While the Reserve Bank of India continued to stonewall all efforts to share information on why they imposed restrictions on the Punjab and Maharashtra Co-operative Bank (PMCB), customers of the bank's Sion branch, the head office, are raging against the central bank for its "unfair" punitive decision which has put Rs 11,600 crore of deposits under high risk.

Thousands of PMCB depositors have decided to march to the Sion branch and then go on a protest march to RBI in Fort over the "step-motherly" treatment to cooperative banks.

Depositors are also questioning the RBI for sparking panic without warning the bank against engaging in advanced negotiations a few months back to acquire the Goa-based Mapusa Urban Co-operative Bank (MUCB).

"If RBI sensed that PMCB was in fragile financial health, they should have sent strong signals against any acquisition move of another ailing bank. Just last week, MUCB shareholders had agreed to the proposal to merge with PMCB or any other bank," said SD Varshani. "RBI should have given the management more time before they came out with a public notice. Because of this there is now a run on the deposits," he added.

An account holder with PMCB since 1997, Varshani has mortgaged his house and pledged Life Insurance Corporation's (LIC) term policy for a loan he was taking to repay what he had borrowed from an acquaintance.

Though LIC credited Rs 3.90 lakh of the loan to his PMCB account on Monday, Varshani could only withdraw Rs 1,000 the next day.

Day 2 Of Despair and Uncertainty

|

| RBI’s restrictions on PMCB have tied the hands of its customers |

- Depositors blame RBI for hasty decision after it barred PMCB from any business for six months and capped their withdrawals at Rs 1,000

|

- PMC was doing a due diligence to take over Mapusa Co-op Bank; it under-declared bad loans

|

- Customers proactive in the head office, provide food for the staff

|

- Aggrieved clients said they had now had enough and that govt should be open about inquiries

|

The RBI, on Tuesday, suspended PMCB's business for six months on account of bad quality loans. The restrictions included the capping of depositor withdrawals at Rs 1,000.

Jitendra Juneja, who has put his savings in fixed deposits, feels that the RBI has been too harsh to impose lending and deposit restrictions on PMCB for under declaring its non-performing assets (NPAs).

"In the last couple of years, several commercial banks had also under-declared its NPAs," he said.

Despite their deposits being at risk, several customers in the Sion branch have not lost their faith in the bank's revival. Located in the Koliwada area across the road from Sion Hospital, the branch has a majority of Punjabi customers who consider the bank to be their community's pride.

"We have huge deposits but we will continue to keep the deposits once the problem is sorted out. Many staff members are also from the silk community.

PMCB, which has 137 branches across Maharashtra, Delhi, Karnataka, Goa, Gujarat, Andhra Pradesh and Madhya Pradesh, was started by a group of Sikh entrepreneurs in Mumbai. Founded in 1984 from a small room, the Punjabis consider it to be a community bank.

When the news of the RBI restrictions seeped in on Tuesday, the Sion branch opened at 7 am and customers were soon witness to an unusually friendly sight even as they wore worried looks as they waited for hours, unmindful of the drizzle.

Parvinder Singh, owner of the well-known restaurant 'Mini Punjab', provided food for the bank staff as they stood to assuage the fears of the depositors.

Next day, Ajit Singh, originally from Peshawar who landed up in Mumbai after Independence, arranged for brunch for the staff. "The staff was without food so I organised lunch from my restaurant yesterday," said Parvinder, whose family has been banking with PMCB for over 30 years.

It is not just Punjabis who bank with PMCB at the Sion branch. Known for its customer service, some of the customers shifted their accounts from other commercial banks to PMC. Lata Panga, aged 31, shifted her Rs 3-lakh fixed deposit from State Bank of India to PMC just last week. "I also have a savings account. Yesterday, when I had taken my sick son to Holy Cross Hospital, I tried to swipe the debit card but transaction was being disallowed," said Lata, hoping that things would get better.

Radha Iswaran, 66, is an old account holder, with a bunch of fixed deposits maturing in different periods. "I recently renewed my fixed deposit," said Iswaran, who retired from the Military Engineer Services.

Incidentally, this the third time that the bank is undergoing a crisis. "In 2004, there were rumours that the bank would go under. That time the branches were open all night to return money to the depositors," recalled 42-year-old Ajit Singh, who is an authorised dealer for major air conditioner brands in the city.

About six years back, rumours again circulated that the bank would shut down after the launch of a flagship fixed deposit scheme called 'Bal Bhavishya', where the bank offered an interest rate of 21%. PMCB started returned the deposits to customers who doubted the scheme. But after a short span of time, the same depositors came back to the bank at lower rates of interest.

