You can now add CAs, ERIs or any authorized representative on the new Income Tax e-filing portal. Know details here.

If you are also finding it difficult to file your Income Tax return, then there is no need to panic. Nor do you need to find a chartered accountant for this. Income Tax Department has solved your problem.

E-filing portal for taxpayers

The new e-filing portal was launched by the Income Tax Department on 7 June. On this portal, you can now add Chartered Accountant (CAs), e-Return Intermediary (ERI) or any authorized representative to the taxpayers for assistance in ITR filing or other related services. This will facilitate those taxpayers who find it difficult to file returns.

Who are CAs, ERIs and authorized representatives?

For the unversed, while CAs are members of the Institute of Chartered Accountants of India (ICAI), ERIs are authorized intermediaries who can file income tax return and also perform other functions on the behalf of taxpayers.

According to the new e-filing portal, an authorized representative is a person who can act on your behalf with specific authorization if you cannot attend your income tax-related affairs on your own.

Taxpayers will get CA, ERI

You can easily add a CA using 'My CA Service' on the e-filing portal. In addition, you can also remove a CA or revoke a previously assigned CA. These Chartered Accountants will fully assist you on the e-filing portal. With this, you will also get updates from time to time.

How to take help of CA on e-filing portal

Let us tell you how you can take advantage of 'CA Services' on the e-filing portal. For this you have to follow this simple process.

1. Visit the Income Tax e-filing portal https://www.incometax.gov.in/iec/foportal/about-portal and login.

2. Now go to 'Authorized Partners' and click on 'My Chartered Accountants'.

3. Now click on 'Add CA' and fill the details like membership number, name of chartered accountant and validation etc.

4. After filling all the details and after validation from the ICAI database, you will be able to take the help of the assigned CA.

CAs can assist you in the following activities through the e-filing portal-

- Filing Statutory Forms (once the person is added as a CA by the taxpayer and has accepted the request)

- Upload bulk form (Form 15CB)

- e-Verify the forms assigned by taxpayer

- View filed Statutory Forms

- View & Submit Grievances

- Set higher security Login options through Profile

- Register DSC

Assistance from ERIs

For getting the assistance of ERIs, the new e-filing portal says, "In order to allow an ERI to assist you, you have to add an ERI through the e-Filing portal (using My ERI service). Additionally, you can activate, deactivate or remove an added ERI on the e-Filing portal. You can refer to My ERI user manual to learn more. Alternatively, an ERI can add you as a client in the e-Filing portal (after obtaining your consent to do so). In case you are not registered on the e-Filing portal, an ERI can also register you before adding you as a client. You can refer to Verify Service Request & Add Client services to learn more."

![submenu-img]() DNA TV Show: What will UP CM Yogi Adityanath discuss with RSS chief Mohan Bhagwat in Gorakhpur?

