realities of flight attendant job, says 'people think...'![submenu-img]() 'Egg fry or fish fry': Viral video shows egg dish looking like goldfish; watch

'Egg fry or fish fry': Viral video shows egg dish looking like goldfish; watch![submenu-img]() Viral: IndiGo crew protects passengers from rain, watch heartwarming video

Viral: IndiGo crew protects passengers from rain, watch heartwarming video![submenu-img]() This variety of mango costs Rs 2.50-3 lakh a kg, know why

This variety of mango costs Rs 2.50-3 lakh a kg, know why

)

)

)

)

)

)

)