Currently, 10-year returns from smallcaps and largecaps are similar. There could be further gains if you pick the right stocks

It is said that smallcaps are biggest wealth generators when it comes to investing. Investors, especially retail guys, look for tips about small unheard firms in a bid to make outsized returns. But, did you know Nifty Smallcap 100 Index and Nifty 50 (largecaps) sport the same 10-year returns? Both these baskets comprising different types stocks gave 14.7% return for the last 10-year period. If, in the long-run, like 10 years, returns of smallcaps converge with largecaps, questions can be asked why experts often tell investors to bear the excess risk of smallcaps.

Correction carnage

Smallcap stocks belong to small companies. They have the potential to grow, which is why investors are ready to invest in them despite the higher risk. Smallcaps have seen a major correction in the last 12-13 months. The correction happened after explosive returns.

According to Sachin Shah, fund manager, Emkay Investment Managers data shows the effects of correction on smallcap returns. Between February 19, 2009 and January 1, 2018, smallcaps basket of stocks had given 22% return every year. Unfortunately, the correction happened in January 2018 and the mood has become somber since then. Including the correction, that is, February 19, 2009 to February 19, 2019, the returns of smallcaps falls to 15.1% every year.

Markets do tend to move from complete dis-belief (buying opportunity) to running too much ahead of time (discounting too much in to future, selling opportunity) and, therefore, capitalising on such opportunities becomes very critical to generate higher returns from smallcaps.

"Sometime in mid-to-late CY2017 & very early CY 2018, the mid & smallcaps were the darlings of investors and valuation ratios were running too much ahead of time (selling opportunity). At that point in time investors were getting very high returns as compared to largecaps," says Shah.

Agrees Sousthav Chakrabarty, co-founder and CEO Capital Quotient, "At present, it appears that smallcap returns are the same as largecap returns, since the former has been beaten down recently."

Smallcaps are usually high risk-high return options while largecaps provide a lower growth potential with lower associated risk, opines Gautam Kalia, head–investment products, Sharekhan by BNP Paribas.

Resilient risk

There is no question that investing in small-caps has inherent risk because small businesses are more vulnerable to external and internal challenges. There is higher volatility of share prices and poor liquidity resulting in higher impact cost during investing and exiting in such companies.

Largecaps show decent performance between three and five years, but smallcaps typically take longer to demonstrate a superior return. One needs to look at one's own financial goals and horizon before allocating to small caps, says Chakrabarty.

Jason Monteiro, associate vice-president - mutual fund research & content, Prabhudas Lilladher feels the return of the Nifty SmallCap 100 index, over the past decade, does not represent the true potential of good quality smallcap stocks. "Through detailed research, one would come across multiple smallcap stocks on the index with dubious fundamentals, and questionable management quality. Such stocks can destroy wealth," he says.

MF route is safer for retail investors

Research is done by MF managers. Smallcap funds with experienced fund managers should be able to pick out the right stock for the portfolio. Not surprisingly, the two to three smallcap funds—which were smallcap funds even prior to SEBI's recategorisation norms—have generated a substantial alpha over the smallcap index.

"These funds have generated a compounded return in excess of 20% over the past decade, versus a return of around 16% of the Nifty SmallCap 100-TRI benchmark. Even if we look at the past one-year performance (as of January 31, 2019) of the 14-odd smallcap funds, as many as 13 schemes have outperformed the benchmark. A fund manager can help curb the downside risk too, as they have the flexibility to take an exposure of up to 35% to largecap stocks if necessary," points out Monteiro.

Shah advises that most retail investors should restrict their smallcap allocation to in the range of 10%-25% of their total equity exposure.

Bounceback bluster

Historical data also shows when returns of smallcaps and largecaps converge, smallcaps rebound. In the next few years, smallcaps' returns could out-perform largecaps. In 2018, smallcaps (represented by Nifty Smallcap 250 index) fell 28%, while largecaps (Nifty 50) gained 3%. The recent underperformance by smallcaps in 2018 is most severe in the last 12 years. Also, investing in smallcaps has been rewarding when last one year returns are negative. The subsequent five years see 13-15% year-on-year gains in smallcaps. Can the good days return?

Kalia says, "Yes this can happen again. There are numerous points in time when smallcaps have significantly outperformed largecaps and there is no reason to believe that this will not repeat itself."