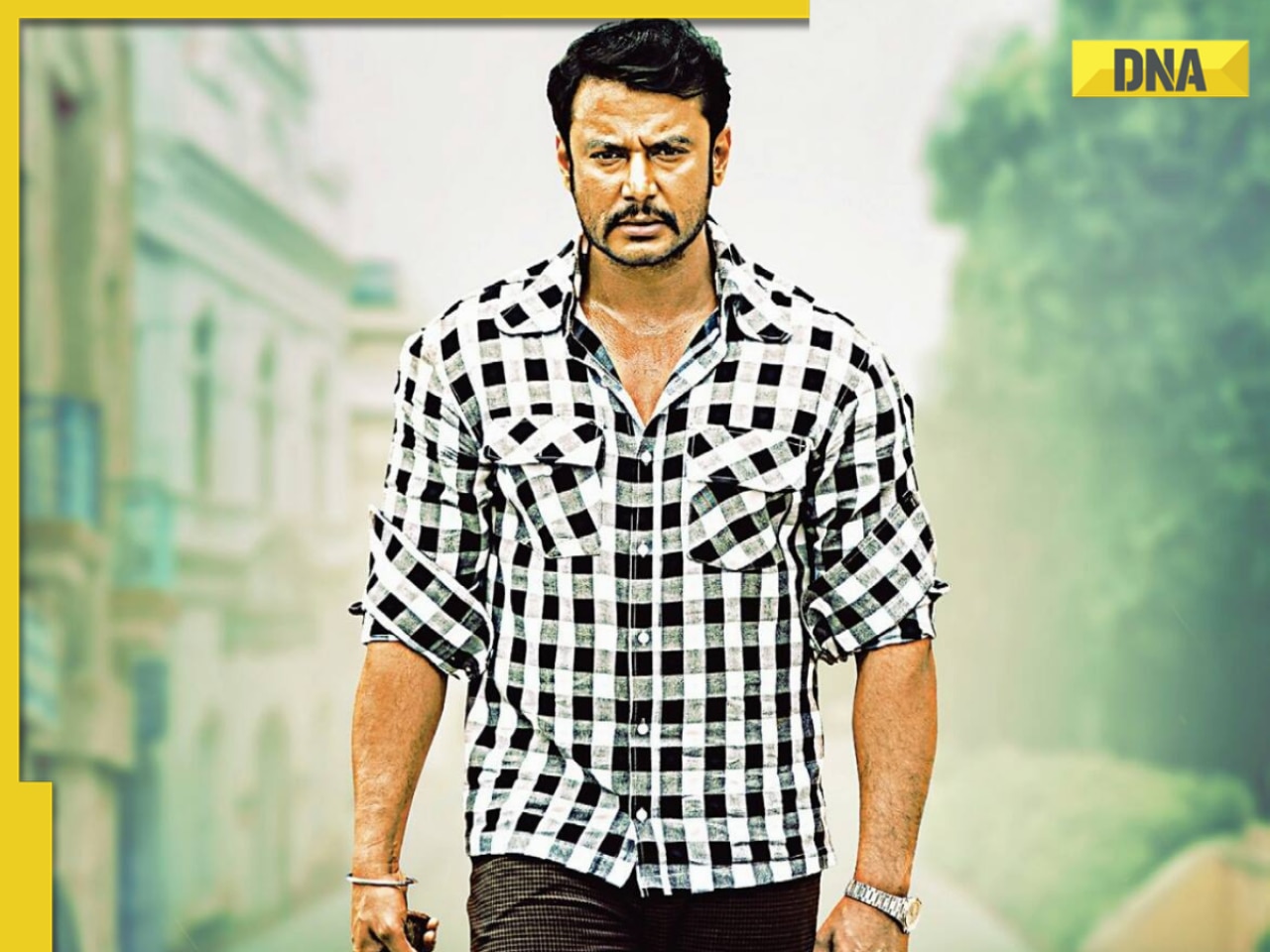

DNA TV Show: What will UP CM Yogi Adityanath discuss with RSS chief Mohan Bhagwat in Gorakhpur?![submenu-img]() Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...