Ajit Singh believes that the bank will tide over this crisis too. Though he just opened an account in Canara Bank on Wednesday, he has not lost faith in PMCB. "I will continue to put all my deposits in this bank once the issue is resolved," he says.

![submenu-img]() Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...

Meet man, an Indian, whose family topped list of richest people in the UK with net worth of...![submenu-img]() Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged

Pune: Tanker explodes in Pimpri Chinchwad, nearby hotels, houses and parked trucks damaged![submenu-img]() Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'

Rohit Sharma lashes out at IPL TV broadcaster for 'breach of privacy'![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...

Meet IAS officer, daughter of milk vendor, who cracked UPSC in second attempt, secured AIR...![submenu-img]() UGC NET June 2024: Registration window closes today; check how to apply

UGC NET June 2024: Registration window closes today; check how to apply![submenu-img]() Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...

Meet IAS officer, son of teacher from Rajasthan, who cracked UPSC after multiple failed attempts, secured AIR...![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

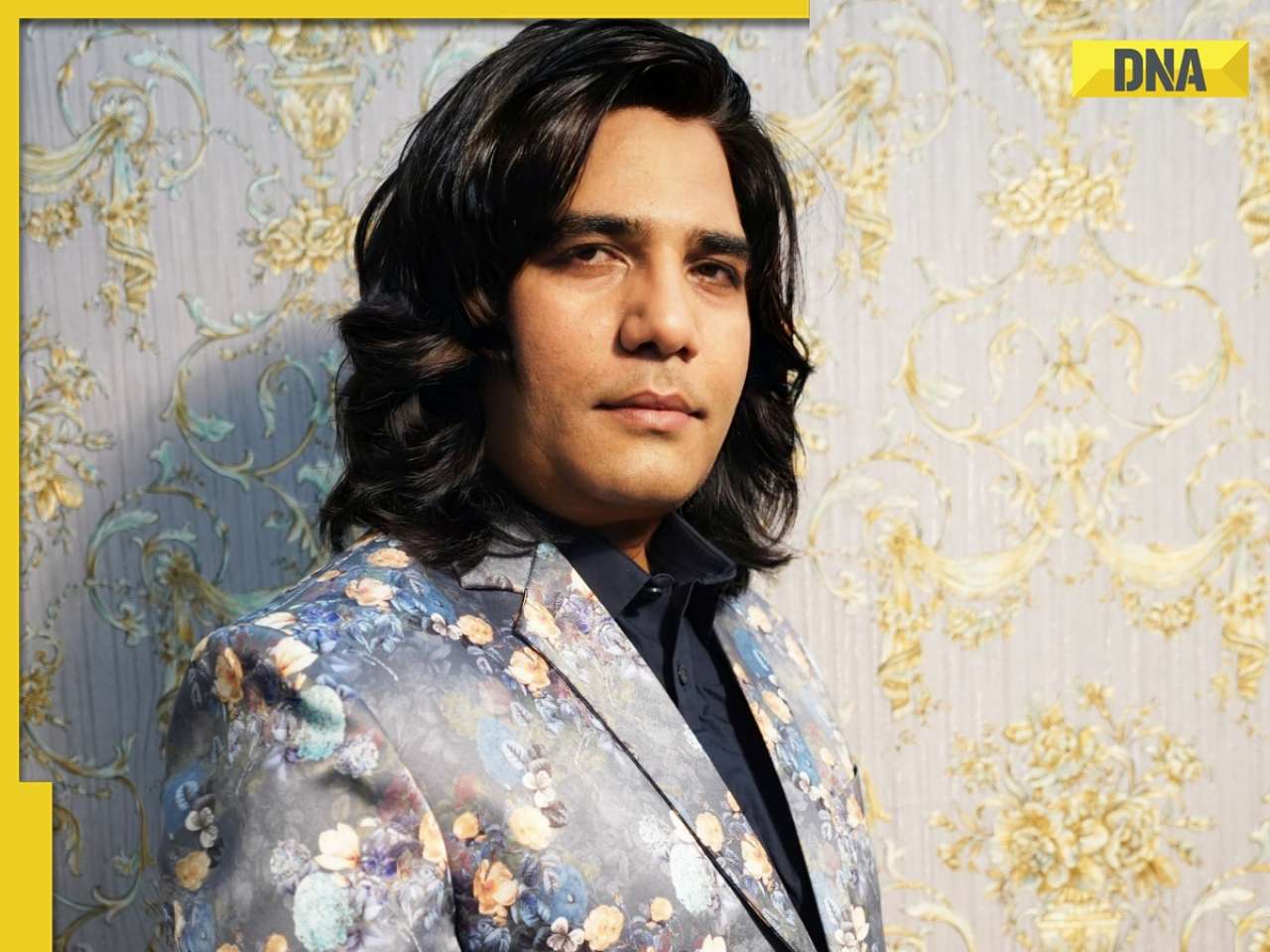

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive

Heeramandi lyricist AM Turaz on Azadi: 'Women's contribution in Indian freedom movement has never been...' | Exclusive![submenu-img]() Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'

