- Home

- Latest News

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday

Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday![submenu-img]() PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details

PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details![submenu-img]() Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence

Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence![submenu-img]() Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

- Election 2024

- Webstory

- T20 WC

- Education

![submenu-img]() Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..

Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..![submenu-img]() Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process

Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process![submenu-img]() NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents

NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents![submenu-img]() Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...

Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

- DNA Verified

![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

- Her DNA

- Photos

![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

- DNA Explainers

![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

- Entertainment

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

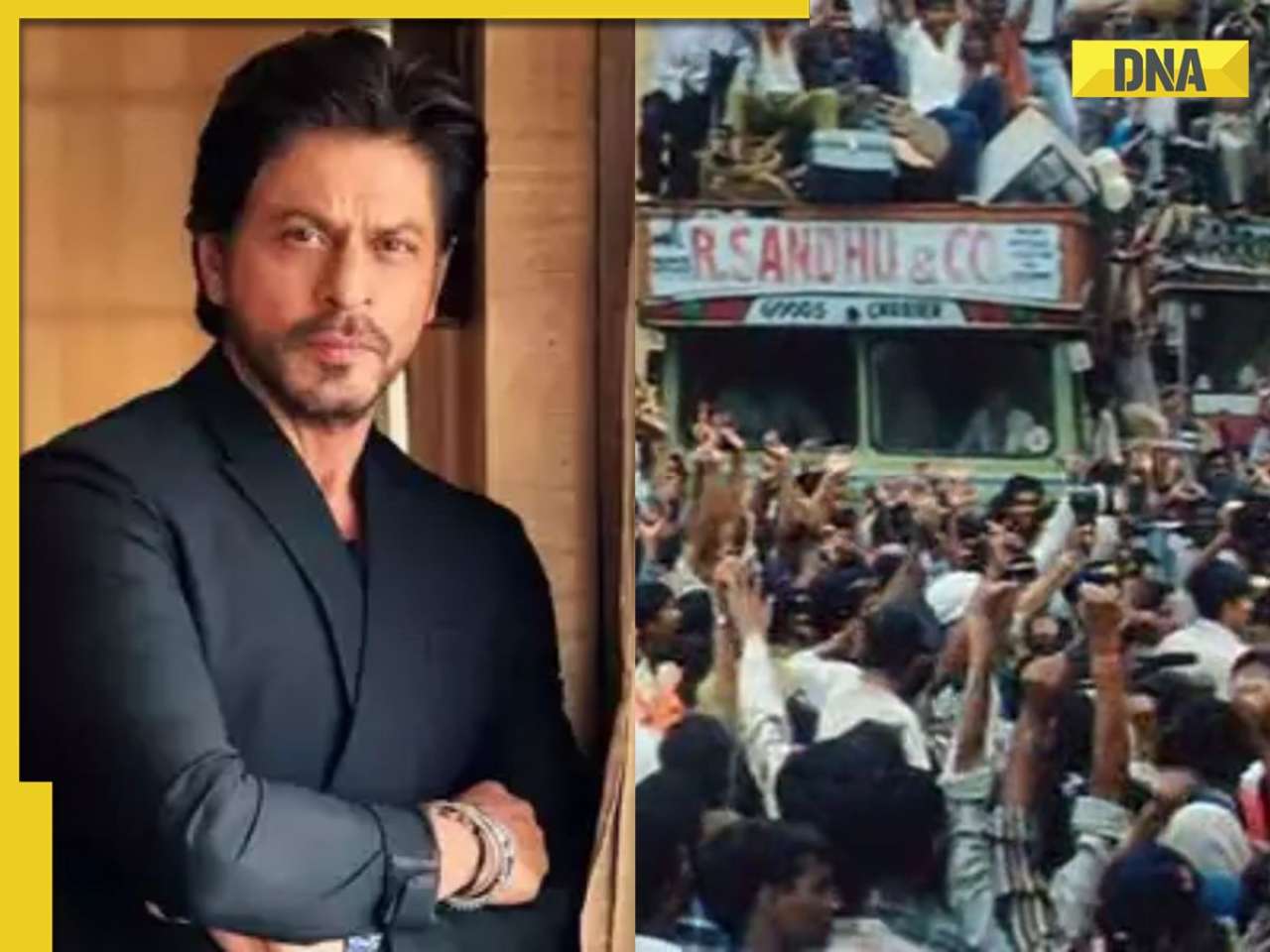

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..

Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..![submenu-img]() Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...

Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...![submenu-img]() 'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films

'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films![submenu-img]() Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

- Viral News

![submenu-img]() Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..

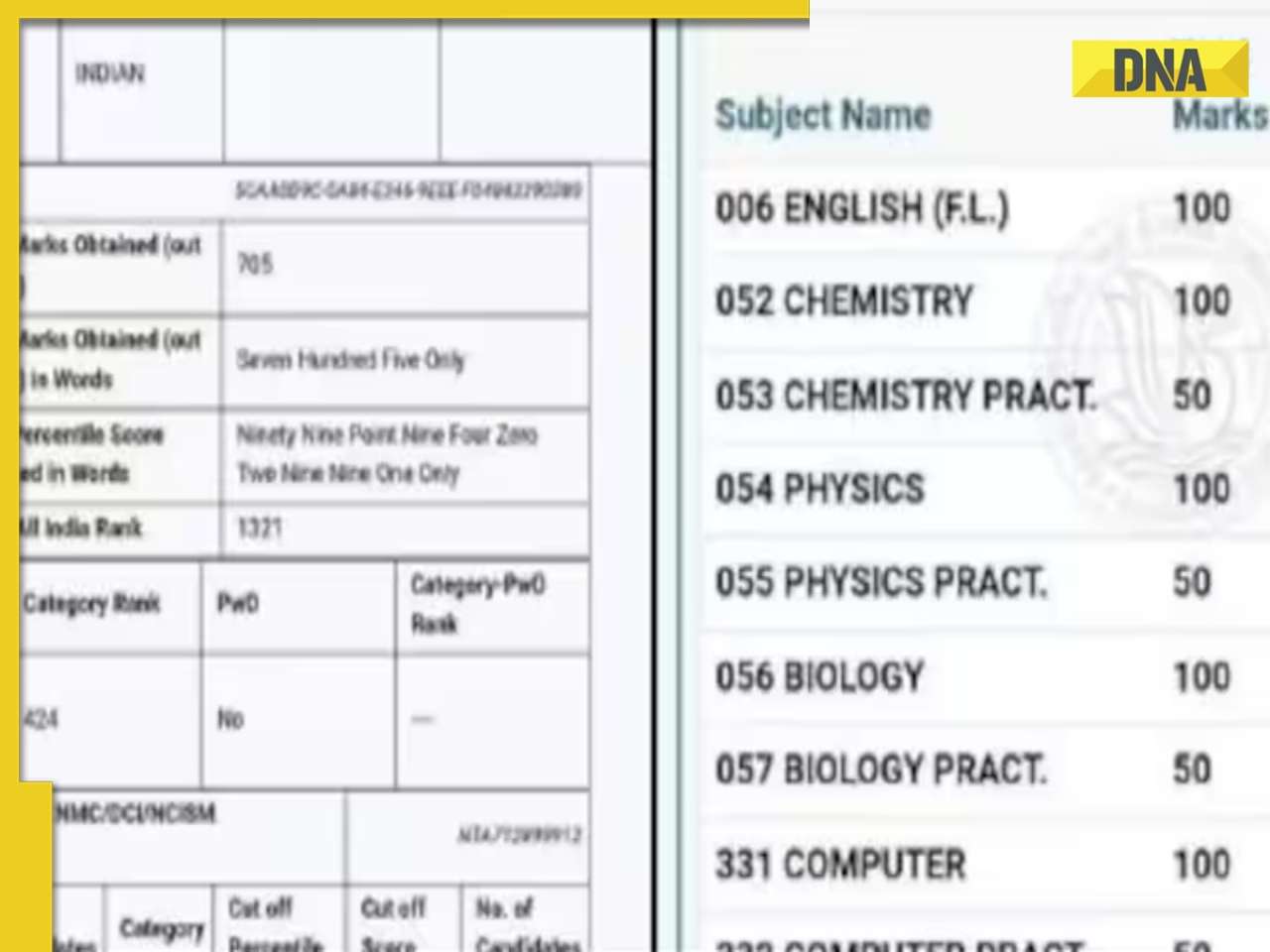

Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..![submenu-img]() Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral

Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral![submenu-img]() Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference

Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference![submenu-img]() Girl shocks internet by eating snake like snack in viral video, watch

Girl shocks internet by eating snake like snack in viral video, watch![submenu-img]() Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

)

)

)

)

)

)

)