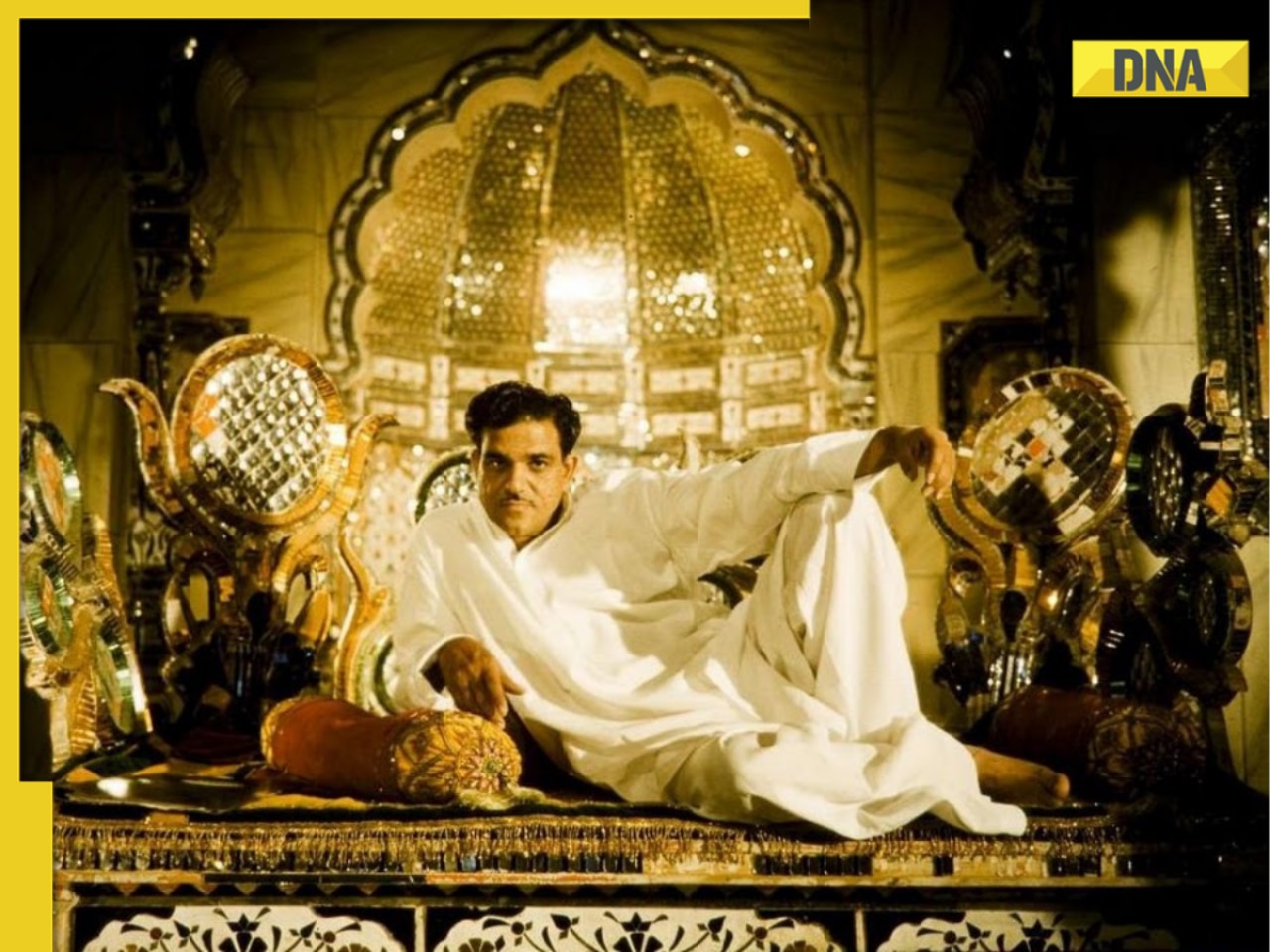

Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...![submenu-img]() This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..

This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..![submenu-img]() Former champions Pakistan crash out of T20 World Cup 2024, USA qualify for Super 8

Former champions Pakistan crash out of T20 World Cup 2024, USA qualify for Super 8![submenu-img]() Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse

Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() Dr Vivek Bindra spoke in favor of NEET students, now the Supreme Court has also ordered a re-test

Dr Vivek Bindra spoke in favor of NEET students, now the Supreme Court has also ordered a re-test![submenu-img]() NEET 2024 re-exam notification released, exam to be conducted on...

NEET 2024 re-exam notification released, exam to be conducted on... ![submenu-img]() Bihar NET-UG Paper Leak: Burnt papers, post-dated cheques, Rs 32 lakh, why is NTA silent over these?

Bihar NET-UG Paper Leak: Burnt papers, post-dated cheques, Rs 32 lakh, why is NTA silent over these?![submenu-img]() Meet woman, a Phd holder who cracked UPSC exam with AIR 6 without coaching in 2nd attempt, but didn’t became IAS due to…

Meet woman, a Phd holder who cracked UPSC exam with AIR 6 without coaching in 2nd attempt, but didn’t became IAS due to…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...

Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...![submenu-img]() This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..

This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..![submenu-img]() Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse

Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse![submenu-img]() Raveena Tandon sends defamation notice to man who shared her 'fake' road rage video

Raveena Tandon sends defamation notice to man who shared her 'fake' road rage video![submenu-img]() Drashti Dhami announces pregnancy after nine years of marriage, shares hilarious video with husband Niraj Khemka

Drashti Dhami announces pregnancy after nine years of marriage, shares hilarious video with husband Niraj Khemka![submenu-img]() In latest gaffe, US President Joe Biden salutes Italian PM Meloni at G7 Summit, watch viral video

In latest gaffe, US President Joe Biden salutes Italian PM Meloni at G7 Summit, watch viral video![submenu-img]() 'My tax is for the nation's development, not for free distribution': Why is this slogan trending on social media?

'My tax is for the nation's development, not for free distribution': Why is this slogan trending on social media?![submenu-img]() Mukesh Ambani's guest list for Anant-Radhika’s 2nd pre-wedding bash had family, friends and..