Chakrabarty strikes a more cautious tone. In any bullish market investors first enter largecaps, followed by midcaps, and then experiment with allocations to smallcaps. "Hence, the question is whether the bullish phase is over for now. Unfortunately, there is no easy answer to that. There are a lot of external and intrinsic factors. Golden days are usually repetitive. The next one could be around the corner, after a little bit of pain," he says.

Sticking with the right stock is rewarding. But the wrong choice could bleed you to death. If we look at the current constituents of the Nifty SmallCap 100 index, the top 10 stocks delivered a 10-year compounded return in excess of 35% per annum. The top five stocks returned a CAGR between 45%-50%.

"However, the bottom 10 stocks on the smallcap index led to capital erosion. These stocks generated a negative return ranging from -3% to as much as -27%," says Monteiro of Prabhudas Lilladher.

It is important to mitigate smallcap risks. "Firstly, the selection of right management and businesses is very critical. Secondly, allocation discipline is very critical – for example, no single stock or sector should have a high concentration in the portfolio. Thirdly, investors need to give adequate time, anything less than five years may not make sense for true small-cap investing," remarks Shah of Emkay.

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

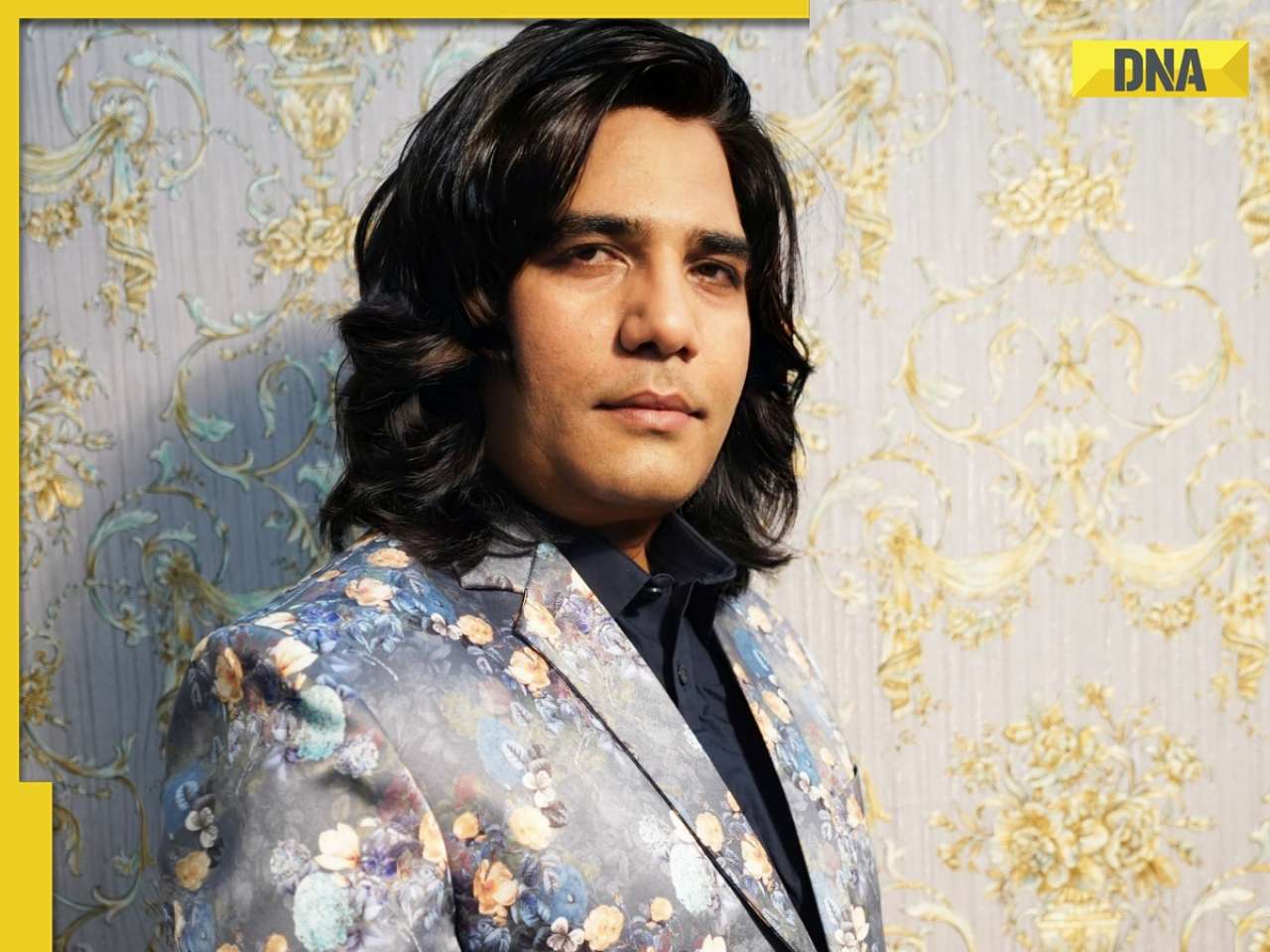

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

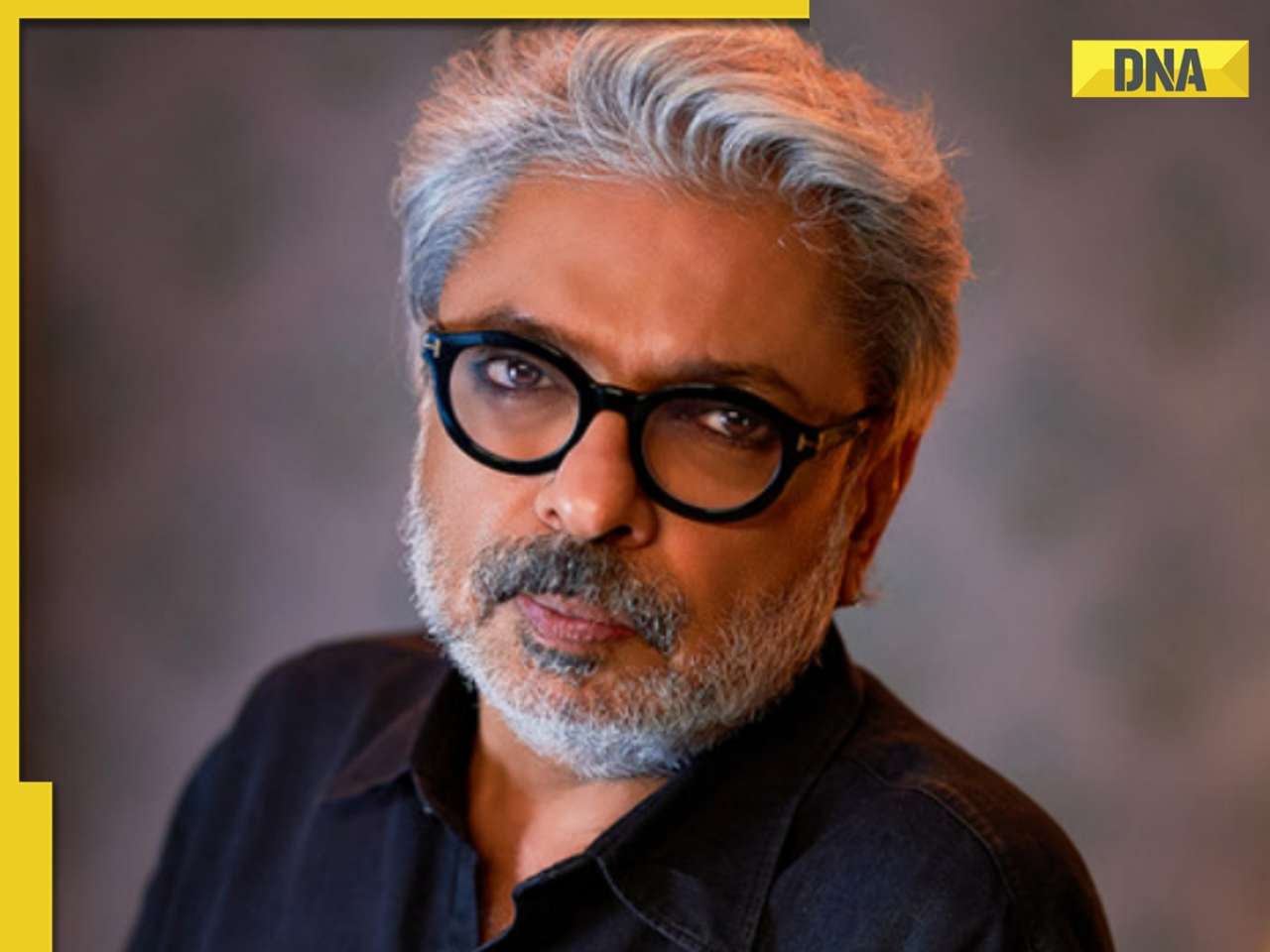

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

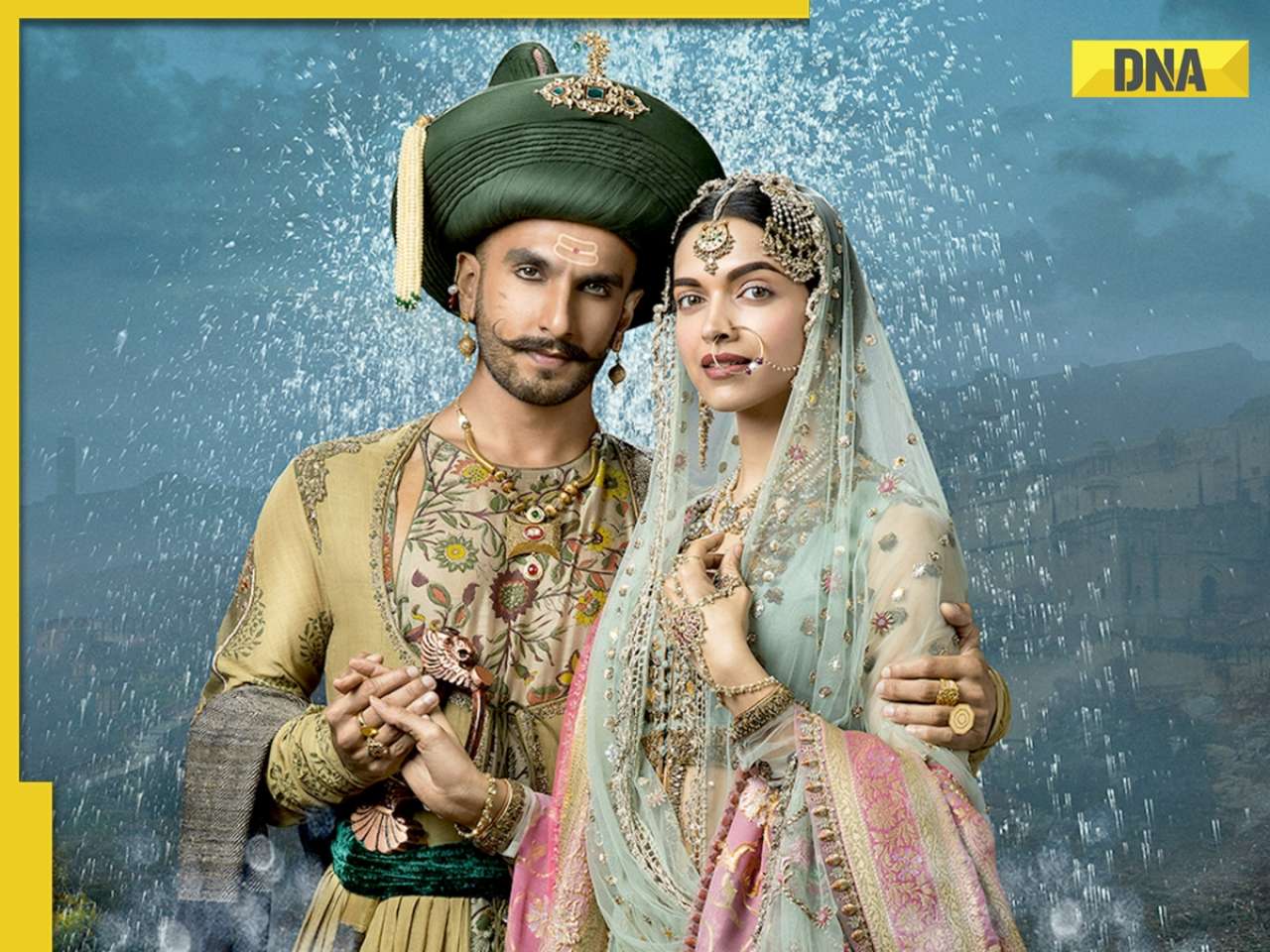

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)

)

)