Kangana Ranaut reveals if she will quit films after winning Lok Sabha elections, calls Bollywood 'jhoothi duniya'![submenu-img]() Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'

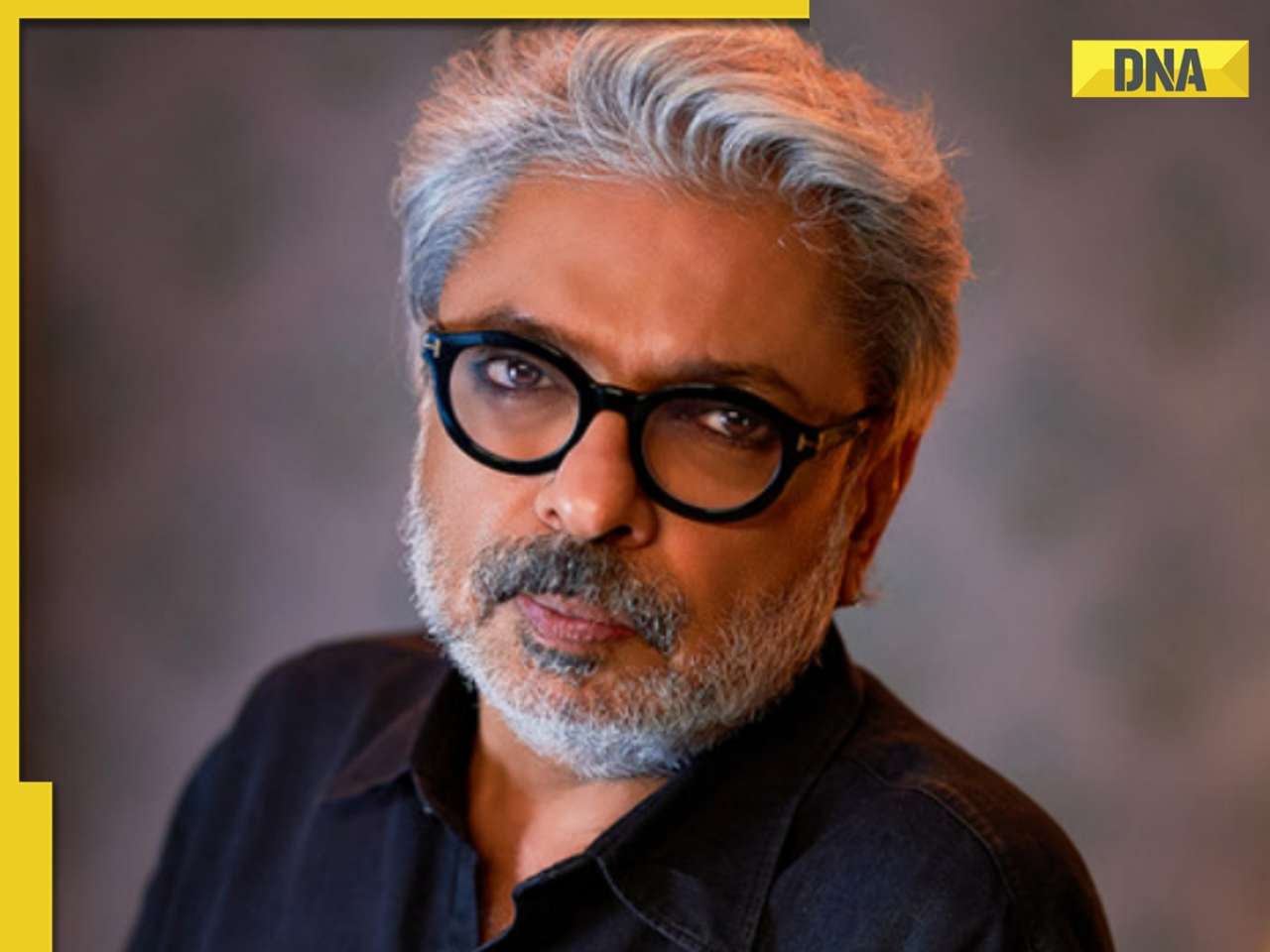

Sanjay Leela Bhansali calls this actor his only friend in industry: 'He doesn't care about my film, he cares about me'![submenu-img]() Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits

Jolly LLB 3: Akshay Kumar wraps up first schedule; local artiste reveals actor's inspiring daily habits![submenu-img]() Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved

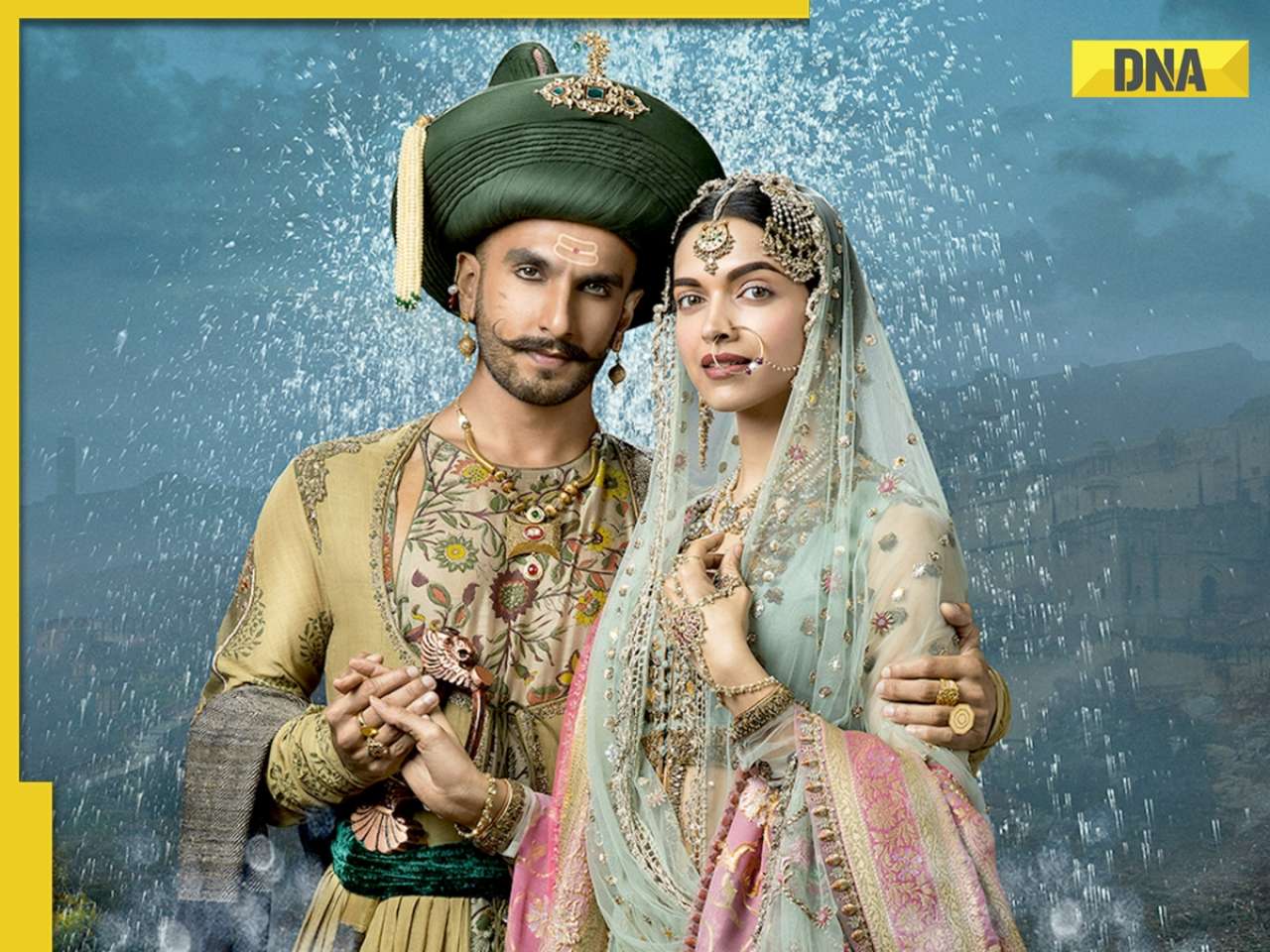

Before Ranveer Singh, Deepika Padukone; Bajirao Mastani was announced with these two superstars in 70s, it got shelved![submenu-img]() Viral video: Donkey stuns internet with unexpected victory over hyena, watch

Viral video: Donkey stuns internet with unexpected victory over hyena, watch![submenu-img]() Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch

Viral video: 'Breathtaking' blue meteor illuminates skies over Spain and Portugal, watch![submenu-img]() Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...

Google CEO Sundar Pichai reveals his favourite foods in Delhi, Mumbai, Bengaluru and they are...![submenu-img]() Cow fight injures two girls enjoying street snacks, video goes viral

Cow fight injures two girls enjoying street snacks, video goes viral![submenu-img]() Viral video: Man sets up makeshift hammock on bus, internet reacts

Viral video: Man sets up makeshift hammock on bus, internet reacts

)

)

)

)

)

)

)