Mukesh Ambani's guest list for Anant-Radhika’s 2nd pre-wedding bash had family, friends and..![submenu-img]() Viral video: Influencer faces backlash for dancing to Bollywood song at Kolkata airport, watch

Viral video: Influencer faces backlash for dancing to Bollywood song at Kolkata airport, watch![submenu-img]() Vet monitors lion's heart rate using Apple watch, video goes viral

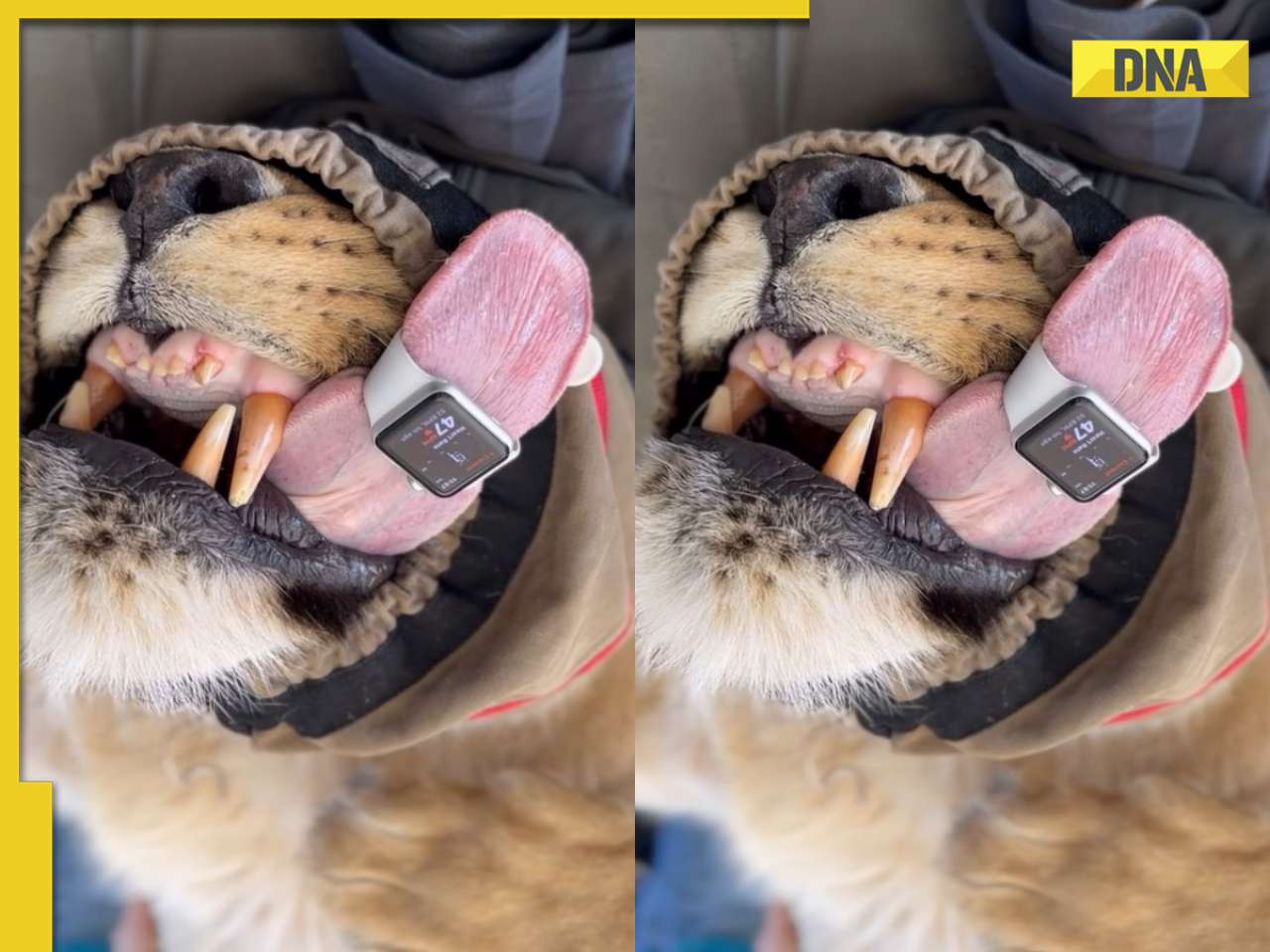

Vet monitors lion's heart rate using Apple watch, video goes viral

)

)

)

)

)

)

)