The tax-free bonds issued in 2004 against seven assured returns schemes (ARS) of the erstwhile Unit Trust of India (UTI) are set to mature on March 31.

The tax-free bonds issued in 2004 against seven assured returns schemes (ARS) of the erstwhile Unit Trust of India (UTI) are set to mature on March 31.

If you are among the investors who did not exit any of these schemes at that time by taking cash and have stayed invested, the maturity amount of these bonds would come into your hands just 40 days hence.

The seven assured returns schemes, which were converted into bonds are the Children’s Gift and Growth Fund - 1986 and 1999 (CGGF-86, CGGF-99), Rajlakshmi Unit Plan - 1994 and 1999 (RUP-94 and RUP-99), Monthly Income Plan -98 (V) and 99 and the Bhopal Gas Victims Monthly Income Plan - 1992 (BGVMIIP-92).

Why the bonds?

All these were guaranteed-return schemes that ran into trouble when UTI collapsed. In March 2004, investors in these schemes were given an option to either convert to 6.60% tax-free bonds or to exit by accepting cash. Further, UTI was split into two entities - UTI-I or the Special Undertaking of the Unit Trust of India (SUUTI) and UTI-II (later renamed as UTI Mutual Fund).

All the non-performing schemes, including the infamous US-64 and the seven assured return schemes against which bonds were issued, were transferred to SUUTI.

The ARS bonds, whose principal and interest is guaranteed by the Government of India, can currently be traded on the National Stock Exchange, but would not be available for trading post March 1, 2009.

How much will one get?

As per the ARS Bonds, an investor would get an interest of 6.60% per annum on the bonds purchased at a face value of Rs 100. However, the interest for the same is paid half-yearly, which means all investors have received the interest twice a year for five years since March 2004. This interest is tax-free in the hands of investors.

What falls due after March 31, 2009 is the remaining interest for the past six months and the principal amount invested in the bonds.

It is estimated that around Rs 6,000 crore would be disbursed to investors after maturity.

What if you haven’t received interest?

As per the ARS bonds offer, investors were to be paid interest half-yearly. However, there have been several complaints about interest payments not being received. If you are among those who haven’t got the interest yet, you can contact the UTI TSL head office in Navi Mumbai or any of the service centres or email to mumbai@utitsl.co.in quoting your certificate number.

How to claim the amount?

The UTI Financial Centres (branches of UTI Mutual Fund) and the offices of UTI Technology Services would help investors claim the maturity amount under the ARS bonds. The bonds were issued five years ago and in case you have not submitted your bank particulars or have changed your bank account since then, you would need to update the same by February 28, 2009.

The forms to update bank account details can be obtained on the websites www.utimf.com and www.utitsl.co.in or from the offices of UTI TSL and UTI Mutual Fund. The branch addresses of these offices can be found on the two websites.

What do you need to submit?

If you hold more than 400 ARS bonds, you will have to surrender the certificates at the UTI Financial Centres or UTI TSL offices before February 28, 2009. Those holding less than 400 ARS bonds need not surrender their certificates. They will get direct credit of the maturity proceeds, provided the bank account details are furnished accurately. So, it is essential to verify whether the bank particulars held by SUUTI are accurate.

What to do with the amount?

Investors visiting UTI Mutual Fund branches to get maturity proceeds are being offered an option to invest in UTI Mutual Fund schemes. However, investors should look at specifics of the scheme performance and viability in the current phase before investing maturity proceeds from the ARS bonds.

Sandeep Shanbhag, director of tax and financial planning firm Wonderland Consultants, suggests, “Depending on the risk appetite, a small part should go to equity. How small depends on the age of the person. The rest should be invested in fixed deposits, about 10-15% in gold and in short-term mutual funds.

Shanbhag suggests short-term funds since the interest downturn theory has been halted by the interim budget.

“Long-term interest rates will rise in spite of RBI cutting rates because of the fiscal deficit of the country. Long-term bond funds have started negative returns. So people should invest about 40% in low-duration income funds, whose maturity is not more than 2-3 years,” he says.

![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…

Google banned over 2200000 apps from Play Store, removed 333000 bad accounts for…![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet

Manipur Police personnel drove 2 Kuki women to mob that paraded them naked: CBI charge sheet ![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

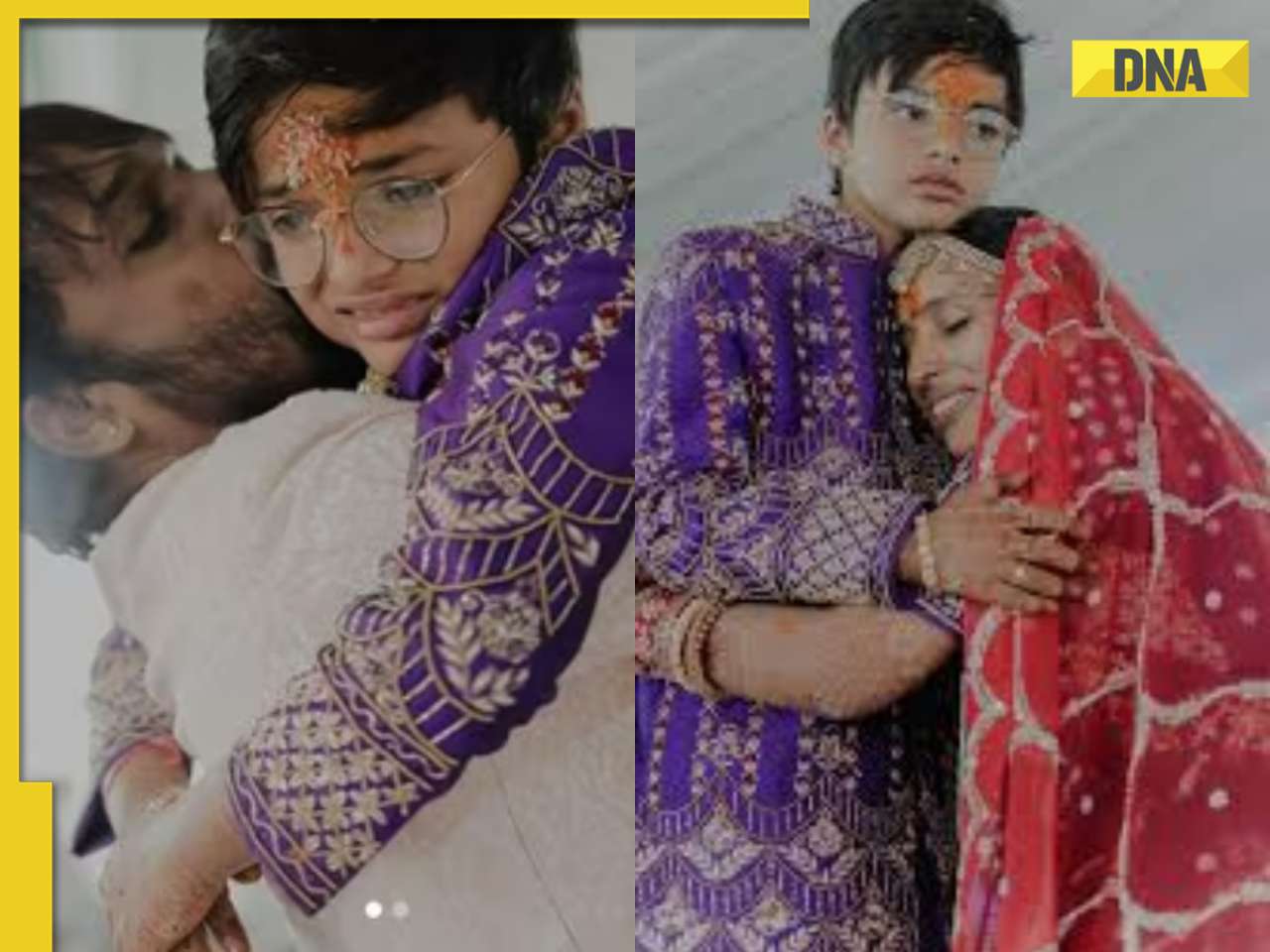

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...

Once one of Bollywood's top heroines, this actress was slammed for kissing King Charles, ran from home, now she...![submenu-img]() Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’

Makarand Deshpande reveals reason behind Monkey Man’s delayed India release: ‘I feel because of…’![submenu-img]() Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore

Meet actor, beaten up in school, failed police entrance exam, lived in garage, worked as driver, now worth Rs 650 crore![submenu-img]() Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report

Harman Baweja and wife Sasha Ramchandani blessed with a baby girl: Report![submenu-img]() Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him

Parineeti Chopra says she didn't even know if Raghav Chadha was married, had children when she decided to marry him![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() 'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident

'Horrifying, hope he keeps...': KKR co-owner Shahrukh Khan on Rishabh Pant's life-threatening car accident![submenu-img]() CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings

CSK vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Chennai Super Kings vs Punjab Kings![submenu-img]() KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....

KKR's Harshit Rana fined 100 per cent of his match fees, handed 1-match ban for....![submenu-img]() Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch

Viral video: Python escapes unscathed after fierce assault by aggressive mongoose gang, watch![submenu-img]() Where is the East India Company, which ruled India for 200 years, now?

Where is the East India Company, which ruled India for 200 years, now?![submenu-img]() Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral

Russian woman alleges Delhi airport official wrote his phone number on her ticket, video goes viral![submenu-img]() Viral video: School teachers build artificial pool in classroom for students, internet loves it

Viral video: School teachers build artificial pool in classroom for students, internet loves it![submenu-img]() Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

Viral video: Wife and 11-year-old son of Bengaluru businessman become Jain monks, details inside

)

)

)

)

)

)